"Determinism" and "uncertainty" on the eve of Bitcoin's cuts, how should miners and investors respond?

The production cuts have taken turns to become the most realistic portrayal of the currency circle in 2020.

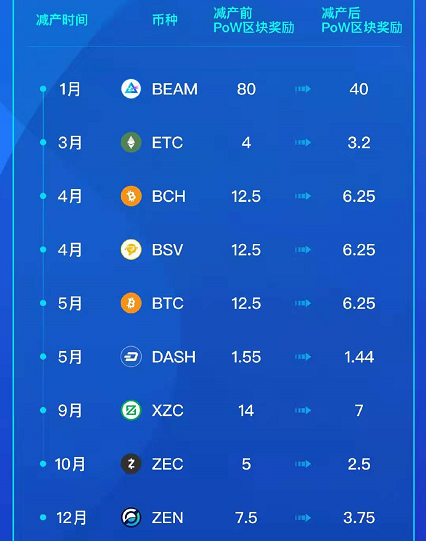

The latest statistics show that Beam and ETC have been reduced in the first quarter, BCH, BSV, BTC, and DASH have been reduced in the second quarter, and XZC and ZEC have been reduced in the third quarter. ZEN, can be said to have a good show every quarter. Therefore, the protagonist of the currency circle in 2020 is to reduce production.

So what effect will this "protagonist" have on the currency circle? What will happen to the mining market outlook? As practitioners and investors, how should they follow the trend? Will this be the year of the rat with salted fish turning over?

1. The "certainty" of the reduced production

The bell for New Year's Day in 2020 has just sounded. At that time, Bitcoin was only around 7,200 US dollars, BCH was only 200 US dollars, BSV was less than 100 US dollars, ETC prices fluctuated around 4.5 US dollars, and ZEC prices sideways around 28 US dollars It's been more than half a month …

- Year-to-date soaring 47%, will ETH become the dark horse this year?

- Commentary | Epidemic promotes China's digital economy to enter a higher version of the crisis

- ConsenSys restructures core business and cuts staff by 14%

At this time, only 3 months are left to reduce production by ETC, and only 4 months are left to reduce production of BCH and BSV. It is in line with Litecoin's 2019 production reduction just in the past-opened half a year in advance and within one day Up 35%-compared to this price performance, in any case is not like the eve of a "potential situation".

Based on this, many analysts are still discussing whether the output reduction will come on schedule, and investors are still worrying about going long and short. For example, a well-known investor in the currency circle chose a short position to short BSV at around BSV95.

Currency cuts every quarter

Many big coffees are also directly involved in the forecast of production reductions.

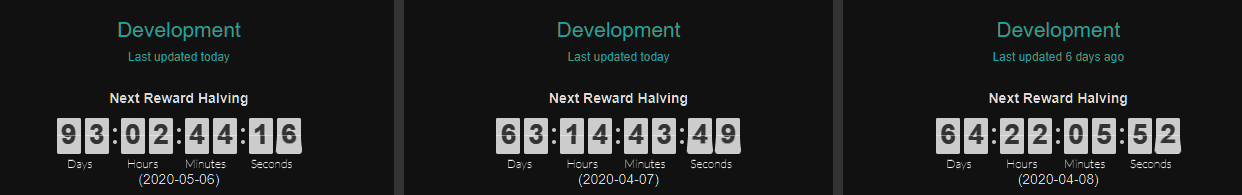

Regarding whether the market will come down, Sun Yuchen, the founder of Tron, even "posted the certificate" in the circle of friends. He said, "Today I met Charlie, the founder of Litecoin, and he has always been my admired trading master. He told me to halve. The market is bound to come. There is no problem with Bitcoin's conservative breakthrough of 14000 in the early period. The halving time is approximately May 12 and there are 107 days remaining.

As Charlie's point of view, history does not stand short.

After New Year's Day, BCH took the lead in firing the first shot of reducing production. The price rose from US $ 195 to around US $ 220, and it showed a very strong trend in the next few days. Since then, ETC, BSV, BTC, ZEC, BTG, etc. have followed up. Today, ETC is up 260%, BCH is up more than 90%, ZEC is up more than 110%, BSV is up more than 170%, and the price of Bitcoin, which best represents cryptocurrencies, has risen from $ 7,300 to $ 9,300.

Today, the production cut is no longer an analyst's forecast, but a deterministic event.

Google trend graph data shows that the current bitcoin halving keyword "bitcoin halving" has reached a four-year high in Google search, second only to the search volume before the bitcoin cut in 2016.

Google Trends: "Bitcoin halving" search trend graph for the past 5 years worldwide

At the same time, the data company also provided professional research on the "bitcoin halving" Google index.

According to BraveNewCoin, according to a recent report from Norwegian research company Arcane Crypto, Google searches for "bitcoin halving" have doubled since December last year, reaching the last halving event in 2016 The highest level since. As of the week of January 19, the relative search volume for the "bitcoin halving" keyword in the United States reached 37, while the average figure in December last year was only 14, which has more than doubled, compared with the number before the last halving event. Search volume growth trajectories are similar.

These signs indicate that the market is far from over, and bullish sentiment remains strong.

Regarding the increase since New Year's Day in 2020, RenrenBit CMO Zi Cen seems that it is just a "warm-up".

At the "How to Grab the Halving Market" conference held by Golden Finance and OKEx Mining Pool on February 4th, he experienced two bitcoin production cuts. Ziren, currently RenrenBit CMO, said:

"I think it's just a warm-up. At least the mining industry has responded in advance. On the one hand, it is an optimistic expectation for the halving market. On the other hand, it is hoped that it will dig as much bitcoin as possible before the halving. The halving brings more than just a reduction in the inflation rate. It is more that the holders start to raise money and no longer sell. At least the old players I have met, none of them will sell coins before the halving. . According to the experience of halving the last time, the next story should be all the way up, approaching a wave of callbacks before halving, and then continue to attack, finally breaking through the previous high, and finally a sea of stars. "

So, is there a sea of stars ahead of the market after production reduction? How will those miners who are most closely related to the currency price be affected?

2. "Uncertainty" after production cuts

"The wave of miners who came into play around New Year's Day was right, including me."

Hai Tao is a miner who experienced bitcoin production reduction in 2016. His mine is located in Xinjiang. Due to the impact of Wuhan pneumonia, he spent the Chinese New Year with his operation and maintenance staff at the mine throughout 2020. He said this when the recent market impact on the mining industry. In his view, all the miners who have come in since the second half of 2019 can make money, and they seize the opportunity.

"But don't be too happy, no matter how much confidence the miners have, you must also take the market uncertainty into account." Hai Tao said, "Be sure to take into account the upcoming production cuts, 2 months later The coming BCH and BSV production cuts will drive some miners to the BTC network, but after 3 months BTC production is cut, where is the computing power going? "

"Now that the global miners have full horsepower, the miners that can be used are basically on. If there is no accident, the SHA256S computing power of the entire network will not increase significantly in the second half of the year." Haitao made such a judgment.

This is the uncertainty brought by the reduction in production of PoW currencies such as ETC, BCH, BSV, BTC: it may lead to mining disasters.

At present, the price of BTC is around $ 9,300. If it does not rise significantly after 3 months, "it may be enough for miners to drink a pot."

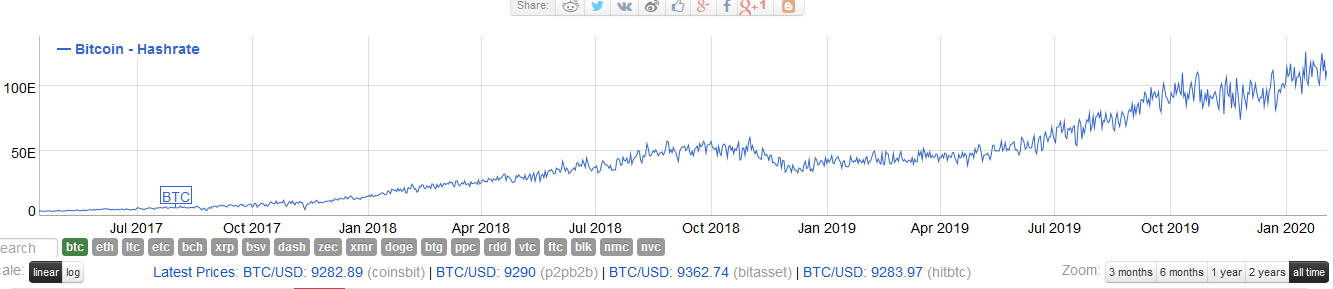

"For miners, when the price of the currency is unknown, a reduction in production means an increase in mining costs. BTC.COM data shows that the current computing power of the entire network is around 120EH / s. Without a substantial increase, many miners will face losses. "Hai Tao said.

At the same time, the replacement of mining machines will also exacerbate the "uncertainty" brought about by Bitcoin's reduced production.

2020 coincides with the replacement of the mining machine.Bitmain's 7nm mining machine has even evolved from the first generation S15 to the current S17, and the Shenma M20 has already come out. Jianan Yunzhi and Ebon International's 7nm mining machine have already been listed. More than half a year. This is both an opportunity and a challenge for the mining circle.

In mid-January 2020, at the dialogue Godfish event held by the chain node, Cobo CEO Godfish said:

"Will the price increase sharply after halving, if the currency price does not increase significantly, the current mining machine represented by S9 at 30-40E will have to shut down, and the computing power of the entire network will drop, and the mining machine will return to this cycle. Will become longer; whether there will be substantial negatives in terms of electricity costs and feng shui. If both factors are negative, halving the risk may bring mining difficulties. "

In the view of Shenyu, the previous generation of the mining machine ant S9 may become the "sacrifice" of the market.

F2pool latest "shutdown coin price"

According to the observation of the OKEx Intelligence Bureau, the real-time information of the "shutdown coin price" provided by F2pool shows that when the Bitcoin price was around $ 9,300, the ant S9's mining electricity cost accounted for 87%. This also coincides with the judgment of Shenyu about the possible mining disaster in the future.

"Some may be new to the circle. I don't quite understand why this logic is the case, so I will simply popularize it." Hai Tao said.

"The reason why miners want to mine is to go for rewards. When the entire network's computing power, mining rewards, bitcoin price, electricity costs, mining machine costs, operation and maintenance (labor costs, mine lease costs) are unchanged. The miner's income is fixed and the years are quiet. However, the reduction of Bitcoin production will forcibly break this static process. At the beginning of May 2020, the reward of a single bitcoin Bitcoin will be changed from 12.5 to 6.25, and all the miners' earnings will be halved. At this time, those miners with poor performance will lose money, such as the S9. If you have to shut down, it is equal to a mining disaster. "

"This process is like an avalanche. Someone in the quiet valley shot a lot of cold. At this time, a lot of snow began to collapse, which will cause more collapse."

Whether it is certainty or uncertainty, it will become a part of the entire market. As investors, observers and practitioners, actively participating in this wave is the most correct choice.

3. Will it be your salted fish turnaround year?

"No matter how many people go short and are keen to be short-term, I will only go long."

Since New Year's Day in 2020, Xiao Xie, who has quadrupled his BCH assets, told the OKEx Intelligence Bureau that he has been acquainted with the currency asset price trend for 3 years and has learned to comply. heart.

"Stableness is my investment logic. On the New Year's Day of 2020, I think that the production reduction will inevitably come, and it will be staged one after another." Based on this judgment, Xiao Yan bought all his assets in the currency circle. BCH, and added 5x leverage. "Although there are many people who are shorting strongly, for example, the influential Xiaoxia on Weibo has been shorting BSV, but I will not follow."

Of course, there are still few investors like Xiaoyan, after all, "steady, accurate, and cruel" is not something everyone can do.

In June 2019, after the Litecoin production cuts ended, the blockchain media "Blockchain Tax Bureau" conducted a survey called "Cryptocurrency Investment Yield in 2019" for its fans, with 1,400 fans participating. The survey It was found that with the increase of BTC exceeding 700% and the increase of LTC exceeding 240%, 66% of investors had a yield of less than 240% (not outperforming the market), and 85% of investors did not exceed 700% (no Outperformed LTC gains).

In other words, in a situation where most people are basically unable to outperform the market, it is important to grasp the trend.

As a more experienced investor in the currency circle, Xiao Yan believes that we must step on every “point” in 2020.

"On my own operation, I just want to share one point, which is also the most important: BCH cuts production on April 7 and BTC cuts production on May 6. Should you change your BCH to April 7 What about BTC? Of course, there will be a lot of currency reductions in the future, which may mean opportunities. But I must remind that I am just sharing my thoughts and ideas, maybe I will not do it myself. "Xiao Yan said.

How should miners "operate"?

In the face of the wave of production reductions that came from April to May, Haitao also prepared some emergency plans, "connected some low-cost electricity in Central Asia. If the currency price does not increase significantly before the reduction, Mining machines are shipped to foreign countries with low electricity costs, and high-performance machines are also used in China. "

Haitao's operation idea is not the first.

"At the end of 2018, when Bitcoin dropped from US $ 6,000 to more than US $ 3,000, there was a mining disaster in the mining circle. At that time, Middle Eastern miners with low electricity bill resources had '30 yuan per pound 'to transport domestic mined mining machines. Go back, because the cost of the mining machine is very low, and the electricity bill is cheap, they can basically pay back in 40 days. You can believe this, but this is a fact that has happened before. "

So, will history really repeat itself? No answer.

Gao Ye Capital Zhang Lei said that investing in China is not suitable for weak-willed people.

This sentence is suitable for investors anywhere in the world. The weak-willed cannot bear annual losses, but the stock has quadrupled Tesla stock (TSLA) in 8 months. In the face of the investment market, whether it is the miner Haitao, Xiaoyan, or observers like you and me, we all need our own courage and belief.

As the well-known financial blogger "Ban Tongdai Boss" said, no matter how angry and shouting you have, but in investing in this battlefield, you must have a long-term optimism and avoid making the following three mistakes: treat the problem of rhythm as Structural problems, periodic problems as trends, and local problems as general problems. Avoiding these three points, most of the lucrative returns in the market will be irrelevant to you.

In 2020, I wish you salted fish (if you are the same as me) turn over.

Note: The interviewees in this article are anonymous, and the opinions of this article do not make any investment recommendations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- God V: central bank digital currencies can interact with cryptocurrencies

- Free and Easy Weekly Review | What can the blockchain do when fears spread by the virus are spreading?

- Two types of cryptocurrencies become dark horses for return on investment, but they still can't fight bitcoin

- Learn about British digital currency taxation in one article

- Feeding Developers with Miner Taxes: Zcash's Decentralized Governance Dilemma

- People's Daily February 4th article: Blockchain technology can improve government governance

- Former Deputy Director of the State Network Information Office: After "New Crown Pneumonia", the blockchain will accelerate into the application implementation stage