Token Watch | Ponzi Finance, Negative Interest Rate and Bitcoin

In the previous Ponzi series of studies, we established a simple model, the old school Ponzi model, in which I took you to the development and life cycle of Ponzi scheme. In this model, several matches were obtained. Intuitive conclusion:

1) Ponzi is essentially a process of cash flow management; 2) The existence of interest and compound interest is actually a power law function of the difference between cash inflow and cash outflow. 3) The ceiling of Pon's market is limiting its life. The core factor of the cycle.

Today we continue to analyze the Ponzi financing model, further study the paradigm shift of the three financing models, and the impact of negative interest rates on digital currencies such as Bitcoin.

I. Three financing activities: Ponzi financing, hedge financing and speculative financing

- Devcon's first day of editing: State Rent, Uniswap and Plasma's second floor DEX

- Monthly Report | In September, 70 global blockchain application projects were disclosed, and the Chinese market cooled.

- Diss bitcoin, lack of money, development no strategy, V God and community members are still discussing what is going on at Devcon, the biggest event of the year?

Recently, there have been more and more Ponzi schemes, such as the typical e-rental Ponzi scheme, the recently listed Wework, the US stock repurchase, and even the US debt and pension, which are said to be Ponzi schemes. The human feeling is that "the Ponzi scheme is a brick, where to move."

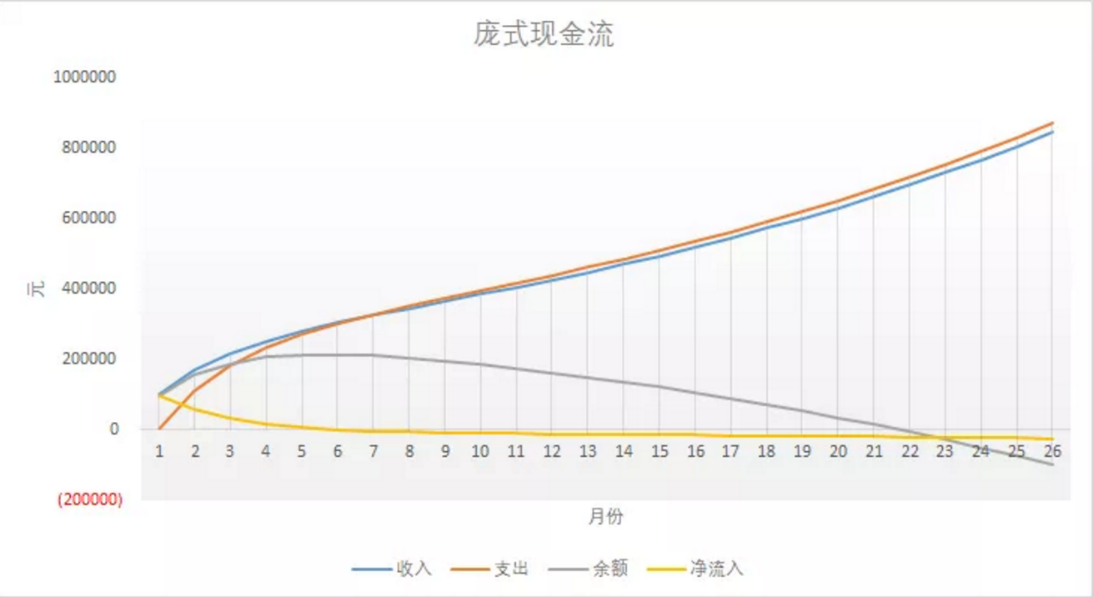

In essence, the Ponzi scheme is a mismatch game with new money and old money . The key is cash flow management . When you can't get enough new funds, the life cycle can't be sustained, as shown below:

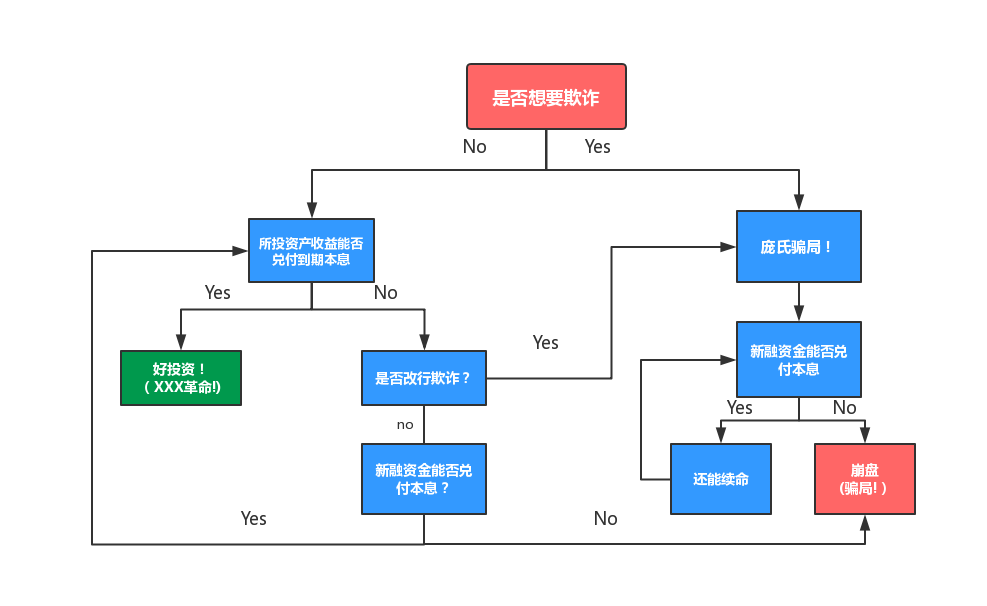

First, the difference of intention

Ponzi schemes must be fraudulent. By using cash flow control, the ultimate goal is to obtain large amounts of money illegally . Other projects are mainly concerned with the development of maintenance or expansion projects. Second, the difference between the source of repayment The source of repayment of the Ponzi scheme is new funds, and the above projects will at least transfer the funds raised to specific targets, and use the interest or value-added income generated by the bid to repay. The implied condition of the Ponzi scheme is that it takes a period of time to hold the assets, which naturally leads to a phenomenon of maturity transfer, which leads to the possibility of mismatch.

Third, the difference in profitability

Since the Ponzi scheme does not have a real investment , the repayment ability of the repayment source must be 0 or even negative. For the ordinary fund pool business, although it does use the funds raised for investment, the investment is risky after all, and there is a possibility that the expected income cannot be achieved and the principal cannot be repaid.

This is the key to distinguishing whether a project is a Ponzi scheme.

When the investment income of the mismatched fund pool can repay the agreed principal and interest on time, then there is no problem and the whole system can continue to operate. In the event of a risk, the project cannot be paid in full, and when it is necessary to rely on the new funds to “renew”, it will inevitably gradually change to Ponzi. Of course, if the word is used well, when the income rises back to the water, it can be separated from the Ponzi team.

To sum up, the main difference between these projects and the Ponzi scheme is the management of the cash flow statement to the management of the balance sheet.

In the book "Stable and Unstable Economy: A Perspective of Financial Instability", American economist Minsky divides the financing behavior of the above process into three types according to the income-debt relationship:

(1) Hedge finance, in which the debtor expects cash flow from the financing contract to cover interest and principal , which is the safest financing behavior. Corresponding to the good investment in the above process, the general foreign exchange carry trade, credit-good loans can be attributed to this. (2) Speculative finance, in which the debtor expects cash flow from the financing contract to cover only interest , which is a behavior that uses short-term funds to finance long-term positions.

Corresponding to the part of the above flow chart that uses the new financing to redeem the principal and interest to the asset income and has the ability to redeem the principal and interest. Generally, it can be understood as a bridge loan. The recent large-scale US debt has also developed into speculative financing.

(3) Ponzi finance, that is, the debtor's cash flow can neither cover the principal nor cover interest, and the debtor can only fulfill the payment commitment by selling the assets or making new financing, which is bound to be very high. The financial risk, once the capital chain breaks, the debt can not be repaid, may also trigger financial turmoil and crisis.

Minsky further defined Ponzi financing : Ponzi financing is often associated with marginal and fraudulent financing activities , although its initial intent is not necessarily fraud. Corresponding to the collapse of the above process, some projects are difficult to confirm at the initial stage, and sometimes it is only possible to judge whether the result is a crash or not. It is worth noting that the above three types of financing are often converted to each other .

Second, the conversion of three financing modes

There are no advantages and disadvantages in the three financing models, but they will always change. We can also find these changes in our daily investment life. Generally, we can also divide into three paths:

1. Hedge financing → Speculative financing → Ponzi financing

P2P companies are typical of this shift. Under normal circumstances, P2P companies invest a sum of money from users into a supply chain company that uses specific cash flows or collateral as a source of repayment.

However, when the risk factors such as the economic downturn occur, there is a problem in the accounting period of the cash flow of the supply chain enterprises. At this time, P2P companies need to replenish new money to repay the principal and interest of the previous financing to prevent default , and then switch from hedge financing to speculative financing.

When the supply chain company determined that it could not receive cash flow from the downstream, P2P company said, I really don't have money, whether it is a debt-to-equity swap, you will earn income by selling stocks. At this time, refinancing has shifted from speculative financing to Ponzi financing (investment).

2. Hedge financing → speculative financing → hedge financing

A typical case is a variety of banks, and the general maturity mismatch will be beautified as a term transfer in the context of the bank. It is because the general banks supplement the liquidity category of “speculative financing” through interbank lending and other means, and ultimately they can effectively renew their lives and return to hedge financing.

3. Ponzi financing → speculative financing → hedge financing

A typical case is a variety of Internet ventures. Starting from the “suffocation for the dream”, investors know that the platform thinking needs to burn money constantly, but as long as the money can burn out the scale, it is not afraid to find the man. This process is a combination of Ponzi financing and speculative financing, such as the common ABCDEFG round of financing and listing, private placement . If the final profit model is verified by actual data and the economic account can be counted, it will be converted into hedge financing. Otherwise, you can only go down to Ponzi until you finally find the biggest Ponzi audience market, or you can kill yourself.

For example, shared charging treasure, originally in the shared field, shared charging treasure is considered to be the most unreliable project. Because the price of the charging treasure is cheap, everyone has more or less at home, and because of its small size, it can be carried with you. Why spend a higher unit price to spend money to charge?

In this incomprehension, the entire industry still raised 2 billion yuan in 2017. But if you understand it, these three characteristics: you will not carry the charging treasure + charging is really just need + is not sensitive to the price, resulting in a shared charging treasure has become the most economical account (cost recovery period) a business . From Ponzi financing to hedging financing. The negative case is about OFO. The initial theoretical cost recovery period is only 3 months, the economic account is considerable, and the story is grand narrative. Many capitalists have thought that the “social public welfare” has paid the bill, and the accumulated financing has totaled 15 times totaling 15 billion yuan. Looking at the final round of financing, E2-1 raised $866 million. How creative is E2-1 relative to the simple letter of financing. However, the title of such creative financing rounds still can't stop the final economic accounting, but Ponzi's financing has reached the bottom.

There are still many negative cases, such as LeTV, Storm Video, and various listed companies in 2015.

Under the mature capital market and diversity tools, the three financing modes are switched more frequently, and good market value management requires a reasonable mix of the three financing modes.

3. Hedging and Ponzi's investment logic

If further promoted, we find that these three financing models will correspond to two kinds of investment logic: the logic of hedging and the logic of Ponzi. The former pursues a more tangible and stable income , derived from cash flow or interest . The latter comes from the logic of the receiver that expects the latecomers to pay the bill at a higher price . The former sounds more valuable, and the latter sounds more speculative, but in fact, between value and speculation, it often changes. Take the example of the recent performance of central banks releasing water and promoting large-scale asset under negative interest rates.

The investment in bond assets itself includes both the interest income and the price increase of the bond itself . In the case of a stable macro interest rate environment, since the risk-free interest rate remains relatively stable, the main income comes from interest income. As long as the interest income is greater than the risk-free rate, there is a profit, which is equivalent to the hedging investment logic.

Under the bond pricing formula, the market risk-free rate of return will push up the price of bonds. If the risk-free interest rate is expected to continue to decrease, the bond price will continue to rise in the long run, even if there is no interest income. Gaining profits through the rise in the price of the bond itself. For example, German government bonds have been rising for more than 10 years.

At the same time, due to the expectation of the recession, investors are more interested in safe-haven assets, and will compete for the US debt and European debt-type safe-haven assets to further push up the price. This represents a Ponzi investment logic. . Under negative interest rates, low-interest or zero-interest assets such as treasury bonds and gold have become equally favored by the real demand for hedge logic funds, and are also favored by Ponzi's logic funds. In August of this year, Germany’s 30-year-old zero-interest bond, which was 2 billion euros in size, was snapped up, attracting a report from the media. The traditional zero-interest asset gold has been sung many times by Dario in the public to use the paradigm shift.

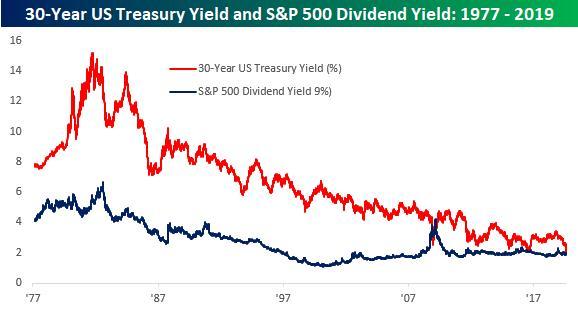

In turn, Ponzi's investment logic may also turn into a hedge logic. This year, the recession is expected, the valuation and price of assets will be killed. If the absolute value of dividends on the asset does not change significantly, when the asset price falls sharply, it will find that the dividend rate or dividend rate is greatly increased, and thus exceeds the level of risk-free interest rate, which becomes a good interest-earning asset, making the traditional two In the market, the original logic lies in Ponzi's investment logic, which is expected to bring asset prices up with the takeover of the market, but under the increase of dividend yield, the funds of the hedge logic will also be attracted to the market. Both are converted.

The high dividend strategy under the bear market and the “core assets” of the A-share fire this year are the products of this logic. When everyone (institutions) recognizes high dividends and buys them, they will change from the logic of hedging to Ponzi logic, and then they need to carefully analyze the risks.

In short, the two kinds of logic will be mutually converted. If you can grasp the opportunity of logical transformation, you may get better returns. The most interesting phenomenon recently is that the two met at the intersection: the 30-year US bond yield fell below the S&P 500's average dividend yield, the first time since March 2009.

Fourth, the three stages of bitcoin investment in a negative interest rate environment

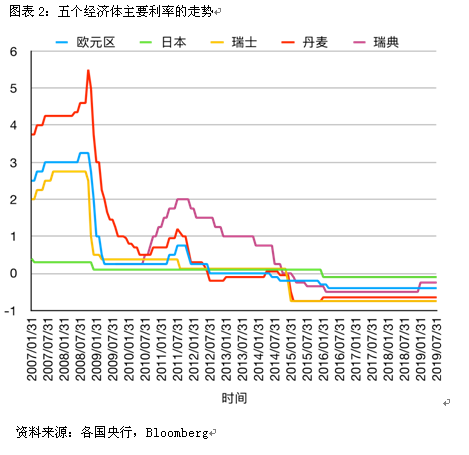

Many people mentioned that in the negative interest rate environment, Bitcoin, like gold, is a zero-coupon asset and will be favored by more funds:

First, in order to avoid being charged negative interest rates, funds will be saved in the form of gold or bitcoin , which will bring buying, that is, the investment logic of hedging; second, the revaluation of value , like bonds, when the market continues to lower interest rates It is expected that in the future, there will be expectations of a rise in bitcoin prices. Third, when the above two were fermented, the rise in bitcoin prices attracted Ponzi's logic in the market.

But although it sounds reasonable, but from the recent actual performance of Bitcoin, the market does not buy. Why is this? This is because the logic of hedging has not yet formed a real demand.

Let's first take a look at the negative interest rate story of Bitcoin. Imposing a negative interest rate, the depositor’s money in the bank is not without interest, but instead is subject to interest by the bank. Can this be tolerated? No, buy a bitcoin! This is of course not to be said casually. There are real cases in Cyprus:

On April 17, 2013, Cyprus President Nikos Anasta Summers delivered a televised speech. In order to obtain the EU's 10 billion euro emergency aid loan, the Cyprus government will impose a deposit tax on local bank depositors, including deposits of 100,000 euros. The above tax rate is 9.9%, and the tax rate below 100,000 Euro is 6.75%. As soon as the news came out, the people of Cyprus flocked to the banks, and the banks were long queues in front of the cash machine. The situation was out of control. A Cypriot person commented on this matter: “This is a government robbery against us. This is the worst time of my life. It reminds me of Turkey’s invasion of Cyprus in 1974.” To prevent the situation from continuing to deteriorate A number of banks in Cyprus issued a notice on the 19th, announcing that they will temporarily take holidays on the 19th and 20th, and the online banking and international transfer will be suspended. The only ATM machine that can withdraw cash has already been taken by the depositors and cannot provide services. In order to alleviate the cash pressure in Cyprus, the British Air Force dispatched an aircraft and urgently airlifted 1 million euros to Cyprus. Affected by this Cyprus incident, there have also been people's runs in other countries in the Eurozone. As people worry about deposits, Bitcoin has become an attractive alternative. Bitcoin soared from more than 30 US dollars to 265 US dollars in just a few days.

But the reality is not the case. At present, the object of negative interest rate collection is the excess deposit reserve placed by the bank in the central bank. It is the measure taken by the central bank in order to let commercial banks do not spend money on the account to collect interest on the central bank, but not for ordinary people.

Therefore, banks are affected by negative interest rates, not ordinary people. It is also unrealistic for banks to buy bitcoin for negative interest rates.

From this point of view, the hedging logic of Bitcoin as a zero-coupon asset is still only at the logical level , there is no real demand, and there is no strong consensus. This is the first stage we are currently in. How do you form a stronger consensus? Real cases are needed, that is, the scope of negative interest rates is extended from commercial banks to ordinary people.

In a more representative area, a landmark event like Cyprus in 2013 caused the people to feel the fear of being dominated by negative interest rates, generating real hedge demand for Bitcoin and deepening consensus. This is the second stage, hedge. The stage in which logic really works, at this stage, due to the panic effect of the iconic event , it will also bring the process of switching logic to Ponzi logic, bringing a bubble rise.

The third stage is the stage of normalization of the hedge logic . Under the second stage of fermentation, the consensus of bitcoin as a zero-rate asset is deepened. If there is no major breakthrough in technology, the economy continues to decline, and the area where negative interest rates are implemented expands. The more ordinary people have real demand for bitcoin, increase the consensus, and make the hedging logic normal. According to the research, the theoretical lower limit of the implementation of negative interest rates is -2% ("the theoretical basis, transmission mechanism and macroeconomic effects of the "negative interest rate" policy). In addition to Europe and Japan, many countries have not yet launched negative interest rates, leaving negative interest rate fermentation. There is still a lot of time, and the second and third stages are reserved for the fermentation time.

The premise is that negative interest rates will be transmitted to ordinary people? For the time being, it is a bit difficult. If the bank wants to collect interest from the depositors, the depositors will tend to put the cash in order to save it, which the bank does not want to see. Therefore, countries that currently charge negative interest rates still charge zero interest rates for ordinary depositors.

This is also a problem with negative headaches under negative interest rates : the conduction of negative interest rates. Is there a solution to this? Yes, and very cleverly, it is solved by digital currency. Once the depositor takes the money out of the bank and keeps it in cash, it is difficult for the central bank to charge interest in cash because of its anonymity.

In summary, under the negative interest rate, bitcoin investment is divided into three stages: the first stage is the current stage of using the hedge logic brain , and it is not reliable; the second stage is the need for real event fermentation to bring a small part of the hedge. Financing just needs and the resulting Ponzi logic buying stage ; the third stage is if the economy continues to slump, the negative interest rate policy continues to ferment and transmit to more countries, making the phase of the bitcoin's hedging demand normalized. In the process of the second and third phases, the central bank's digital currency may be first promoted to enhance the transmission effect of negative interest rates.

In order for Bitcoin to better help users avoid being smashed, it is necessary to promote legal digital currency to help negative interest rates to better lick wool. The world is often so interesting.

Reference material: A sea dog in the sea, "Turtle and Hare Racing", Sun Guofeng, "The lower limit of deposit interest rate and the transmission mechanism of negative interest rate"

Xiong Qiyue's Theoretical Basis, Transmission Mechanism and Macroeconomic Effects of "Negative Interest Rate" Policy

Source: X-Order

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Non-profit organizations play a key role in the Libra Association through Libra's global inclusive finance

- Bitwise and more brave Bitwise: We will resubmit the Bitcoin ETF application as soon as possible

- Monthly report | ICO is back to life? September cryptocurrency financing increased by 33 times

- Introduction | What is the Ethereum Trading?

- The original market maker is not "Zhuang"? What is the significance of the coin safety ball recruitment market?

- DCG Annual Survey: What is the future of the blockchain seen by more than 60 portfolio companies?

- What issues are explained by the IRS's updated cryptographic tax guide?