Summary of the DeFi Market in the Third Quarter Three Major Narratives and Three Major Projects

DeFi Market Summary 3 Narratives, 3 ProjectsAuthor: The DeFi Edge; Translation: LianGuaixiaozou

Rise, fall, rise, fall – the volatility we see is enough to drive traders crazy. The on-chain trading activity in the third quarter can be said to be the lowest since this bear market. This article is the latest issue of the DeFi Edge quarterly review, let’s summarize the development of DeFi in the third quarter.

First, let’s look at some data for this quarter:

-

DeFi TVL dropped from $77 billion to $69 billion (a decrease of approximately 10.38%).

-

The market value of stablecoins also dropped from $128 billion to $123 billion (a decrease of approximately 3.5%).

-

BTC fell 14% ($25,000), ETH fell 19% ($1,530).

-

The total market value of cryptocurrencies decreased by about 9% to $1.119 trillion.

Although overall economic activity is trending downward, there are still some highlights worth noting.

1. Three Major Narratives in the Third Quarter

The major narratives of the third quarter are some that existed before and some that are new.

(1) Real World Assets

DeFi investments are often accompanied by risks such as vulnerabilities. If the returns are substantial, then the risk is worth taking. One metric we track is the median DeFi APY, which has dropped below 2%.

In contrast, the US Treasury yield, the safest USD yield, is 5% for a 3-month Treasury bill. One of the main reasons for the low DeFi TVL is the disproportionate risk-reward ratio.

If the yields continue to remain low, capital will continue to withdraw from DeFi. In addition to printing money (referring to tokens), we need new sources of income.

Understanding real-world assets…

RWA (Real World Assets) brings traditional assets into the blockchain through tokenization. While all DeFi charts are trending downward, RWA-related charts have been on the rise. RWA could become a new source of income in this field.

The TVL trend in the top 9 protocols in the RWA category shows green for the month of January. Top protocols like stUSDT and Ondo have shown tremendous growth.

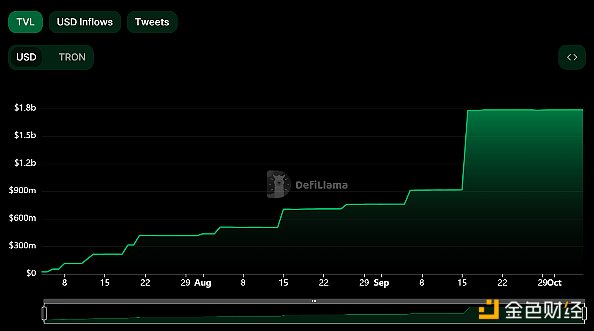

Below is the TVL trend chart for the stUSDT protocol.

In theory, we can tokenize various assets, whether it’s precious metals or real estate. However, the best assets to bring onto the chain are short-term US Treasury bills.

MakerDAO was the first to bring Treasury bill yields onto the chain. They lend DAI to a group that invests in short-term Treasury bills. The returns from short-term Treasury bills are transmitted on-chain through the interest payments of DAI loans.

The result is obvious. In the third quarter, the MKR price rose from $830 to $1,530. It’s impressive for an ancient dinosaur coin in a bear market.

Now, other protocols are also following suit. Frax has established a non-profit organization specifically for handling US Treasury bonds and other RWA businesses. Pendle has joined this narrative by creating fUSDC and sDAI markets.

(2) SocialFi

Tokenizing internet celebrity accounts? Haven’t we already tried that in 2021 with Bitclout?

Anyway, this new field has brought much-needed activity and interest to this dull market. It’s an unexpected narrative for the third quarter.

Leading the way is Friend.tech.

Friend.tech 101: It allows anyone to publish “keys”. These keys can be used for exchanges. Key holders can enter the private groups of key publishers to chat. In theory, you will get exclusive alpha from these guys.

Friend.tech became popular immediately after its release. Here are some numbers:

-

The number of unique users was about 138,000 in the first month after its release.

-

The total number of transactions was about 3.4 million.

-

The total protocol fee was $6.18 million.

Here are several reasons why it became popular:

-

Potential airdrops.

-

There is a mobile application.

-

Interesting social games.

-

Earning opportunities.

-

An app ecosystem built on FT.

Once this narrative became popular, competitors emerged. New SocialFi protocols began to appear on different chains. Post.tech appeared on Arbitrum, FanTech appeared on Mantle, and StarsArena appeared on Avalanche, and so on.

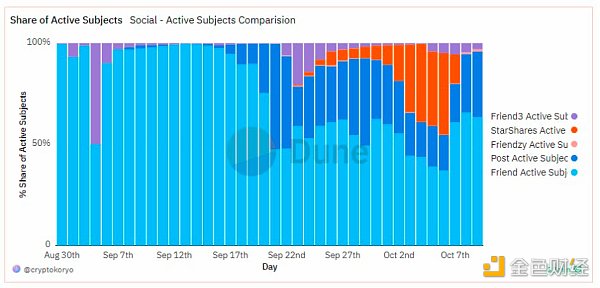

The following image shows the proportion of active participants in different SocialFi protocols.

This image tells the story of the FT opening the narrative, followed by the entry of competitors into the market. Although Friend3 also occupies a certain proportion in the image, Friend.tech dominates the market. Then Post.tech appeared on Arbitrum. It has a considerable share of users (about 20% on October 5).

Stars Arena (the new name for Star Shares) is the latest major challenger and has attracted a large number of users. However, they have unverified contracts and have been hacked. Now, they are out, and no one will deposit money into their app anymore.

In terms of protocol fees and trading volume, Friend.tech is still the king. On October 5, 91.6% of the protocol fees and 82.2% of the USD trading volume were generated by FT.

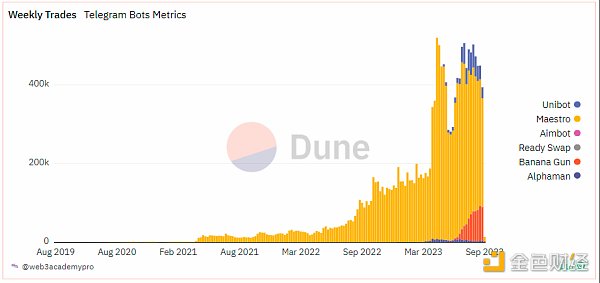

(3) Telegram Bots

I have been paying attention to the huge fees charged by Telegram Bots. What are they? They are bots that allow users to trade cryptocurrencies on the Telegram interface. These bots not only perform basic buying and selling transactions but also execute advanced tasks, including:

-

Crypto trading.

-

Handling airdrops.

-

Portfolio management.

-

Strategies, technical indicators, etc.

This is a narrative with enormous potential.

Poor UI/UX is one of the more serious issues facing DeFi. For beginners, operating a regular wallet and interacting with decentralized exchanges is very complicated. Typically, users have to navigate between multiple websites, ensure security, approve various transactions, and so on.

TG bots eliminate this hassle. They integrate (almost) all activities into a familiar Telegram interface. An additional benefit is that the bots can also be used on mobile phones, which is not common in standard setups.

Telegram is a massive platform with over 550 million monthly active users and over 55 million daily active users.

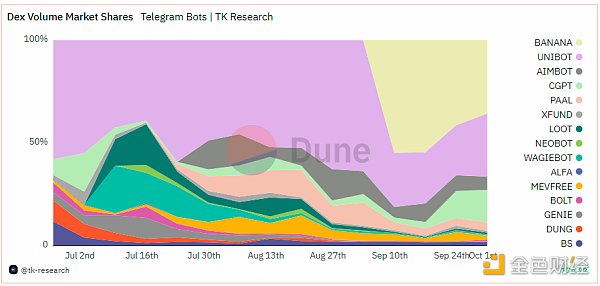

There are many competing projects in this field. The following graph tracks the market share of DEX trading volume for different Telegram bots.

Here are three projects worth tracking around this narrative.

#1 Maestro

Maestro is an OG bot with Q3 revenue of $11.38 million. Maestro still controls around 70% (September data) of the weekly trading volume in this category. However, they do not have a token. If they were to issue a token, it would be quite significant.

#2 Unibot

Unibot is the market leader (since Maestro does not have a token). They share revenue with UNIBOT token holders. These holders have accumulated over $1.2 million in revenue.

#3 Banana Gun

Banana Gun is a popular front-running bot. It is a relatively new protocol. But if we exclude Maestro, they control about 35% of the DEX trading volume market share. That’s more than Unibot. (They also suffered a reputation hit due to a failed token launch.)

2. Top 3 Projects in Q3

Here are the top three projects that I consider to be the most important in Q3.

(1) Base

On August 9th, Base Chain officially launched.

It is an Ethereum L2 supported by OP Stack and immediately achieved success upon launch. Here are a few reasons for its success.

-

Coinbase support.

-

L2 roulette game.

-

“Onchain summer” event.

-

Friend.tech becoming a super app.

-

Ecosystem fund attracting projects.

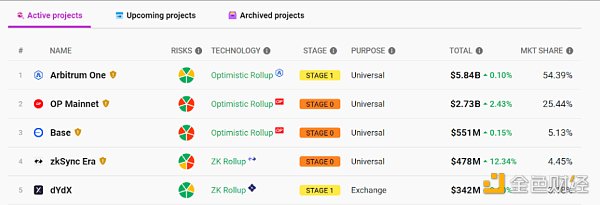

Despite being launched for only two months, it has become the Ethereum rollup with the third-largest TVL.

Base also has a rich protocol ecosystem, with 133 protocols already in place. L2s launched around the same period, Mantle and Linea, only have around 30 protocols. Even Optimism, one of the OG L2s, only has 190 protocols.

Base also has a rich protocol ecosystem, with 133 protocols already in place. L2s launched around the same period, Mantle and Linea, only have around 30 protocols. Even Optimism, one of the OG L2s, only has 190 protocols.

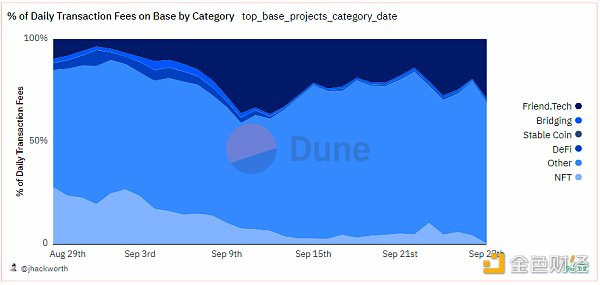

Base performed exceptionally well in Q3. All indicators show green. However, there are two major unfavorable factors for Q4:

-

Arbitrum will launch its short-term incentive program, and liquidity may be transferred from Base to Arbitrum.

-

Over-reliance on Friend.tech. On September 9th, 36.2% of the daily transaction fees on Base came from Friend.tech. What’s going on! Is this an application chain or something?

(2) EigenLayer

EigenLayer is a restaking protocol.

Restaking means staking already staked ETH onto other protocols. You can restake your liquidity staked tokens and native staked ETH.

EigenLayer is a marketplace between the protocol and restakers. The protocol requires participants to provide some services. Restakers do this in exchange for profits. If they fail to deliver on their commitments, they will lose the ETH they restaked.

Another way to understand EigenLayer is as a “custom carrot and stick generator” for the protocol. Users receive carrots, which are profits, if they act according to the protocol’s requirements. If users don’t, EL will use the stick, which is confiscating the restaked ETH.

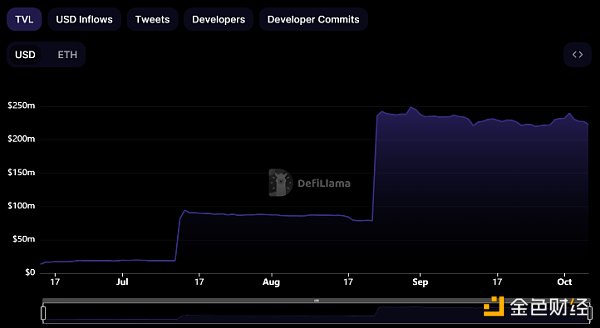

Their Ethereum mainnet was launched on June 14, 2023. For security reasons, they set restaking limits. EigenLayer’s mainnet reached the restaking limit on the day of its launch.

They increased the limit again on August 22, 2023. The limit on LST, including stETH, rETH, and cbETH, was removed, and if the restaked tokens of LST reach 100,000, the LST will be capped.

This limit was also reached within a few hours. TVL rose from $78 million to $238 million. From this perspective, only three rollups have more TVL than this (according to DeFiLlama data).

This demonstrates the crazy demand for EigenLayer. As long as they can provide a functional product, the demand will skyrocket.

EigenLayer will enable a new tokenomics mechanism. Projects now have a new way to distribute tokens in exchange for specific services.

It will also accelerate true innovation. Previously, many decentralized projects were forced to create their own token networks. Projects can now outsource it to EigenLayer and focus on real innovation. Twelve projects have publicly started building on EigenLayer.

Liquid Restaked Tokens are another innovation. They are similar to liquidity staked tokens like stETH and rETH. In addition, they also earn income from other protocols.

(3) Solana’s comeback?

FTX crashed, and SOL fell with it.

SBF heavily promoted SOL, but it lost a lot of value when he was crowned the scammer of the year. But the community is still moving forward. Solana seems to be making a comeback.

Solana has an active developer community. DeFi protocol-related data is displayed in green.

It seems to have solved the chain downtime issue, with no chain downtime events occurring in the second and third quarters.

While the total TVL of cryptocurrencies and DeFi collapsed, Solana’s TVL grew by 18.52% in the third quarter. It increased from $770.88 million on June 30th to $913.66 million on October 1st.

Solana also had some bullish developments in the third quarter.

-

Maple Finance returned to Solana.

-

Shopify integrated Solana into its platform.

-

Visa added stablecoin settlement functionality on Solana.

-

Many DeFi protocols on Solana are growing.

-

Membrane Finance launched a Euro stablecoin on Solana.

-

Recognized as an execution engine with advanced technology. (The founder of MakerDAO hopes to use Solana’s codebase to create an L1 for Maker.)

I am not optimistic about L1 right now, but Solana may be an exception.

3. Future Outlook

While reviewing is helpful in learning from experience, real opportunities lie ahead.

-

The Arbitrum ecosystem. They approved a $50 million ARB incentive program. The program will run until January 31, 2024. Therefore, the yield chasing profits of degen will move to Arbitrum. The DAO is voting on which projects should receive funding. The optimal strategy is to focus on protocols that are being incentivized and have a place in them (but make sure they align with your investment strategy).

-

Canto has recently shown promising development trends. It is a Cosmos chain that has launched many economic innovations, such as paying a certain percentage of gas fees to smart contract developers, which incentivizes developers to build on Canto; providing financial primitives like DEX, lending markets, and stablecoins as public goods without charging any fees; recently they announced that they are using Polygon CDK to migrate to an Ethereum ZK L2. They have also collaborated with Fortunafi & Hashnote to develop an RWA strategy. The L2 and RWA narratives are very strong. I will keep a close eye on them.

-

We also need to monitor common suspicious areas: decentralized perpetual contracts, ETH L2 (Base, Mantal), LSDfi, LRT (liquidity re-collateralized derivatives), GamblFi, Cosmos, Solana, etc.

From a longer-term perspective, I am looking forward to the Ethereum Dencun upgrade. This upgrade will introduce proto-danksharding, which will make rollups use Ethereum at a lower cost. Just as the Shapella upgrade was a catalyst for the LSDfi narrative, the Dencun upgrade can also be a catalyst for L2 projects.

On a larger scale, there is the geopolitical backdrop of the Israel-Hamas conflict. This article does not describe politics, but I still want to mention it because political factors may affect the market.

In general, I think the fourth quarter ahead will be calm.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of Outlier Ventures’ 6 Cosmos investment portfolio projects

- Summary of the latest Ethereum core developer execution meeting Devnet-9 launch delayed again, Holesky test network validator participation rate close to 80%.

- Vitalik Should Ethereum integrate more functions at the protocol layer?

- The enthusiasm for the ‘Anti-Shib Movement’ is high, ‘Abandoned Child’ CAL becomes the most powerful weapon.

- Overview of the selected projects for the second phase of Outlier Ventures’ Zero Knowledge Base Camp

- ETHGlobal New York Hackathon 13 Winning Projects Overview

- ETHGlobal New York Hackathon A Review of the 13 Finalist Projects