EigenLayer, which raised $64.5 million in financing: A new narrative in the collateralized track

Author: Yinan

Background:

Bitcoin pioneered the era of decentralized trust, but its application-specific nature has limited the development of new decentralized applications.

Ethereum, through the concept of fully programmable and modular blockchain, enables DApps to be built on its trust network without permission, decoupling innovation from trust and promoting the development of pseudo-anonymous economy. Then, when Ethereum turns to the rollup-centric development path, the number of applications that can be built on it without permission increases significantly. By outsourcing execution to a single node or a small group of nodes, but can absorb Ethereum’s trust by proving computation to Ethereum, it further promotes permissionless innovation and gives rise to the prosperity of various proof technologies.

However, any module that cannot be deployed or proven on the EVM cannot absorb the collective trust of Ethereum. Such modules involve processing inputs from outside Ethereum, so their processing cannot be verified within the Ethereum internal protocol. Examples of such modules include side chains based on new consensus protocols, data availability layers, new virtual machines, keeper networks, oracle networks, bridging, threshold encryption schemes, and trusted execution environments.

- US SEC Chairman’s pessimistic tone: Cryptocurrency businesses often non-compliant, filled with opacity and risk

- What would happen to Bitcoin if the black swan of US debt occurs?

- Inventory of the top 5 Ethereum GAS consumers

Typically, such modules require active verification services, which have their own distributed verification semantics for verification. Typically, these active verification services (“AVS”) are either protected by their own native tokens or require permission in nature.

The organization of the AVS ecosystem has four basic shortcomings:

-

The problem of launching new AVSs

Innovators who want to develop new AVSs must launch a new trust network to gain security.

-

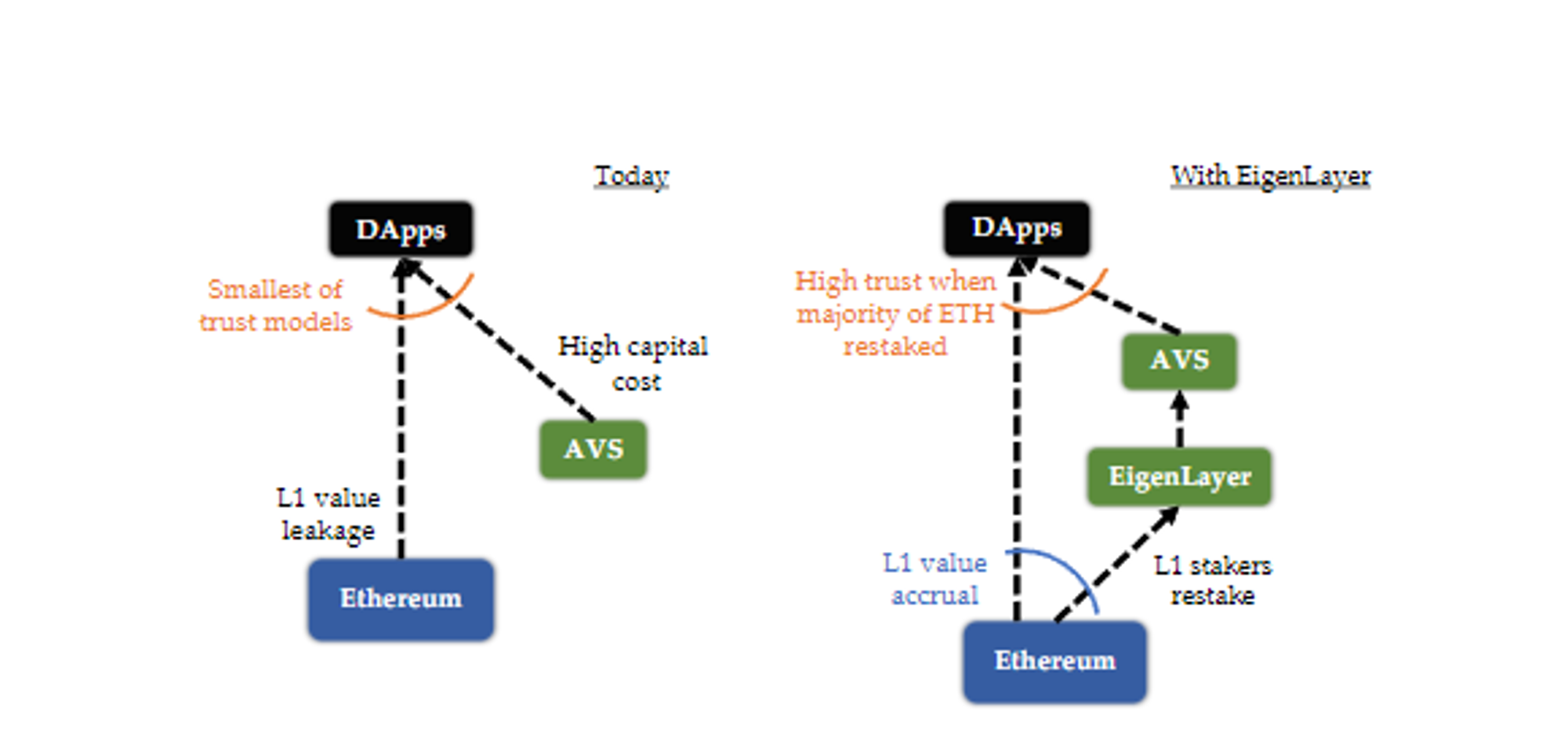

Value leakage

Because each AVS has developed its own trust pool, users not only have to pay fees to these pools, but also to pay Ethereum transaction fees. This cost flow offset leads to value leakage from Ethereum.

-

Burden of capital cost

Validators pledging to protect new AVSs must bear capital costs, which are equivalent to the opportunity cost and price risk of pledging in a new system. Therefore, AVSs must provide a high enough pledge return to cover this cost. For most operational AVSs, the capital cost of pledging far exceeds any operating cost. For example, consider a data availability layer with a $10 billion pledge protection, assuming that the expected annualized return rate (APR) of the pledger is 5%. This AVS needs to return at least $500 million to the pledger each year to compensate for the capital cost. This is far greater than the operating costs associated with data storage or network.

-

Low trust model for DApps

The current AVS ecosystem produces an extremely undesirable security dynamic: in general, any middleware dependency of a DApp may become a target of attack. Therefore, the corruption cost of a DApp must usually be considered to be at least no higher than the lowest cost of corrupting its dependencies.

Project Introduction

What is EigenLayer:

According to the official website, EigenLayer is an Ethereum re-staking collection, which is a set of smart contracts on Ethereum that allows stakers of the consensus layer Ether (ETH) to choose to verify new software modules built on the Ethereum ecosystem.

Stakers who choose to join EigenLayer can verify many types of modules, including consensus protocols, data availability layers, virtual machines, keeper networks, oracle networks, cross-chain bridges, threshold encryption schemes, and trusted execution environments.

EigenLayer provides a new permissionless innovation platform where innovators do not need to establish their own trust network to implement new distributed verification modules, but can rely on EigenLayer’s security and decentralization provided by ETH re-stakers to save costs and enjoy the security of Ethereum.

To summarize: EigenLayer allows re-stakers to participate in the verification of different networks and services through a set of smart contracts, providing cost savings and security of Ethereum for third-party protocols, and providing multiple benefits and flexibility for re-stakers.

Target audience:

- Re-stakers: Can earn rewards by helping to operate and protect various networks and services built on Ethereum, such as data availability layers, decentralized sequencers, and bridges.

- Active verification service provider: Includes third parties such as consensus protocols, data availability layers, virtual machines, keeper networks, oracle networks, cross-chain bridges, threshold encryption schemes, and trusted execution environments, such as Chainlink.

Risks:

-

Many operators may collude to attack a group of AVS

Idealistically, all operators will transfer their stakes to all AVS, and the cost of corrupting any one AVS on EigenLayer is now proportional to the total stake on EigenLayer. This is the best case scenario in terms of maximizing the cost of corruption. However, in a realistic situation, only a subset of the operators choose to participate in a given AVS, and there exist complex attacks where some operators may collude to steal funds from a set of AVS. In particular, if only a small fraction of stakers participate in multiple service re-stakes, the system may become insecure in terms of the cryptoeconomics.

One solution is to limit the PfC (Potential Financial Cost) of any specific AVS. For example, (1) the bridge can limit the flow of value during the slashing period, (2) the oracle can bound the total value during the transaction, etc. Another solution is that EigenLayer can actively increase the CoC (Cost of Corruption) of corrupt AVS.

-

AVS built on EigenLayer may have unexpected slashing vulnerabilities

This is the risk of honest nodes being slashed. For example, creating an AVS with an unintended slashing vulnerability (e.g., programming error) that is triggered and results in financial loss for honest users. Here, the team proposes defenses: (1) security audits; (2) the ability to veto slashing events.

-

Risk of Eigenlayer’s own smart contract

Use cases:

EigenLayer supports many use cases, including MEV management, Data Availability Layer (DA), decentralized sequencer, light node bridging, and fast mode bridging.

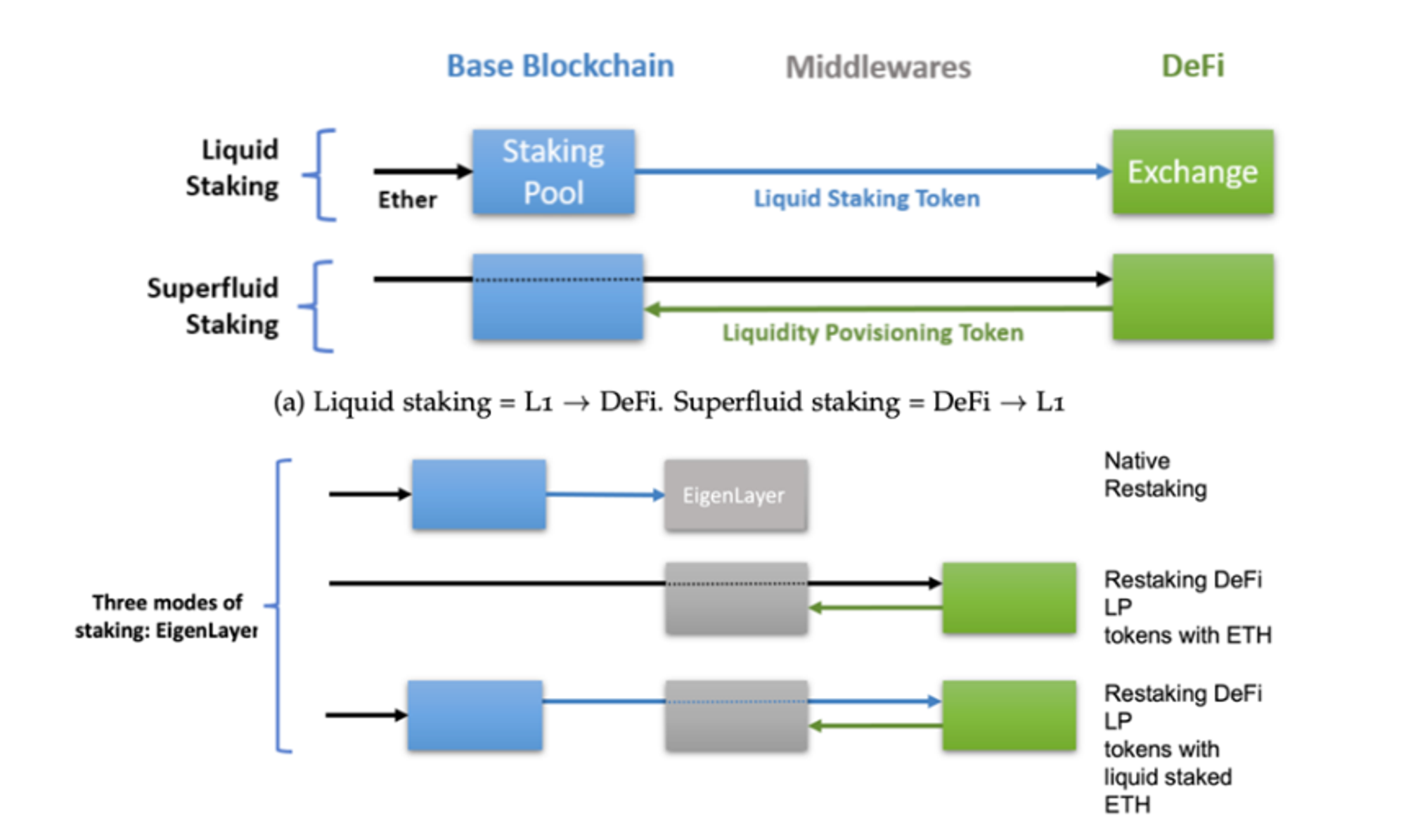

Staking options provided by the testnet:

Liquidity restaking: Liquidity staking is a service that allows users to deposit their ETH into a staking pool and receive a liquidity staking token as a reward (offered by services such as Lido and RocketPool). Stakers can then deposit these liquidity staking tokens into EigenLayer. There are various options here, such as ETH LP restaking.

Native restaking: This option is suitable for independent stakers/family stakers who want to restake the same staked ETH. When they stake within the Ethereum protocol, they need to specify a withdrawal credential, which is the account authorized to withdraw the stake. To participate in EigenLayer, you need to assign this credential to the EigenLayer smart contract. (L1 → EigenLayer)

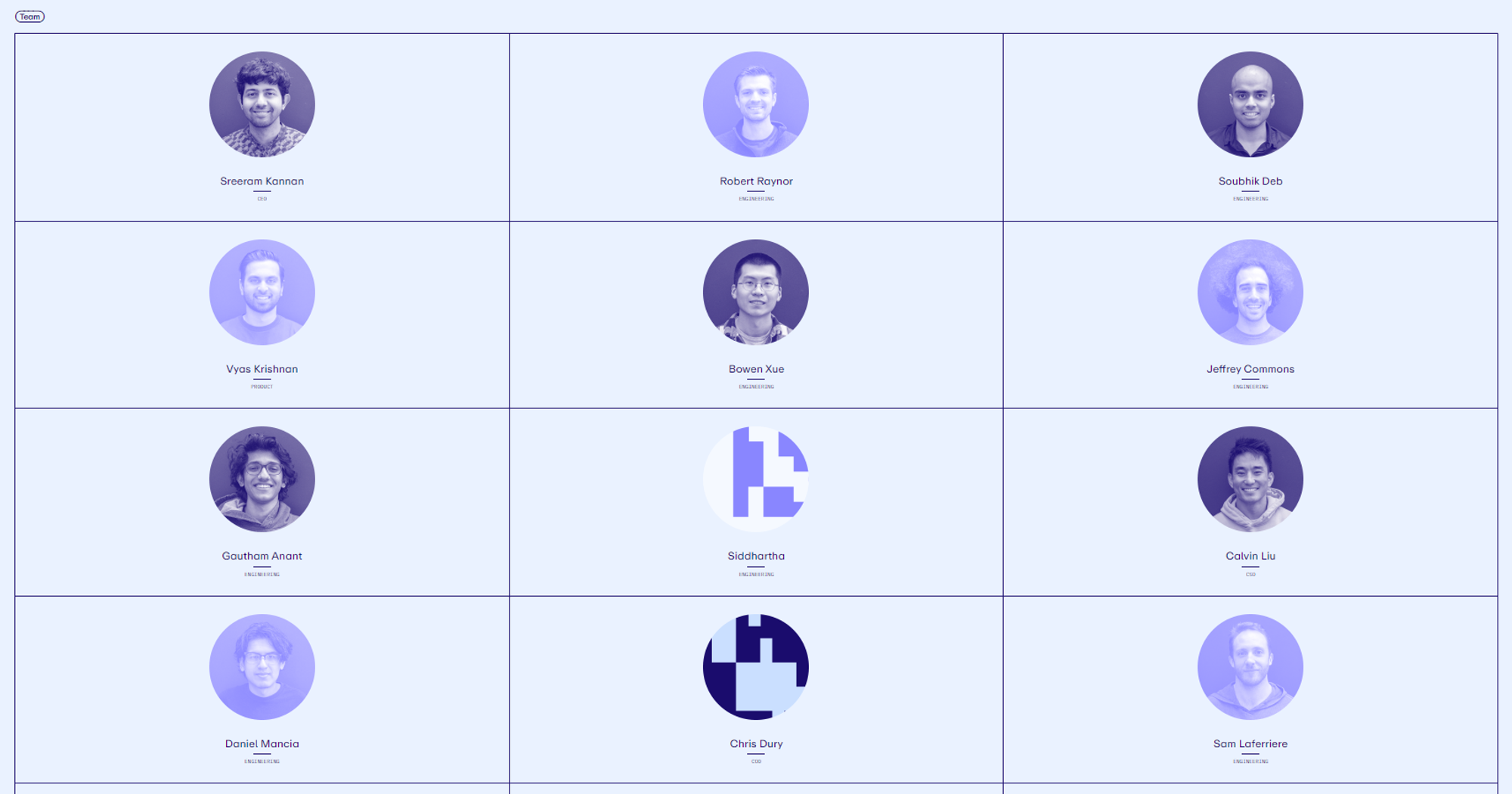

Team:

The team is mainly located in Seattle, Washington. Founder Sreeram Kannan is a professor at the University of Washington and is also in charge of the University of Washington Blockchain Lab. The first batch of members of the team come from the lab.

Financing:

- A total of two rounds of financing, raising a total of 64.5 million US dollars.

- The seed round was announced in August 2022, raising $14.5 million in seed round financing led by Polychain and EtherealVC, with participation from Figment Capital, DaoFive, RobotVentures, P2Pvalidator, and others.

- The A round of financing was announced in March 2023, raising $50 million in financing led by BlockchainCap, with participation from ElectricCapital, PolychainCap, Hack_VC, FinalityCap, cbventures, and others.

Project Progress:

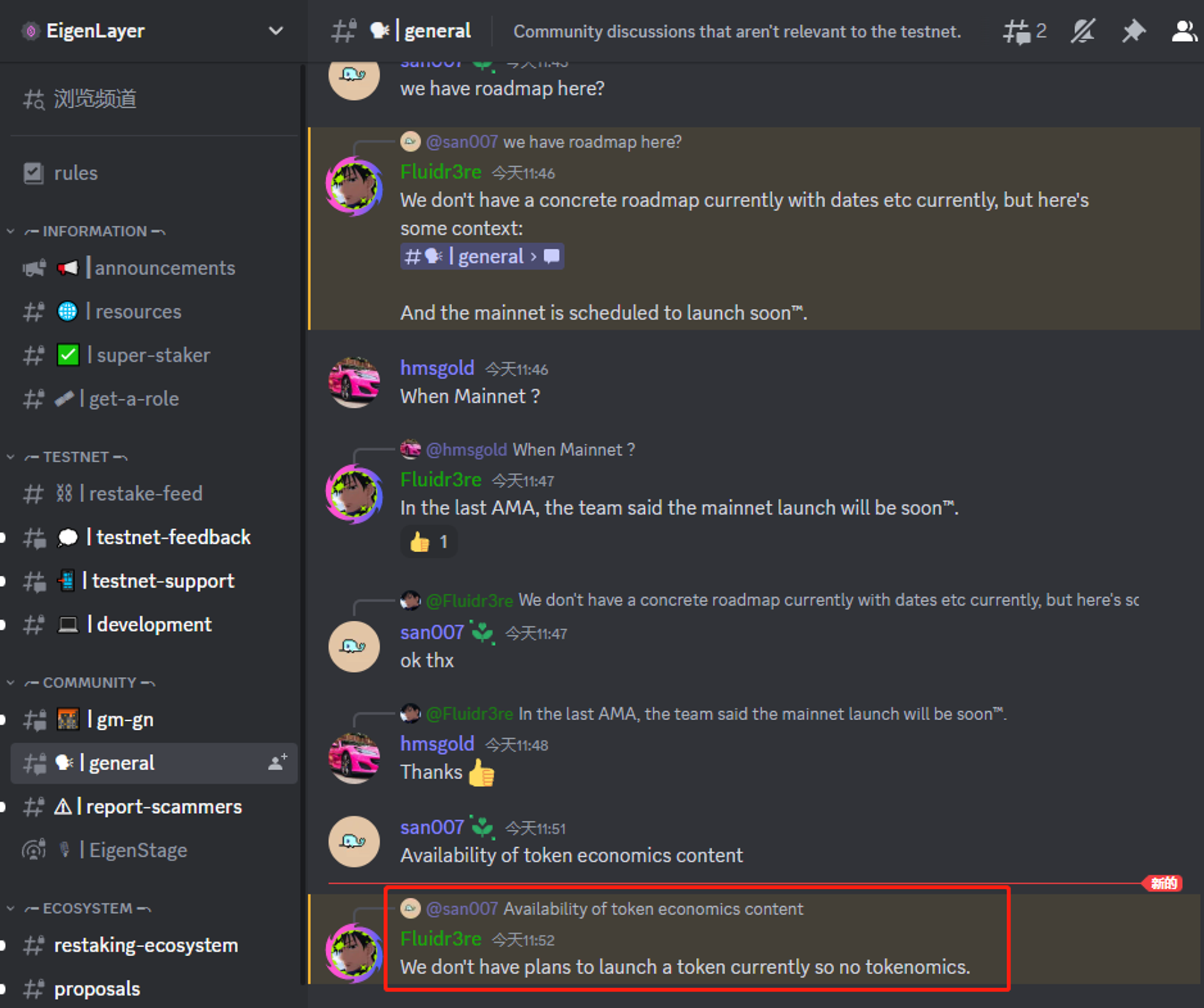

Currently, the project is in the first stage of the testnet and announced the launch of the first stage of the testnet on April 6, 2023. (The article says it is a non-incentive testnet, judge for yourself)

The protocol will be launched in three stages: pledging, operating, and servicing. The first stage is currently for pledgers. Pledgers can participate in liquidity re-pledging and local re-pledging. Pledgers will later be able to delegate their re-pledging to operators without having to verify it themselves, similar to delegating votes.

According to the latest community AMA meeting, the mainnet will be launched soon. According to a reply from a Discord mod, there is currently no token plan, so there is no token economics. (As a re-pledging protocol, with funding in the tens of millions, there are few projects that can capture value solely through the protocol itself.)

Summary:

With the increase in Ethereum’s staking rate, the demand for re-pledging protocols is gradually increasing. The new re-pledging solution proposed by Eigenlayer is very promising in terms of vision, providing multiple benefits for re-pledgers and releasing higher security and cost savings for protocol innovators. From the current testnet stage, only a part of the pledgers can operate.

The first project on Eigenlayer will also be EigenDA, a super-large data availability layer built by the team itself. Espresso Systems is developing Espresso Sequencer, and they plan to re-pledge using EigenLayer. Mantle plans to use EigenLayer’s data availability (DA) layer, and these innovators deploying on Eigenlayer will need to pay validator service fees and enjoy security that is also affected by the number of participating verifying nodes. Therefore, it is difficult to say whether more protocol innovators or middleware can be attracted in the future. In any case, stay tuned for further updates.

Relevant Links

Official website: https://www.eigenlayer.xyz/

Twitter: https://twitter.com/eigenlayer

Discord: https://discord.gg/eigenlayer

Documentation: https://docs.eigenlayer.xyz/overview/readme

Forum: https://forum.eigenlayer.xyz/

Testnet tutorial: https://docs.eigenlayer.xyz/guides/get-testnet-tokens

Related Articles:

Reshaping and Extending the Ethereum Ecosystem: The Principles, Challenges and Use Cases of EigenLayer

FinalityCap Research Report

Whitepaper: chrome-extension://bocbaocobfecmglnmeaeppambideimao/pdf/viewer.html?file=https%3A%2F% 2F2039955362-files.gitbook.io %2F~%2Ffiles%2Fv0%2Fb% 2Fgitbook-x-prod.appspot.com %2Fo%2Fspaces%252FPy2Kmkwju3mPSo9jrKKt%252Fuploads%252F2dCfPgItRfQbX25KriQv%252Fwhitepaper.pdf%3Falt%3Dmedia%26token%3Dd4d94480-3f01-4e63-bc92-a0658ea37aab

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Future Development History of NFT Derivatives: From Commodity Speculation to Financial Speculation, Gradually Abstracted Asset Symbols

- Why did Ethereum have two brief outages in a row? An analysis of the causes of the incident.

- After the explosion, searching for the past of BRC-20

- Facebook’s issue of stable currency is likely to fail

- Vitalik: Radical Market, ZK, Privacy and more

- Interview with She Knows|Exclusive dialogue network project TOP Network, Fetch.AI, IEO will continue to fire?

- Interview with She Knows | Dialogue with IEO Exchange: Really Disguised ICO? Is it going to be a chicken feather? Faced with compliance risks?