Do the bull engine start? After a year, the Bitcoin Bulls and Bears indicator "Super Gubby" first turned cattle

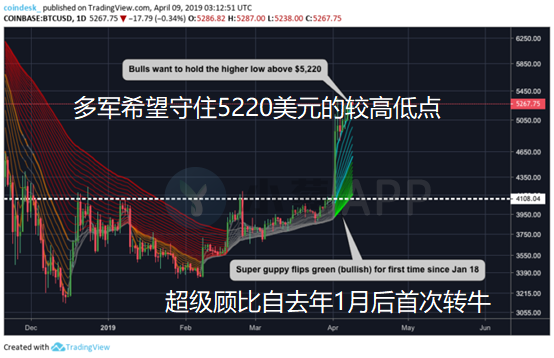

The Bitcoin daily chart recently issued a bullish signal, and the highly-accepted “super guppy” bull-bearing indicator has finally collapsed for more than a year, and has been turned for the first time since January 14, 2018.

The signs of the bear-to-bovine show that the multi-military has firmly controlled the market, and as long as the bitcoin price remains above the psychological level of $5,000, they will continue to do more.

The Guby Composite Moving Average (GMMA) is a set of technical indicators for judging market prices created by Dai Ruo Gubi, one of the top ten international financial analysts and a global financial market analyst. The Gubi moving average is composed of two groups of moving averages, of which the 3, 5, 8, 10, 12 and 15 day moving averages constitute the “short-term group”, while the 30, 35, 40, 45, 50 and 60-day moving averages constitute the “long-term group”. The former reflects the behavior of short-term speculators in the market, while the latter reveals the behavior of long-term investors in the market.

- Is the change in the number of "bitcoins" searched for a price lag indicator or a leading indicator?

- The secret of the industrial park: This opinion draft blocked the road of “compliance” of the mine?

- The rise of EOS, the public link is great, and the second wave of the market opens?

The law can be summarized as:

The “short-term group” completely wears the “long-term group”, and it is recommended to buy more and more, and then wear it to close the position;

The “short-term group” completely wears the “long-term group”, and it is recommended to buy shorts and short positions.

The improved Gubi indicator is called “Super Gubby.” Over the years, Gubby’s indicators have played a significant role in analyzing securities, indices, commodities, and foreign exchange markets.

Long and short confrontation

At the beginning of this month, the price of BTC soared to $5,000, and then broke through the $5,200 mark. As you can see from the monthly chart below, Bitcoin has recently stood on the 26th EMA moving average (currently $5,064), or marks the arrival of a new round of bull market.

Except for November 2018, Bitcoin's last drop below EMA26 has been traced back to the end of 2014, when bitcoin prices fell back below the line after falling below the 26-day moving average.

In addition, the Relative Strength Index (RSI) has climbed above 50, indicating that the bulls are still dominant and are constantly putting pressure on the Air Force.

If bitcoin prices are able to stabilize above these key indicators, it will greatly boost market confidence and attract more investors.

Previously, Seeking Alpha market researcher Victor Dergunov said that "strong rebound" and technical indicators are similar to the previous bull market. Therefore, he believes that this is likely to be the beginning of the next bull market for Bitcoin. As bitcoin becomes more popular, the peak of the new bull market is always significantly higher than the peak of the previous bull market. Currently only about 0.56% of potential users have been exposed to Bitcoin, which means that nearly 99.5% of the potential market has not yet been developed.

But at the same time as the multi-military carnival, the Air Force did not stop.

On April 5, the US Commodity Futures Trading Commission (CFTC) released its weekly position report. The report shows that although Bitcoin has recently experienced a “bull market”, large professional investors are increasing their short positions in bearish bitcoins.

According to the report, small capital investors increased their long position by 18% and their short position by 27% compared with a week ago. In light of current changes, retail and small capital investors tend to continue to rebound from bitcoin prices beyond current levels. However, large capital investors (hedge funds and institutional traders) increased their short positions by 45% a week ago and reduced their long positions by 24%, almost completely contrary to the behavior of retail investors.

Forbes analyst Brendan Coffey said institutional investors are bearish for Bitcoin. He pointed out that the 200-day moving average itself provides a source of price resistance, which is one of the most closely watched indicators of BTC price movements. Bitcoin has not broken the $6,000 mark in this rally, which provides substantial resistance to bullish investors. Considering that the $6,000 is the price at which many investors are stuck, if Bitcoin returns to $6,000, then a large number of investors are expected to sell the solution, which will prevent the BTC from rebounding further.

This article comes from the onion blockchain. For more information, please visit https://xcong.com/ or Scallion APP.

Author | Gu Mengting, please indicate the source. The copyright belongs to the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A picture of bitcoin bifurcation history

- What is the actual impact of the “Development of Bitcoin Mining” by the National Development and Reform Commission? Different opinions in the industry

- The rise of the PoS mechanism can bring "new mining market" to the fire?

- US Attorney Davidson's Attitude: Demarcation of Digital Tokens and Securities Law

- Staking Economy (Series 7) is wary of Staking Profit, talking about Slash risk! ! !

- Old text rereading | Ethereum and black box

- GeekHub Global Online The fifth phase of cross-chain – dialogue COSMOS content record