Defi Sport Enlightenment Project MakerDAO's ambition and brutal struggle

Bloomberg correspondent Alastair Marsh hopes to write an article to introduce the ambitions, hopes and conflicts of the definitive financial (DeFi) world to the elites of the traditional financial industry. He said that people in the DeFi world hope to rebuild the ambition of the financial services industry is both a mad dream and a genius . So he interviewed MakerDao in depth and wrote this report.

However, this story, apart from DeFi's ambitions, is more conflicting and struggling, and it also shows the challenges faced by various practices in the "decentralized world."

MakerDao is currently the largest project in the DeFi field and is widely considered to be the “project to launch the DeFi campaign”. On October 9th, MakerDAO founder Rune Christensen announced at the Ethereum Developers Conference Devcon 5 that multi-mortgage Dai (MCD) will be officially launched on November 18th. Multi-mortgage Dai will bring many new features to the Maker agreement, including Dai. Deposit Rate (DSR) and more collateral types. When the MCD is officially launched, it will become an important milestone in the development of MakerDao.

For Ashleigh Schap , the 2008 Great Recession was not so much an economic crisis as it was an awakening of ideology. Her hometown of Houston escaped the financial turmoil that swept through much of the United States. Her parents kept their jobs, and the house she lived in saved most of her value. She has little reason to imagine that American capitalist machines will stop working.

- Babbitt Entrepreneurship + | Luck and strength blessing, how does Taraxa endorse for the blockchain + IoT?

- When the cryptocurrency market is not good, what kind of trading strategy can you use to make a profit?

- Successful breakthrough in the broader market, platform coins are expected to meet the opportunity

However, what happened that year left an indelible impression on her teens.

She read a lot of blogs about the financial crisis and the rest of the wave, and also discussed these topics with her classmates, which made her realize that good times will not last forever. She said that this made her disgusted with the unbalanced financial system, which at the expense of the interests of the underlying people, provided welfare and blessing to those at the top of society, and this understanding also for her later life. Has had an important impact.

"I am from Texas, and my family supports conservatism and capitalism," she said. "And in this year, I saw the first evidence that the idea of maintaining growth at all times, that talents can always be discovered, and that the market is always effective is a failure."

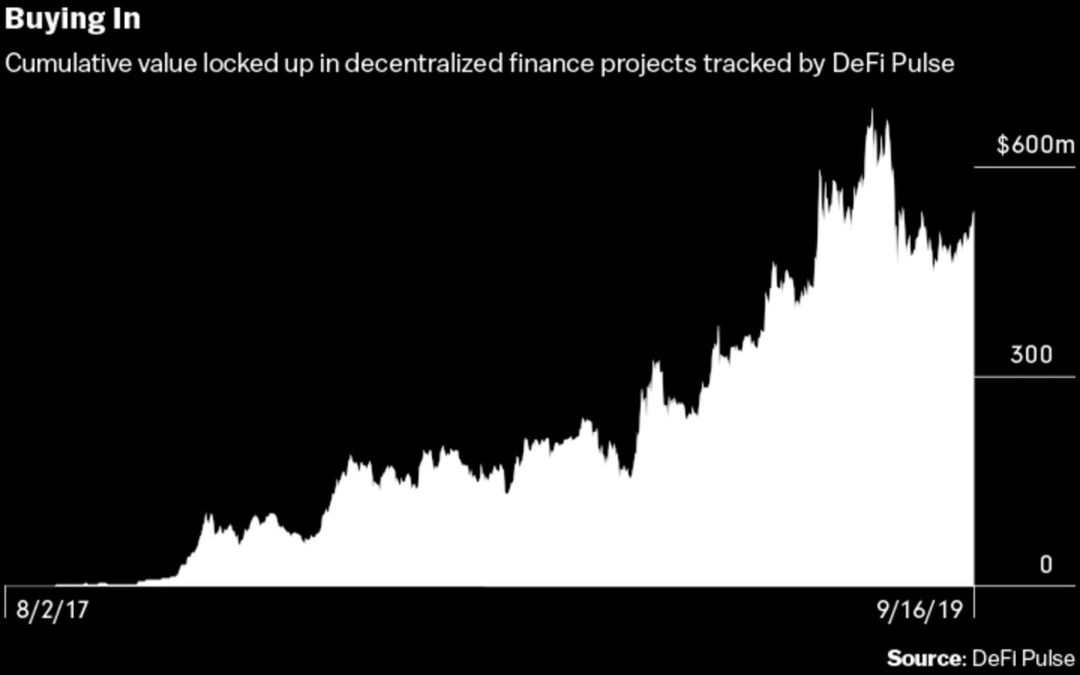

MakerDAO is the most important player in the rapidly evolving decentralized financial movement. # DeFi , this Twitter tag is widely known, and its goal is to create a financial world in which anyone can get everything from loans to investments, all programs can circumvent the decision of who can play the janitor or every time An intermediary who has to pay.

In this world, Scarpe is more than capable. In her early 20s, the online game World of Warcraft led her to contact Bitcoin: she needed to use Bitcoin to buy an accessory for her game character. In February 2013, she purchased 5 bitcoin tokens (one year later, the Mt. Gox exchange was frozen due to hacking of the system, causing her to lose another 5 bitcoins) .

Decentralized finance is a natural product of the concept of cryptocurrency. The DeFi movement is small in scale; it is almost entirely a territory of encrypted utopians, and many of them are gathered in San Francisco. And it counts a lot of critics that it is a crazy experiment, and the operator has no ability to design financial products.

"This technology may be interesting for more effective financial services, but its naivety and lack of knowledge of financial history has shocked me," founder of Richard Bernstein Advisors LLC, Merrill Lynch & Richard Bernstein , former chief investment strategist at Co., said: "They have a mentality of disintegrating everything and almost nothing to know about financial regulation."

Scarpe said she is not a financial newbie. She said: "I have left the traditional financial community for a reason, not because I don't think the salary is high enough, but because I want to see what we can do with this new technology and how far we can push it. I Not a crazy traitor. On the contrary, I believe that the blockchain has the potential to create a fairer financial system than the current one, with greater flexibility and more credit opportunities."

In fact, the idea behind decentralized finance can have a broad resonance outside the currency. Starting from the global occupation movement, it is the young people who oppose social injustice and existing power structures, including the financial industry.

While working at MakerDAO, Scarp dyed her hair pink, and her workplace was just a stone's throw from the New York Stock Exchange . She said that she liked MakerDAO at the time, precisely because it stood on the opposite side of a corporate giant like JPMorgan Chase, not so much a MakerDAO as a company, a cooperative, a digital age commune, developers around the world and Entrepreneurs work together on this exciting new project.

However, Scarp did not know that when she joined MakerDAO, a rebellion was brewing inside the rebellion. In this melee that revolves around the extent to which financial services can be decentralized, Scap is inadvertently involved.

At the time, Rune Christensen , the founder of MakerDAO, had begun to believe that it was time to get rid of encryption anarchism and integrate the project into the existing financial system. Others, including Chief Technology Officer Andy Milenius and Scap , believe that such a move is a betrayal of the ideals they cherish.

In early April of this year, Millenius reviewed the startup's ideological battle at the company's chat server. He said that Christensen tried to impose his vision on a loose alliance of developers and merchants, giving them an ultimatum and asking them to either agree with his plan or leave.

Millenius said in a post that many employees were dissatisfied with Christensen's high-pressure offensive, but he only named one of the employees, that is, Scap.

Soon she will understand that her days at MakerDAO are few and far between.

Skapu's study at the University of Texas at Austin is not a natural springboard for her development in the financial industry. She majored in philosophy and minored in French. When applying for JP Morgan Chase, she tried to prove to people how liberal arts taught her to think about problems. That job did not suit her at the end. She said: "I don't think we are doing anything big. We collect money, but I feel that the fees we charge are too much. This is not a profound rocket science."

Scarpe is increasingly feeling that he has been pulled to the edge of finance. She said that in the five years of working in the traditional financial industry, there are not many opportunities for career development in the field of cryptocurrency that she can encounter. But last year, she felt that she was qualified enough and boring, so she seized the opportunity to join MakerDAO.

Skap is engaged in business development. At first it was a mixed job, but soon turned to focus on the most ambitious stage of the project: creating a stable currency supported by multiple collateral. She said she has been looking for partners who can provide collateral for the MakerDAO system.

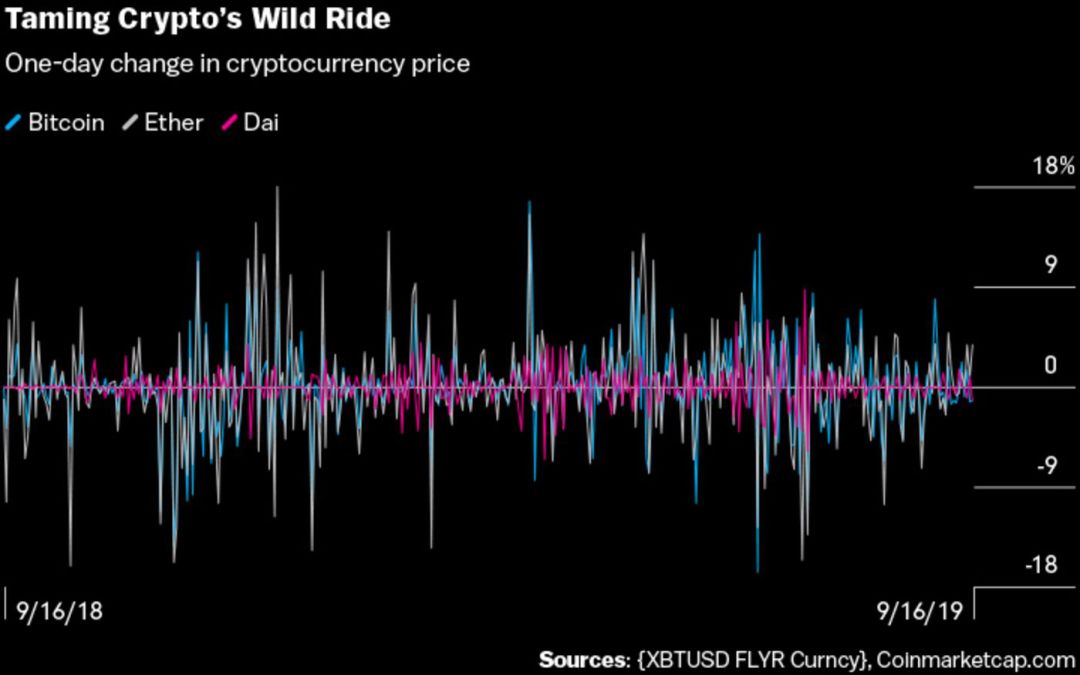

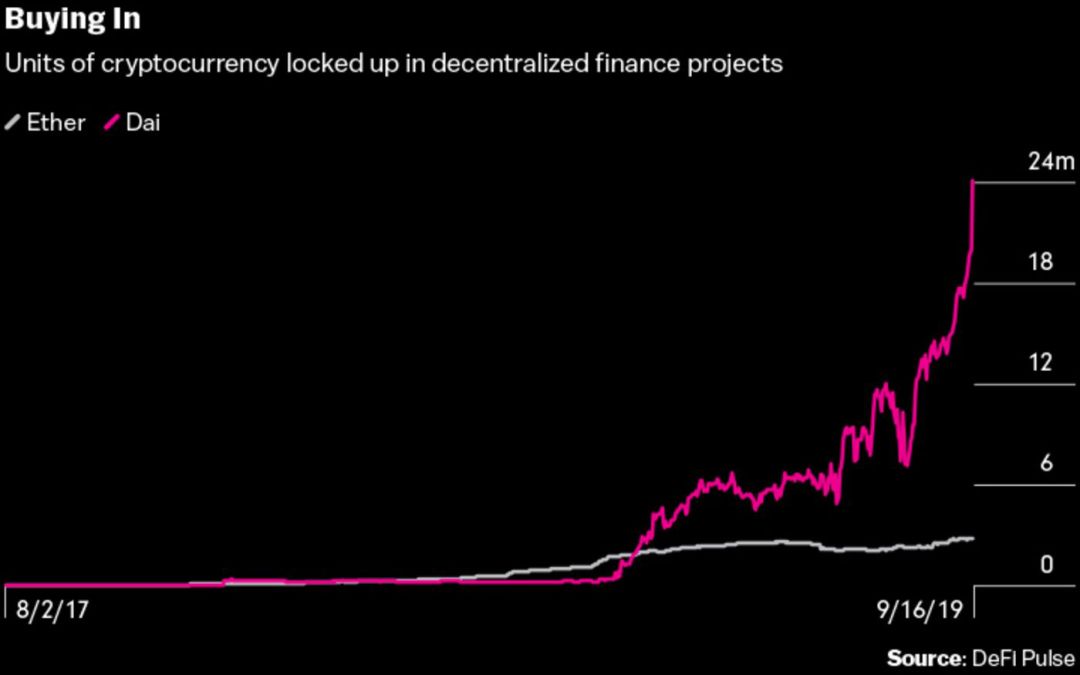

MakerDAO's stable currency, Dai, is pegged to the US dollar, and in the current version it is also supported by Ethereum. As of September 19, the value of Dai in circulation was approximately $82 million. Launched around the end of 2017, Dai was one of the first virtual currencies designed to avoid price volatility.

Stable assets like Dai can be used to hedge against volatility. ETH reached a peak of more than $1,400 at the beginning of 2018, falling to $84 at the end of the year and $175 at the beginning of October. Dai can also be used to pay. Dai's users claim that they used it to buy cars and pay employees. According to MakerDAO, some payment companies such as Wirex Ltd. allow customers to use this token to support the flow of funds between cryptocurrency and traditional currencies.

Dai tokens also support lending. When ETH holders send their tokens to a blockchain-based contract developed by MakerDAO and open a so-called collateralized debt position (CDP, or "collateralized debt") You can generate Dai. The CDP then issues a loan to the ETH holder in the form of Dai. Under market pressure, the loan amount is lower than the value of ETH to maintain excess guarantee.

Just a few weeks ago, Christensen, who co-founded MakerDAO in 2014, published his ultimatum with a true counter-culture attitude. Christensen is 28 years old and is from Denmark. When he was still in college, he spoke Chinese and co-founded a company to recruit European teachers to work in China. Inspired by the sci-fi movie The Matrix , he offers two options for the MakerDAO development team. Red Pills: Supporting Christensen's views into the group, according to what Milenes said in his post, Christensen's "main focus" is "government compliance and Maker and the existing global financial system." Integration." Blue Pills: If you have a different opinion, get your hands done and leave. Taking a red pill doesn't mean you are going to mainstream finance. Christensen said: "I refuse to accept that I am not an idealist." He said he believes that startups like MakerDAO have few precedents to follow. To succeed in a fast-paced industry, they need to adapt to the real world.

Just a few weeks ago, Christensen, who co-founded MakerDAO in 2014, published his ultimatum with a true counter-culture attitude. Christensen is 28 years old and is from Denmark. When he was still in college, he spoke Chinese and co-founded a company to recruit European teachers to work in China. Inspired by the sci-fi movie The Matrix , he offers two options for the MakerDAO development team. Red Pills: Supporting Christensen's views into the group, according to what Milenes said in his post, Christensen's "main focus" is "government compliance and Maker and the existing global financial system." Integration." Blue Pills: If you have a different opinion, get your hands done and leave. Taking a red pill doesn't mean you are going to mainstream finance. Christensen said: "I refuse to accept that I am not an idealist." He said he believes that startups like MakerDAO have few precedents to follow. To succeed in a fast-paced industry, they need to adapt to the real world.

"The key to this great journey and challenge is how to achieve this vision," he said. "It's easy to write white papers and code, but to get a truly decentralized financial system to work, you need to address the challenges of regulation and how to integrate with existing systems."

In his view, the setting of DAO cherished by Scap is led to "disorderly tyranny."

MakerDAO founded the Maker Foundation last year. Its purpose is to promote the success of the Dai credit system and formalize its architecture. Christensen said that as of mid-September, the foundation is still recruiting professional board members.

In response to his ultimatum, Scap and some like-minded employees proposed a third method, known as the "purple pill." They want to seek a compromise to maintain the decentralized spirit of MakerDAO and ensure that its resources will be used to fund the widest possible range of DeFi projects.

Scarp said: "If you want to build a new system, it will need unselfish ideas and design, avoiding a company or entity to take all the rewards. You should eliminate the top-level advantage, and it is difficult Do it: If we build something, we will inevitably feel that we should be assigned to our own reward."

According to Millenius's post, Christensen sees the discussion of purple pills as an uprising. Millenius said many supporters of purple pills were fired. Scarp was fired at the end of April. She said that the company’s reason for expelling her was that she violated the “ non-solicitation” clause and she denied the allegation. A spokesperson for MakerDAO declined to comment.

The 27-year-old Millenius resigned as chief technology officer shortly before writing this essay. He said that MakerDAO represents a broader conflict that swept the encryption community. In this conflict, one thinks blockchain technology. It is a means of completely reshaping the financial world, while the other believes that it is only an effective tool to improve the efficiency of the financial world. He said: "The blockchain community has been divided into two groups, one to support improvement and the other to have a radical view of a new way of life. After this spring event, I clearly realized that Maker is now completely Belong to the former camp."

For Christensen, the next phase of the project is to increase users and profits. He said he is considering whether MakerDAO should get a broker-ownership license or acquire a licensed brokerage firm so that the MakerDAO system can accept real-world collateral to support Dai.

He said: "The future is not to let Maker work, but to figure out how to expand this ecosystem as much as possible and how to make it profitable. There is still much to be done before the encryption ecosystem becomes a self-sufficient large economy. "

Scape said that she did not expect to be in the center of the MakerDAO storm. She said: "I don't know how, I am inexplicably a typical representative of this rebellion. But this is not true. I have neither acted as the leader nor a coup."

After losing his job at MakerDAO, Skapp went to Egypt to rest for a while. She has been practicing snorkeling for a long time, in Dahab in the Red Sea, she has tried a more adventurous approach: learning to dive freely from a depth of 20 meters. Scarp said she enjoyed this spiritual challenge. "It calms your brain and overcomes the urge to breathe or swim on the water."

After leaving Egypt, she went to Berlin, where she was at the heart of the blockchain developer, where she advised on some DeFi projects.

Scap said that her experience at MakerDAO has strengthened rather than undermined her belief that decentralized financial services are necessary and worthwhile. She said she hopes MakerDAO will be able to go all the way. After all, she spent a year on this project and now holds some MKR tokens. But she still doesn't think that platforms such as MakerDAO need to be regulated.

In some people's eyes, decentralized finance is nothing more than a farce, distracting the attention of the financial community, so MakerDAO's next step is critical: it is the largest and most concerned DeFi project. Robert Leshner , CEO of the virtual money market compound, said that this is unusual for the $220 billion encryption market in the broad sense.

Lashner said that MakerDAO and DeFi have helped solve the problem behind hidden cryptocurrencies more broadly. "After the bubble burst in 2017 and 2018, people naturally ask, "What do we do with these things?" he said. "DeFi is the first reasonable answer to this question. DeFi is about to usher in its glorious moment, because this is the next chapter in encryption."

As for Skapu, decentralization has become a life goal. She said she is now working with her friends to start her own DeFi company, working in Berlin and New York. She said: "I don't think Maker will ultimately determine the success or failure of DeFi. It has helped DeFi start. I think that even if Maker fails, the train will not stop rolling forward."

Author: Alastair Marsh, Bloomberg reporter, the article published in "Bloomberg Markets" magazine compiled 10/11 January double issue: Zhan Juan Source: Wen chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vitalik: Ethereum 1.0 will become the subsystem of Ethereum 2.0, PoW will lose its meaning

- Token Watch | Ponzi Finance, Negative Interest Rate and Bitcoin

- Devcon's first day of editing: State Rent, Uniswap and Plasma's second floor DEX

- Monthly Report | In September, 70 global blockchain application projects were disclosed, and the Chinese market cooled.

- Diss bitcoin, lack of money, development no strategy, V God and community members are still discussing what is going on at Devcon, the biggest event of the year?

- Non-profit organizations play a key role in the Libra Association through Libra's global inclusive finance

- Bitwise and more brave Bitwise: We will resubmit the Bitcoin ETF application as soon as possible