Data show: Bitcoin and gold are greatly improved

Bitcoin is often referred to as "digital gold" because of its non-political monetary policy and trading methods. Gold has always been a hedge asset for governments to deal with the incompetence of money supply. In a world where the current sense of cash is getting weaker, Bitcoin is an option to avoid legal currency and avoid excessive financial regulation.

In other words, the trend of bitcoin and gold is not in the same track. In fact, according to historical data from Coin Metrics, there is no correlation between the two assets over the past five years.

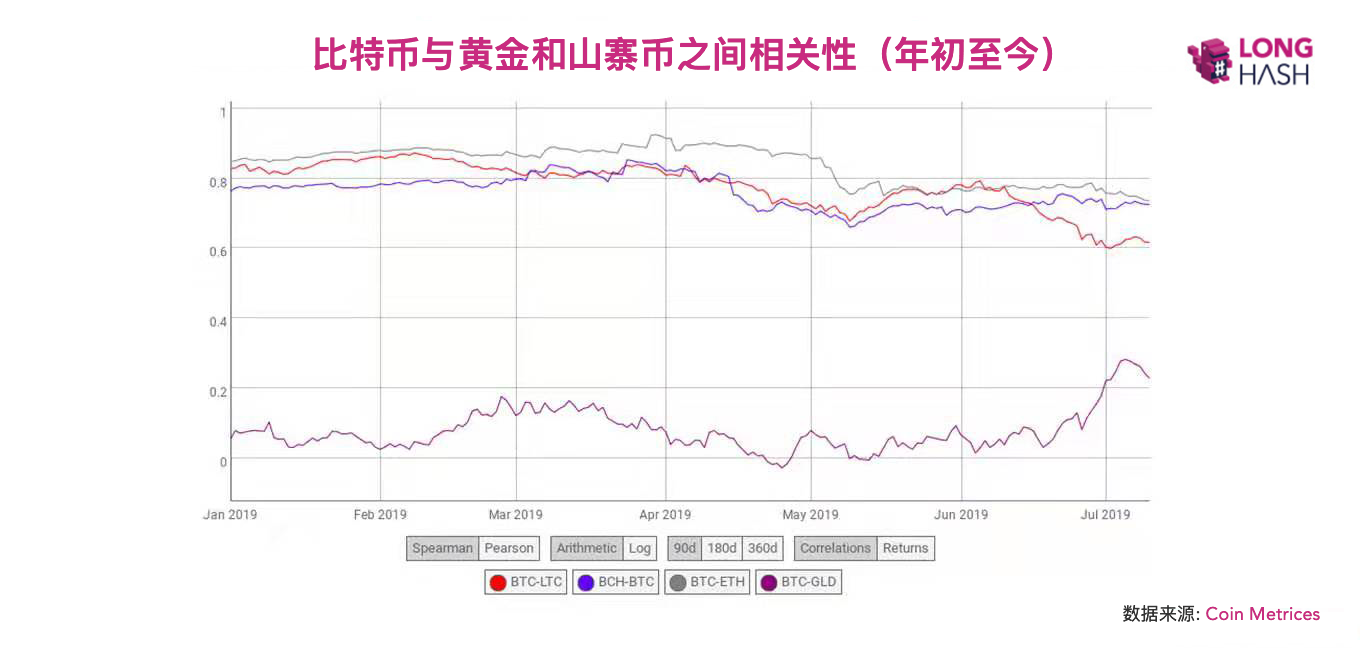

However, according to this year's data, the correlation between bitcoin and gold prices has increased, while the correlation between Bitcoin and altcoin has declined.

Behind data

- Hot discussion on "blockchain experts": within 11 years, bitcoin mining will become too expensive to continue

- A number of large Korean companies cooperate to launch a blockchain-based mobile identity recognition system

- "Naughty" Facebook, "fear" Congress, what is going to be about the upcoming hearing?

Correlation measurements are usually taken from the range of -1 to 1. If the score is -1, then the two variables are inversely related; if the score is 0, there is no correlation between the two; if the score is 1, it means that the two are closely related.

This form of measuring the degree of correlation between two variables is the "Spilman correlation coefficient".

From the Coin Metrics year-to-date correlation data sheet, it can be seen that the correlation between bitcoin prices and altcoin and gold began in April this year. Here's how the correlation between Bitcoin and several major assets changed from April 1 to July 10:

– Ethereum (ETH): 0.91451 to 0.73607

– Bitcoin Cash (BCH): 0.82189 to 0.72571

– Litecoin (LTC): 0.80934 to 0.61724

– Gold: 0.07508 to 0.22846

Although the correlation between Bitcoin and gold has improved, it has only risen from "very weak" to "weak". And although the correlation between Bitcoin and the altcoin has declined, its relationship with ETH, BCH, and LTC has only dropped from "very strong" to "strong".

In addition, it is worth noting that the correlation between Bitcoin and the altcoin has reached an all-time high earlier this year. This strong correlation began to weaken as bitcoin prices far exceeded other mainstream altcoins between April 1 and July 1.

At the same time, the "currency war" has pushed the price of gold up. At the Bitcoin 2019 conference at the end of last month, some speakers also pointed out that global macroeconomic factors such as increasing government debt and loose monetary policy, combined with the halving of Bitcoin miners' rewards next year, may be brewing for bitcoin prices. A "perfect storm".

In the long run, it makes sense to make bitcoin and gold more relevant – at least if Bitcoin's “digital gold meme theory” makes sense. And the performance of the past few months may be able to show that Bitcoin has been regarded as a digital substitute for gold.

It is worth noting that Federal Reserve Chairman Jerome Powell compared Bitcoin with gold when he presented the Senate Banking Committee with questions about the Facebook cryptocurrency project Libra.

In the end, Bitcoin bulls expect that this digital asset will overturn the gold market worth about $7 trillion. In addition, Blockchain Capital's Spencer Bogart recently pointed out that as a value storage asset, Bitcoin's bull market performance far exceeds the gold market.

Source: Longhash

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ETH fell to the $200 mark, paying attention to short-term risk

- Over 60 team campaigns than the original chain consensus node, early bird voting over 100 million BTM | Bystack Flint Project Shenzhen Station

- Tether hand-slip increased 5 billion USDT and quickly destroyed in a few minutes

- The cryptocurrency market evaporates over $20 billion in a single day, and investors are welcoming forks

- The US Securities and Exchange Commission approved the listing of two generations of coins, Reg A+ or the conventional way of listing into cryptocurrency

- Comment: Is mining a good business?

- Babbitt column | Bitcoin has no financing, what financing do you use?