Suggested that the SEC "cut off" IPO underwriters, the NYSE also played IEO?

Wen | Wang Ye

Production | Odaily Planet Daily

"Isn't this the IEO of the currency circle?"

On November 26th, Eastern time, the New York Stock Exchange (hereinafter referred to as the "NYSE") submitted an application document to the United States Securities and Exchange Commission (SEC), and proposed to modify the relevant regulations on direct listing.

- 60% of Bitcoin has not been moved for nearly a year, investors prefer to store coins rather than trade

- Or the strongest outlet in the next 10 years: the era of industrial blockchain is officially coming

- Ethereum developers agree to upgrade network on January 6, ETH inflation rate will rise again

Direct public offering (DPO for short) means that an enterprise can go public on the exchange without a roadshow without going through investment banks and other underwriters. Earlier in February 2018, the U.S. SEC approved a proposal submitted by the NYSE in March 2017 to modify the listing process.

In 2018 and 2019, Spotify, the world's largest streaming music service, and Slack, an office application development company, respectively listed on the NYSE in this way. In 2019, China Index Holdings, which was spun off from SouFun, was also listed on Dasdaq by direct listing.

However, DPO can save listing costs, but cannot issue new shares, and can only buy and sell old shares, which means that companies cannot raise new funds.

The application of the NYSE is to change relevant regulations to allow direct listed companies to issue new shares to raise funds at the same time, so that the cost of raising funds is lower than that of an initial public offering (IPO). At the same time, the NYSE also recommends that the market value of new shares issued in this way should not be less than 250 million US dollars in order to provide the market with appropriate trading liquidity. . This is mainly to motivate companies to go public at low cost.

As soon as this news came out, the rules for direct listing triggered discussions in the currency circle. Odaily Planet Daily noticed that some people in the currency circle forwarded and ridiculed in the WeChat circle of friends. The DPO mentioned in the document and the IEO (Initial Exchange Offering) model of the currency circle are exactly the same, and there are no third parties. Get involved and go directly to the exchange for trading.

Liquidity is king, "IEO" attracts corporate IPOs

The DPO bypasses the underwriters required for the IPO, allowing corporate employees, insiders, and investors to sell their existing shares directly to the market without selling new shares, there is no problem of dilution of new shares, and no insiders have Restrictions on selling shares such as lock-up periods allow institutional and individual investors to purchase equities on an equal basis. In traditional IPOs, the NYSE and Nasdaq require original shareholders to lock in for six months.

Like IEO, the purpose of DPO is not to raise money. For companies that want to list through DPO, what they want more is the high liquidity of the stock.

Generally, companies have two main purposes for listing. One is to raise funds for development, and the other is to obtain liquidity. The latter includes other objectives such as the withdrawal of early investors.

DPO is an old stock trading, so there is no financing. Its biggest purpose is to float the company. The most important thing for a DPO is liquidity, and the transaction volume is "water". Once no one buys or sells, no one recognizes it, and the company is an empty shell. Finally, the fundamental significance of DPO is lost.

In contrast, the fundamental of IEO is to solve the problem of token circulation. The difference is that the IEO pioneered by Binance is more like a new stock market in the traditional financial market. Before the official launch of the exchange, the project party must take out a portion of the early investor's quota at a low price and give it to participants, attracting more retail investment at a time Those who come to the exchange to trade, improve the liquidity of the Token.

If the application of the NYSE is approved, the issue of new shares also bypasses the underwriter, it is really that the NYSE also played IEO.

"Liquidity is king, as long as they can come to trade, they are all good kids." Some people in the industry once commented on DPO. Under the IPO winter, the NYSE is also doing all it can to attract corporate IPOs.

According to 36 氪, after 2000, the IPO of American technology companies was sluggish, and they preferred to choose private equity financing rather than go public. Equity capital markets (ECM) revenue in the United States in 2017 was $ 7.3 billion, accounting for only 43% of 2000. Data show that the number of IPOs in the United States in the third quarter of 2019 decreased by more than one-third compared with the second quarter.

"Cost reduction in risk exposure"

"If an IPO is like a wedding, going public is like running away."

Erin Griffith of Fortune Magazine once commented on DPO.

Industry insiders dubbed this direct listing model without underwriters: "No middleman makes a difference." In the past, companies often needed to invite investment banks as underwriters to conduct IPOs, and they also needed to spend a lot of money to help them prepare for listing.

For enterprises, cutting off underwriters means that the cost of listing is greatly reduced, which is the biggest advantage of DPO. But KEx, director of investment analysis at OKEx, believes that "the middlemen not only make a difference, but also play a funnel."

In addition to providing process services, IPO underwriters also help companies endorse, publicize, and communicate with investors. This is equivalent to helping companies sell their shares. It also provides a certain degree of liquidity for companies that have no visibility in the US capital market. Sex and price underpinnings.

Lord K does not think that DPO is progress, it is likely to be a retrogression. DPO removes the underwriter, and it is likely that liquidity risk and valuation risk will occur. "This is a reduction in costs in exchange for risk exposure."

Once a company's listing is expected to be too high, it is very likely that after listing, there will be no investor acceptance and the stock price will fluctuate violently. This is the biggest controversy facing the DPO so far.

Due to the lack of new shares and the lack of liquid stocks, the stockists who have just been listed are higher than the market's reasonable price, and the lack of professional underwriters roadshows and inquiries. The fluctuations may also be greater.

The current IEO has been developed by some exchanges into a "ten times opening" fast-running game. The currency price has skyrocketed and plunged too quickly. Many retail investors have no time to run, and have become high-end "receivers." quilt. This is still the case for IEOs that require some private equity investors to lock their positions. Is there even a DPO with no lock-up period? Will it be even worse?

DPOs speak for themselves

IEO endorses by trading platform

DPO and IEO seem similar, but the internal logic is not the same.

The less well-known Bitcoin blockchain project is willing to endorse itself with IEO; DPO may be a well-known unicorn.

Considering a company that is listed directly, it generally needs the company's reputation to be large enough and sufficient cash to pay the investment bank underwriting without roadshow advertisements. If it is not known at all, there is no roadshow without an underwriter to help the company's tray. Fall to the heart.

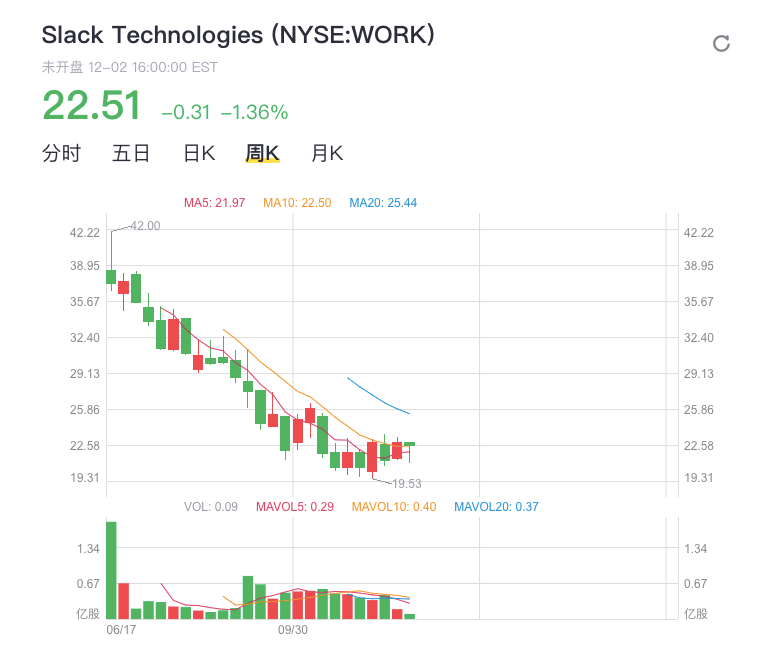

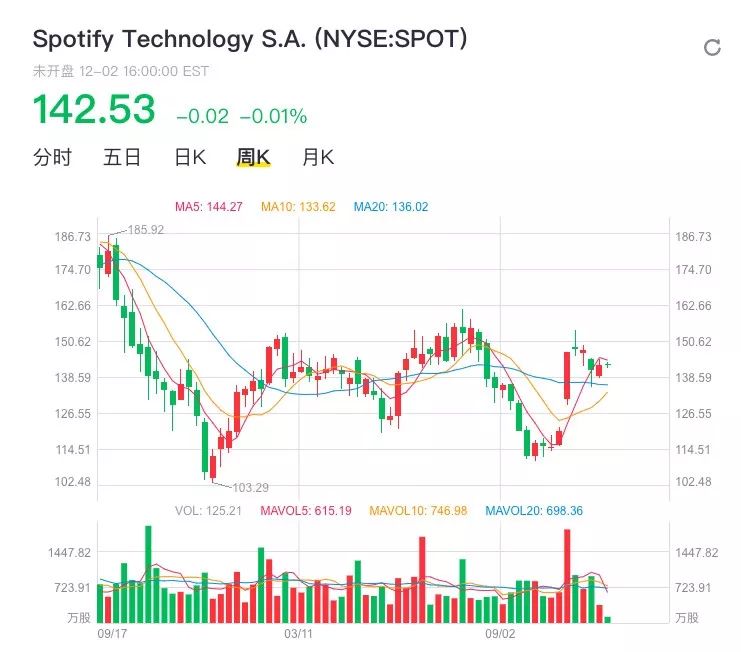

Currently, there are only two companies listed on the U.S. stock market as DPOs. One is Spotify Technology SA, an online music company, and the other is Slack Technologies Inc, a recently listed company that works with SaaS.

Take Slack, which just recently went public via DPO. Over the past three years, Slack's annual revenue has increased from US $ 110 million in fiscal 2017 to US $ 230 million in 2018 and US $ 400 million in 2019, with annual growth rates of 110% and 82%, respectively, at a compound annual growth rate of 95%; net losses attributable to ordinary shareholders were $ 147 million, $ 140 million, and $ 140 million, respectively.

Although the profit is negative, the loss is small, and there is no shortage of capital market support.

In addition, Slack's reputation in the market is also large enough. Since 2009, Slack has experienced 10 rounds of financing and a total of 1.2 billion US dollars. In the early days, it has received support from world-renowned giants such as Andreessen Horowitz and Accel Partners. Andreessen Horowitz It is one of the world's largest technology-based venture capital companies, at the same level as Japan's SoftBank (SoftBank) and San Francisco's Sequoia Capital, both of which have a market capitalization of more than $ 1 trillion. Top venture capital Accel Partners was an early investor in Facebook and Dropbox.

All these factors have laid the foundation for Slack to go public via DPO. Spotify, the world's largest streaming music service, is also a household name in the United States. At present, the stock prices of both companies have not exceeded the listing date.

(Screenshot from Tiger Securities)

IEO relies on the trading platform to endorse assets. Generally, the blockchain projects that choose to conduct IEO are some very early projects. The Tianwang level project does not need to carry out IEO.

The blockchain and cryptocurrency industries are still in a very early stage of development. There are only a handful of unicorn projects that have run out. For these Uranus-level projects, exchanges generally list them for free, and also pass these Uranus-level projects. Bring traffic to yourself.

As for those projects that are still relatively early in development, their tokens have no value and no liquidity. They can only rely on the reputation of the exchange to endorse themselves to attract investors to trade. However, the liquidity of the token obtained in this way is only short-term. If the project party does not act on its own, it will not do technical development and scenario landing to increase the value of the token. In the end, it still cannot escape the fate of becoming an "air coin".

Although the DPO and IEO are similar, there is no lack of ridicule, but in summary, we can feel that the same thing is that in the environment of a bursting capital bubble, difficulty in raising funds, difficulties before listing, and frequent breaks after listing, everyone is in Explore the way forward.

References:

Why did Slack go public? Did you make it?

NYSE IPO "cuts off" middlemen?

IPO / DPO distinction-a brief discussion on direct listing

NYSE, NASDAQ plan new rules for direct listing (DPO) issueable shares

Direct listing without IPO: New York Stock Exchange changes rules to fight for unicorns

What is the difference between a direct listing and an IPO?

Focus analysis 丨 New York Stock Exchange raises new rules, no IPO in the future IPO? Not so easy

Original articles; unauthorized reprinting is strictly forbidden, and illegal reprinting will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Does Bitcoin need an account? The developer thought it was necessary, and it took 1 year to design the system

- Views | Qian Xuening: If the central bank's currency issuance is fully digitized, the current bank's electronic accounting system will need to undergo significant changes

- What are the impacts of these 20 upcoming mainnet projects on the blockchain industry?

- Interview with Zheng Zhiming, Academician of the Chinese Academy of Sciences: Blockchain is a relatively mature and reliable evaluation system built for the first time in human history

- Viewpoint: A blockchain without a community is just a database, a community without a charter is not a community at all

- From quantum computing to blockchain: frontiers, trends, and challenges

- Featured on Twitter | Unlocking 1 billion XRP? You misunderstand Ripple too much