Deep Panda DAO’s new way out: Closing down is more profitable than struggling to survive

Deep Panda DAO's solution: Shutting down yields greater profit than persisting.Author: IGNAS, DEFI RESEARCH; Translation: Katie Gu, Odaily

When a DAO dissolves, the remaining funds are distributed to token holders. In some cases, DAOs can become more valuable after they shut down. This is what happened with the Rook DAO, a MEV project. ROOK token holders voted to shut down and distribute its $25 million treasury. The token price surged 5x as a result. This price jump was mainly due to the treasury value exceeding the total market cap of ROOK tokens.

It is important to note that not all ROOK token holders will redeem their tokens. The ROOK example is just part of the “new play” currently unfolding in DeFi DAOs.

- Xiyou Cong: Have you prepared for the next wave of hype narrative after Brc20?

- a16z Crypto CTO: Protocol Design is More Important than Token Economics

- One year after the Terra-Luna reset: Rebuilding Trust, centralized exchanges will continue to exist

In this article, we will explore strategies for dissolving DAOs profitably and analyze the potential risks in such events. This strategy is controversial, DYOR.

What is “Slow Rug”?

People in the industry should be familiar with the term “rug pull.” A rug pull is a scam in which developers suddenly drain project funds for personal gain and exit the market. But there is also the “slow rug,” a more subtle version in which funds are slowly drained over a longer period of time and usually disguised as legitimate operating expenses such as salaries.

For example, Rook Lab, composed of 22 DAO contributors, receives $6.1 million per year ($300k per contributor). However, the team has been unable to provide a roadmap or goals, even as protocol trading volume has dropped by about 78% in just six months.

The “slow rug” is more complex than it seems because DAOs face several issues in this situation:

-

Legal clarity: DAOs are in a legal gray area, leading to uncertainty in operations, fund management, and taxation;

-

Legal compliance relationships: Due to different jurisdictions, managing legal relationships with individuals and organizations around the world is complex;

-

Liability limitations: The potential liability of DAO token holders is an issue that can be addressed by establishing a legal entity, joint fund, or compensation fund;

-

Governance: Balancing efficiency with decentralization and transparency is a major challenge in governance;

-

Talent management: Recruitment, onboarding, and management of talent in DAOs can be difficult due to the self-directed nature of roles and the lack of legal entities that can sign contracts.

How do we supervise teams that are not adding value to token holders? Some DAOs take responsibility by “dissolving in place”. For example, the core team of Fei (Tribe DAO) decided to dissolve and distribute 220 million dollars from its treasury to token holders. At the time of the vote, the valuation of TRIBE was only $66 million, but now the trading price is $128 million.

In the cases of Rook and Tribe, the dissolution of the DAO was beneficial for token holders. But what happens when core team members resist governance votes? That’s where things get interesting.

Is Aragon DAO under attack and at risk of being dissolved for profit?

Recently, Aragon DAO was hit by a 51% attack from a coordinated group called the “Risk-Free Value (RFV) attacker” which was connected to the dissolution and liquidation of Rook DAO. Aragon pointed the finger at a large asset management company – Arca Capital Management. Evidence suggests that Arca’s involvement was for economic gain from Aragon.

On May 2, a large number of new members flooded the Aragon Discord channel and sent private messages to multiple contributors, pressuring them to move funds from Aragon Association to Aragon DAO as soon as possible. These members were reportedly connected to the asset takeover event in Rook DAO, where they spent several months accumulating ANT tokens, which gave them voting power in Aragon DAO. Eventually, Aragon Association banned suspicious Discord users, each of whom CoinDesk interviewed was a member of Rook. Rook dissolved its DAO last month after investor calls for the project to return capital to its token holders.

The “RFV attacker” describes themselves as “crypto bald eagles” and reportedly is a complex, well-resourced, and coordinated organization. They are said to be “responsible for the destruction of Rook DAO, Invictus DAO, Fei Protocol, Rome DAO, and Temple DAO”. It is noteworthy that one member of the group was sentenced to jail for participating in the Mango DAO exploit. Recently, the group led a financial takeover of Rook DAO, attacking the organization using social engineering tactics, successfully dissolving the DAO and liquidating half of the treasury for economic gain. In response, the Aragon Association announced plans to “reposition” Aragon DAO as a funding project for emerging DAOs. The association is now transferring funds in batches, rather than transferring the entire treasury fund at once.

Attackers of “RFV Attack” are motivated by the difference in value between Aragon’s treasury assets worth about $189 million and the lower market value of ANT tokens, which is $128 million. In the DAO, enough tokens can be purchased and voted according to one’s own wishes. The DAO is at risk when the token trading price is lower than the value of its treasury assets. Conversely, if the token is traded at a premium, the risk of asset takeover is lower.

In an interview with DL News, Jeff Dorman, co-founder and CIO of Arca, said this was a clear message from the market to the company or project that “the market believes that Aragon is not properly managing these assets”. Jeff Dorman further explained, “If you don’t issue tokens, you have complete autonomy. When you issue, airdrop, or sell tokens and publicly trade them, you owe the token holders a fiduciary duty.”

Profit from Asset Takeover

Is it a takeover or a seizure? Different beneficiaries may have different views on tactics of the RFV attackers. However, it also provides a unique arbitrage opportunity for DeFi, and here’s how the strategy unfolds:

-

Identify DAOs where asset value is lower than token market value;

-

Buy enough project tokens to gain influence over DAO decisions;

-

Use this influence to vote for dissolution of the DAO;

-

If the vote passes, the DAO’s funds will be distributed to token holders.

In Aragon’s case, the last part is crucial. If you buy tokens and the core team ultimately ignores the majority vote, you may hold governance tokens but have no governance rights, and these governance tokens actually have no voting rights.

In addition, achieving a real takeover is much more difficult than it sounds. You must buy tokens without causing a significant price spike, especially when faced with issues such as slippage and liquidity. Then there is due diligence and governance advice to be dealt with. If this is not enough to complete the takeover, a public relations campaign must be conducted to persuade other token holders to support your proposal.

Although the name “Risk-Free Value (RFV) Attacker” may imply low risk, it is not a risk-free strategy at all. However, the 5x increase in the ROOK example also shows that it can bring huge returns.

How to Identify Risky DAOs?

Assuming the trend of making money by dissolving DAOs continues and RFV attackers and Arca continue to target new DAOs, our top priority will be to identify DAOs whose treasury assets are worth less than their respective token market values.

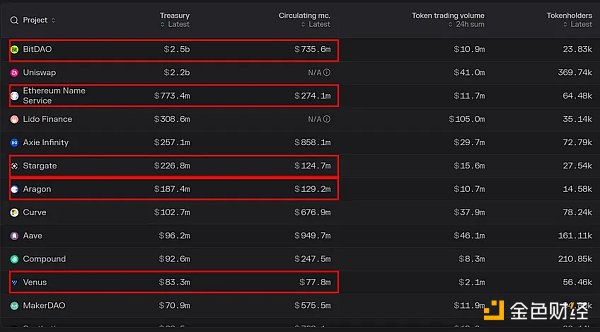

There are some tools that can be used to identify them, such as Token terminal and DeFiLlama. Token terminal has a treasury database of 67 projects. We can even increase the circulating (or fully diluted) market value to immediately see which DAOs are at risk.

At the time of writing this article, I found that out of 67 online projects, the treasury value of 23 projects is higher than their respective circulating market value.

Here are some of the projects and their treasury values and circulating market values:

-

BitDAO: 25 billion USD vs 7.35 billion USD

-

Ethereum Name Service: 7.73 billion USD vs 2.74 billion USD

-

Stargate: 2.26 billion USD vs 1.24 billion USD

-

Aragon: 1.87 billion USD vs 1.29 billion USD

-

Venus: 83 million USD vs 77 million USD

-

Instadapp: 61.6 million USD vs 25 million USD

-

Wombat Exchange: 55.3 million USD vs 8.9 million USD

-

Hop Protocol: 53 million USD vs 7.8 million USD

-

Euler: 41.6 million USD vs 31.8 million USD

-

Gearbox: 38 million USD vs 7 million USD

-

Tornado Cash: 34.9 million USD vs 10 million USD

If we take into account the fully diluted valuation, the situation will change, but these tokens are not in circulation and cannot be used for voting.

The issue with TokenTerminal’s data is that it takes into account a project’s own token in the calculation, whereas DefiLlama provides the total value locked without the project’s own token.

Here is a list of the latest treasury assets worth at least $10 million:

-

BitDAO: $822 million vs $735 million

-

Olympus DAO: $215 million vs $206 million

-

Aragon: $187 million vs $129 million

-

Wonderland: $89.5 million vs $10 million

-

Blockingrrot Protocol: $50 million vs $8 million (MC data from DefiLlama)

-

JPEG’d: $41 million vs $14 million

-

Klima DAO: $30.6 million vs $17 million

-

Hector Network: $22.9 million vs $10 million

-

Jade Protocol: $21 million vs $8.4 million

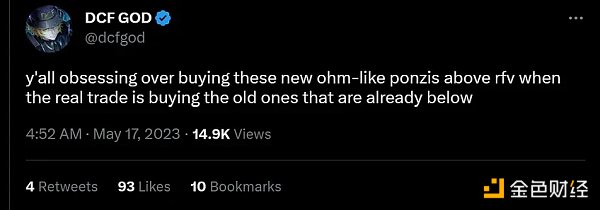

However, there is a key piece of data missing from this list. We need to consider the proportion of tokens owned and attributed to users, as a large portion of tokens are typically owned by the team or venture capitalists. Therefore, the final list of DAOs with potential risks is even shorter than the list above. Interestingly, DCF GOD recently mentioned OHM on Twitter.

Note that when analyzing DAOs facing dissolution risk, further due diligence is required, taking into account factors such as token slippage, actual community-held tokens, governance structure, and so on.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of a16z’s Q1 Investment Layout

- Hourglass: What is a time-bound token?

- Nike Embraces NFT Marketing: What Lessons Can Other Companies Entering Web3 Learn?

- What is “Onion Routing” in the Lightning Network and how does it work?

- Can the fluctuating Worldcoin and the UBI economics of the AI era come true?

- “Tactical” dissolution, division of national treasury assets, new profit model for DAO?

- MakerDAO Core Development Team proposed to increase the DAI savings rate from 1% to 3.33%