Dry Goods | Blockchain Economics: A Guide to Institutional Cryptography

Author: Chris Berg, Sinclair Davidson and Jason Potts

Translation: Nicole Yao

Source: Ethereum fans

A blockchain is a digital, decentralized, distributed book .

- The MakerDAO rate has dropped to the lowest level in half a year. How to arbitrage from it?

- QKL123 market analysis | Bitcoin adjustment is nearing the end, or will start the slow cattle market (1104)

- Speed reading | Bitcoin S17+ new mining machine revenue evaluation; exchange wallet holds 6.7% of all bitcoin

Most of the explanations for blockchain technology begin with bitcoin and the history of currency development. However, currency is only the first use case for the blockchain and is not necessarily the most important application.

This may be a bit strange, the book, the boring and practical record of the main and accounting related, which will be described as a revolutionary technology. However, the blockchain is important because of the importance of the books.

Account source

The books are ubiquitous and their functions are not limited to recording accounting transactions. A ledger is made up of data structures arranged according to rules. Whenever we need to reach some consensus on some facts , we will use the books. The facts recorded in the books support the cornerstone of our modern economics.

The ledger confirms ownership . The property deed is registered like a map showing who owns what and whether their land has been warned or destroyed. Hernando de Soto has proved how painful it is when the poor's own property is not confirmed in the books. A company is a book, like a network of ownership, employment, and production that serves a single purpose. The community is also a book, and it is determined who will benefit or cannot benefit.

The account confirms the identity . After the business entity registers its identity on the government book, its status under the tax law can be recorded. Birth certificates, death certificates, and marriage certificates are all used to record the moments when individuals exist, and when these individuals interact with the world, this information can be used to identify individuals.

The book confirms the status . Citizenship is a book that remembers who should be entitled to rights and obligations as a national citizen. The electoral roll is a ledger that allows voters registered on the roster to vote (Australia is a universal electoral system). Employment is a book that allows employees to obtain work compensation in accordance with contract claims.

The book confirms authority . The ledger proves who can legally occupy a seat in Congress, who can access the relevant bank account, who can work with the child, and who can enter the forbidden area.

Fundamentally, the books depict economic and social relationships .

It is the cornerstone of market capitalism that people agree on facts and their changes (ie, consensus on the content of the book and full confidence in the accuracy of the book).

Ownership, possession and books

Let us make a distinction here between the concept of ownership and possession . This is important, but it is easy to ignore.

Take a passport as an example. Every country maintains its right to control who can enter and exit. In addition, each country maintains a book that records which citizens can travel. A passport is a kind of thing, and it can also be called a token to check the book.

Before the advent of the digital age, possession meant ownership of that right. Australian passport books consist of index cards held by state governments. When the border staff get the passport they submit, they can make the following assumptions: The traveler is recorded on a remote ledger and is allowed to travel. Of course, this radical border control is vulnerable to fraud.

– A Belgian passport in the National Archives of Australia, A435 1944 / 4 / 2579-

– A Belgian passport in the National Archives of Australia, A435 1944 / 4 / 2579-

Occupation implies ownership, but ownership is not possession. At the moment, modern passports allow the authorities to directly confirm ownership. Its digital character allows airlines and immigration authorities to determine whether to allow the passenger to pass freely by visiting the National Passport Data Center.

Passports are a relatively straightforward example to prove the difference between the two. However, Bitcoin has shown us that money is also a kind of bookkeeping.

The possession of bank note vouchers symbolizes ownership. In the nineteenth century, the holders of bank notes, the “bearers”, had the right to use the value of these notes in the issuing bank. These bank notes are recorded on the bank's books as direct liabilities of the issuing bank. The system of possession states that ownership means that bank notes are vulnerable to theft and forgery.

In the era of our legal currency circulation, a five-dollar bill cannot be returned to the bank in exchange for gold. But the relationship still exists – the value of the banknote depends on the society’s consensus on the currency and the government that is the subject of its distribution. But unfortunately, as Zimbabwe, Yugoslavia and the German Weimar Republic realize, bank notes are not wealth. A banknote is an access to a (synthetic) record of a relationship in the book, but if that relationship collapses, the value of the banknote collapses.

Evolution of the books

Although the books are very important, this technology has almost never changed much… until now.

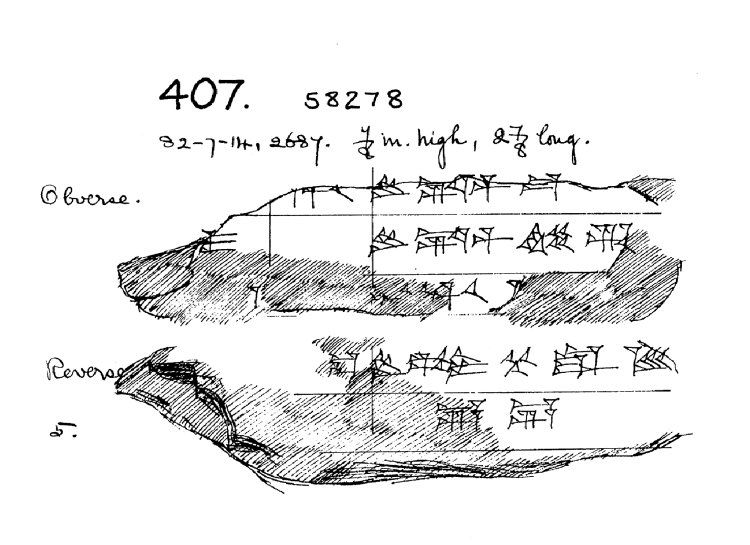

The books appear in the early stages of written communication. In the ancient Near East, books and writing were developed at the same time to record production, transactions and debt. The number of rations, taxes, workers, etc. is recorded in detail by engraving cuneiform characters on the mud board, and then burned and preserved. The first international “community” was formed in the form of a structured network alliance, which operates in much the same way as a distributed ledger.

– A fragment of the Babylonian cuneiforms in the collection of the British Museum, 58278-

– A fragment of the Babylonian cuneiforms in the collection of the British Museum, 58278-

The first major change in the books appeared in the fourteenth century, when people invented the double-entry bookkeeping method . The double-entry bookkeeping method requires simultaneous registration of equal amounts of loan data in multiple (distributed) ledgers to preserve the information between the books.

In the nineteenth century, with the rise of large companies and large bureaucracies, the book-based technology had the next development. These centralized accounts have dramatically increased the size and scope of the organization, but are based entirely on trust in centralized institutions.

In the late twentieth century, the simulated ledger was transformed into a digital ledger . For example, in the 1870s, Australian passport books were digitized and centralized. The database enables more complex allocation, calculation, analysis, and tracking. A database is computable and searchable.

However, the database is still based on trust. The reliability of a digital ledger depends on the organization that maintains its books and the employees employed by the organization. This problem is solved by the blockchain. The blockchain is a distributed ledger that does not rely on a trusted central authority to maintain and verify the ledger.

Blockchain and capitalist economic system

The economic structure of modern capitalism has evolved to serve these books.

Oliver Williamson, winner of the 2009 Nobel Prize in Economics, argues that the production and exchange of people between markets, companies, or governments depends on the difference in transaction costs between these institutions. Williamson's transaction cost method points to the key words of "Which organization manages the books?" and "Why does the organization manage the books?"

The government maintains the rights, privileges, responsibilities and access to the books. The government is a trusted entity that maintains a database of citizenship and its travel rights, tax liabilities, social security rights and property ownership. When the books need to be enforced, we will need the help of the government.

The company also needs to maintain the books. The company's proprietary books cover the duties and duties of employees, ownership distribution, human and physical scheduling, suppliers and customers, and the management of intellectual property and corporate privileges. Companies are also often described as "a series of contractual connections." The value of the enterprise comes from the way and structure of the group. Therefore, the company is actually a book that records contracts and capital.

Companies and governments can use blockchain technology to increase their productivity and credibility. Multinational companies and their corporate networks need to check their global transactions, and the blockchain can do the job almost instantaneously. The government can use the unchangeable technology of the blockchain to ensure that property deeds and identity records are accurate and untamed. The application of blockchains, after being designed with clever licensing rules, allows citizens and consumers to better control their own data.

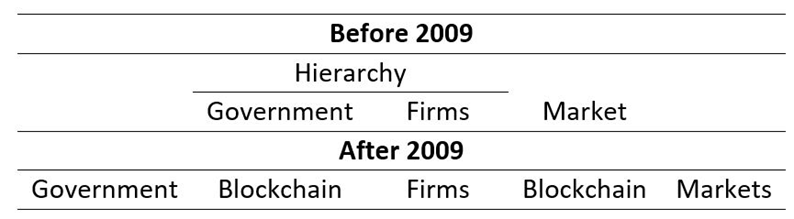

But at the same time, the blockchain has a competitive relationship with the company and the government. Blockchain is an institutional technique. Unlike government and companies, blockchain is a new way of maintaining books, namely collaborative economic activities.

– New capitalist economic system –

– New capitalist economic system –

Companies can use blockchain technology, but they can also be replaced by this technology. Now, a book that records contracts and capital can exist in a decentralized and distributed way, which is unprecedented. Accounts that document identity, permissions, privileges, and authorizations do not need to be maintained and executed with government support.

Institutional encryption economics

The research object of institutional cryptography economics is the importance of institutions in cryptographically secure and trust-free accounts. Classical and neoclassical economists study the production and distribution of scarce resources, as well as the elements that support production and distribution.

Institutional economics is an economics that takes rules as the object of study. Rules (such as law, language, property rights, regulations, social norms, and ideologies) enable activities between dispersed and speculative people to collaborate. Rules can promote exchanges – not just economic exchanges, but also social and political exchanges.

The so-called cryptography economics is focused on the economic principles and theories that support the blockchain and its derivatives. It looks at the game theory and incentive design that are mainly used in the design of blockchain mechanisms.

Conversely, institutional encryption economics focuses on institutional economics in blockchain and cryptographic economics. The economy, like institutional economics as its branch, is a system of coordinated exchange. But institutional economics does not focus on rules, but on the books: data made up of rules.

Institutional encryption economics is interested in the following: governance rules for books; the development of social, political, and economic institutions that serve these books; and how the invention of blockchains changes the book-based model across society.

The important position of economics in the blockchain

Institutional encryption economics gives us a tool to understand what is happening in the blockchain revolution and what we can't predict.

Blockchain is an experimental technique. Where should it be used? This is a question for most entrepreneurs. Some books will be transferred to the block, and some entrepreneurs will not succeed if they try to transfer the books to the blockchain. Blockchain is not a panacea. We have yet to see the blockchain killer application. We can't now estimate what the combination of books, cryptography, and peer-to-peer networks will bring in the future.

This process will be extremely confusing. We expect that the global economy will face uncertainty for a long time, and this uncertainty comes from the fact that the factual evidence behind it will likely be adjusted, abolished and reconstructed.

The best way to use the blockchain remains to be discovered. Later, it will inevitably be introduced into the real-world political and economic systems, which already have a number of senior and mature institutions that serve the books, so the price must exist.

The use of books is extremely common, and some of the basic principles governing society are at your fingertips. Therefore, the application of blockchain can be described as all-encompassing.

Creative destruction of the system

We have also experienced such a revolution.

It is easy to compare the invention of bitcoin and blockchain with the Internet. The blockchain is Internet 2.0 or Internet 4.0. The Internet is a powerful tool that subverts the way we interact and do business. But any of these comparisons underestimate the value of the blockchain. The Internet allows us to communicate and exchange more smoothly, quickly and effectively.

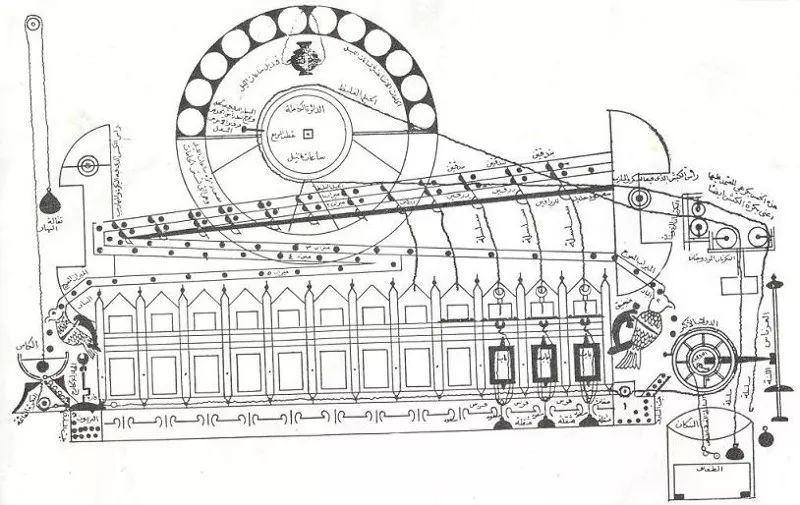

However, the blockchain allows us to exchange in different ways. A better analogy to blockchain technology is the invention of mechanical time.

Before the emergence of mechanical time, human activities were subject to the temporary regulation of nature: the cock dawned and the night gradually darkened. As the economic historian Douglas W. Allen puts it, the problem is the variable: “The variables that measure time are too numerous… so that you can't find a reference in many everyday activities.”

– Jayrun Water Clock in the 12th Century –

– Jayrun Water Clock in the 12th Century –

“The impact of variable factors that reduce measurement time can be felt anywhere,” Allen wrote. Mechanical time opens up a whole new class of economic organizations that are incredible and almost impossible. Mechanical time allows trade and exchange to be synchronized, surpassing geographical restrictions. It allows production and transportation to be coordinated, allowing one-day arrangements to be achieved, allowing labor to be paid according to working hours (to let workers know if they have received reasonable compensation). Employers and employees can verify that the contract is fulfilled based on a standardized, independent tool.

Complete and incomplete smart contracts

Oliver Williamson and Ronald Coase (1991 Nobel laureate in economics) see contracts as the core of economic and business organizations. Contracts are also at the heart of institutional encryption economics. This is where the blockchain is the most revolutionary.

Smart contracts on the blockchain enable contractual agreements to be executed automatically, anonymously, and securely. Smart contracts eliminate a lot of the work that is currently being done to maintain, implement, and confirm that contracts are executed—accountants, auditors, lawyers, and the legal system.

However, smart contracts are limited by algorithm compilation. Economists focus on the difference between a full contract and an incomplete contract.

A full contract specifically refers to the terms that will be enforced under either possibility. Incomplete contracts allow the terms of the contract to be reconsidered in the event of an accident. The incomplete contract explains the following questions: Why is the company exchanged? Why is there an exchange in the market? At the same time, it provides further guidance on a range of issues regarding the vertical integration and scale of the company.

A full contract cannot be executed, and a full contract is more expensive. But with smart contracts, blockchain can reduce the information and transaction costs associated with many incomplete contracts and thereby expand the scale and scope of economic activity that can be carried out. In this way, the market can be operated in a place where only large companies can operate before, and at the same time, businesses and markets can be operated in places where only the government can operate.

It is the problem and challenge faced by entrepreneurs when and how to achieve the above situation. Now, the oracle predicts the blockchain algorithm world and the real world, allowing the trust subject to transform the information into data that can be processed by smart contracts.

We believe that the real benefits of the blockchain revolution should come from the development of more sophisticated and powerful predictors—converting incomplete contracts into fully-complete contracts that can be compiled and executed by algorithms on the blockchain.

The development of commercial courts allowed the commercial revolution in the Middle Ages to be realized. A trusted and efficient predictive machine allows traders to execute agreements privately. But for the blockchain, this revolution does not seem to have arrived.

Where will the government go?

The blockchain economy has brought a full range of pressures on government processes, from taxation and regulation to providing services. Our current research project is to investigate this series of changes. We can think about it, for example, how to supervise banks?

We use a prudential regulatory system to ensure that the interaction between financial institutions and the public is safe and secure. However, what we often see is that these regulations (such as liquidity and capital requirements) fail to allow depositors and shareholders to observe the bank's books. Depositors and shareholders cannot punish companies and their management.

When depositors find (or simply imagine) that the banks they save may not be able to pay their deposits, people will scramble to withdraw money, and at this point, the bank will run.

– The scene of a bank run in the movie "Happy Man" (1964) –

– The scene of a bank run in the movie "Happy Man" (1964) –

One possible application of the blockchain is to allow depositors and shareholders to continuously monitor bank reserves and loans to substantially eliminate information asymmetry between them and the bank's management.

In this world, market self-discipline is possible. Public trust in the unchangeable nature of the blockchain will ensure that no erroneous bank runs are made. The role of regulators will be limited, they only need to ensure that the blockchain is built correctly and safely.

A more far-reaching significance would be to encrypt banks – an autonomous blockchain application that can be used to match borrowers and lenders directly. An encrypted bank implemented by a smart contract algorithm has the same transparency characteristics as other banks, and a bank with a public blockchain and other features may completely ignore the need for regulation. For example, an encrypted bank has the ability to pay off itself . When an encrypted bank needs to trade in bankruptcy, its related assets will be automatically paid to shareholders and depositors.

In such a world, it is unclear what kind of regulatory role the government should assume.

Tyler Cowen and Alex Tabarrok argue that it seems that most government-designed regulations are used to address information asymmetry, but in a world where information is ubiquitous, such problems are not always present. Blockchain applications have dramatically increased the spread of information, making it more transparent, permanent, and accessible.

The blockchain puts its users in so-called “ regulatory technologies ”—using technology for traditional regulatory functions such as auditing, compliance, and market regulation. But what we can't ignore is that there will be some new economic issues in the world of blockchain, which will require us to develop new consumer protection measures and market management measures.

In any case, the reconstruction and reconstruction of a basic economic form like a bank will not only put pressure on how to implement regulation, but also put pressure on what regulation should do.

Where will the big business go?

The impact on large companies can be very far-reaching. The scale of operations is usually driven by the cost of covering its business level, and is driven by incomplete contracts and technical necessity under large-scale financial investment. This business model means that shareholder capitalism is the main form of business organization. If you can develop more complete contracts on the blockchain, it means that entrepreneurs and innovators can maintain their ownership, human resource control and profits. The relationship between running a successful business and gaining financial capital has long been eroded, but now this relationship may break. Human capitalism is ushering in a new era of dawn and dawn.

Entrepreneurs will develop a valuable application and post it to anyone in the “wild” who is ready to be hired or who needs the application. Entrepreneurs only need to observe the micropayments accumulated in their wallets. A designer can post his work to the "wild", and then the end consumer can download the design to a 3D printer and get the relevant product right away. This business model enables Australia to have more (localized) manufacturing than it currently does.

This ability to allow consumers to communicate directly with manufacturers or designers will limit the role of middlemen in the economy. Although logistics companies will continue to thrive, the emergence of driverless transportation will also subvert this industry.

What needs to be remembered here is that the disruption of any business model will undermine the company's tax base. Perhaps the government will have difficulty collecting taxes on business activities, so we may see tremendous pressure on sales (consumption) taxes and head tax.

in conclusion

Changes in the blockchain and its related technologies will have a huge disruptive effect on contemporary economic conditions. The industrial revolution emerged in a world where business models were based on hierarchy and financial capitalism. The blockchain revolution will witness an economic system dominated by human capitalism and a high degree of autonomy.

How this will ultimately be presented is not yet clear. Entrepreneurs and innovators will continue to try and solve our uncertainty through continuous trial and error. Undoubtedly, a lot of wealth will be created and destroyed before we know exactly how this subversion will be presented.

And our contribution is that when this subversion comes up, we can provide a model that allows people to clearly understand the meaning of this subversion.

Chris Berg, Sinclair Davidson and Jason Potts are from the RMIT Blockchain Innovation Center, the world's first centre of the Academy of Sciences, which focuses on economics, politics, sociology and law in blockchain technology.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the major impacts of the accelerated development of the central bank's digital currency?

- Failed to pay 500,000 bitcoins, CSW violated the settlement agreement, litigation restarted

- The first anniversary of the Uniswap agreement, how is this alternative Ethereum DEX developed?

- Research report | Libra is still on the line, the project development is hot

- Weekly data on the BTC chain: data on the chain began to fall, and the exchange traded frequently

- Can BTC be independent?

- BTC retreats slightly, but the average support is still strong