The future of Bitcoin under the Great Depression

During the National Day of China, the US stock market crashed in a week, the European market collapsed, and Bitcoin was in a low position. The market has a strong wait-and-see attitude, and it seems that everyone is tossing and turning and frightened.

The United States released the latest survey indicators. In September, the US ISM manufacturing PMI index and non-manufacturing PMI index both fell significantly. The former was the lowest since the 2008 subprime mortgage crisis. US stocks fell by 4% last week. . Last Friday, the United States announced 136,000 new non-agricultural jobs in September, which was less than market expectations. The wages only increased by 2.9% for the whole year, the lowest increase since July 2018.

The intensive economic data released in Europe aggravated the market's concerns about the economic recession in the Eurozone, and the escalation of trade frictions in Europe and the United States caused a sharp drop in the European market. Among them, the UK FTSE 100 index fell from 7426 points on September 27 to 7155 points on Friday, the largest weekly decline since October 2018. The fear of hard Brexit in the UK triggered a sharp sell-off in the stock market.

- Full-text translation + interpretation | New rules of the US Internal Revenue Service: income tax due to forked virtual currency

- Wu Jihan's latest share: 2-4 million users worldwide, cryptocurrency will soon be widely adopted

- Coin City, Xiaoliang Mining Winter Reserve

In October, under the background of the overlay of China's Hong Kong issue and the US Trump's impeachment, the Sino-US consultation will be exceptionally subtle.

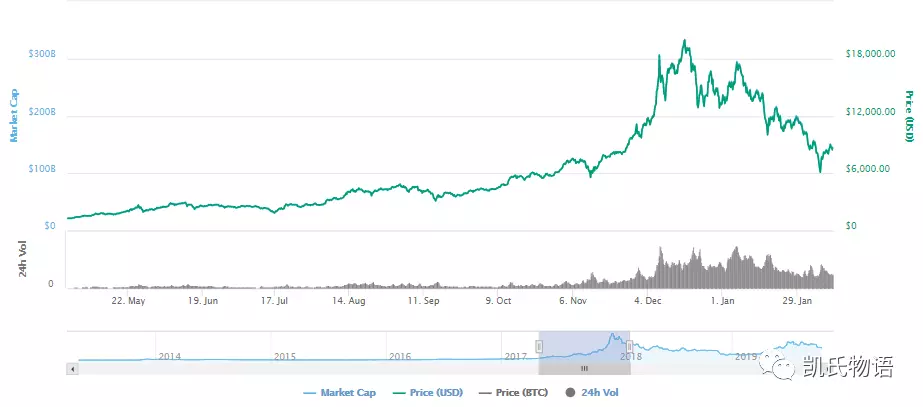

During the holidays, I have been thinking about what will trigger the global economic crisis of 2020. Judging from the historical data of the past century, human beings know each other about the arrival of the crisis. Few people have a foresight on the slip of the summit. Only at the moment of reflection will you see that the highest point in the original market means to escape. The same is true for Bitcoin's 2017 bull market.

The core of this global economic depression is the collapse of the US dollar debt. What is the specific performance? In the investment assets of the Chinese people, the proportion of real estate is close to 80%. In the United States, in 2018, the assets of Super Seven became financial assets, and real estate only accounted for 24%. This is determined by the stage of specific development. China will also follow the path of the United States in the future.

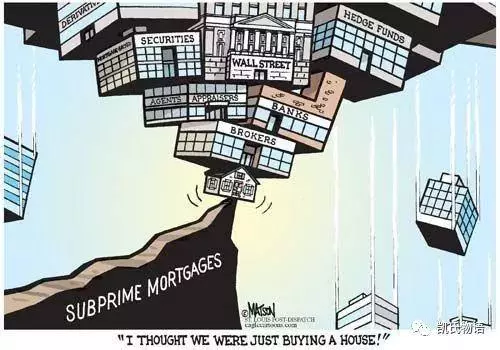

Let's take a look at the subprime mortgage crisis in 2008. There are three key points in the core of the 2008 subprime mortgage crisis:

1. The lenders of subprime loans are highly sensitive to the increase in interest rates, while the opaque pricing in the bond market and the reliance on credit rating agencies create market imbalances. In the subprime market, floating interest rates account for more than 90%, which means that in addition to the first 2-3 years, the interest rate on loans will continue to increase. But most lenders are low-wage groups that neither understand the market nor understand the economy. Everyone is rumored to be singing and dancing, which has caused the market bubble to accumulate in the early stage and gradually increase the risk.

2. Financial derivatives innovation, asset securitization and high leverage have pushed market risk further. After 2000, the global economy recovered and the risk appetite of capital increased significantly. More and more inclined to chase investment products with high returns. The loose monetary policy has made the market abundant, and promoted the rising real estate prices. The credit rating of subordinated bonds based on sub-prime mortgages is stable, which provides a basis for related asset securitization product innovation. A large number of violations have become a sparsely normal behavior in the market.

3. The global monetary policy entered a rate hike cycle, and real estate prices fell, resulting in a decline in the solvency of subprime lenders, an increase in default rates, and the inevitable outbreak of the crisis. Under the double pressure of rising benchmark interest rates and resetting loan interest rates, lenders can't make ends meet, and real estate entering the downtrend channel will cause more lenders to give up their houses. The innovation of financial derivatives is actually to cover the different financial products based on asset securitization. Finally, the lid can not cover the pot and thunder.

The greed and laziness in human nature are as old as mountains, and the stories that happen every time are not new. The global financial tsunami of 2020 will begin with the collapse of the US stock market.

Since the global financial crisis in 2008, quantitative easing has been opened. China's QE is mainly to enter the real estate industry and infrastructure construction. This has both historical inevitability and historical contingency. China’s demographic dividend peaked around 2024. After the global financial crisis in 2008, China was in the core of the demographic dividend.

The United States is different, and the US QE mainly enters financial assets. The main turning point in the changes in the asset allocation of Americans was around 1980, and in the 1980s, the United States happened to be in a long-term bull market. Since 1980, the US stock market has ushered in a long round of bulls. In just ten years, the US S&P 500 index has nearly doubled, from more than 100 points in 1980 to more than 300 points in 1990. Since then, the bull market has not stopped, but has accelerated its pace. At present, the US S&P 500 index is nearly 27 times that of 1980.

On the one hand, the long-term profit-making effect attracts funds to bring new allocations to the market. On the other hand, after the 08 real estate subprime bubble burst, everyone is more inclined to put assets into financial products instead of real estate.

The big bull market in the past ten years has mainly come from three reasons: 1. The quantitative easing of the US dollar has mainly entered the financial asset market, which is the market related to US stocks; 2. The positive dividends of US stock companies and the opening of repurchase have increased the market. Confidence; 3. The sharp rise in stocks of high-tech companies has driven the overall rise in the market.

I seem to have smelled the specific context of the 2020 global financial crisis.

The reason for the big bull market in the US stock market is bound to be accompanied by three important processes: one is the financial product innovation related to US stocks, the other is that the US stock companies with low market volatility need to cover up the truth, and the last one is that the story of the unicorn is getting bigger and bigger.

Obviously, this bull market for US stocks Over the past decade, Wall Street has got what it wants from Washington, namely large-scale corporate tax cuts and deregulation. At the same time, we found that most of the funds did not outperform the market. Even Buffett’s funds did not outperform the index. At this time, the story seems very clear. If there is no investment fund to outperform the index, why don't we invest directly in the index fund?

This is a good question. If we follow this line of thought, we will find a mine that seems to be logically complete but actually very dangerous. This mine is called a passive investment index fund.

Passive index funds generally select specific index constituents as the target of investment, and do not actively seek to surpass the performance of the market, but try to replicate the performance of the index. Passive funds always maintain the current average market return level, so their income will not be too high or too low. The corresponding active funds are classified according to the different investment strategies of the stock fund: the general active fund aims to seek to achieve performance beyond the market.

According to estimates by JPMorgan Chase, passive investments such as index funds and exchange-traded funds (ETFs) now account for 60% of US stock assets. At the same time, quantitative funds that follow trending investments rather than based on stock fundamentals also account for 20% of the US stock market share. The two together account for 80% of the US stock market.

As of August, passively invested equity funds, including mutual funds and ETFs, surpassed active funds for the first time in history. Passive funds currently reach around $4.27 trillion, while active models are around $4.25 trillion. That is, the main transactions in the market are done by robots, not humans. There is nothing wrong with this, but it is back to the problem itself. The key is who is designing the rules of the game, and the game's setters must make the rules biased toward the interests rather than neutral.

The key design of this game rule has an uncontrollable factor or a factor that is deliberately ignored, called market liquidity.

As I explained in the article "Understanding the Truth of Bitcoin's Plunge in Last Week ," there are many rules of the game that can be exploited. The vast majority of investors in the world see the rise and fall of investment products, but no one thinks carefully about the reasons and significance behind the rise and fall.

For example, a certain weighted bank stock rose, but all other banking stocks fell, driving the banking sector index to rise, and finally the short-selling bank index. Is it reasonable? Very reasonable. Is it unreasonable? Very unreasonable. Children only see right or wrong, adults only look at interests.

There are a lot of stocks in the US stocks that are not liquid, which is a very low trading volume. The price rise and fall is not that important, because in many price positions, there are not many people actually buying or selling, just the figures on the books. When the overall market is rising, in fact, this game is particularly simple, that is, drumming flowers. Companies with low market volatility use dividends and buybacks to hide the truth about low transaction volumes.

When 80% of the market transactions are quantified by robots buying passive index funds, no one is going to calculate the impact of low-volatility stocks on the overall data. When the drums spread to the last person and the music stopped, the tide began to fade. When the robots in the passive index fund began to sell the stocks automatically and proportionally, they found that the stocks in the head might be okay because of the large volume of transactions, and the stock at the bottom became a game of “running fast”. Everyone rushing to flee will bring the price of the bottom stock to plummet, so that the price collapse of a stock will drive the robot to sell the stock more quickly, and it is better to become a plunge in the whole market.

Two-line capital CEO, "New Debt King" Gundlach recently warned that this trend is causing widespread problems in the global stock market, including US stocks, "this is grazing behavior." Michael Berry, who first discovered the problem of CDO and started to short in the big shorts, said recently: Some simple papers and models allow people to buy index funds or ETFs and other mutual funds. No investors have an in-depth analysis of the price of stocks. . This is very much like the CDO bubble before the last financial crisis. The longer it lasts, the more serious the crash will be.

The 2020 passive index fund ETF is likely to be the CDO of the 2008 subprime mortgage crisis.

However, we noticed that the CDO of the 2008 subprime mortgage crisis was not actually collapsed when the real estate bubble collapsed and the default rate began to appear. Because the asset market and the securitization market are completely two markets. When the real estate default rate began to rise, there was still a continuous increase in CDO prices.

Because the rules of the game rules are never neutral, but biased towards the stakeholder group.

Therefore, at the bottom of the stock, in most cases, no one cares. Everyone is concerned about the stock of the head. It's like the example of the bank stock I just raised. There is always an instinct to escape from human nature, and there are only a handful of people facing the pain. Therefore, it is always a minority to make money in this world, because it is not ordinary people who can truly resist humanity.

Then the question comes, if there is a problem with the stock in the head?

At this time, we saw a "small thing" in September: Sun Zhengyi and his vision fund were weak, and the second-phase fund-raising amount could not even be raised. A series of events, such as the failure of Wework's listing, the collapse of Uber's listed stock price, and the suspension of listing, have dealt a heavy blow to investors.

The first phase of the Vision Fund, which was formed in May 2017, wanted to raise $100 billion and eventually $93 billion, opening the era of global giant capital funds. All agencies are accelerating to run away, and red shirts and sorghum have also raised $8 billion and $10.6 billion, respectively.

Because there is not a large enough volume, it is impossible to lead a high-quality enterprise, and there are few high-quality enterprises. The strength of Sun Zhengyi, which has huge capital support, in turn further influences the decision-making power of investment targets. For example, when Sun Zhengyi wanted to invest in Didi, Cheng Wei originally wanted to refuse. Sun Zhengyi only dropped one sentence: I will transfer the funds to your competitors with several times of funds. Finally, Didi had to accept an investment offer.

In fact, we look at the projects invested by the Vision Fund, especially in the era of the sharing economy. Basically, it is to burn money for traffic, to generate scale for traffic, to form barriers to scale, and finally to form an “absolute valuation” approach. What is an absolute valuation? There is no reference, the valuation is all you have the final say. Just like Wework, it has been the leader of the vision fund all the way, directly magnifying the valuation.

Radical capital has accelerated the growth of the technology "unicorn" and spawned another non-dominant bubble: the tech stock bubble.

When radical capital pushed up the valuation of technology stocks, passive index funds also caused the market value of FANNG and the stocks of high-tech companies in the United States to rise sharply. We say that the core of this round of the Kangbo cycle is the productivity advancement driven by Internet technology. The second phase of the decline of the Vision Fund means that no rich people are willing to pay for the story and vision.

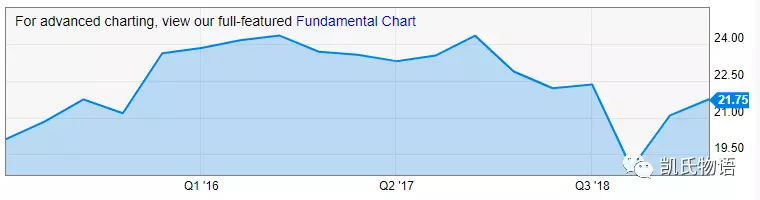

As I mentioned in the previous article, from the technical point of view, the US stock market has already appeared a warning signal that the stock price deviates from the trading volume. This signal is likely to indicate the reversal of the future trend. Before the US stock market adjustment in 2000 and 2007, such signals Have appeared. At the same time, the current US stock-earnings ratio is second only to the historical peak before the dot-com bubble burst in 2000, which is higher than the value of the eve of the 2007 international financial crisis, which is equivalent to the value of the 1929 Great Depression.

Although US stocks have been in a bull market in the past decade, many retail investors have not entered the market. The money-making effect is highly concentrated in the rich class, and the gap between the rich and the poor has increased significantly. To date, 0.1% of the wealthy in the United States have 25% of wealth, 1% of wealthy people have 40% of wealth, and 10% of wealthy people have 84% of wealth. This number is surprisingly consistent with the Great Depression of 1929.

For most people in the United States, the main assets are still in the real estate. After the 2008 subprime mortgage crisis, most people’s wage income has not increased, but the assets are still stuck in the property with little increase, so when the United States When the QE entered the financial assets, the middle class did not benefit, but the rich were rich and the poor were poorer.

The global economic depression of 2020 will be a superposition of the collapse of the tech stock bubble in 2000 and the collapse of the subprime mortgage crisis in 2008. The intensity may be more than the 1929 Great Depression.

The technology stock bubble was the first to burst, and the decline in the US stock index caused by the decline in high-tech stocks led to the decline of the US stock index, which led to the escape of passive index funds. When the bottom stocks are caused by the lack of liquidity, the quantitative robots will step on each other, which will cause a large number of bottom stocks to plummet, which will further pull the US stock index down. The robot does not know that this is a huge decline, it will continue to sell, and then form a vicious circle, making the technology stock bubble burst more serious, causing a system crisis.

In the end, US stocks may have plummeted from more than 27,000 points to below 16,000 points. Only the trillions of dollars in the US stock market have been wiped out, and all the derivative markets and the collateral effects of the global market have not been calculated.

Under the circumstance of the nest, the human economic stock competition will face a reshuffle, and politics is the upper echelon of the economy, which will further intensify the conflict. For example, the ideological dispute caused by China and the United States, today's Morey and the NBA are typical examples. For the United States, working with China to form a true G2 is the best choice. If you combine the two benefits, the fight will hurt.

It is a pity that the United States is in a dilemma. Capital has no country and only interests. The final result is a big probability that the US dollar will break through, but it will not be able to return to the sky, and the RMB will rise. In the incremental market of machine network economy, digital currency will gradually rise. Bitcoin is only the first step, not the last step.

The theme of the next decade of humanity will be the digital economy and the human economy, the competition between Bitcoin and the renminbi and the US dollar.

Personally, I never think Bitcoin will lose upwards because of short setbacks. In fact, we are watching the shocks on Monday, June 24, until the last three months of the week on September 16th. Is Bitcoin losing consensus? In fact, the running project led by Plus Token is continuing to ship, but now it has been basically shipped.

In the past, I have been emphasizing that Bitcoin is no longer the same as in previous years. The core players have changed from small players to big players, moving from the digital currency market to the traditional financial market. And most importantly, there have been forces from several countries involved in trying to grasp the future trend of Bitcoin. For a long time in the future, we will see the infighting between the country and the country, between the human social economy and the digital economy in Bitcoin.

As 2020 gets closer, the war will become more intense. Is the miner important? When the bitcoin cut-off period in May 2020 comes, it will no longer matter, and Bitcoin will become a hunting ground for national power.

In the secondary market, top-level players are often long-term trends, because they have more funds and influence on the market, and it is impossible to enter and exit the market frequently. The long-term trend is like the dark forest in the universe. The more top players, the more they hide themselves and disappear into the invisible. But the position you see is the same, the decision is who will pull the trigger first. Then the remaining trend players follow up, followed by the mid-term players to follow up, and finally the short-term players.

Looking at the trend of the 100-year-old must be a heavenly person who has never come before. There is no one in trillions. It’s already Buffett’s billions of people watching the trend for decades. Looking at the trend of the decade is already the top of the top of Wall Street.

The trend is the most important of all conditions. Don't let yourself get lost in the long-term trend because of the short setbacks in the market, and finally regret it.

Today, we see the eve of the global economic depression. The importance of 2019 is because it determines the main tone of the next 10 years – the rise of the digital economy led by Bitcoin. 2020 is important because it will change the fate of 7 billion people around the world.

There must be hope in the ruins.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Notes | Gartner: Most blockchain technologies have a five to ten year time away from the impact of change

- Opinion: Bitcoin is not a better Paypal, it is better for the dollar

- Cryptography in Bitcoin: Five characteristics of hash function and mining principle

- At the site | Is Staking suitable for small white users to invest? How does the market turn from bear to cow? Listen to the hot topics in the industry

- Quotes | BTC failed to gain a firm foothold, short-term market regression consolidation

- The Central Bank Digital Money Institute recruits and recruits! These graduate students have the opportunity

- Monthly News | September global blockchain private equity financing projects fell by 39% from the previous month, the Chinese and American markets cooled sharply