Defi Attack: Open Finance for Open Finance

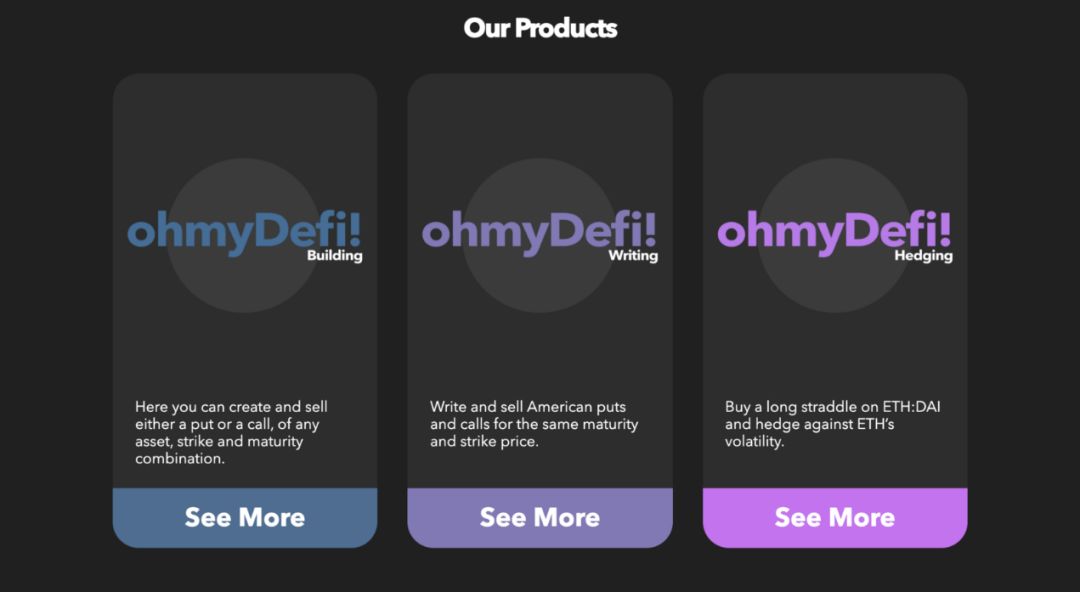

Ohmydefi: Dedicated to building a decentralized options market

- Perspectives | DeFi Insurance Design: Always Start with General Equilibrium and Reduce Systemic Arbitrage

- On the road to industry, how does a decentralized blockchain replace the centralized Internet?

- Viewpoint | Blockchain is the only way to realize the digital economy in cyberspace

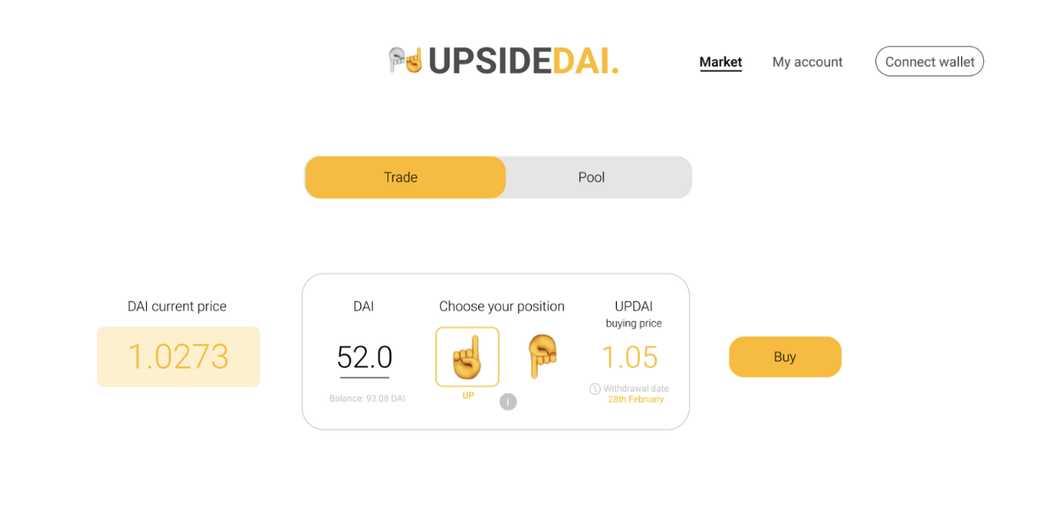

UpsideDAI: Afraid that the stablecoin itself still has volatility? This project helps you hedge the risk of fluctuations in DAI

We often think that DEFI is the new place for ETH's value to fall , but from the second half of 18 to 19, the overall trend of ETH seems that the market does not quite accept the value in this direction. What is the problem?

There are some clues from the above projects:

- DeFiat: Most people who need to buy ERC20 tokens should have an exchange account. Moreover, ERC20 tokens can also be purchased at the central exchange wallet entrance. If you do n’t even have an exchange account, why would a user first think of buying ERC20 instead of just BTC and ETH?

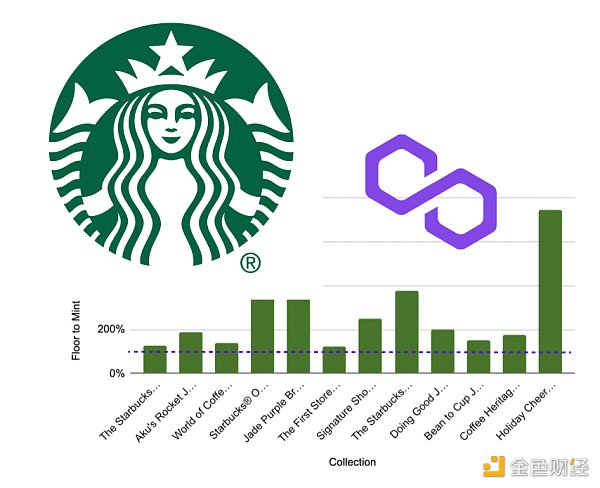

- Ohmydefi: Deribit, the most mature centralized option market in the currency circle, has only this point of liquidity. Is there anyone trading in the decentralized one?

- UpsideDAI: Instead of focusing on the fluctuations of the stablecoin itself, it is better to look at the fluctuations of all other unstable coins in the entire cryptocurrency market without hedging methods. Wouldn't it be more marketable?

re-locate

If the entire encrypted digital currency world is considered as an independent world, then there is no doubt that DEFI is the financial system in this world.

There have been many points of view before (maybe I have a similar point of view), DEFI does not have enough users because the financial system is not yet perfect, whether it is speed or experience, etc., are not comparable to the traditional financial system in reality, so as long as we continue Iterative improvement, speed up, and experience will attract more users .

But in fact, just as the tenfold good theory mentioned in Peter Tier's "From Zero to One", if it is to achieve the same function and goal, it must be ten times better than the opponent (traditional financial system). DEFI is obviously an unattainable standard. It takes some time to equalize, let alone ten times better.

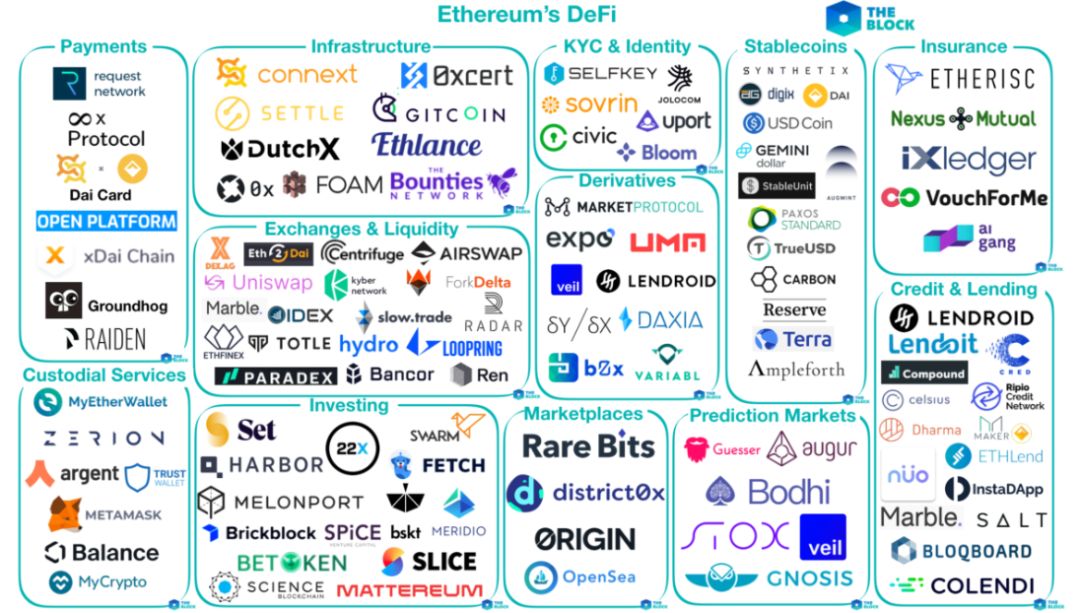

As far as the current development situation is concerned, aside from the performance experience, from a functional point of view, DEFI as a cryptocurrency's financial system is already very complete . We can casually list some familiar targets:

- Lending Market-Compound

- Stablecoin-Makerdao & DAI

- Leveraged Products-dYdX

- Options market-ohmyDefi

- DEX-Kyber / Uniswap / 0x

- Decentralized insurance-Nexus Mutual

- Payment-xDai

- Oracle system-Chainlink

The above is a classic DEFI map made by The Block a year ago. It can be found that some projects are dead or have changed, but the basic framework and field have been formed.

Therefore, what is more important now is not to optimize a local function, but to find a key breakthrough that can bring more user traffic-out of the circle.

Find another way

In my opinion, DEFI has to go out of the circle. As mentioned above, the road that "people have me better" is not accessible, and the only one left is "people have me."

Specifically, there are two refinement directions:

Start from the blind spots of the traditional financial system

Traditional finance is not everything, there are strong needs in some areas but they have not been met, and good innovation has always been the biggest advantage of the currency circle . Let us look at two cases:

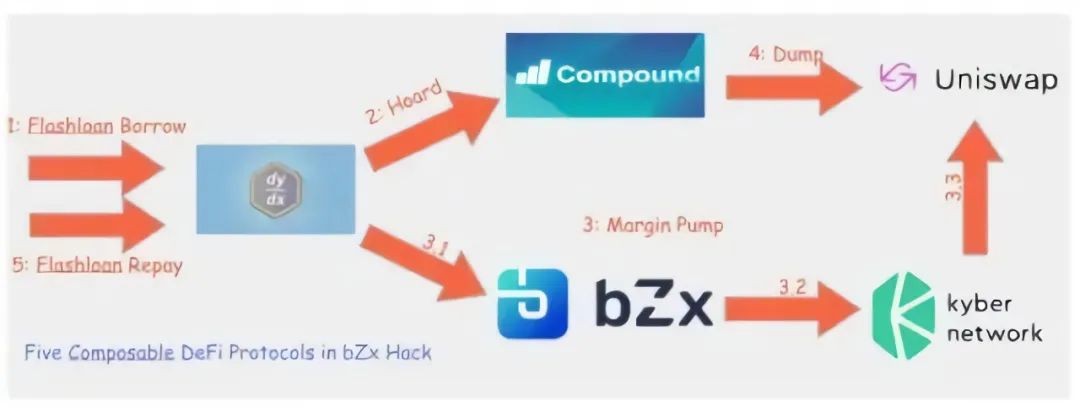

One is the recent hot lightning loan . Some hackers used the lightning loan to loan 10,000 ETH and in 13 seconds, they made a profit of 51 BTC through continuous calls of multiple contracts. Although things themselves reflect security holes in some of DEFI's protocols, we can interpret other important information from them.

- Lightning loan itself is unsecured , and it is unsecured without the need for a clear identity. This is impossible in traditional finance.

- In traditional finance, there are closed loops of some debt chains, which is what we commonly call triangular or polygonal debts , because the entire chain collapses due to the problem of turnover. Lightning loan can solve similar problems.

- As for security, it was said that the DEFI community does not lack all kinds of matching infrastructure. We saw that bZx immediately found a chainlink cooperation to solve the manipulation problem of oracle data. A combination of Lightning Loan + chainlink will become standard in the future, maximizing its effectiveness while ensuring security. Even if we don't start with oracle, we can see that there is contract insurance like Nexus Mutual. So don't worry too much about security issues.

In this case, I will look forward to seeing the Lightning Loan Portfolio open up a corner from traditional finance and let DEFI penetrate.

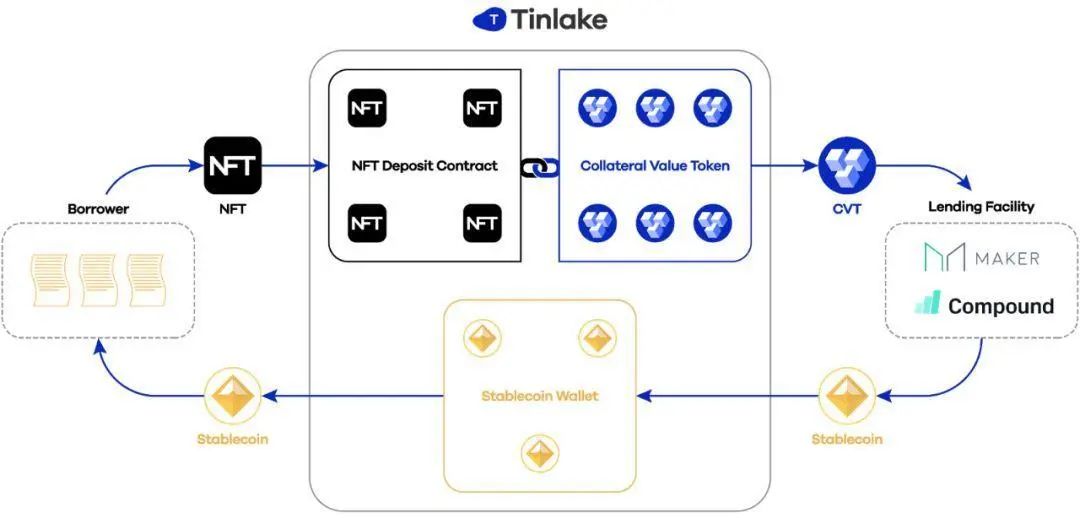

The second case is a project called Centrifuge, which is still in the pilot phase.

He is committed to solving the problem of invoice liquidity in traditional supply chain finance . In simple terms, it is to register real invoices as NFT tokens, and then go to Makerdao and other platforms in NFT to obtain DAI to solve the supply chain finance liquidity problem . This is also a big step towards bringing real assets to DEFI.

However, although this solution solves a liquidity problem in traditional finance, the process of asset authentication and the conversion of real assets on-chain into NFT tokens still require the participation of many traditional institutions . This may not be perfect.

From the above two interesting cases, we can find that the existing DEFI can already form a lot of closed loops with applications, and the functionality of the infrastructure is complete.

We can use chainlink as the oracle to call whether it is traditional data information or on-chain contract information, or we can use the ERC1155 protocol of enjin to create various NFT tokens to meet the needs on the chain.

Everything is ready, only a blind spot in traditional finance, finding and cutting in, will bring DEFI a new world.

Enter from the payment field

There has always been payment first, followed by borrowing, which in turn forms the foundation of traditional financial markets. If this development corresponds to the field of encrypted digital currencies, in fact, it can be seen that DEFI targets traditional finance, and the entire encrypted digital currency targets payment and settlement.

So from this perspective, it is not that DEFI is going to be out of the circle, but the entire category of encrypted digital currencies is going to be out of the circle, and it has truly become the point-to-point payment currency ideal for those Bitcoin fundamentalists. It is a bit difficult to throw this burden on DEFI alone. It should become such a problem. How can DEFI help the encrypted digital currency go out of the circle?

Perhaps, stablecoin? Unfortunately, it seems that stablecoins do not solve this problem well.

Let's take a look at this dining car that appeared on ETH Denver-Denvor Taco Truck.

At the conference site, this dining car provides lunch, but you must pay through BuffaloDai, which is a customized version of the DAI for the conference, which can be used to pay for various types of conference-related activities, including the purchase of lunch.

The end result was that 60% of the payments were successful, and 40% failed, and had to resort to traditional credit cards. The experiments in such a group of geeks who are keen on cryptocurrencies can only reach such a level. It is conceivable that what will happen if it is extended to a wider range.

Objectively speaking, we must admit that there seems to be no particularly successful case in the payment field. Maybe in small countries such as Venezuela where the exchange rate collapses, there is a certain degree of applicability, and there are cases where people in some regions can't use bank accounts to switch to BTC, but these are too small.

As we simulated in the previous currency game (click on the blue text to read it) , it is not so simple to successfully become a widely accepted currency. What is needed is more than technical support. Rather than relying on DEFI, cryptocurrencies require a powerful group of spokespersons to fight for their rights.

Strengths and avoid weaknesses

In addition to the target circle, then in addition to the possible development paths described above, we should also maximize the advantages of DEFI-the combination superposition effect.

Everyone in the circle understands that the most convenient point of smart contracts is that they can call each other to achieve various novel effects. Geeks are constantly creating useful module contracts in anticipation of an Iron Man combination. But how can we maximize the effect of such a combination? Here I want to emphasize that I call it the hidden rule of sight.

Let's take a lightning loan as a case. Lightning loan itself means that it only needs to complete the lending, use and return of funds in one block, then there is no need for any collateral. If the return is not completed in the same block, then the transaction is actually invalid, which means that the initial lending is also invalid, and there is no real capital loss.

Then the problem comes. After the contract is called, after the loan, the transfer of funds is used to stimulate another contract. Do n’t you need to wait for the block confirmation?

After consulting some technical people, I got the answer: the contract call does not need to wait for block confirmation. In my opinion, this is the golden key to open the product of Lightning Loan.

Indeed, all the rules of the blockchain are open and transparent, but in fact there are some hidden rules hidden in many details, and these rules may be the key points in determining whether they can exert their maximum effectiveness.

It reminded me of Slay the spire, a well-known card game on steam.

There is a card in the game that says if the opponent tries to attack you, you gain 3 power (power is used to increase your attack power). I didn't realize its importance at first, but when I found out that this card matches the turn-based game system, after repeated use, the power will be raised to a very high level, and even the opponent can be killed in one shot.

Therefore, in a field like DEFI that relies on a combination of hands to attack the world, it is not enough to just know the rules. It is also necessary to find hidden rules that have been ignored by others and cooperate to get higher damage .

Is DEFI the future?

In the future, it is possible that DEFI will not function as it is today, but will appear in a form of open finance that we better recognize, and all its constituent components will not be absent .

we will see:

- Makerdao's large-scale on-chain automatic mortgage system can provide liquidity for your various digital assets;

- A large number of off-chain assets are continuously digitized through a oracle system similar to Chainlink;

- Individual requirements are injected into NFT tokens one by one through Enjin's ERC1155 protocol;

- We can use DEX in the unmanned scene to trade with robots that call 0x;

- Temporarily loan some stablecoins from Compound to pay back credit cards;

- …

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Weekly | FCoin incident continues to ferment, 12 listed companies disclose blockchain business

- Viewpoint | What is the first principle of decentralization of blockchain?

- Interpretation of the Central Bank's "Technical Specifications for Financial Distributed Ledgers"

- Protocol Lab's latest keynote: Internet pioneers are talking about distributed networks

- Data privacy black hole under the new crown epidemic: industrial crux needs to be solved by blockchain

- Listed Company Topics | The Way of Huobi Holding

- I could have: The role of the blockchain in the epidemic is called "regret"