A paper on the role and advantages of Bitcoin in institutional portfolios

On Wednesday, investment management company VanEck released a report on the Investment Case for Bitcoin for investors.

The report pointed out that Bitcoin, as a means of storing value, deserves a place in the institutional portfolio. In addition, Bitcoin has a “currency value” that has the potential to become a digital gold and can improve the upside of the portfolio and reduce the risk return of the portfolio.

The following is the full text of the report:

Bitcoin is a potential means of value storage

Bitcoin and currency theory

- Data Analysis: Do miners "manipulate" bitcoin prices?

- Viewpoint | DeFi era is coming, bitcoin dynasty will end

- College student blockchain cognition survey: 23% don't know anything, 8% are holding money

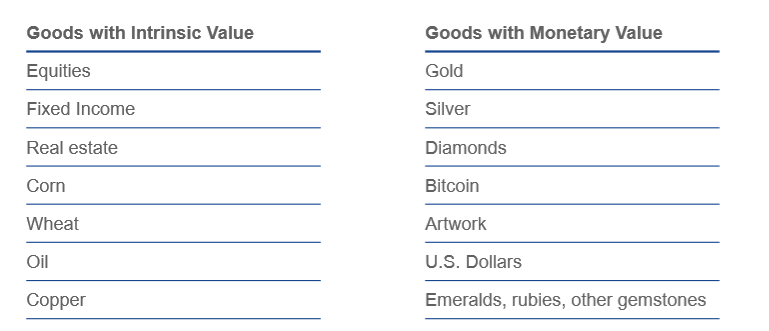

To determine if Bitcoin is valuable, first understand the difference between monetary value and intrinsic value. The persistence, scarcity, privacy of Bitcoin and its nature as a bearer asset help it hold monetary value.

Intrinsic Value (IV): Values that exist because of the cash flow of an economic commodity or its public utility: stocks, fixed income, real estate, and consumer goods (corn, oil, etc.).

Currency Value (MV): The value that exists when an economic commodity has no intrinsic value or value that exceeds the intrinsic value of the economic commodity.

Currency value (MV)

Nothing "supports" the MV: In essence, the MV is a bet that an object will retain value or add value in the future. An item with a MV is a stored value item that can be considered a claim of the future IV. This can be uncomfortable, but it is a fact since the birth of civilization.

The production of MV stems from collective beliefs: behavioral economics, behaviors heard, and so on. For a long time, humans have always needed a way to store value outside of IV.

The value of money is not necessarily related to any sovereign power: historically, the object of most monetary value has nothing to do with sovereign power – gold, gems, etc.

Creating a new thing with monetary value is rare, but not unheard of. Art is a good example. Art works as MVs are a phenomenon of the past few centuries. In early society, art works did not have MVs.

MVs usually come from special needs or environments :

Gold gets the MV because it is scarce, long lasting and relatively easy to make coins.

Bitcoin has an MV because it is scarce, durable, and has strong privacy features. Is an anonymous asset that can be remembered (this makes it particularly useful in authoritarian regimes)

Monetary theory

The generation of MV does not require an object to be attached to a payment system:

Artwork is not used for payment but its value is entirely MV

Used to pay in gold, but now only on a very limited basis

Bitcoin is not an amazing payment system, but it is definitely better than art and gold.

More and more people are beginning to accept an object with a MV, so the more likely this object will have a MV in the future.

Volatility is an intrinsic result of an object's MV process: When gold first acquires a MV, there are many differences in how many goats can be bought for an ounce of gold.

Money is a type of Money. Currency is a subtype of MV items:

The dollar is a currency: it can be used for everyday transactions – gold coins are a kind of money: they can be used for very limited transactions, but not as easy as money – art is an item with MV. Bitcoin is not a real currency, but it must be a kind of Money, although it will come to be a currency.

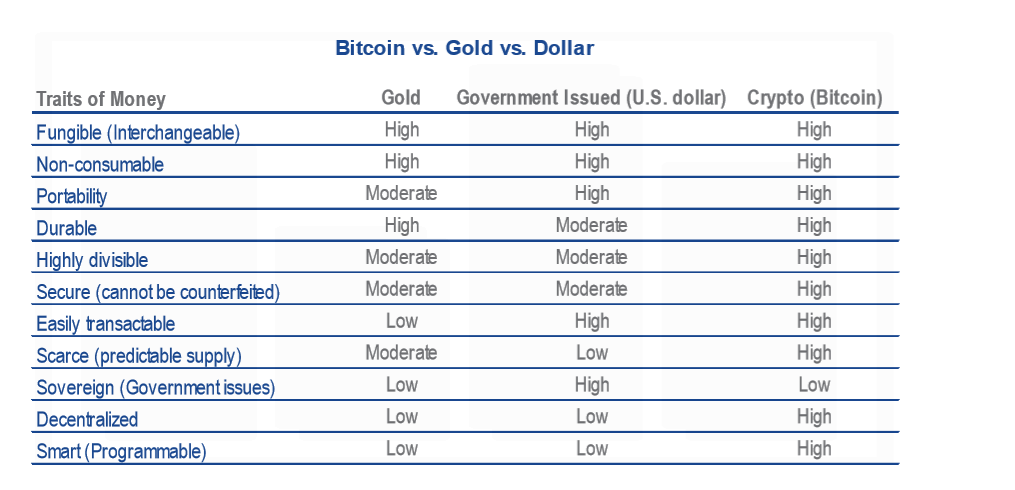

If Bitcoin is compared with gold and the US dollar, bitcoin has the potential to become “digital gold” in terms of substitutability, scarcity, portability, durability, security, intelligence and so on.

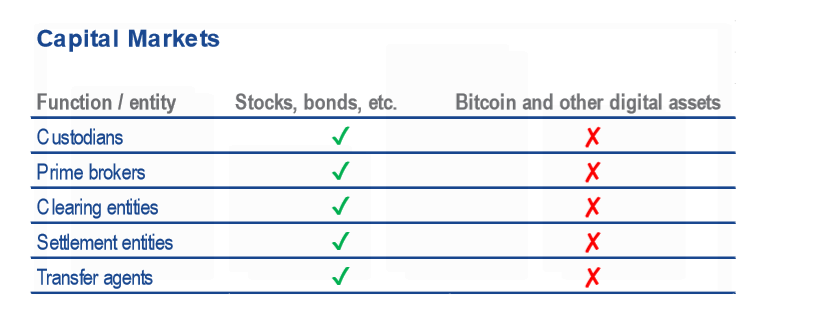

But compared to other assets such as stocks and bonds. At this stage, the problem facing Bitcoin is that because it is a kind of bearer assets, the pipeline connecting Bitcoin to the capital market is limited. In fact, the participants of the traditional capital market infrastructure do not deal with Bitcoin. .

The role and advantages of Bitcoin in the portfolio

If Bitcoin is increasingly used as an asset with both on- and off-chain monetary value, how can people see it as an investment?

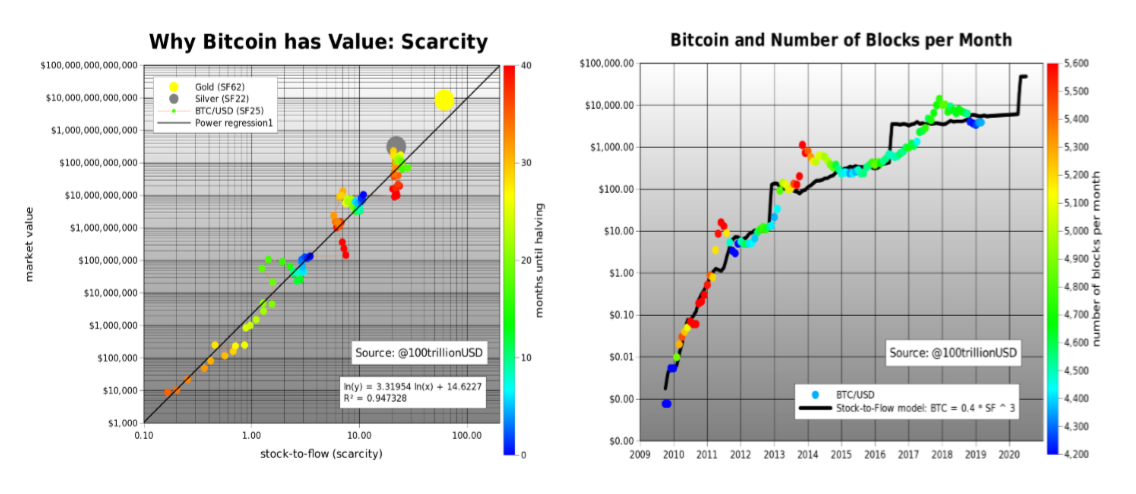

There are several theories that point to increasing scarcity and network transfer value is part of the driving force behind Bitcoin's historical growth.

Next we take a look at the historical performance of Bitcoin and how to incorporate it into the portfolio.

Inventory and current ratios show the growth potential of Bitcoin

The definition of inventory and current ratio is the amount of an asset held in a reserve divided by the amount produced by that asset over a certain period of time.

The following stock to flow data suggests that bitcoin may have growth potential based on historical data and the scarcity characteristics of bitcoin, gold and silver.

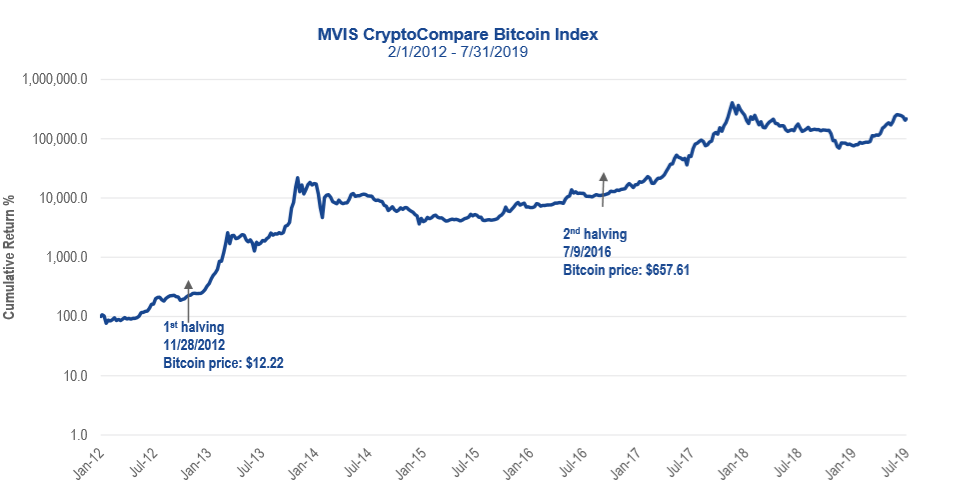

The halving of bitcoin shows that historical growth is driven by scarcity.

Historically, considering the increase in scarcity caused by halving, the price of bitcoin has risen in half during its life cycle.

The next halving is expected in May 2020.

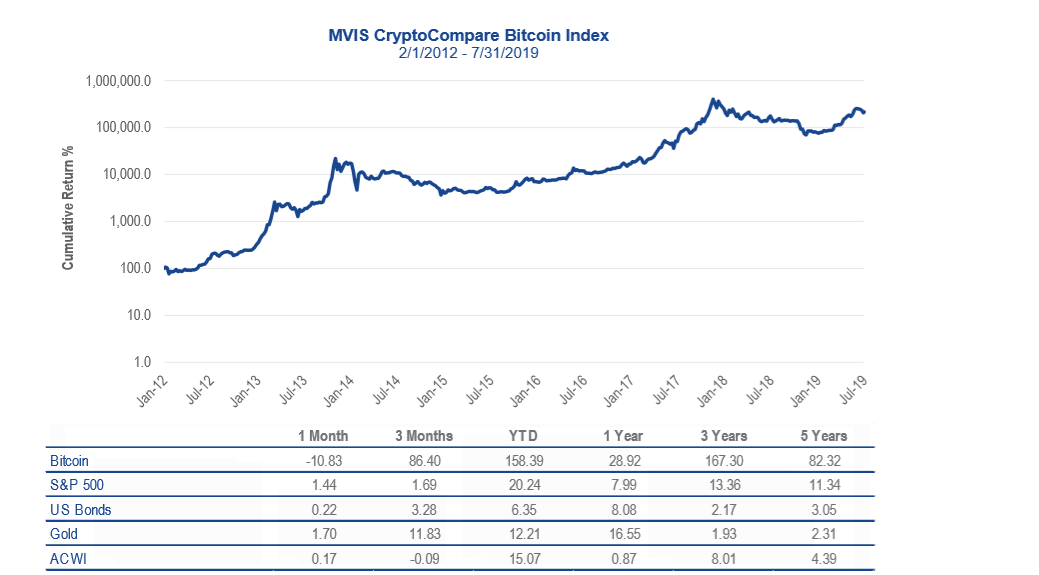

Historically, Bitcoin has outperformed traditional asset classes.

As you can see from the chart below, Bitcoin performed well compared to the main index (S&P 500, US bond, gold, ACWI).

Historically, most of the long-term periods, such as 3 and 5 years, are good for Bitcoin.

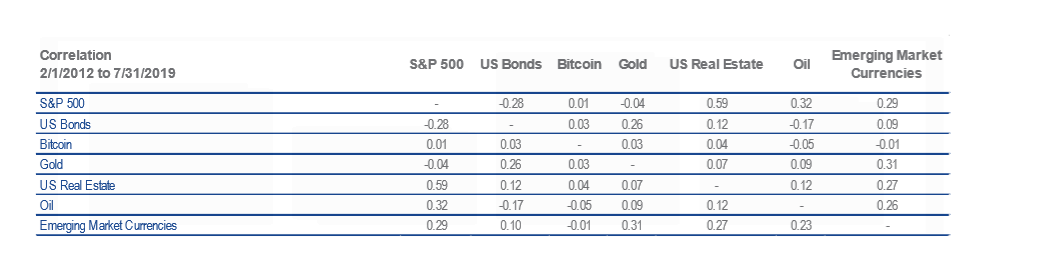

Low correlation with traditional asset classes

Bitcoin has a very low correlation with traditional asset classes such as broad market stock indices, bonds and gold. This increases its potential in portfolio diversification.

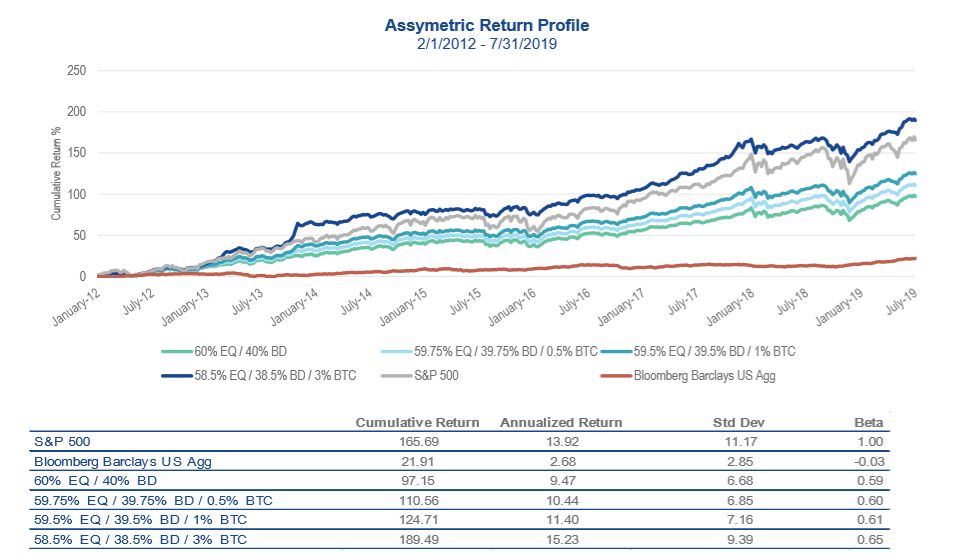

A small amount of bitcoin configuration may improve the upside of the portfolio

Bitcoin can increase the risk and return of an organization's portfolio.

A small amount of bitcoin configuration has significantly increased the cumulative return on 60% of stocks and 40% of bond portfolios, and this has little impact on its volatility.

(From the chart, the combined return on investment with a small amount of BTC has increased significantly)

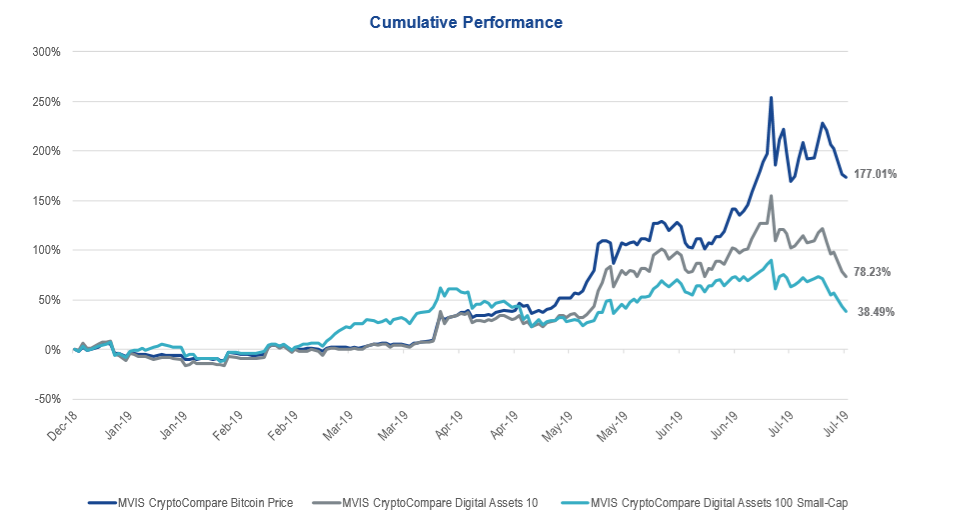

Bitcoin and large-cap stocks decoupled from small-cap stocks

With the maturity of the digital asset industry, Bitcoin is decoupled from small-cap stocks, driving the performance of the large-cap index.

In the past year, the difference in performance between Bitcoin and small cap stocks was 139%, and the difference between large and small cap stocks was about 40%.

Bitcoin market structure risk

- Bitcoin risks to consider include:

- Intrusion trading platform and participants in the trading life cycle

- Price fluctuation

- Encryption vulnerabilities; the development of quantum computing (which will increase the success of private key cracking, however, credit cards are more vulnerable)

- Novelty/extreme early stages of many applications

- Unintentional coding error

- Governance defect

- Can miners and developers “run” the “core” software? (Linux is a good example of a successful implementation)

- Ecosystem design

- Will payments continue to be processed and verified?

Encryption technology is developing strongly

- National regulations: Colorado cryptocurrency exemption bill; Wyoming recognizes cryptocurrency as property, allowing banks to act as custodians, allowing tokenization

- Physical settlement of bitcoin futures approved by regulatory authorities

- Trustee hosted cryptocurrency

- Old brokers offer spot digital asset trading.

- Pension funds and endowments are allocated to digital assets.

- Bitcoin is different for global regulators to start cracking on ico/unregistered products.

- The ETF is still considering, the VanEck-SolidX solution is the most important.

Accelerate the adoption of Bitcoin

Cryptographic currency trading is healthy : it won't disappear

Bitfinex has revenues in excess of $400 million.

Bitcoin and other cryptocurrencies have become easier for retail investors:

- Swiss exchange offers encrypted transactions (no European stock exchange)

- US brokers such as Robinhood, TD and Etradeoffer offer encrypted transactions

- Large-scale encryption broker Etoro offers commission-free trading of ETFs

- Transaction standard implemented by cryptocurrency exchange monitoring software

- Off-exchange cryptocurrency brokers provide price information to the market via MVIS

- Open interest on the Chicago Mercantile Exchange futures contract up to 25,000 BTC with a face value of $350 million

- The exchange is the target of hacking, but can compensate for the loss

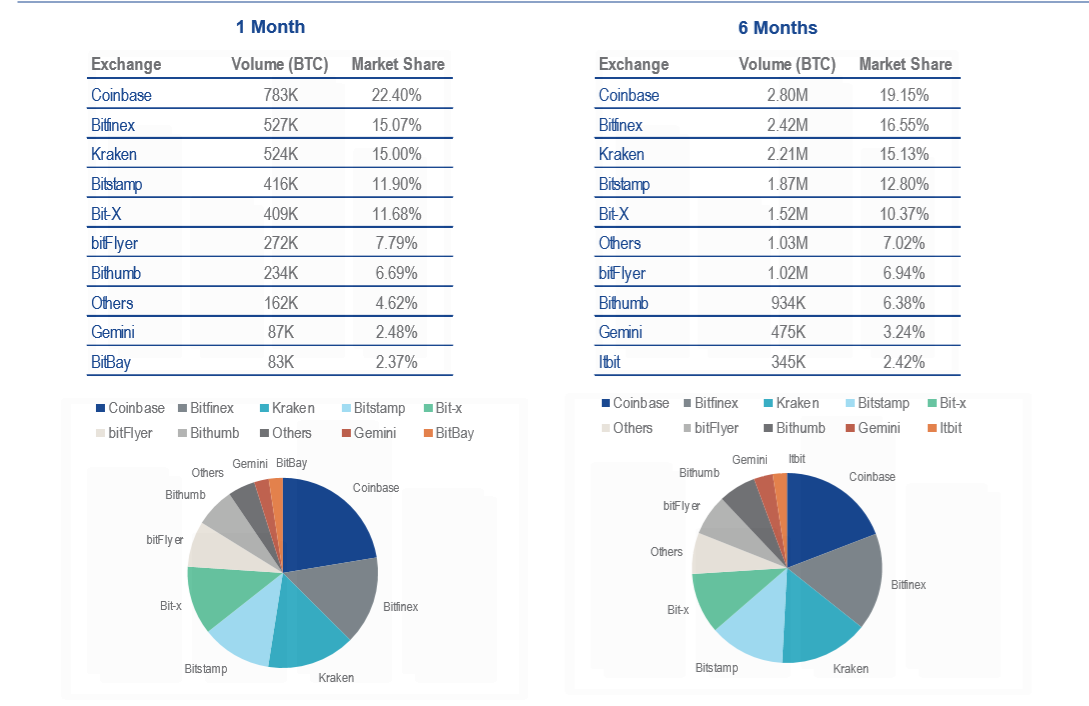

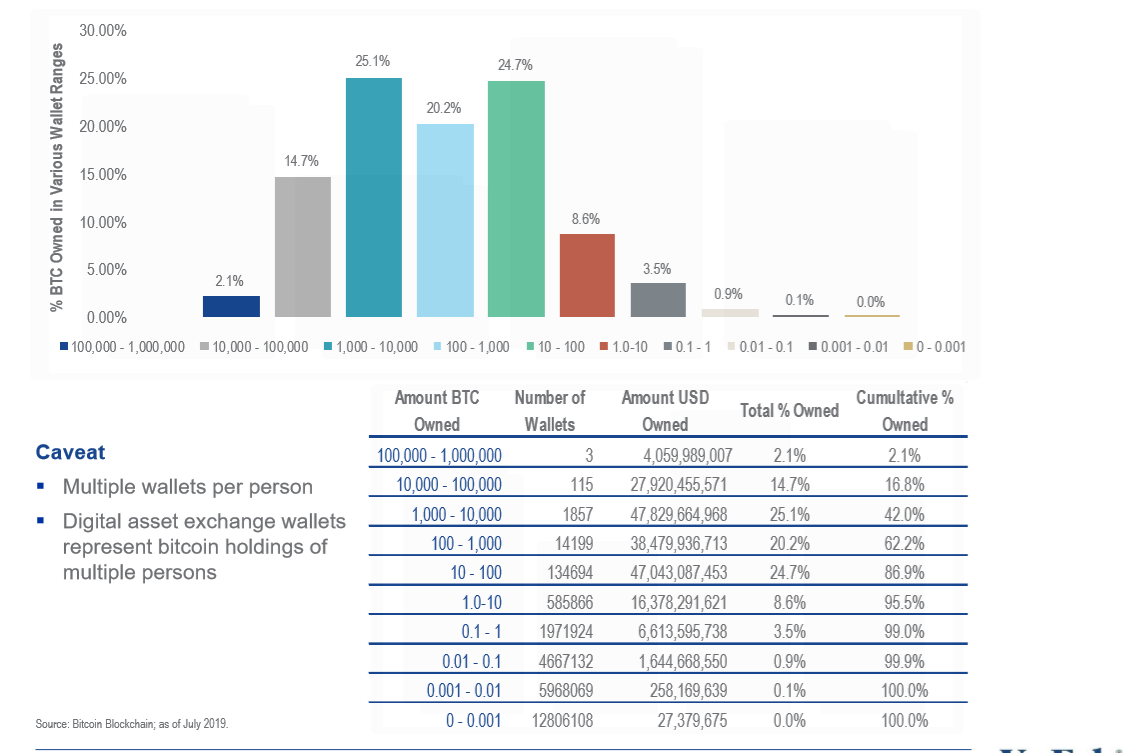

Bitcoin transactions are not concentrated

Bitcoin ownership seems to be very fragmented/not concentrated

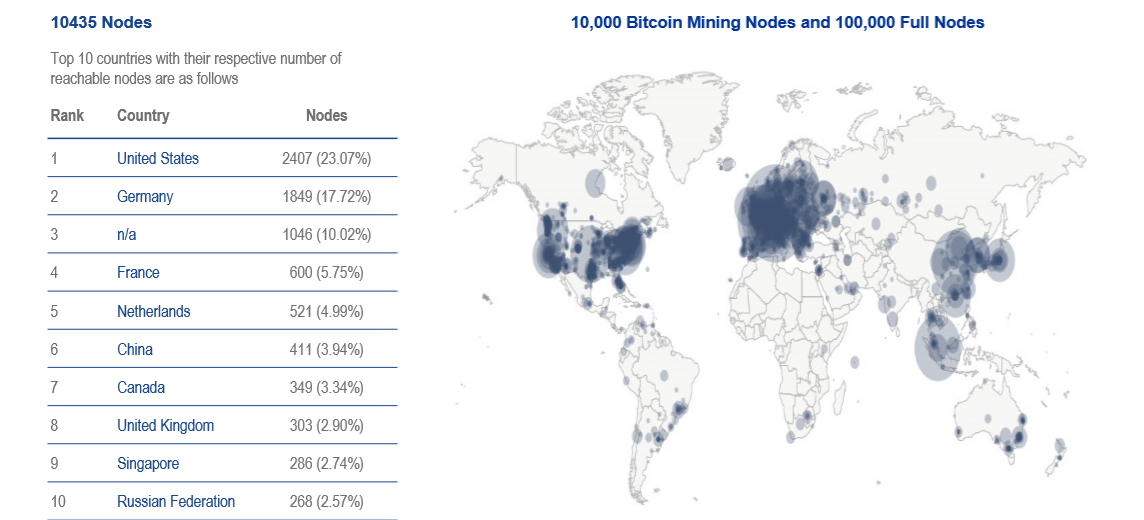

The use of Bitcoin continues: nodes and users

The use of Bitcoin continues: nodes and users

A full node is a computer that downloads and continuously updates a complete copy of the Bitcoin blockchain. (You can host your full node with a minimum of 200GBs!) This is your own mini bank)

The mining node is a computer that participates in Bitcoin blockchain transaction verification.

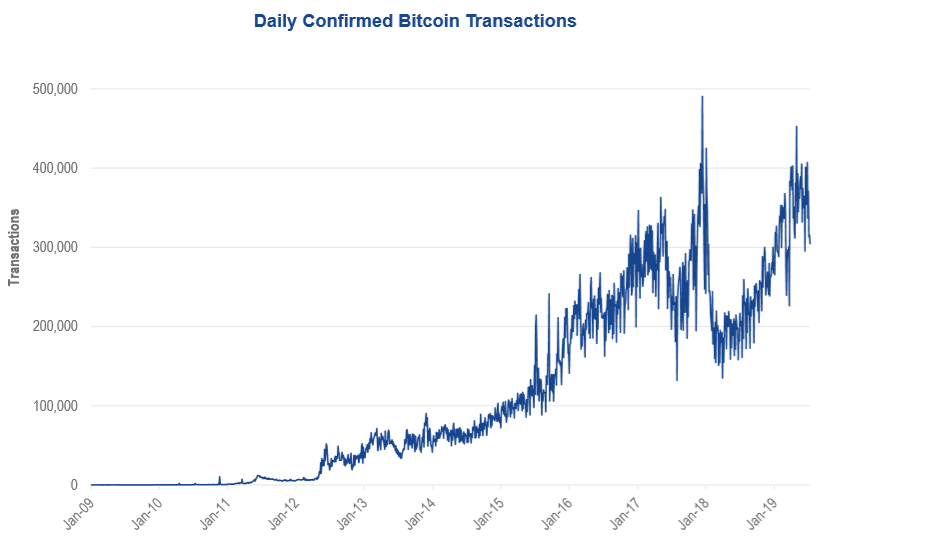

Bitcoin continues to be adopted: chain trading

Bitcoin continues to be adopted: chain trading

Bitcoin has more than 400,000 unlicensed transactions per day, showing tremendous network value.

Bitcoin chain trading accounts for a large portion of SWIFT transactions.

Other uses of Bitcoin

Many applications are built on Bitcoin, and the natural evolution of sidechains may be the next step in driving Bitcoin applications because they support scalability and customization while preserving the security attributes of Bitcoin.

The Lightning Network builds on the Bitcoin blockchain and pushes the boundaries of Bitcoin's ability to pay at a lower cost and faster.

Using Bitcoin to minimize trust, Microsoft is committed to building a decentralized identity platform on the Bitcoin blockchain.

Sidechains enhance Bitcoin's ability

- Building a code base: Sidechain is based on Bitcoin – blockchain architecture

- Security: Sidechains retain the most important security features of the Bitcoin blockchain

- Scalability: Sidechain transactions make verification faster

- Privacy: Encrypted transactions increase the privacy of network participants

- Customization: may impose investor restrictions on sidechains, Bitcoin is unlicensed

Lightning Network is an important payment layer for Bitcoin

- Lightning Network: is a payment-centric second-tier application built on top of the Bitcoin blockchain (somewhat like a side chain, but different)

- Scalability: Millions of transactions per second. For Bitcoin (7 pens / sec) and Visa (45,000 pens / sec)

- Cost: Bitcoin transactions are reduced to a fraction of a cent, not dollars

- Privacy: Keep Bitcoin network private; identity information is only released when the lightning channel is closed

- Importance: Dispersion and trust-minimized transactions compete with mature centralized payment networks such as Visa, MasterCard, and PayPal.

Microsoft chooses Bitcoin to create a new identity system

- A bitcoin-based decentralized identity system designed to improve privacy, security, and control while enabling tens of thousands of operations per second. The credentials in the new identity system will be fully owned and controlled by the user.

- Microsoft decided to base on Bitcoin.

- Built on the Bitcoin-Blockchain (Layer 2), based on a new set of open standards.

- Launched in May 2019.

Attachment: Top Ten Most Liquid Digital Assets

Source: Vaneck

Original link: https://www.vaneck.com/globalassets/home/us/blogs/bm-blog-categories/vaneck-digital-assets–the-investment-case-for-bitcoin.pdf

Compile: Sharing Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ConsenSys founder Joseph Lubin: Ethereum 2.0 full shard or will start in 2020

- Heavy! After PayPal, five important Libra members, including Visa, MasterCard and eBay, announced their withdrawal.

- In the second half of the Internet, can the blockchain solve the economic difficulties of the platform?

- Science | Blockchain data availability issues and solutions

- Babbitt column | Long Bitcoin, Long the world

- What are the opportunities and challenges for the rise of the token economy?

- Technical point of view | Big country contest, the war of post-quantum cryptography has been ignited?