Data Analysis: Do miners "manipulate" bitcoin prices?

The latest data shows that miners may be the driving force behind the large fluctuations in bitcoin prices.

The miners had sold off before they bottomed out

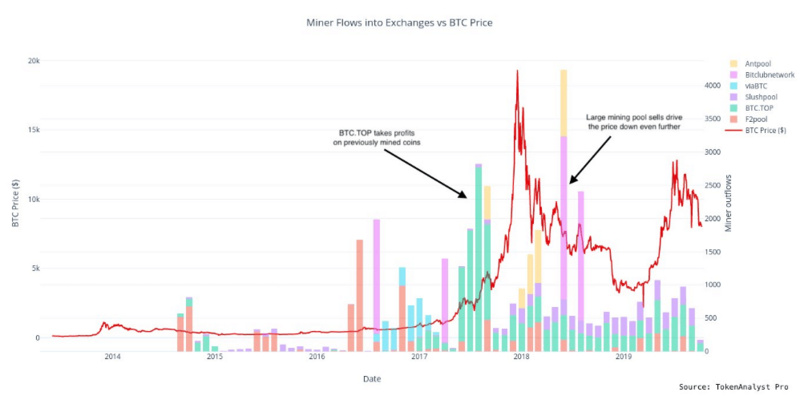

On October 11th, blockchain analysis firm Token Analyst released its latest analysis on social media, saying that miners selling bitcoin directly affected their price movements.

This statement was well supported by last year. At the end of last year, when BTC fell to $3,100, “just happened” there was a large-scale sell-off. A large amount of Bitcoin was transferred to the exchange in June and August, which “further depressed the price”.

Token Analyst concluded: "We found that miners rely on their own bitcoin to exploit market volatility and then sell off during periods of huge price volatility."

- Viewpoint | DeFi era is coming, bitcoin dynasty will end

- College student blockchain cognition survey: 23% don't know anything, 8% are holding money

- ConsenSys founder Joseph Lubin: Ethereum 2.0 full shard or will start in 2020

The data was based on a study by Decentral Park senior research analyst Elias Simos in early August. Simos tracked the whereabouts of Bitcoin mining incentives and found that more personal miners shared these bitcoins before the block rewards were halved in 2016.

Mining "three major eras"

Let's take a look at what Elias Simos's research has said (the following is the Odaily Planet Daily based on Twitter content):

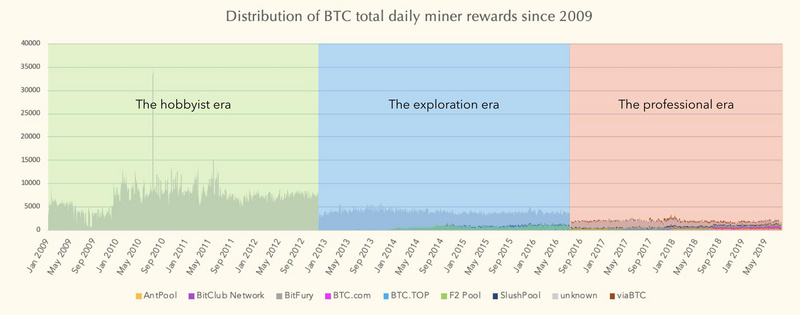

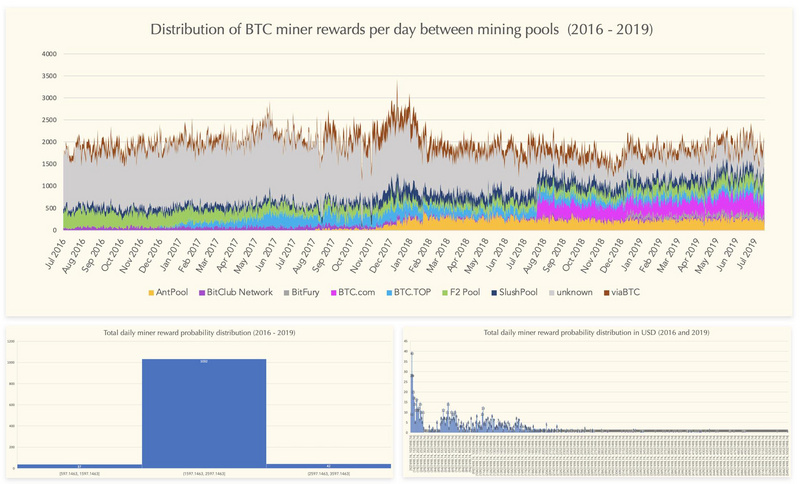

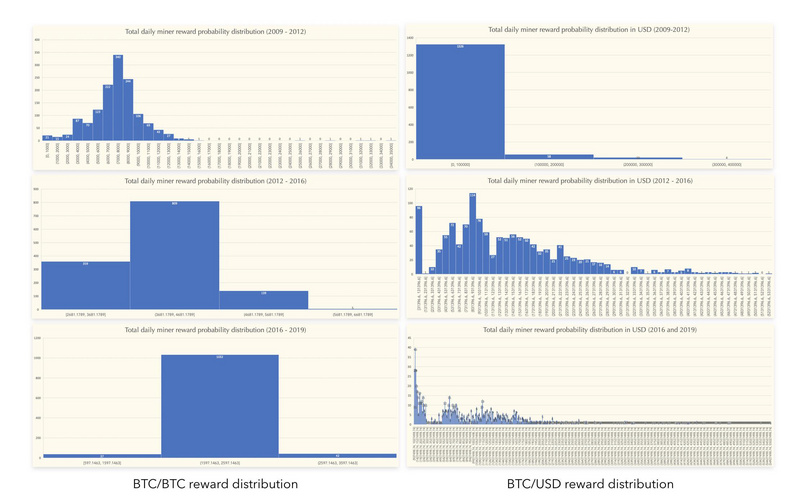

The picture below shows the distribution of block rewards obtained by miners since the first block of BTC was mined.

Here are divided into three different stages of development, namely:

1) The hobbyist era

2) The exploration era

3) The professional era

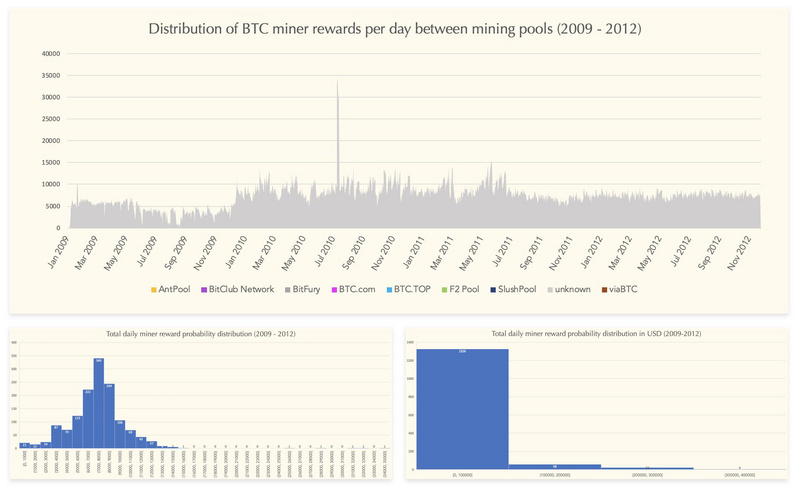

1. Amateur era: There are almost no organized mining activities, and the daily distribution of block rewards is inconsistent.

In dollar terms, the vast majority of daily returns are below $100,000.

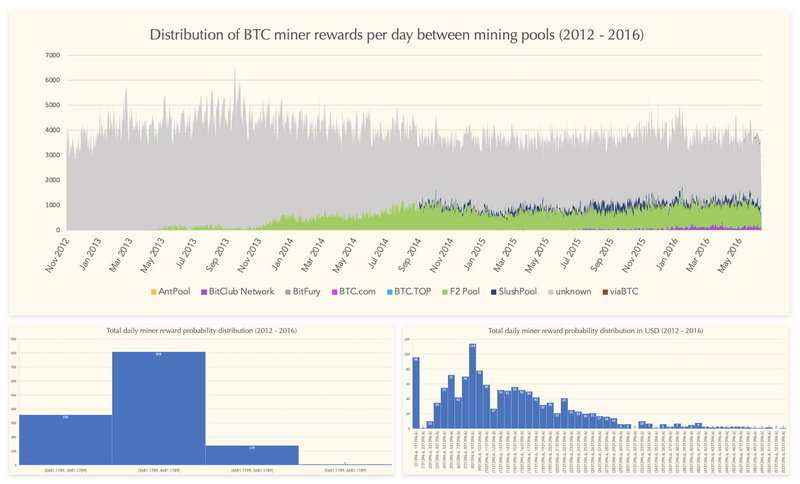

2. Exploring the era: The mine pool was added to the mining at the beginning of the second bear market.

Bitcoin-denominated returns (block rewards) have decreased a lot, and huge changes in returns can now be attributed to price volatility.

3. Professional Age: This is an era when individual ("anonymous") miners are eliminated. Starting from the halving of the 2016 block awards, it continues to this day.

Initially, 70% of the incentives flowed to non-mineral associated entities. However, this number is now about 25%.

4. Throughout history, there seems to be a negative correlation between incentive volatility and industry specialization. Of course, we should consider the difficulty of mining, but this is an interesting but potentially underestimated angle.

5. In addition, over time, the source of incentive volatility shifts from issuance to market prices. Although the long-term BTC/USD price volatility continues to decline, the increase in mining profits seems to be in the opposite direction of the price increase.

6. As a result, the industry environment seems to be changing, which is good for entities that are well-funded and prefer short-term gains.

Will the next era be the "enterprise era", or will it surprise us? I tend to the former.

Miners manipulate prices?

There are more and more arguments about miners controlling bitcoin prices, and Token Analyst's data is definitely adding another fire.

As Bitcoinist has previously reported , well-known commentators are increasingly aware of this phenomenon. The most important one is PlanB, which predicts the price of bitcoin based on the Stock-to-Flow model, which has proved the importance of miners' participation.

Another famous hypothesis was proposed by Filb Filb, Cole Garner et al., who believed that miners maintained the lowest bitcoin price.

This week, Garner mentioned that Nakamoto has expressed support for this concept. In 2010, Nakamoto said that the price of a commodity “is often close to its production costs”.

“If the price is lower than the cost, production will slow down; if the price is higher than the cost, you can make profits by producing and selling more products,” Garner added.

Therefore, under the current circumstances, miners are unlikely to sell Bitcoin for less than $6,400. Then we can conclude that this number represents a new bottom price for Bitcoin.

For everyone, the next halving in May 2020 is a critical moment. As in 2016, Bitcoin will begin to create new historical highs after block rewards fall to 6.25 BTC per block.

This article is from Bitcoinist , the original author Anja Van Oosterhout

Odaily Planet Daily Translator | Nian Yinsi Tang

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Heavy! After PayPal, five important Libra members, including Visa, MasterCard and eBay, announced their withdrawal.

- In the second half of the Internet, can the blockchain solve the economic difficulties of the platform?

- Science | Blockchain data availability issues and solutions

- Babbitt column | Long Bitcoin, Long the world

- What are the opportunities and challenges for the rise of the token economy?

- Technical point of view | Big country contest, the war of post-quantum cryptography has been ignited?

- Bitcoin options, the next battlefield of the exchange?