Digital gold, scarcity, and Bitcoin halving

Source: Coinbase blog

Author: Mike Co

Compilation: Share Finance Neo

What gives value to money?

- Report: Darknet activity in 2019 is higher than in the past, how should law enforcement agencies respond in 2020?

- From 1 to 21, an article captures the role of blockchain in government reports

- Shanghai takes the lead in putting crisis into action: suggestions for accelerating the construction of smart cities, including support for blockchain traceability

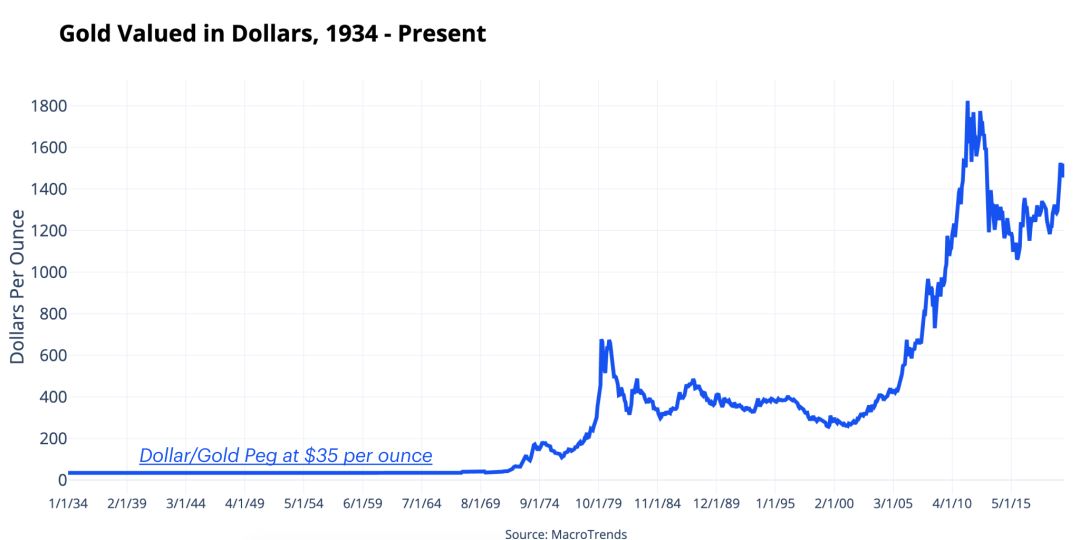

Today, the value of the dollar is not directly related to the value of any other asset. However, not long ago, currencies were directly linked to gold, and this continued until 1971, when in the United States, an ounce of gold could be exchanged for a fixed value of $ 35. However, for governments that want to increase the money supply to increase spending, the gold standard is limited.

Gold is scarce and the government cannot simply produce more gold to meet political goals. Therefore, the United States abandoned the gold standard in 1971, and the US dollar became a legal currency that was not directly linked to gold. Since then, the dollar has depreciated, and gold has risen from a fixed price of $ 35 per ounce to more than $ 1,500 today.

Gold has always been a historical value storage method, mainly because of its scarcity.

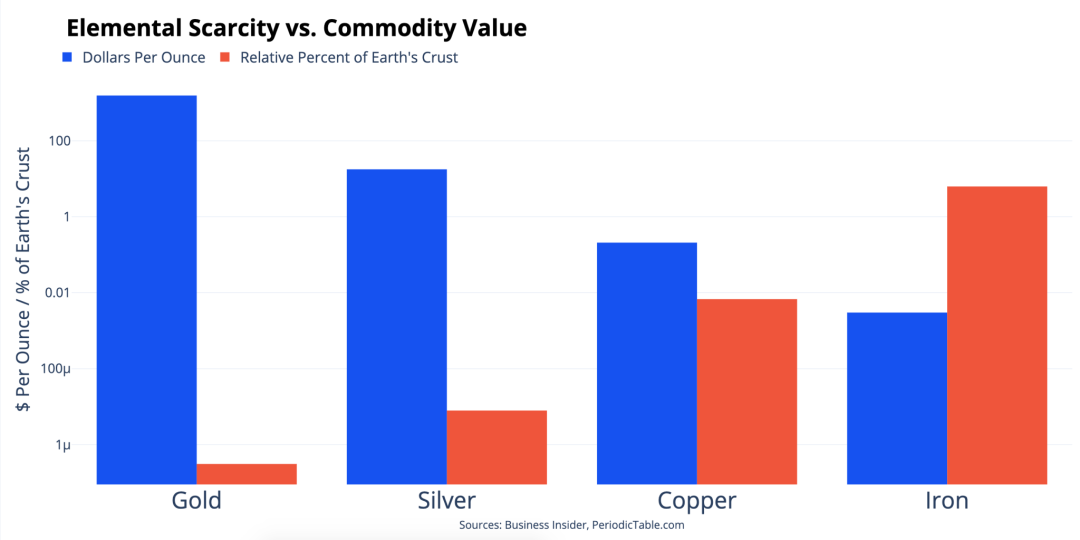

Although gold is shiny and useful in electronics, so are other metals such as copper. However, the value of copper is only a small part of the value of gold. It turns out that the scarcity of elements is inversely related to the value of commodities. Gold is very rare, accounting for only 0.00000031% of the earth's crust, and the price of gold per ounce exceeds $ 1,500.

Due to the needs of global financial institutions, individuals and central banks, the scarcity of gold has been the basis for a total market value of more than $ 7 trillion. Now, imagine if there is a base metal that is as rare as gold, but has a special property: "It can be transmitted through a communication channel."

This is what the mysterious Bitcoin creator Satoshi Nakamoto said in an online forum in 2010. Can possession of such property be a means of preservation comparable to gold? Ten years ago, when curious Internet users visited this forum called Bitcointalk, they would answer these questions with crazy and thoughtful guessing. Ten years later, the answer is proving itself in a way that only the most ardent believers can imagine.

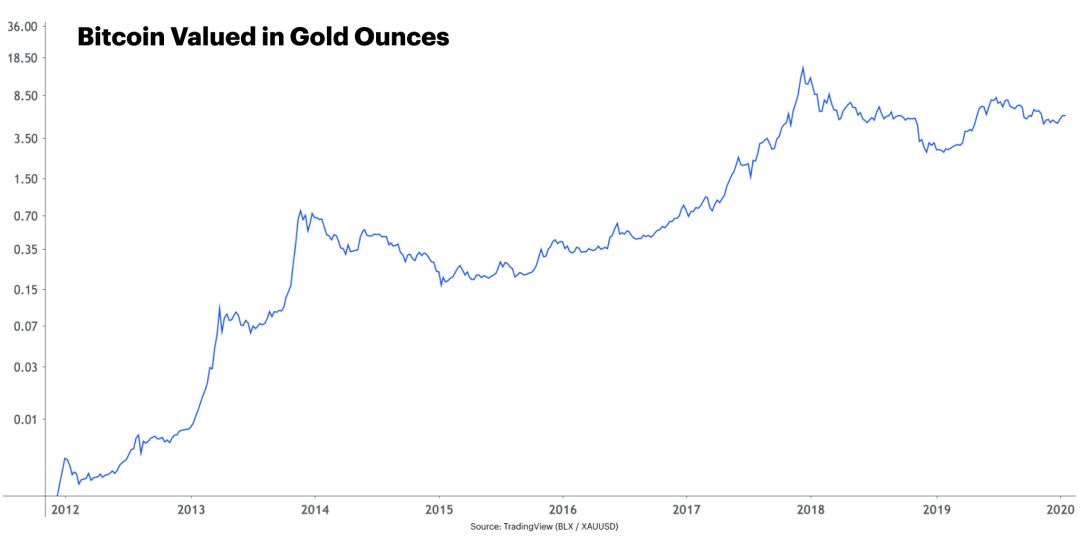

In 2013, one Bitcoin could only buy 0.01 ounces of gold. Today, at the time of writing, one Bitcoin can buy more than 5.5 ounces of gold, and the current Bitcoin price is about $ 9,500. Even compared to gold, the value of Bitcoin has increased significantly over the past decade. Bitcoin is as scarce as gold. Producing new bitcoins requires a lot of work (also known as "proof of work"), a process called mining. Therefore, in order to fully understand the scarcity of Bitcoin and how new Bitcoin was created, we must understand Bitcoin's monetary policy:

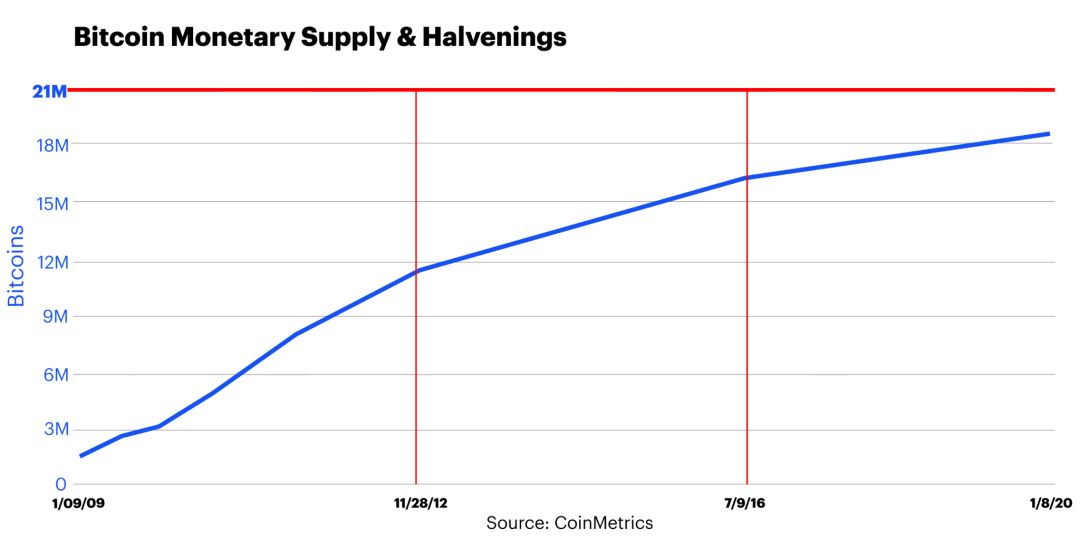

Since its birth, the maximum supply of Bitcoin has been 21 million. Today, approximately 18 million bitcoins exist, and new bitcoins are being supplied at a rate of approximately 3.6% per year. Almost every ten minutes, when a miner processes a new block, 12.5 new bitcoins are generated. In May 2020, during an event called "halving", the issuance of new bitcoins will drop to produce 6.25 new bitcoins every 10 minutes. According to the plan, Bitcoin will be halved almost every four years. By May 2020, this will be the third halving of Bitcoin.

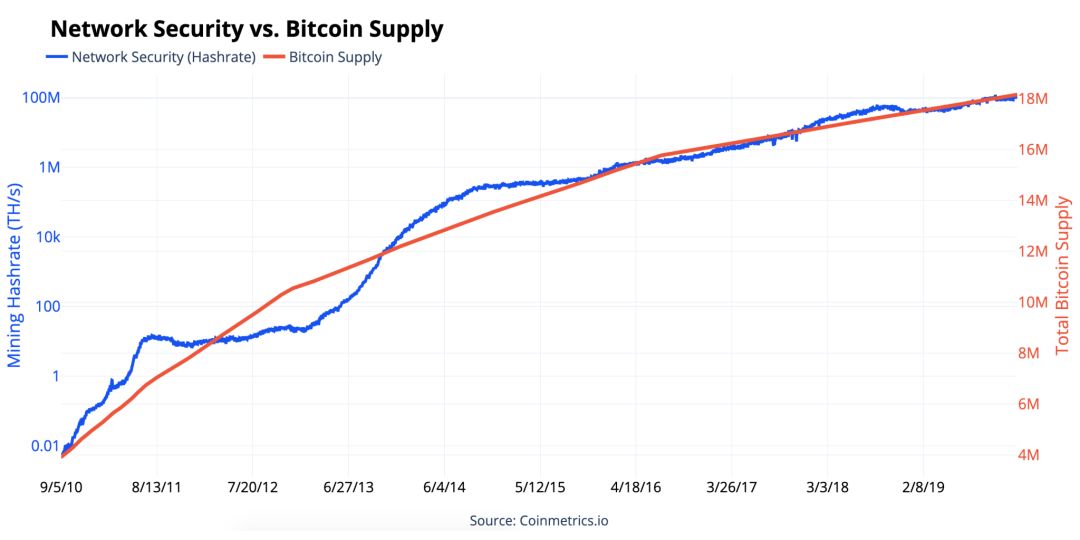

Bitcoin is secured by mining, and it can verify and record the timestamps of transactions. The higher the mining hash rate (computing power), the greater the computing power required to disrupt the Bitcoin network. One might think that as mining rewards continue to decline after each halving, fewer miners will protect the network. However, Bitcoin's economics is often resilient and self-balancing. Revenues from mining rights (aka hashrates) have been cut in half over the past two periods and have recently reached record levels. In other words, as the supply of bitcoin gradually approaches the upper limit of 21 million, the level of network security also increases.

The mining industry ensures a range of differences between Bitcoin and gold. Although we have the best estimates, no one knows exactly how much gold is on the ground; there is no way to independently verify the total supply of gold. With Bitcoin, anyone, even the simplest computer, such as the Raspberry Pi, can verify the entire Bitcoin supply that exists.

Also, if you buy a gold ring, you can hardly prove its purity independently. According to Reuters, "Fake gold bars-gold plated with cheaper metal blocks-are relatively common in the gold industry. Although some machines can test small amounts of gold, they are expensive and difficult to operate.

Being able to independently verify Bitcoin is called running a full node. Imagine what it would look like if a gold purity machine could simultaneously verify the public records of all gold transactions in history. Currently, there are more than 52k nodes running in 96 countries to verify the Bitcoin network.

In addition, any complete node can confirm that by 2020, the annual supply of Bitcoin will fall to about 1.7%. A term called inventory flow measures the new supply rate divided by total supply:

If the total ground stock of gold is 190,000 tons, and the production of new gold is 3260 tons per year (that is, the annual inflation rate is 1.7%), it will take 58 years to restore the existing reserves. When the new annual supply of bitcoin reaches 1.7% after the next halving, the stock of bitcoin will also reach about 58. Inventories of gold will be higher than any other metal commodity, and Bitcoin will soon follow.

Although inventory flow is an interesting measure of scarcity, it accounts for only half of the equation that determines value. Demand is just as important as supply. If Bitcoin does not have useful qualities other than a supply shortage, the prediction of the value of inventory in circulation will definitely fail. Not to mention, in the reality of obstacles such as Bitcoin volatility, any form of quantitative prediction can fail.

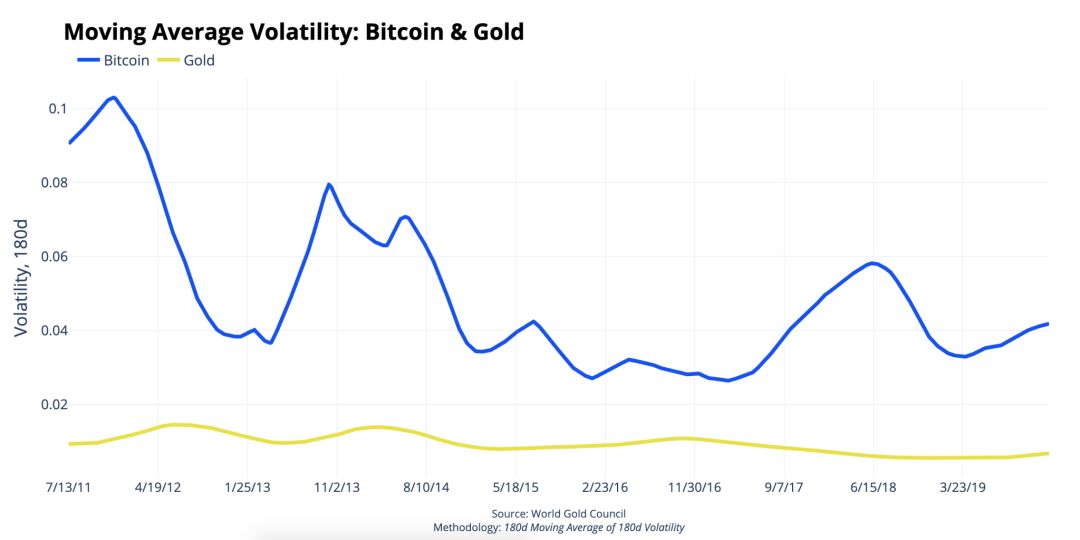

Compared to gold, Bitcoin is much more volatile. However, Bitcoin's volatility has been weakening for years. According to CoinMetrics, the average volatility of Bitcoin has decreased compared to the previous five years: from 6.4% in 2011-2015 to 3.7% in 2015-2020.

The predictable supply of gold, basic scarcity, and global markets make it a stable means of value storage relative to fiat currencies. At the same time, Bitcoin's development is accelerating and has proven its many advantages over precious metals:

Auditability: Bitcoin nodes ensure that they can independently verify any Bitcoin received, as well as the entire historical account book.

Low-fee cross-border transactions: The current median transaction fee is approximately $ 0.24, and Bitcoin can be sent to any user in any country in the world. Last September, a bitcoin transaction worth more than $ 1 billion was charged only $ 700 in fees. The cost of shipping the same amount of gold internationally would be too high, requiring armored transportation and insurance.

Privacy: Transferring gold without a third party requires the presence of both parties, and Bitcoin's peer-to-peer transactions can be sent digitally and anonymously.

Portability: Since Bitcoin's private key can be memorized with a simple 12-word phrase and can be sent digitally, Bitcoin is highly portable, even if the amount is large, this is similar to gold different.

Severability: Unlike gold that needs to be melted, Bitcoin is easy to split. You can own or send a small portion of Bitcoin, or you can send thousands of Bitcoins at once

Scarcity: Bitcoin's supply will soon be as scarce as gold, while also being more programmatic and predictable.

So, in a world without a fixed exchange rate, what gives assets such as gold or bitcoin?

Valuation needs to compare the volatility of different assets. The same applies to fiat money itself. In a world of floating exchange rates, the value of the dollar and the euro is constantly changing. In the global market, the demand for one asset is declining, even exceeding the demand for another asset. The modern monetary system is dynamic, especially as global central banks increase or (very rarely) reduce the money supply.

When independent central banks increase the money supply, the economy sometimes prospers. On the other hand, history is full of hyperinflation, such as Germany from 1921 to 1923, Zimbabwe from 2007-09 and Venezuela today. Or, in the words of a St. Louis Federal Reserve report on the soaring U.S. government debt, the report eventually warned of hyperinflation, "We live in a scarce world-it means we Demand exceeds the resources needed to meet demand. "" The new money supply is not a solution that magically creates more resources. Banknote printing has hidden costs for all citizens, as the new supply will dilute the existing currency. value.

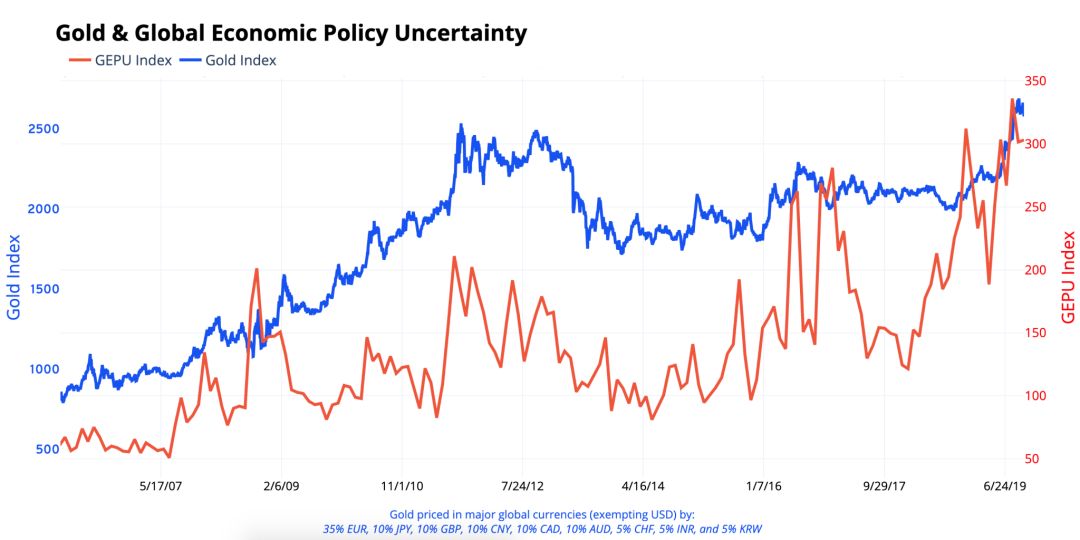

This economic phenomenon has driven historical demand for gold, especially during periods of increasing economic uncertainty. In difficult times, the temptation to print money is always the greatest. Due to the scarcity of gold, it is a historical value storage method against the depreciation of fiat currencies. Recently, global economic worries measured by the Global Economic Policy Uncertainty Index are reaching their highest levels in history. At the same time, the value of gold linked to major global currencies (except the US dollar) has also reached an all-time high.

Over the past 10 years, as the global economic uncertainty has intensified, the value of Bitcoin in gold has increased significantly. Gold and Bitcoin are safe havens that circumvent the devaluation of fiat currencies, which are often triggered by soaring government debt. Bitcoin has numerous technical advantages, accelerated development, and a mature global market. In the digital age, it is a value storage method that can rival gold.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Strong alliance! JP Morgan discusses merger of blockchain unit Quorum to ConsenSys

- The two mining pools control 60% of the Monero network's computing power. Will the centralization of the mining pools cause security problems?

- Lava PoC2 + protocol upgrade hard fork solution

- BM: Why does the security of every company depend on the blockchain?

- Cryptocurrency overwhelming, Trump releases fiscal 2021 budget to increase regulation

- In the face of the epidemic, how can blockchain improve the ability to govern according to law?

- Destiny and reincarnation: the moment of Bitcoin's production reduction