Will modularization become the ultimate solution for cross-chain?

Can modularization solve cross-chain issues?Whether it is asset cross-chain or information/data cross-chain, there are currently too many cross-chain bridges and various cross-chain protocols on the market. According to chainspot, there are currently about 114 cross-chain bridges and more than 130 networks on the market, and the track is crowded.

Against this background, cross-chain aggregation is a must. Regardless of whether it is asset cross-chain or data/information cross-chain, how to better integrate official bridges, third-party bridges and other cross-chain solutions, and introduce more liquidity, is the problem that cross-chain aggregators need to solve.

Before discussing cross-chain aggregators, let’s first define and classify cross-chain methods. Dmitriy Berenzon, a research partner at 1kx, has provided a more authoritative explanation of cross-chain bridges:

“Bridge” is defined as a system that transfers information between two or more blockchains. Information can refer to assets, contract calls, identity verification, or status.

- Themis Protocol: An all-in-one DeFi platform, powering the full growth of Filecoin

- What kind of Midjourney does Web 3 need? Exploring practical AIGC with Orbofi as an example

- Revolution of AI in Chain Games (Part 3): Electronic Games, the Hidden Driver of Technological Development

It can be simply understood that cross-chain bridges allow any data, including tokens, chain states, contract calls, and even identity verification, NFTs, governance voting, etc., to be transmitted from the source chain to the target chain, allowing assets and data to flow freely on different blockchains. The two chains can have different protocols, rules, and governance models. Cross-chain bridges enable both parties to interoperate in a communicative, compatible, and secure manner.

Early cross-chain bridges were mostly focused on asset cross-chain, while data/information cross-chain requires more complex structures and designs. To observe a cross-chain bridge, it is often necessary to discuss several main components:

- Monitoring: responsible for monitoring the status and smart contract function calls on the source chain, often involving roles such as oracles, validators, or relays.

- Consensus (if any): In some patterns, before the information relayed to the target chain, the relay node reaches consensus on the correctness of the relayed message.

- Message passing/relaying: After receiving the event, the monitoring role passes the message from the source chain to the destination chain.

- Signature: The relay node signs the message and encrypts and signs the information sent to the target chain (as an individual or part of a multisig).

Looking at the different blockchain frameworks and structures corresponding to different cross-chain methods, we can better observe the functions and innovations of a cross-chain product:

- Application Layer: Asset cross-chain bridge

- Data transmission layer: Message cross-chain protocol

- Trust Layer: Inter-chain trust mechanism

- Incentive layer: Trust layer or transmission layer may involve incentives, which can be observed separately.

Trust Layer is very important for cross-chain protocols. The design of the trust mechanism will balance security, cost, delay, and fees during information transmission, which is an important position for cross-chain projects in technological innovation.

The development of cross-chain aggregation products relies on the development of the cross-chain bridge ecology itself, and various types of cross-chain bridges need to have a certain degree of maturity before more perfect products can appear.

After 2022, under the continuous progress of cross-chain bridge projects, updates of modular blockchain concepts, and the development of new technologies such as ZK, there are many cross-chain bridge solutions based on different needs, and the maturity of cross-chain transaction aggregators (such as LI FI, etc.) is increasing;

Message cross-chain protocols are also receiving attention in the primary market and have obtained good valuations. In LayerZero, a representative general interoperability solution, relayers and oracles have not formed any consensus or verification within the LayerZero framework, only serving as information transmission, becoming a cross-chain protocol without a native consensus system, giving inspiration to the market.

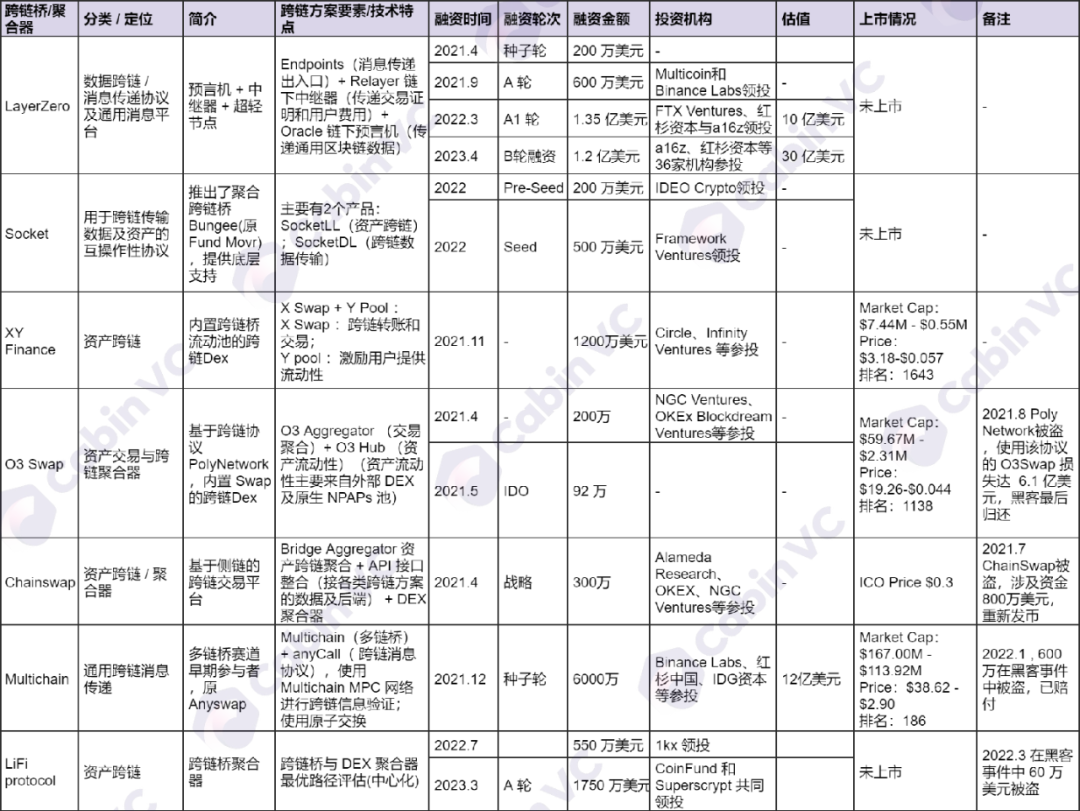

CabinVC has organized information on representative projects in the current multi-chain bridge/cross-chain aggregator/cross-chain information protocol, including LayerZero, Socket, XY Finance, O3 Swap, Chainswap, Multichain, LiFi protocol, and can conduct simple valuation benchmarks and project comparisons in this track:

However, universal cross-chain message transmission may not be the so-called “endgame” either. In some innovative cross-chain projects, the modular blockchain concept also affects this track, trying to break through the “impossible triangle of interoperability” and bring more possibilities to cross-chain.

However, universal cross-chain message transmission may not be the so-called “endgame” either. In some innovative cross-chain projects, the modular blockchain concept also affects this track, trying to break through the “impossible triangle of interoperability” and bring more possibilities to cross-chain.

*Impossible triangle of interoperability:

- No trust required: Has the same security as the underlying domain;

- Scalability: Any domain can be supported;

- Information universality: Can handle any cross-domain data.

Some projects are innovating in cross-chain communication protocols, cross-chain aggregators, etc. based on the modular idea. Brainstorming based on modular interoperability protocols can simply split the structure of the bridge into:

- Application

- Verification

- Transport

Among them, the application layer and the transport layer can be shared to adapt to the current existing application paradigm. At the same time, if the modular interoperability protocol is configured with a verification layer, it can increase the programmability in actual use cases, transaction amount, transaction delay, and other directions based on multiple existing verification mechanisms.

However, this composable approach requires bridges to mix and match various verification methods with different structural parts of the blockchain, and ensure effective information transmission. Among multiple verification methods, the execution layer simplifies the entire verification process by verifying validity through ZK proof.

Based on the above ideas, the following more innovative cross-chain ideas can be focused on:

* Polymer, a modular network protocol based on IBC

Polymer was originally developed based on the Cosmos ecosystem, and expanded cross-chain communication to the outside of the Cosmos ecosystem through ZK-IBC (inter-blockchain communication). Polymer Chain, as a multi-chain routing center, constructs a chain to host ZK light clients and OP fraud proofers to verify transactions from any modular configuration, and supports communication between heterogeneous chains such as Ethereum.

* Hashi Aggregator of Gnosis Chain

Hashi, launched by Gnosis Chain, is defined as an EVM hash oracle aggregator, whose main logic is “requiring information to be verified by multiple independent mechanisms, rather than only one mechanism”. Hashi verifies the correctness of the same message by allowing it to be transmitted in different ways. If the same information appears on multiple provider domains, it is considered correct; if different messages appear, they are resolved through a dispute resolution process.

* Multi-Message Aggregation (MMA)

MMA is a design for Uniswap in governing cross-chain message transmission, which aims to deploy commands from the Ethereum mainnet to Uniswap in other non-L2 EVM chains, and is regarded as an additional security module for cross-chain communication. Recently, Kydo from the Uniswap Accountability Committee proposed the idea of “using the protocol’s client as a bridge”: intended to use MMA to transmit N bridges with the same message from Ethereum to another chain. On the receiving chain, if k/N bridges have transmitted the same message, the message will be executed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why do I always receive “Exchange Withdrawal” messages? Learn about the classification and protection measures of Web3.0 data leakage events in this article.

- Decentralization explorers of Rollup: Polygon, Starknet, and Espresso

- As the countdown to the debt ceiling negotiations begins, Biden and Republican leaders reassure the public that there will be no default.

- Is Binance joining ORC-20, marking the end of BRC-20?

- Understanding the business model and product components of Centrifuge, one of the leading companies in RWA

- Deep Analysis: Exploring Hooked’s Ambitious Goals in Web3 Education through Collaboration with Animoca

- Is the ultimate goal of AI Web3? “Father of ChatGPT” launches encrypted wallet World App