A discussion on whether Friend.Tech is a flash in the pan or the future of SocialFi

Discussion on Friend.Tech Flash in the pan or future of SocialFi?Friend.tech (FT) was officially launched on August 10, 2023. It is a SocialFi platform deployed on the Base chain and created by the developer of another SocialFi project, Stealcam, on Arbitrum.

In just 12 days, FT has achieved impressive results:

-

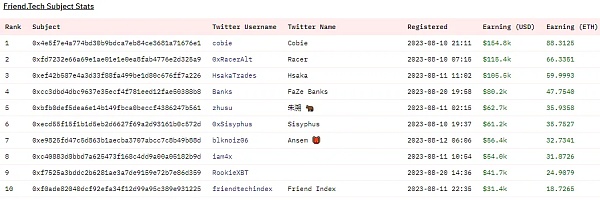

Attracted nearly 100,000 users with a capital inflow of 36,300 ETH, equivalent to about 62.2 million USD.

-

Processed 1 million transactions with a trading volume exceeding 36,500 ETH, equivalent to about 62.4 million USD.

-

Generated nearly 2,000 ETH in protocol fees, ranking second in terms of fees generated on August 22, second only to Ethereum.

With the wave of hype on Twitter and support from investment institutions like LianGuairadigm, people can’t help but wonder: What is FT? Does it have the potential to shape the future of decentralized social media?

What is Friend.Tech?

FT is a social platform that allows users to buy and sell shares of creators. By holding these shares, you can access the creator’s content and interact with them. In the current version, FT can be understood as OnlyFans, but currently limited to text functionality.

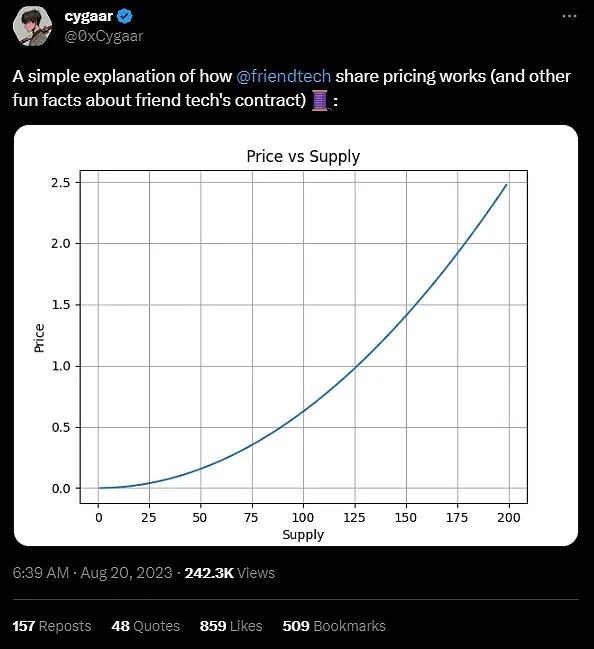

What drives the frenzy around FT is the speculative ability of users on the creator’s stock price. On FT, the stock price is determined by a joint curve, and the price is adjusted dynamically based on the circulation of shares. Therefore, each purchase of new shares will increase the price, while each sale of shares will cause the price to drop.

The joint curve on FT naturally excites people. It provides better conditions for early investors, motivating users to quickly join and buy shares. As the participation increases, the stock price rises, incentivizing early participants to actively promote the platform and contribute to user growth. This dynamic creates a self-sustaining cycle of excitement and expansion, making FT the focus of attention for the crypto-native community.

In addition, creators will extract a 5% fee from each transaction, incentivizing them to promote users to buy their own shares.

Reasons behind the popularity of Friend.Tech

Skeptics may say that FT’s product is not innovative because its social features are not different from mature social media platforms like Twitter subscriptions and OnlyFans. In addition, past attempts at financializing social networks, such as Steemit, Roll, and BitClout, ended in failure after a brief period of glory. Therefore, their skepticism is not unfounded.

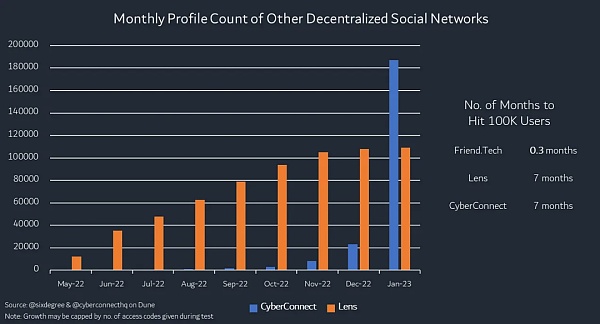

However, FT has gained 100,000 users and processed 62 million USD in transactions in just 12 days, which has sparked a debate about whether it can take a different path from the past.

So far, the outstanding performance of FT can be attributed to the successful execution of the following aspects:

(1) Driving FOMO:

Limited access: Registering for FT requires an access code, which can be obtained from existing members. This exclusivity makes everyone scramble for access codes on Twitter.

Stock priced according to bonding curve: As mentioned earlier, the bonding curve favors early participants, triggering competition among users, everyone wants to buy stocks in advance.

Airdrop mechanism: Over a period of 6 months, app testers received a total of 100 million points, which were promised to be used for “special purposes” after the official release of the app. This indicates that these points may be converted into FT. When users accumulate points based on their in-app activities and the number of referrals they bring in through access codes, they are naturally motivated to use and promote FT. This clever strategy not only stimulates active user participation on the platform, but also encourages users to form consistent usage habits, thereby improving long-term user retention considering the duration of the activity.

(2) Good user experience:

Smooth user experience with Privy: Unlike many dapps that require users to associate their wallets or set up a new in-app wallet (usually with the hassle of remembering a 12-word mnemonic phrase), Privy provides a simplified method. New users only need to log in with their Google or Apple accounts and top up the automatically generated wallet. This effectively reduces login barriers, alleviates users’ concerns about their original wallets being hacked, and eliminates the need for a 12-word mnemonic phrase. In addition, Privy eliminates the requirement for a signature for each FT transaction, enhancing the overall user experience.

Using progressive web applications (PWA): Approximately 83% of social media interactions take place on mobile devices. However, getting a crypto app listed on the Apple or Android app stores is often challenging. To address this challenge, FT cleverly released as a PWA, which functions similar to a native mobile app and allows users to “download” the app directly from the FT website. This approach not only bypasses the restrictions of traditional app stores, but also ensures a seamless user experience consistent with mainstream mobile usage trends.

Lack of sustainable incentives

Personally, I don’t think FT is as revolutionary as everyone is hyping it up to be, and the current frenzy is simply driven by the skyrocketing stock price. Importantly, this is not sustainable, and the FT stock price will decline in the coming months.

(1) Lack of long-term, sustainable incentives to use FT

The main stakeholders of FT can be divided into three categories:

Creators: Those who actively manage their channels and encourage users to buy their stocks, with the incentive of earning a 5% transaction fee.

Consumers: Those who purchase stocks to access creator channels. The purpose is to view the creator’s content or have the opportunity to interact with the creator individually.

Speculators: Those who buy and sell stocks. Their main motivation is to make money through stock speculation.

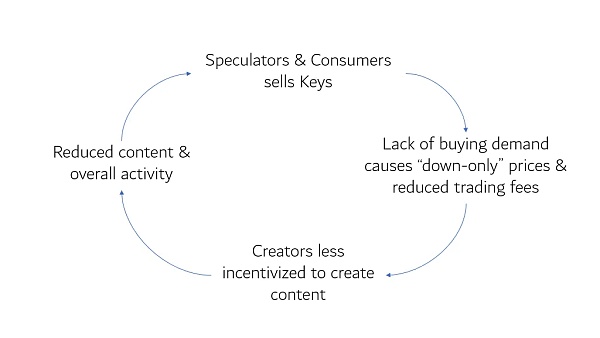

Among these three, speculators may be the first to leave. The nature of speculation means that early participants usually benefit significantly. However, as the platform develops and the initial hype fades, speculation activities tend to decrease because active trading becomes less profitable. This is especially true for FT due to its progressive bonding curve. The pricing curve for FT is the square of the supply, which makes its growth more exponential than a typical bonding curve. As the stock price increases, attracting new user investments becomes a difficult challenge.

The rising content cost of FT is different from the popular models of other content social platforms. For example, platforms like Twitter and TikTok offer free content, while Twitter Subscriptions and OnlyFans offer exclusive content for a fixed monthly fee.

This pricing strategy means that on FT, good content is reserved for those with financial resources. As a result, many users may find themselves only able to see lower quality content, leading to a decrease in engagement with FT and making them the next potential group to leave.

When speculators and consumers leave the platform, they sell their stocks, which may cause a downward spiral in stock prices. Although this downward trend may impose short-term costs on creators, in the long run, there is unlikely to be enough purchasing demand to provide them with sustainable incentives. With the decline in user engagement and a decrease in content creation, the rate of loss of speculators and consumers may accelerate, further dampening the enthusiasm of creators. This chain reaction may be a precursor to the decline of FT, as the platform’s value proposition to all stakeholders weakens.

(2) Conflicting Incentive Mechanisms and Business Models

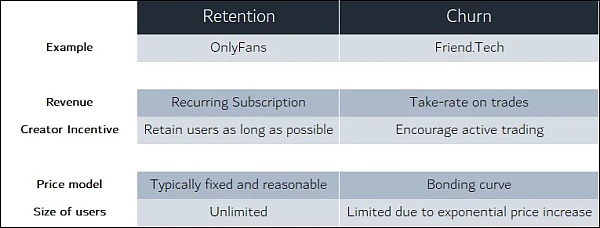

A closer study of the long-term motivations of creators reveals conflicting incentive mechanisms and business models.

On traditional content platforms, creators’ main source of income is sustained user engagement and retention. However, FT presents a non-traditional model: creators earn income through trading activities, particularly through buying and selling stocks that grant access to their content. This model does not encourage stable, lasting relationships, but seems to welcome user attrition.

This model may create a misalignment of incentives between creators and users. Creators may be incentivized to exploit short-term trading peaks rather than foster deep, lasting connections with users.

Although creators benefit when consumers purchase stocks, the exponential growth of stock prices inherently limits the buyer base, effectively restricting the size of the group. In addition, creators can only receive one-time payments instead of continuous income, raising doubts about the sustainability of this model.

Friend.Tech Cannot Escape the Fate of a Flash in the Pan

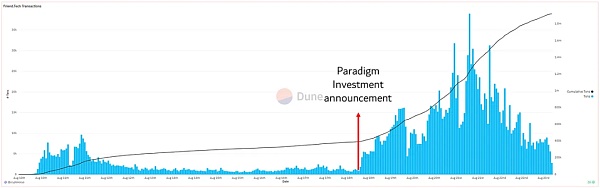

Although Friend.tech set a record of surpassing 4,000 ETH in daily trading volume and 260,000 on-chain transactions on the second day of its launch, causing a wave of enthusiasm, the trading volume plummeted after half a month, and Friend.Tech could not escape the fate of a flash in the pan. According to DefiLlama data, Friend.tech’s protocol income on September 1 was $60,000, a decline of over 96% from the peak of $1.68 million on August 21. The number of hourly active users on Friend.tech also dropped from a peak of over 4,700 on August 21 to less than 600 per hour.

Regardless of the ultimate outcome of Friend.Tech, its recent performance provides an important insight for builders and investors in Web3: while the concepts of decentralization and ownership are commendable, they are not the key drivers of adoption or success in themselves.

When it comes to user-centric encrypted applications, the temptation to satisfy speculative desires and exploit “digital rise” strategies has often proven to be a powerful catalyst for initial participation, while the concepts can operate in the background and be gradually rolled out.

In the end, long-term success requires more than just temporary adoption or concepts. It relies on sustainable strategies that truly meet user needs and improve lives. To achieve lasting impact, platform creators must prioritize genuine value and solutions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Economic Impact and Risks of the Launch of the Cosmos Liquidity Staking Module from Three Perspectives

- Milady, the fog of civil war, founders or indirectly serving US intelligence agencies.

- Review of Permissionless II SocialFi Transforming Social Into Money

- The Stablecoin Landscape after MakerDAO’s EDSR Transformation, Response, and Opportunities

- Phishing attack results in Fortress Trust losing $15 million worth of cryptocurrencies.

- Understanding Fork-Based Tokens in One Article Definition, Operation Mechanism, and Limitations

- LianGuaiWeb3.0 Daily | Huobi renamed as HTX