Analysis of the current status of generative AI usage by consumers

Analysis of generative AI usage by consumersAuthor: Olivia Moore, a16z Partner; Translation: LianGuaixiaozou

9 months ago, ChatGPT was released, and 7 months ago, it became the consumer application with the fastest monthly active user growth, surpassing 100 million users, ushering in a new era of generative artificial intelligence.

But besides ChatGPT, how do consumers interact with generative AI products? Which areas are dominated by established companies? And which areas are emerging companies excelling in? Who might be the next “big winner”?

To answer these questions, we examined SimilarWeb traffic data (as of June 2023) and ranked the top 50 GenAI web products by monthly visits. We also analyzed how these products have grown over time and where the growth is coming from.

- a16z The Most Basic and Feasible Password Security Configuration Solution

- Exploring the true potential of RGB What possibilities are there?

- Interpreting the Economic Impact and Risks of the Launch of the Cosmos Liquidity Staking Module from Three Perspectives

We relied on web traffic and app traffic to determine the companies’ “eligibility” for the list. So far, most GenAI consumer products are web-first (see details below). For companies with mobile apps on the list, we added traffic data from Sensor Tower as of June 2023 to determine their rankings. Therefore, this ranking can be used as a tool to identify and understand category trends, rather than an exhaustive ranking of all consumer AI platforms.

Here are the 6 key takeaways we summarized.

1. Most leading products were initially built around generative AI

Like ChatGPT, most of the products on this list didn’t exist a year ago – 80% of the websites are newly created. This indicates that while many traditional companies are using AI to enhance their products, many of the most notable consumer experiences are entirely new.

Among the 50 companies on the list, only 5 are existing large tech companies (or companies acquired by existing large tech companies), namely: Bard (Google), Poe (Quora), QuillBot (Course Hero), Pixlr (123RF), and Clipchamp (Microsoft).

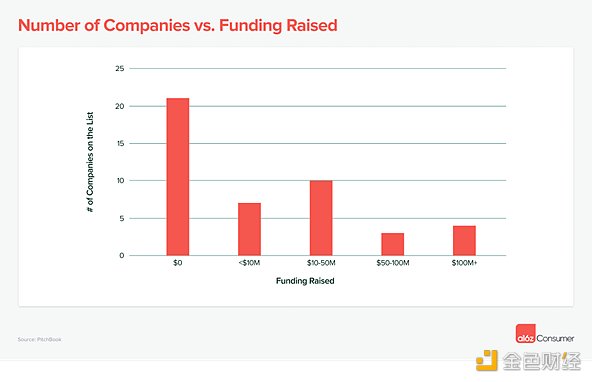

According to PitchBook data, as high as 48% of the list members are completely new startups without external funding. This suggests that large AI products can develop rapidly with relatively little financial support, although 15% of the companies have raised over $50 million!

What is the main difference between venture-backed companies and self-funded startups? It’s the technology. Building and training proprietary models (depending on the size of the model) can cost millions of dollars.

Almost all the top 50 companies fall into one of the following three categories: (1) training their own proprietary models, (2) fine-tuning existing models, (3) building consumer UI on top of existing models (e.g., “GPT wrappers”). However, it’s worth noting that among the top 10 products, half are built on their own models, and 4 products have fine-tuned existing models – only one product belongs to the “wrapper” category.

We will not consider ChatGPT for now (given OpenAI’s $11.3 billion financing, this data is biased), the average financing amount for companies with proprietary models is $98 million. In contrast, companies that fine-tune open-source models require $20 million in financing, while “wrapper” companies only require $9 million.

2. ChatGPT is currently far ahead…

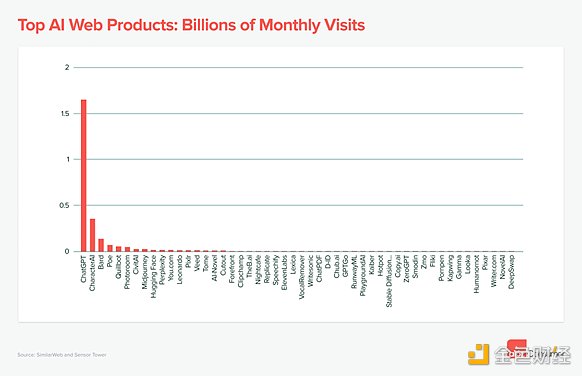

ChatGPT accounts for 60% of the total monthly traffic of the top 50 products, with an estimated monthly visit of 1.6 billion and a monthly user count of 200 million (as of June 2023). This makes ChatGPT the 24th largest website in terms of traffic worldwide.

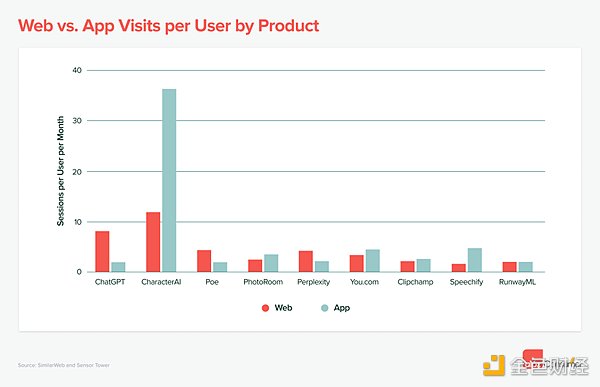

Although the competing platform CharacterAI has firmly secured second place with a scale of about 21% of ChatGPT, no other product has achieved such rapid development. Especially in the mobile field, according to Sensor Tower’s data, CharacterAI is one of the most powerful early players, with daily active user count comparable to ChatGPT and significantly higher user retention rate.

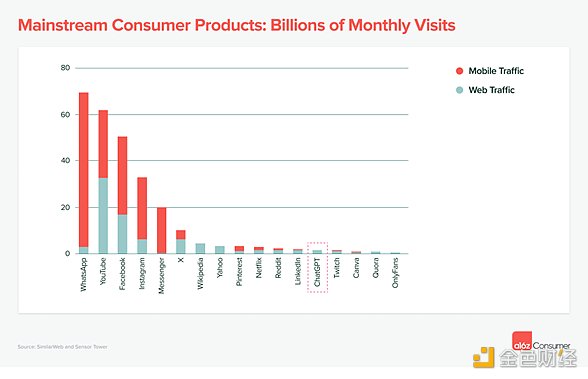

Compared to mainstream consumer products, even the largest GenAI product is overshadowed. When combining ChatGPT’s web traffic and mobile app traffic, ChatGPT’s ranking is roughly on par with Reddit, LinkedIn, and Twitch, but still far below the “giants” (WhatsApp, YouTube, Facebook, etc.).

3. LLM Assistants (such as ChatGPT) dominate, but competitors and innovative tools are emerging

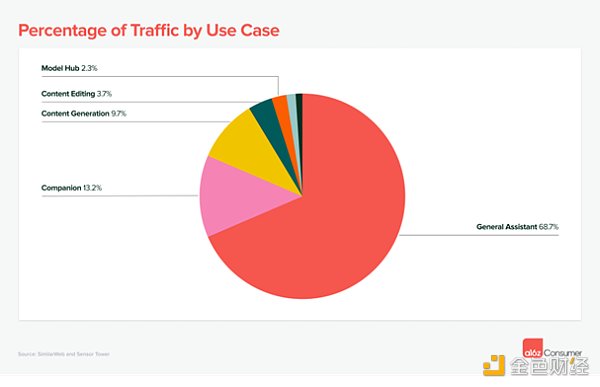

Among the top 50 products, general LLM chatbots account for 68% of total consumer traffic. In addition to ChatGPT, other similar products in the same category include Bard from Google and Poe from Quora, all of which rank in the top five.

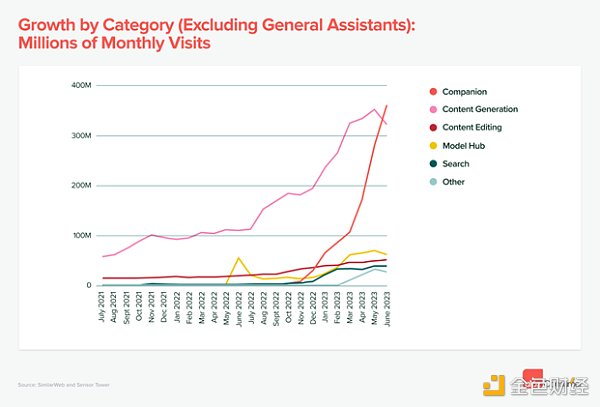

However, in recent months, two other types of applications have gained attention – AI companion apps (such as CharacterAI) and content generation tools (such as Midjourney and ElevenLabs). In the broader category of content generation, image generation accounts for 41% of the traffic, followed by professional consumer writing tools at 26%, and video generation at 8%.

Another noteworthy category is the Model Hub, with only two products listed but with considerable traffic – Civitai (an AI painting model sharing platform) and Hugging Face both ranking in the top ten. This is impressive because consumers usually visit these websites to download locally run models, so web traffic may underestimate actual usage.

4. Early “winners” have emerged, but most product categories are still competitive

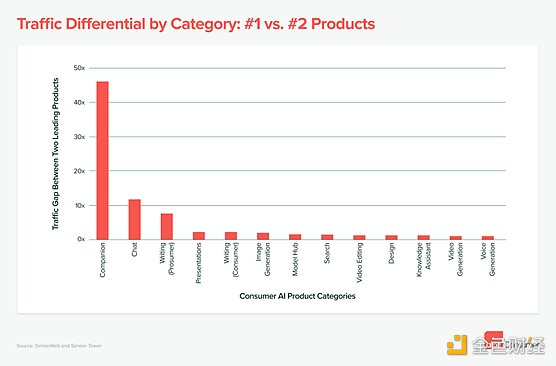

For builders, the good news is that although there has been a surge in interest in generative AI, there are still no absolutely successful products in many categories.

The following chart shows the difference in traffic between the top-ranked and second-ranked players in each field. While there are some exceptions (such as companion products), the majority of categories have a difference of no more than 2x, meaning the top-ranked company’s traffic is only twice (or less) that of its closest competitor. Considering that the companies on the list have an average monthly growth rate of 50% in the past six months, this gap is not insurmountable.

We are also starting to see significant differentiation. Products built specifically for specific use cases or workflows are growing alongside more general tools, and they show signs of being successful companies as well.

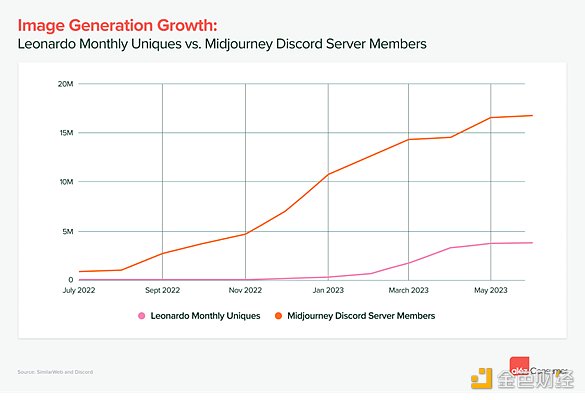

One example is image generation. While Midjourney dominates in the broader field, companies like Leonardo (specifically targeted at game assets) have also seen astonishing traffic growth. The graph below shows the growth of Midjourney’s Discord server members and Leonardo’s unique monthly visits. Although the scales are different, while Midjourney continues to rise, Leonardo has already been able to attract millions of users.

6. Completely organic head product purchases, consumers are willing to pay!

Over the past five years, many consumer applications have struggled with user acquisition. It is difficult to stimulate user excitement for new products due to the lack of platform conversion support (e.g., from the internet to mobile). The cost of user acquisition is also rising, which means that most consumer companies have to worry about metrics such as lifetime value and user acquisition cost.

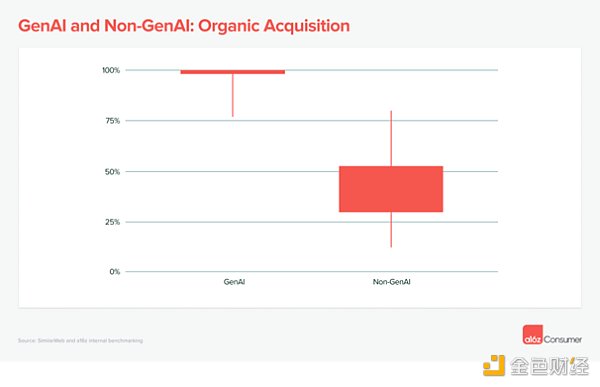

GenAI is changing the rules of the game. Most companies on the list do not have paid marketing (at least SimilarWeb can be classified as such). Through X, Reddit, Discord, and email, as well as word-of-mouth and referral growth, a large amount of free traffic can be “acquired”.

The bottom 25% of these GenAI products have only 2% paid traffic. In contrast, according to a16z’s benchmark test of 150 products, non-AI consumer subscription companies in the bottom 25% have 70% paid traffic.

Consumers are also willing to pay for GenAI. 90% of the companies on the list have started to make profits, almost all of them through subscription models. Any ordinary product on the list can earn $21 per month (for monthly subscription plan users) and $252 per year.

If you have subscribed to any popular consumer subscription products (such as Calm, Headspace, Duolingo) before the emergence of AI platforms, you will know that the annual subscription fee for these products is usually less than $70, and the monthly subscription fee averages $10. Generative AI has opened up a new layer of value and increased consumers’ willingness to pay.

6. GenAI mobile applications are still emerging

So far, consumer AI products have mainly focused on browsers rather than applications. Even ChatGPT took 6 months to release a mobile app!

But there are notable exceptions. In the image generation category, thanks to third-party APIs, the “barrier to entry” for applications is quite low. Products like Lensa and WOMBO have seen a rapid increase in user numbers, and of course, a rapid decrease as well.

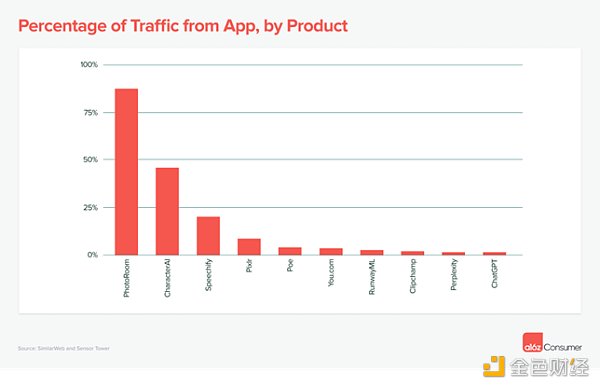

Why aren’t there more AI companies entering the mobile field? The browser is a natural starting point for reaching the widest consumer audience. Many AI companies have small teams and may not want to spread their attention and resources across the web, iOS, and Android. Therefore, currently, only 15 companies on the list have an active mobile app, and almost without exception, these 15 companies have less than 10% of their monthly traffic coming from their own mobile apps, with the majority of the traffic coming from the web.

There are three notable exceptions: design company PhotoRoom targeting professional consumers (estimated mobile app traffic accounts for 88%), companion app CharacterAI (mobile app traffic accounts for 46%), and text-to-speech conversion product Speechify (mobile app traffic accounts for 20%). These companies have higher user stickiness on their mobile apps compared to their websites.

Considering that consumers now spend an average of 36 minutes more on mobile devices than desktop computers per day (4.1 hours vs. 3.5 hours), we expect to see more GenAI products focusing on the mobile end as technology matures.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Milady, the fog of civil war, founders or indirectly serving US intelligence agencies.

- Review of Permissionless II SocialFi Transforming Social Into Money

- The Stablecoin Landscape after MakerDAO’s EDSR Transformation, Response, and Opportunities

- Phishing attack results in Fortress Trust losing $15 million worth of cryptocurrencies.

- Understanding Fork-Based Tokens in One Article Definition, Operation Mechanism, and Limitations

- LianGuaiWeb3.0 Daily | Huobi renamed as HTX

- LianGuai Morning News | Coinbase’s platform delists 38 non-dollar trading pairs