Two types of cryptocurrencies become dark horses for return on investment, but they still can't fight bitcoin

This article comes from Decrypt & Longhash

Author | Daniel Phillips & Charlie Custer

Translators | Moni

- Learn about British digital currency taxation in one article

- Feeding Developers with Miner Taxes: Zcash's Decentralized Governance Dilemma

- People's Daily February 4th article: Blockchain technology can improve government governance

According to Longhash's analysis, in 2019, two types of cryptocurrencies outperformed other competitors in the market, one is a native exchange token, and the other is a DeFi token for cryptocurrency lending. This brings a higher return on investment (ROI).

In fact, the common types of tokens that people are most concerned about in the crypto world are smart contract tokens (such as Ethereum) and currency tokens (such as Bitcoin). However, if you look at the average ROI data for the past 90 days and the past year , you will find that DeFi tokens used for cryptocurrency lending are the real dark horses.

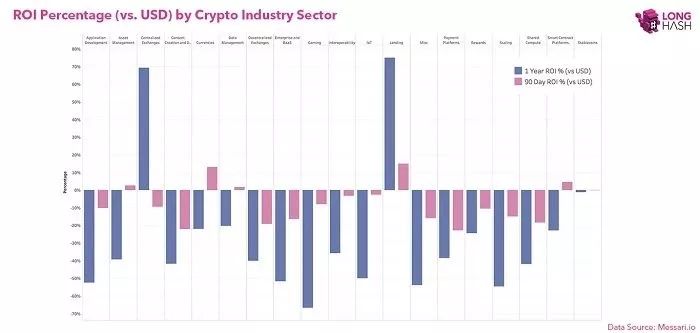

In the chart above, blockchain data company Messari analyzes the median ROI of different cryptocurrencies over the past 90 days and the past year. Messari categorized 349 tokens based on payment methods, infrastructure, finance, services, media, and entertainment (a total of 19 different token categories). The reason for choosing "median return on investment" was The non-average value is used as an evaluation indicator because cryptocurrencies are prone to some extreme outliers, and the median can better represent the overall trend of each token.

Among the DeFi tokens used for cryptocurrency lending, there are two interesting examples, one is the stable currency DAI pegged to the US dollar, and the other is Nexo (NEXO), which provides passive income for token holders. Of course, each project has its own unique "selling point", but in general, crypto lending projects tend to provide users with decentralized investments and loans, allowing users to invest in their own tokens with different risk characteristics And the multiple choices of expected returns-of course, this is due to the immutable and trustless nature of the blockchain.

Of all the token categories in Messari, crypto lending is only a relatively small category, which is classified into 8 tokens, and in the time span of the past 90 days and the past year, there were 5 token investments The median rate of return is positive (all in U.S. dollars). The five tokens are: Maker, Nexo, Ripio Credit Network, Aave, and Cred. In general, the median ROI of the crypto lending sub-categories in the past year has exceeded 75%, and the median ROI of the past 90 days is 15%, which is also in all token categories Best performing.

In fact, these tokens are often used by DeFi lending platforms, allowing investors to borrow money from crypto lenders around the world without having to borrow from banks or other third parties. It can be seen from the analysis data that people's interest in DeFi products and services has increased. Although the sample size of the tokens analyzed in this analysis is not very large, the results have actually shown that, no matter in the near future or in the long run, crypto lending will Is one of the hottest industries in cryptocurrency.

In 2019, the second highest return on investment is native exchange tokens. These tokens are cryptocurrencies inherent to cryptocurrency exchanges, and they are usually used to pay transaction fees or to pay for other services provided by the exchange. Binance Exchange's platform currency has performed well. The platform currency has built a complete ecosystem around the exchange (even using BNB to pay their employees), and it has become a high return on investment for native exchange tokens. The main driving force.

But recently, the performance of native exchange tokens is not very good, especially for decentralized exchange tokens. In the past year, there have been no commendable highlights. The 90-day return on investment has dropped by nearly 20%, and The decline in investment returns over the past year has reached more than 40%.

It is worth mentioning that Bitcoin is the real winner, because no cryptocurrency has a better return on investment than it does.

Although the price has fluctuated greatly in the past 90 days, if you extend the time span to one year, you will find that the return on investment of Bitcoin is as high as 140%, and the return on investment of Ethereum during the period is about 40%. During this period, only lending and centralized exchanges outperformed Ethereum.

All in all, although DeFi and platform coins are hot, from the perspective of return on investment, none of them exceeds Bitcoin.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former Deputy Director of the State Network Information Office: After "New Crown Pneumonia", the blockchain will accelerate into the application implementation stage

- More and more panic! Has Bitcoin really become "gold" in the shadow of the epidemic?

- A brief history of Ethereum prices: ups and downs

- A comprehensive look at the BTC ETF: the holy grail of crypto market participants

- Hubei Red Cross leader was removed from office, but how to use technology to prevent evil?

- Research | What can blockchain technology do to fight the epidemic?

- Clarity and to-be-defined content of the central bank's digital currency issuance