The MakerDAO rate has dropped to the lowest level in half a year. How to arbitrage from it?

Author: Odaily Daily Planet Packer

Source: Planet Daily

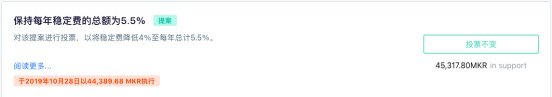

On October 28th, MakerDAO officially released the news that Dai's stable rate was reduced to 5.5%. This proposal was put forward in a conference call on October 24th and was implemented as of October 28th with a support ticket of 45,317.80 MKR.

- QKL123 market analysis | Bitcoin adjustment is nearing the end, or will start the slow cattle market (1104)

- Speed reading | Bitcoin S17+ new mining machine revenue evaluation; exchange wallet holds 6.7% of all bitcoin

- What are the major impacts of the accelerated development of the central bank's digital currency?

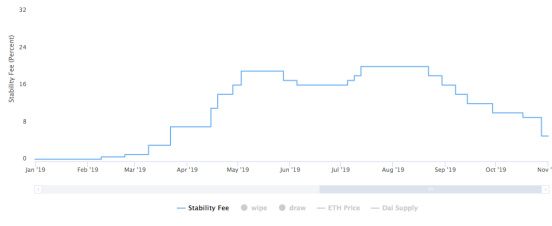

According to Odaily Planet Daily, since 2019, MakerDAO has voted for a stable rate adjustment of 22 times. The data changes are as follows:

The rate adjustment was originally used to regulate the ratio of Dai to the US dollar, so that it will remain at 1:1. For example, when the price of mortgage assets fluctuates, the number of leveraged players will increase. They will mortgage ETH or other digital assets to lend Dai. At this time, the supply of Dai will become larger, and the anchor of Dai and the US dollar will no longer be 1:1 stable. At this time, the community will propose to increase the stable rate (borrowing interest rate), increase the borrowing cost of Dai, thereby limiting the supply of Dai, and maintaining Dai and the US dollar at a 1:1 anchor. When the borrowing cost continues to increase, Dai's supply will change. When too little, it will also make Dai not 1:1 anchor relationship with the US dollar. At this time, the community will reduce the stable rate, reduce the borrowing cost of Dai, and increase the supply. This process is similar to the Fed raising interest rates and cutting interest rates.

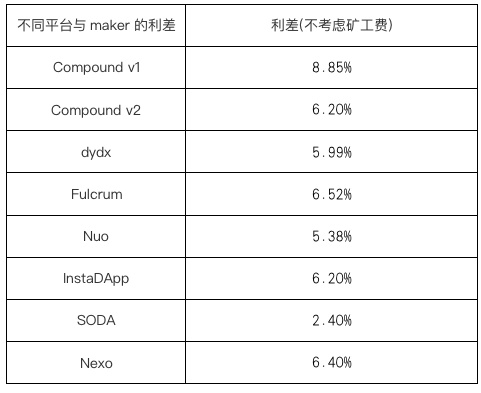

Here the MakerDAO's stable rate is actually equivalent to borrowing interest, and when the borrowing interest is lower than the lending interest of another platform, there will be an opportunity for arbitrage.

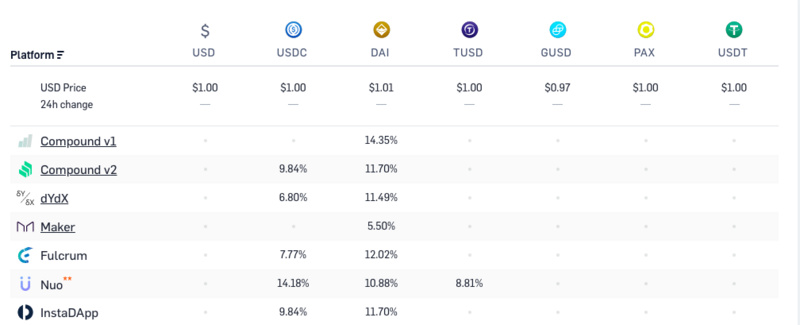

For example, MakerDAO currently has a loan interest rate of 5.5%, while Compound v1 has a loan interest rate of 14.35%, Compound v2 has a loan interest rate of 11.70%, and dydx has a loan interest rate of 11.49%. There are three other platforms, Fulcrum and Nuo. InstaDApp's lending rate is also greater than MakerDAO's lending rate. As shown below:

It should be noted that MakerDAO's stable currency model can only be borrowed and cannot be loaned, while other lending platforms are a matching model that completes lending by combining lenders and borrowers.

Therefore, the following operations can be performed between different platforms to achieve arbitrage purposes:

Of course, in addition to arbitrage between the same assets, it can also be carried out between different assets. For example, after lending Dai on Maker, you can switch to other assets such as USDC or GUSD, and then lend on other platforms. However, from the data given by the loanscan platform, Dai is a relatively mainstream lending asset, which is supported by almost every platform.

There are the following risks in the operation:

- MakerDAO's over-collateralization requirements: In order to prevent insolvency, the MakerDAO system requires a mortgage at 150% of the initial mortgage rate. In addition, as long as the mortgage rate is below 150%, CDP is at risk. In addition, since Ethereum, which is stored in the CDP account, will not have interest return, strengthening the protection of the collateral price will reduce expectations for returns.

- Due to the problem of the MKR voting mechanism, the voting rights for stable rates are in the hands of “cow whales”, so there is a great risk of high rate control. For example, in this vote to reduce the stable rate, a giant whale with 41900 MKR appeared, occupying 97% of the voting rights, and increased the number of votes from 2,489 to 44,539.

- Since some of the decentralized lending platforms are carried out by paying “miners' fees”, all need to consider miners’ rates.

- Also, because the rate change itself has no fixed frequency and upper and lower limits, the systemic risk caused by instability is high. For example, this year's stable rate fluctuated from 20.5% to 0.5%, with the most frequent fluctuations in July, and stable rate changes occurred for three consecutive days.

Original article; violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Failed to pay 500,000 bitcoins, CSW violated the settlement agreement, litigation restarted

- The first anniversary of the Uniswap agreement, how is this alternative Ethereum DEX developed?

- Research report | Libra is still on the line, the project development is hot

- Weekly data on the BTC chain: data on the chain began to fall, and the exchange traded frequently

- Can BTC be independent?

- BTC retreats slightly, but the average support is still strong

- Babbitt Entrepreneurship + | "All changes are possible", how does the investment institution X-Order explore the new open financial order?