Defi's Reasonable Logic and Aging Status

❖Write ahead ❖

Defi is a hot word in the currency circle that became popular in 2019.Its full name is Decentralized Finance, that is, decentralized finance, or politely called it distributed finance.

Regarding Defi, there are two opposing views. One side is optimistic about the social value that Defi brings through decentralization. The other side is short on Defi.

TVB has also analyzed Defi several times. It was originally optimistic about the party, but the development of Defi in 2019 is really optimistic.

❖ Reasonableness of Defi ❖

➤ Centralized Finance

To discuss decentralized finance, let's look at centralized finance first. What is centralized finance? The standard definition is "financial is the general term for money and finance." To put it plainly, money is money.

- "Determinism" and "uncertainty" on the eve of Bitcoin's cuts, how should miners and investors respond?

- Year-to-date soaring 47%, will ETH become the dark horse this year?

- Commentary | Epidemic promotes China's digital economy to enter a higher version of the crisis

To put it another point, finance itself does not really create finance. Those who produce products and services are directly or indirectly providing people's consumer goods to the society, meeting people's needs such as food, clothing, shelter, or entertainment.

But finance is such an area where money is made from money. It's just that people get different funding from the financial sector. Either individuals, enterprises, or governments, almost every social subject will invest funds in the financial sector and then recover more or less of them.

The essence of finance is the allocation of funds or the distribution of wealth.

It can be spatial or temporal. It can also be both time and space.

For example, a bank collects deposits on one side and issues loans on the other. This is the space allocation of funds.

Another example is insurance. We invest in premiums, and we can get insured compensation when we meet the conditions. This is the time allocation of funds.

When we buy funds and wealth management products, the fund manager or wealth management manager collects our funds to invest in other products, and we can recover the investment after a period of time. This is the allocation of funds in both time and space dimensions.

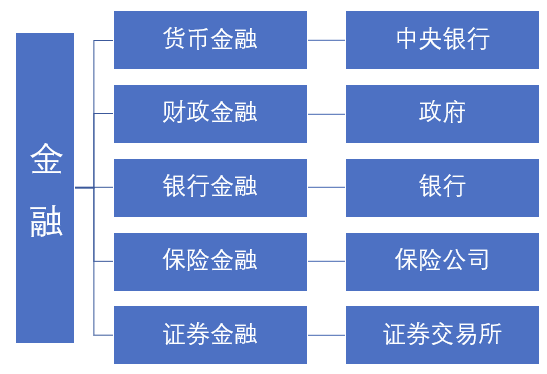

Looking at these financial forms, there are different degrees of centralization.

The central body of monetary finance is the central bank, but the users of money are the whole society.

The central subject of finance is government, and users are the whole society.

The main body of bank finance is the bank, and its use is for individuals, enterprises and institutions.

The central body of insurance finance is insurance companies, and users are individuals and units that apply for insurance.

The central body of securities finance is the stock exchange, and users are securities issuers and securities holders.

These centralized existences will occupy a certain amount of social wealth. The central bank and the government are not for profit, but the impact of monetary and financial development on social development depends on the ability and sense of responsibility of the central bank, and the impact of financial and financial development on social development depends on the capabilities and integrity of various government departments. Corruption is more or less always present in governments around the world. Banks and insurance companies aim at profit. The stock exchange also has room for profit.

➤ Defi

Defi is a form of finance that relies on blockchain.

It is possible to execute it through smart contracts, thereby realizing the flow of funds and the distribution of wealth. When there is no centralization to occupy this part of the wealth, the wealth that participants can distribute is even more.

But more importantly, Defi is based on the blockchain and can form a more transparent form of finance. Frankly, TVB doesn't think it can really be decentralized. Even for smart contracts, someone needs to formulate an algorithm and write a program to execute the financing of financial products.

However, when all this is in an open and transparent form, the centralized incompetence and decay are at a glance. This has prompted financial products to serve the public more equitably. This is where Defi is reasonable.

Therefore, Defi is not an absolute form of decentralized finance. It is a financial that is executed through smart contracts instead of centralized control. It is an open and transparent financial center that is relatively fair and weak.

❖Defi's green status ❖

➤ Decentralized exchange

There are currently two types of decentralized transactions.

The first is that the decentralized exchange is completely on the public chain, and all transactions can be queried on the public chain. It stands for Bitshares, which is a completely decentralized exchange.

The second is an exchange established on the public chain through smart contracts. However, in order to save network costs, there is often a contract account. Users' funds can be charged to the contract account. The transactions in the contract account are run in the form of a centralized exchange. There is no on-chain transfer of funds during transactions. Such exchanges are considered semi-decentralized exchanges.

Because of its centralized form, this exchange must have room for manipulation. When users are trading, each transaction can be queried on the chain. However, the transactions that can be found on the chain are not necessarily real transactions, and the possibility of artificial counterfeiting by the exchange is not excluded.

In a semi-decentralized exchange, a user once mentioned it while chatting with TVB, but actually modified the K line. Considering that it was not experienced by TVB itself, it is uncertain whether the information is true or false, and it is mosaiced. However, semi-decentralized exchanges are indeed similar to centralized exchanges. Modifying the K line can be achieved.

In general, exchanges such as Bitshares that are truly on the public chain can be considered more credible. Due to the throughput bottleneck of the blockchain, the Bitshares official exchange experience is poor (in fact, the experience of the APP GDEX is pretty good), Bitshares is not good at publicity and other reasons. The competitiveness of decentralized exchanges cannot yet compete with centralized exchanges. And semi-decentralized exchanges have many similarities with centralization.

➤ Payment

There are more and more scenarios for using cryptocurrency for payment. About 36% of U.S. SMEs are willing to accept cryptocurrency payments, and 59% of them have used cryptocurrencies. New businesses are twice as likely to use crypto payments and digital assets. 47% of the companies that accept cryptocurrencies have not existed for more than 5 years, while only 21% have a history of more than 20 years. (source)

However, due to the instability of cryptocurrency prices, the payment function is still far from popular. On the one hand, the payee is concerned about the price fluctuation of the cryptocurrency, and on the other hand, the payer is unwilling to pay for a currency with valuable potential (such as Bitcoin).

In addition, when using a blockchain wallet for payment, it is also more troublesome. At the end of last year, the CPU price of EOS skyrocketed, which caused the entire EOS payment to be almost paralyzed. Ethereum-based imtoken wallets often have problems when paying (TVB himself often encounters problems). Let's put it this way, EOS involves too much CPU, memory, and bandwidth when paying, and Ethereum is too slow when paying. These wallets are not yet comparable to centralized payment tools such as Alipay and WeChat. That is, MYKEY is the fastest and most convenient wallet, and there are few problems.

➤ Stablecoin

Stablecoin is a financial instrument anchored in fiat currency, and is a transit medium between cryptocurrency and traditional economy. Therefore, in the traditional economy, there is no financial instrument corresponding to the stablecoin. So for the time being, stablecoins are the most practical and reliable tool in Defi.

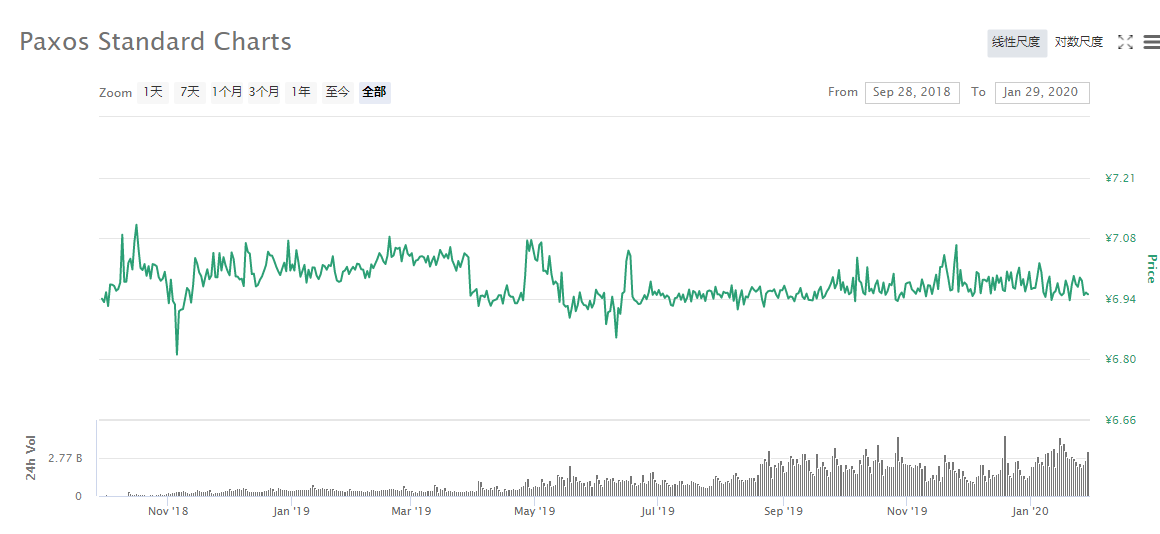

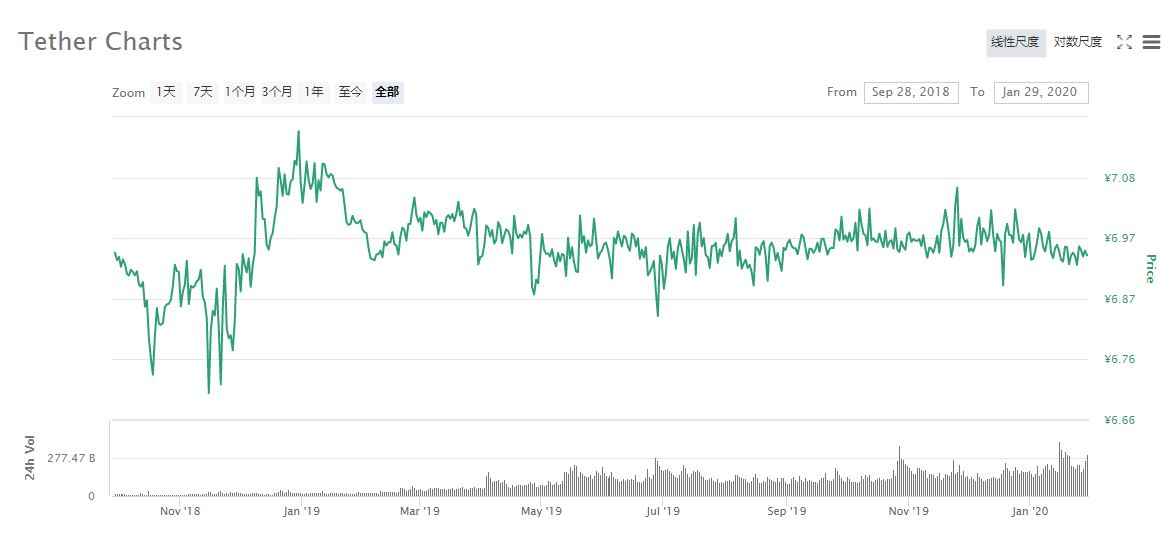

The most familiar decentralized stablecoin is Dai. However, compare Dai with Pax and USDT during the same period.

It can be seen that Dai's volatility does not have a clear advantage over PAX, a centralized stablecoin. Of course, it is significantly more stable than the infamous USDT.

➤ Staking

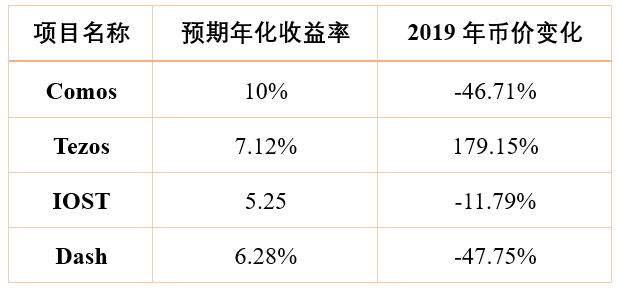

Taking the four projects of Comos, Tezos, IOST, and Dash as examples, we can observe their expected annualized returns and price changes in 2019.

The expected annualized rate of return is from Hashquark's official website, and the price of the currency is based on the coinmarketcap image (slightly different). It can be seen that with the exception of Tezos, the staking of the other three projects is not enough.

The logic of the staking economy is actually fine. But the question is, after the staking coins enter the public chain ecology, can the public chain bring in value?

Is there a difference between the inflation rate of public blockchain and the expected annualized rate of return?

➤ Lending

I don't want to find the loan data. The situation is not too optimistic. Because in traditional finance, lenders use the loan funds for production and construction, put them into the real economy, and organize production to create value.

However, at present, the lenders in Defi are probably used for speculation, or used to develop DAPP on the public chain for use, which also does not really bring in value.

❖ Written at the end ❖

The core problem of Defi is that it is not in line with physical experience.

From the value layer, Defi has not brought inflow of funds to the currency circle, except for speculation, Defi has not increased the wealth of the currency circle;

From the material level, Defi has not brought about improvements in consumption for human beings, and people have not achieved better enjoyment through blockchain technology.

This is the fundamental reason why Defi did not take off.

We look back at traditional finance, whether it is insurance, banks, or stocks. This money will eventually flow to social production and living. The material or spiritual needs for the production of humanity will bring wealth inflow and eventually investment. By.

Although the status quo of Defi is green, there is a bubble in Defi. However, as a kind of on-chain transformation of traditional finance, Defi is worth looking forward to. Defi will not overthrow traditional finance, just as Bitcoin cannot replace fiat currencies.

Defi will become a supplement to modern finance. There can be more rich and decentralized financial forms in Defi. In the form of finance, Defi, we can obtain more diversified forms of wealth distribution.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ConsenSys restructures core business and cuts staff by 14%

- God V: central bank digital currencies can interact with cryptocurrencies

- Free and Easy Weekly Review | What can the blockchain do when fears spread by the virus are spreading?

- Two types of cryptocurrencies become dark horses for return on investment, but they still can't fight bitcoin

- Learn about British digital currency taxation in one article

- Feeding Developers with Miner Taxes: Zcash's Decentralized Governance Dilemma

- People's Daily February 4th article: Blockchain technology can improve government governance