Monthly Report | In September, 70 global blockchain application projects were disclosed, and the Chinese market cooled.

In September 2019, the domestic blockchain application market opened the “cooling down” model.

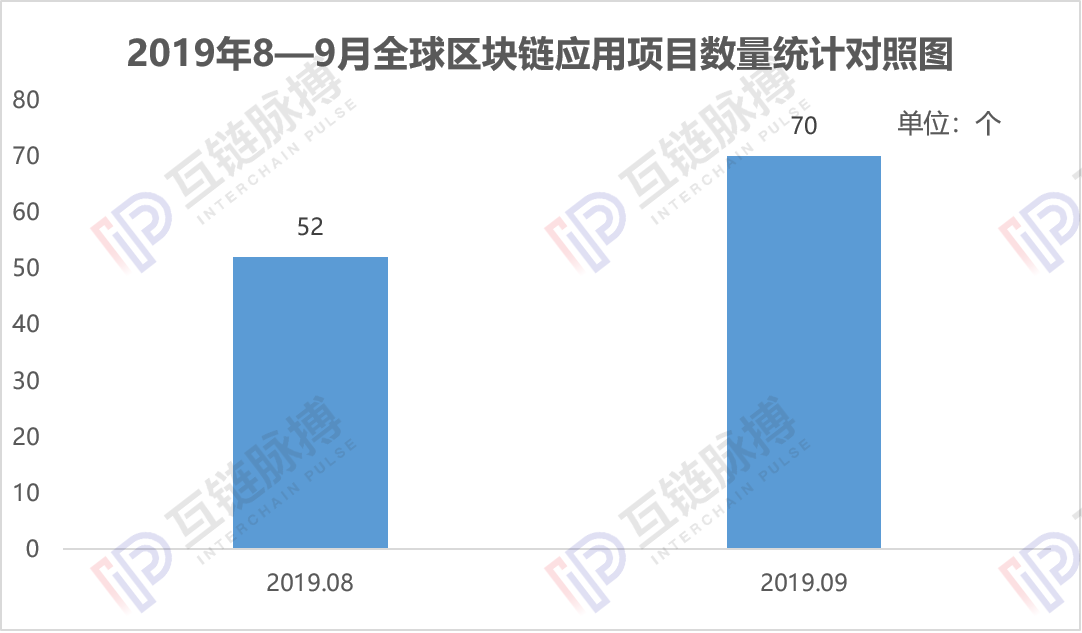

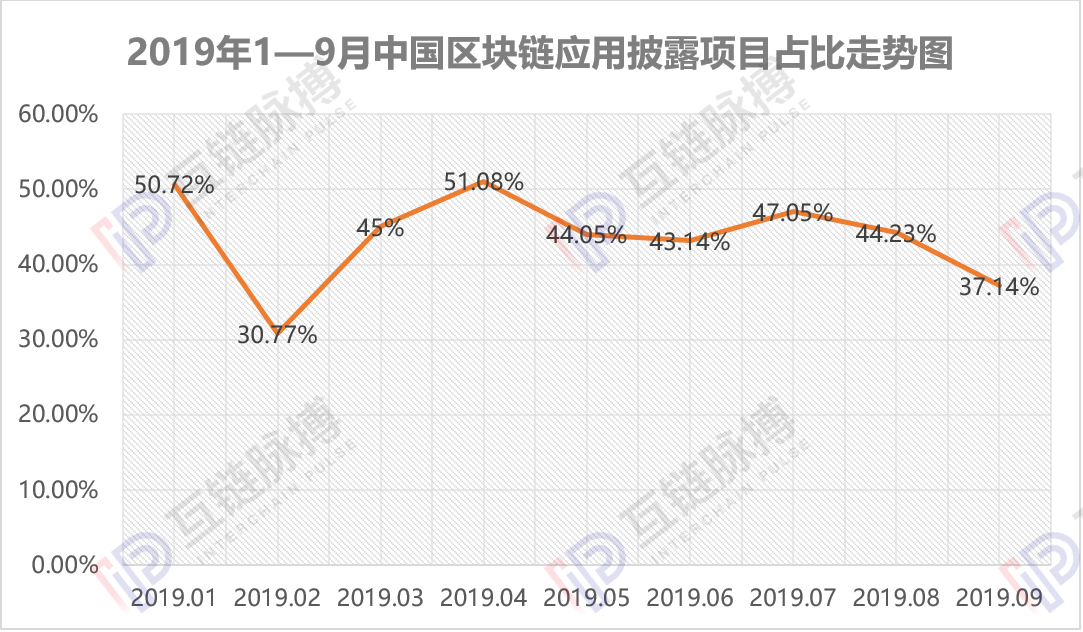

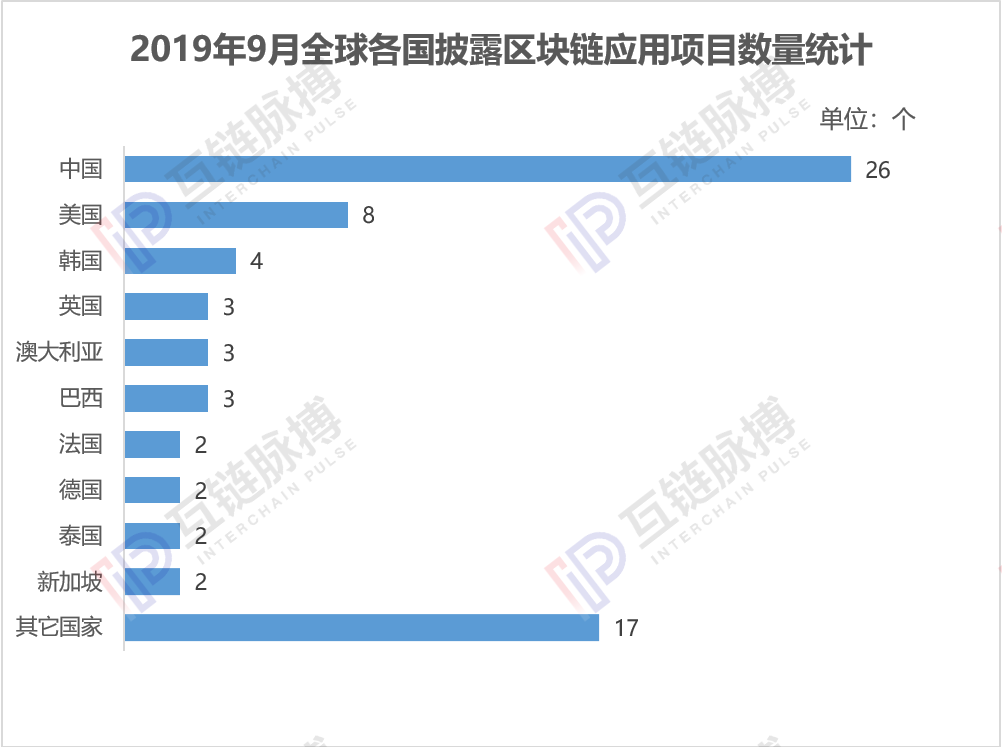

According to the incomplete statistics of the Inter-Chain Pulse Institute, in September 2019, 70 blockchain application projects were disclosed globally, an increase of 34.6% from August. Among them, China has disclosed 26 blockchain application projects, accounting for approximately 37.14%.

This is the month in which China's blockchain application disclosure projects accounted for the lowest proportion in the world since February this year.

In the first nine months of this year, except for the impact of the Spring Festival holiday in February, the number of China's blockchain application disclosure projects in other months was higher than 40%, and the proportion in January and April was over 50%. However, since August, the proportion of China's blockchain application disclosure projects has been falling for two consecutive months.

- Diss bitcoin, lack of money, development no strategy, V God and community members are still discussing what is going on at Devcon, the biggest event of the year?

- Non-profit organizations play a key role in the Libra Association through Libra's global inclusive finance

- Bitwise and more brave Bitwise: We will resubmit the Bitcoin ETF application as soon as possible

In the second half of 2018, the blockchain industry entered the winter due to the collapse of global cryptocurrency, and the continued cooling of the Chinese market, which is the global leader in the application of blockchain, indicates that a new round of winter is coming.

(Source: Mutual Chain Pulse Institute)

(Source: Mutual Chain Pulse Institute)

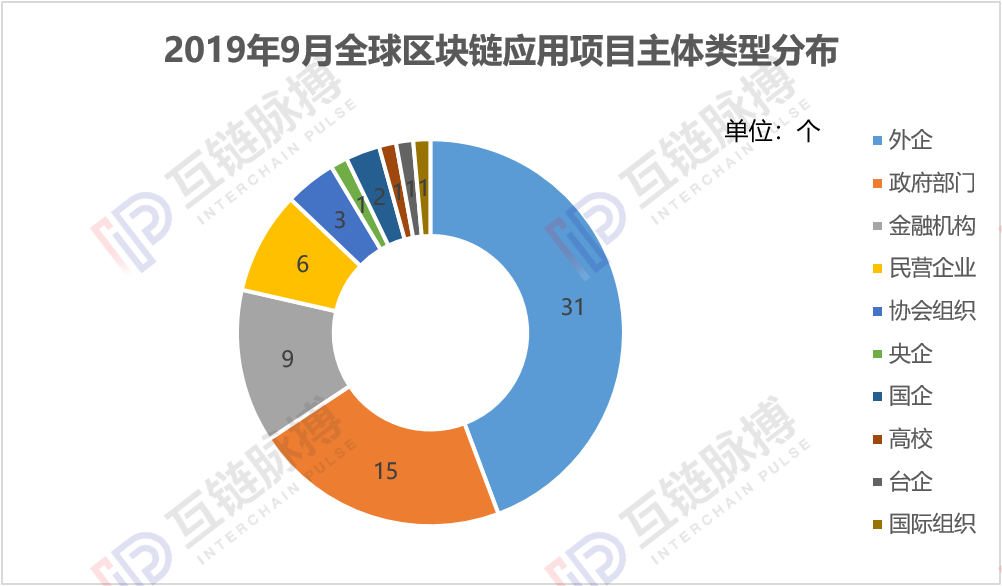

From the perspective of the main types of projects, foreign companies and government departments accounted for the largest proportion of the 70 application projects in September, with 31 and 15 respectively, including 9 local government departments, followed by financial institutions and domestic private enterprises. There are 9 and 6 and finally there are 3, 2 and 1 associations, state-owned enterprises and central enterprises.

Compared with August, the disclosure projects of relevant local government departments and domestic private enterprises have all decreased in September. On the contrary, the number of application projects disclosed by foreign companies has increased rapidly.

(Source: Mutual Chain Pulse Institute)

(Source: Mutual Chain Pulse Institute)

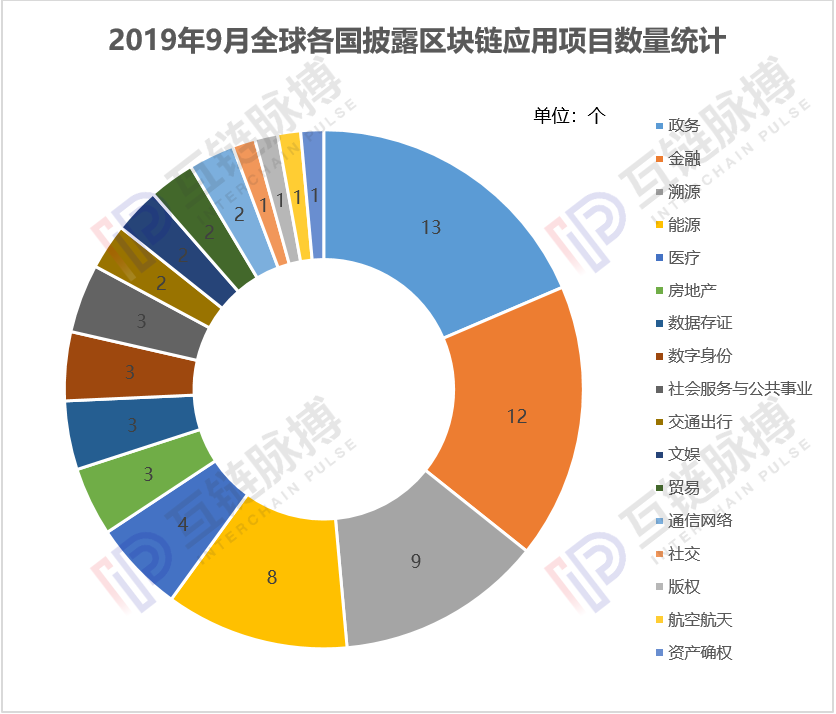

In terms of industry distribution, the blockchain application project disclosed in September covered 18 areas. More than 34.3% of the projects are concentrated in the financial and government sectors, 24.3% of the projects are concentrated in the field of traceability and energy, and the remaining 40% are distributed in medical, real estate, data deposit, digital identity and social services and public More than 10 fields such as business.

According to statistics from the Mutual Chain Pulse Institute, in September 2019, the number of applications disclosed in the financial and government sectors was 13 and 11, respectively, accounting for 18.6% and 15.71% respectively.

(Source: Mutual Chain Pulse Institute)

In the financial sector, new applications in September focused on cross-border trade, cross-border payments, and financing for small and medium-sized businesses. If MasterCard collaborates with blockchain software provider R3 to pilot cross-border payment solutions, the Saudi Arabian Monetary Authority and the United Arab Emirates plan to complete pilot cross-border banking transactions by the end of this year.

In the financing of small and medium-sized enterprises, Financial Accounts has cooperated with UBX, a subsidiary of Philippine United Bank, to build a financial technology platform to address the financing needs of small and medium-sized enterprises in the Philippines; Singapore DBS has launched a multi-layer financing tool to help China's small and medium-sized enterprises. Businesses get trade finance faster.

In terms of government affairs, new blockchain projects in September were mainly concentrated in areas such as tax administration, real estate registration and convenience services. For example, the Fujian Provincial Taxation Bureau officially launched the comprehensive banking tax payment platform for the bank, and the Tianjin Dongjiang Bonded Port Area Taxation Bureau is exploring the use of the blockchain to establish an ecological chain digital tax management of “one ticket, one million, one vote to the end”. system.

In the field of real estate registration and convenience services, the Beijing Haidian District Government officially launched the “Haidiantong” platform, and took the lead in realizing real estate registration online in Beijing; the Yancheng Municipal Government of Jiangsu Province launched the “My Yancheng” APP, an urban life service manager. Under the assistance of Ant Financial, the Chongqing Municipal Government actively explored blockchain electronic licenses to create a complete blockchain application system for government services and citizen services.

Tracing is still the third largest application area after finance and government affairs. In September, there were nine disclosure projects in the field of traceability, covering a wide range of applications from food, drugs, marijuana to diamond trading.

The most representative include French retail giant Carrefour's application blockchain technology to track the process of Camembert de Normandie cheese from farm to store shelves; blockchain startup TruTrace Technologies Inc. collaborates with four auditors Deloitte to use blockchain Technology tracks the entire process of cannabis from seed to sale; and the World Federation of Diamond Exchanges (WFDB) has decided to use blockchain technology to further increase the transparency of diamond trading.

In addition to the above three major application areas, there have been more applications in the fields of energy and real estate in September.

For example, the US startup Modex launched the blockchain-based database platform Modex BCDB and piloted it at Dietsmann, a large oil and gas company; Thailand's state-owned oil and gas company PTT and the blockchain energy non-profit energy network foundation (EWF) are Jointly build a renewable energy platform based on blockchain.

In the real estate sector, the Queensland Real Estate Association of Australia (REIQ) will develop a blockchain-based leasing agreement platform; British real estate giant JLL plans to use blockchain technology to create a platform that aggregates real estate property management and revenue and expenditure information.

Text | Mutual Chain Pulse · Liang Shan Hua Rong

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Monthly report | ICO is back to life? September cryptocurrency financing increased by 33 times

- Introduction | What is the Ethereum Trading?

- The original market maker is not "Zhuang"? What is the significance of the coin safety ball recruitment market?

- DCG Annual Survey: What is the future of the blockchain seen by more than 60 portfolio companies?

- What issues are explained by the IRS's updated cryptographic tax guide?

- US SEC rejected the latest proposal to create Bitcoin ETF

- Heavy! Zuckerberg will attend the US Congressional hearing on October 23 to testify for Libra