Multiple projects announce shutdowns in succession, is the encryption industry ushering in a ‘shutdown wave’?

Is the crypto industry experiencing a wave of shutdowns with multiple projects announcing closures?Author: Sharon, BlockBeats

Despite the buzz of the recent Token2049 conference, the current state of the cryptocurrency industry seems to be mired in a slump, unable to shake off the overall gloomy sentiment.

On September 21st, DeFi project Fuji Finance announced that it would cease operations, and users will be able to withdraw their funds through the user interface by 2024. This is the fourth project to announce its shutdown in September. Prior to this, there were also DeFi projects Gro Protocol on September 20th, None Trading on September 20th, and NFT platform Voice founded by BM, the founder of the EOS public chain.

According to incomplete calculations, there have been 9 project closures in the cryptocurrency industry in 2021, 17 in 2022, and 27 in 2023. At the same time, in 2023, the rate of project closures has been accelerating, increasing from an average of 1 per month to a peak of 5 per month. Behind these events, from community operations to project financing, every participant in the cryptocurrency industry has felt the chill of the bear market.

- Inventory of Binance Labs’ sixth season incubation projects

- 12 New Projects A Summary of Binance Labs’ Sixth Season Global Incubation Program

- 12 New Projects Binance Labs’ 6th Season Global Incubation Program Projects Overview

Increasing Frequency of Project Shutdowns

Fuji Finance, as the “first DiFi aggregator” on Ethereum, has closed down due to lack of funds, just like Gro Protocol, another DiFi project.

In its press release, Fuji Finance stated, “Since February of this year, the Fuji team has been raising funds to continue developing the protocol and building the future of cross-chain DeFi operations. We have been unable to find a product that fits the market. As our funds continue to decrease, we have decided to start shutting down the company and ending operations, and there is currently no sign of the fundraising activities coming to an end.”

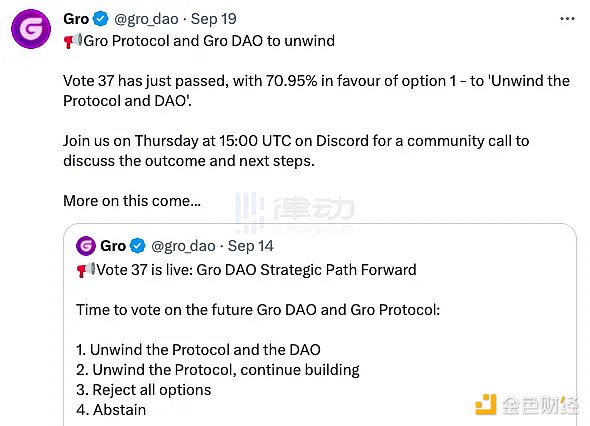

Gro Protocol, on September 20th, also stated, “Despite the incredible dedication, time, and resources contributed by all Gro DAO contributors and members to this community and protocol over the past three years, Gro DAO finds itself facing significant challenges. Difficult market conditions, underperformance of Gro Protocol, and critical deviations from Groda Pod have put Gro DAO at a critical moment, requiring decisions about its future.”

The decision was to shut down and dissolve, which received 70.95% support within the community and will focus on dissolving the DAO and stopping the operation of Gro Protocol from October 3rd to January 3rd, with a budget of 180,000 USDC. Users can withdraw their assets from GVT, PWRD, and Pools at any time (without a time limit).

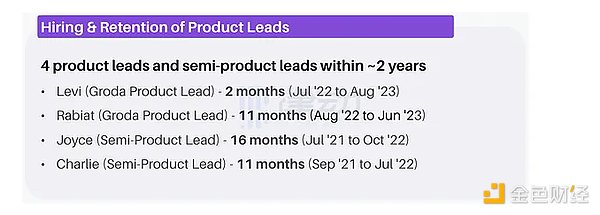

The Gro DAO official website details the reasons for the project’s shutdown: firstly, the performance of the protocol – the flagship product of the DAO, the risk and reward graded Gro protocol, has underperformed for a long time; secondly, the departure of key management personnel (“leadership vacuum”), combined with the failure of other product Pods (LianGuainda) expansion, has triggered broader survival issues for the DAO.

Source: Gro DAO Governance

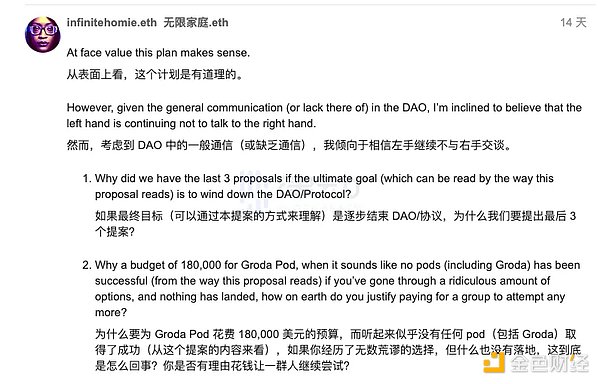

The departure of “4 key figures in Gro DAO, contributors, and community detachment” has also accelerated the process of project dissolution. In response, there are questioning voices in the community pointing out issues with the allocation of funds in their proposal: “Why pay $170,000 to two people to simplify the product?” On the other hand, some question the allocation of their time and budget: “This is the worst time and budget reduction proposal I have ever seen.”

Source: Gro DAO Governance

Going back in time, Voice, the NFT social platform founded by EOS founder BM, announced its shutdown on September 14th, citing “high uncertainty in the cryptocurrency and NFT market”. Launched in June 2019, backed by Block.one, Voice was initially a decentralized social platform, targeting Twitter (X), Facebook, and others, with BM stating that it was an application that “would change the industry landscape”.

At that time, Voice can be said to have been born with a silver spoon. In order to successfully launch Voice and promote it better, on the one hand, Block.one paid a fine of $24 million to the SEC to prepare for the upcoming Voice compliance; on the other hand, BM spent $30 million to purchase the domain name Voice.com, becoming the largest publicly disclosed domain name sales record in history. BM believed it was “expensive but valuable”.

Despite high expectations, Voice did not provide a good user experience and received a lukewarm response from the community after its launch. In May 2021, Block.one announced the upgrade and transformation of Voice into an NFT-based creation and social platform targeting emerging creators, but now it cannot escape the fate of closure.

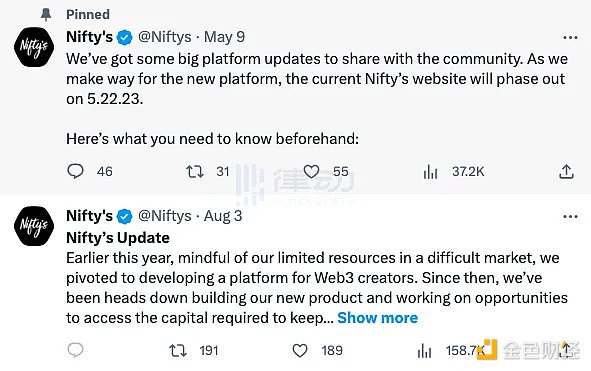

In addition, Nifty, the Web3 creator platform that announced its shutdown on August 3rd, also closed due to “insufficient funds”. They stated on social media, “Earlier this year, considering our limited resources in a difficult market, we turned to develop a platform for Web3 creators. Since then, we have been committed to developing new products and seeking opportunities to obtain the necessary funds for continued development. Unfortunately, despite our best efforts, the investment opportunities we have been working hard for have not succeeded, and we now find ourselves at the end.”

It can be seen that most of the projects that have announced their shutdown in the past month are due to insufficient funds, which is also related to the current bear market situation. The PolkaWorld community has also temporarily suspended operations due to issues with fund allocation in proposals and new governance frameworks.

These projects emerged during a bull market but exited during a bear market. Behind the chaos lies the root cause of money.

Is the money all spent?

Jocy, the founder of IOSG, a top Chinese blockchain venture capital firm, recently wrote that for many teams, if the bear market does not end, then this (referring to Token2049) will be their last public appearance.

“LPs continue to support early-stage VCs that foster industry growth. VCs continuously support founding teams in emerging sectors, and teams continue to expand and scale, seemingly moving in a positive direction. However, the reality is quite different. For many teams, this 2049 event is essentially their last hope for funding. If the bear market doesn’t end, it could be their team’s final brand exposure. Most early-stage teams have exhausted their runway due to expansion over the past two years. Some teams have very high burn rates and, in such a market, only have 5-10 months left. They are even willing to buy overpriced 2049 tickets/sponsorship booths to pitch to more potential investors.”

This also indicates to some extent that perhaps behind the recent shutdowns of multiple projects is the fact that the funds they raised have now been burned out. And from the recent fundraising history of several projects, it may indeed be the case. During the previous bull market, project fundraising was easy, and VCs were generous with their money.

In March 2021, Gro Protocol announced the completion of a $7.1 million seed funding round. It is reported that Galaxy Digital and Framework Ventures led the round, with participation from Variant, Northzone, Nascent, and others. In July 2021, Nifty’s announced the completion of a $10 million seed funding round, with participation from Polychain Capital, Ethereal Ventures, Coinbase Ventures, A&T Capital, and others. Voice even received $150 million in funding from Block.one.

2021 was indeed a bull market period. Now, two years have passed, and perhaps, as Jocy said, the money that was raised has been burned out. However, in the bear market period, these projects face greater obstacles in raising funds, which is one of the reasons for their shutdown and dissolution. But perhaps, as projects like Nifty and Fuji stated in their announcements, they have unwavering confidence in the industry’s development. However, the current situation and conditions do have significant “uncertainty.” Perhaps in the next cycle, these projects will revive and usher in a new summer.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the 12 incubation projects in the sixth season of Binance Labs

- Quick look at the first batch of 24 selected projects for the Variant Founder Fellowship.

- Eclipse Mainnet Architecture Introduction Ethereum SVM L2

- Banana Gun Research Report How did this sniper rifle make its way to the top of the TG BOT queue?

- A comprehensive inventory of the top ten on-chain Rug Pull projects in the crypto community, mainly from the previous bull market.

- Big Brother Ma Ji Huang Licheng to Launch New Project? Overview of its Organizational Structure and Token Economics

- Token2049 Review Lack of Innovation in Projects, Institutional Focus on Regulation