Bitcoin prices have broken through 10,000, according to the ratio model analysis will rise to 60,000 US dollars in 2020

On June 22, according to the number of large-scale global stations, the weighted average price of Bitcoin exceeded 10,000 US dollars, reaching a maximum of 10,900 US dollars. The price of Bitcoin against the US dollar on the virtual currency exchanges such as Kanan and OKex exceeded US$10,000. . Bitcoin's cumulative price increase this week has reached 20%.

Bitcoin has become one of the fastest growing virtual assets in terms of market value over the past few years. Since the beginning of 2019, this digital currency has caused almost a price war. Analysts in the field of encryption have said that due to increased integration, Bitcoin may be heading for another big bull market, which will lead to bitcoin prices reaching 2017 levels.

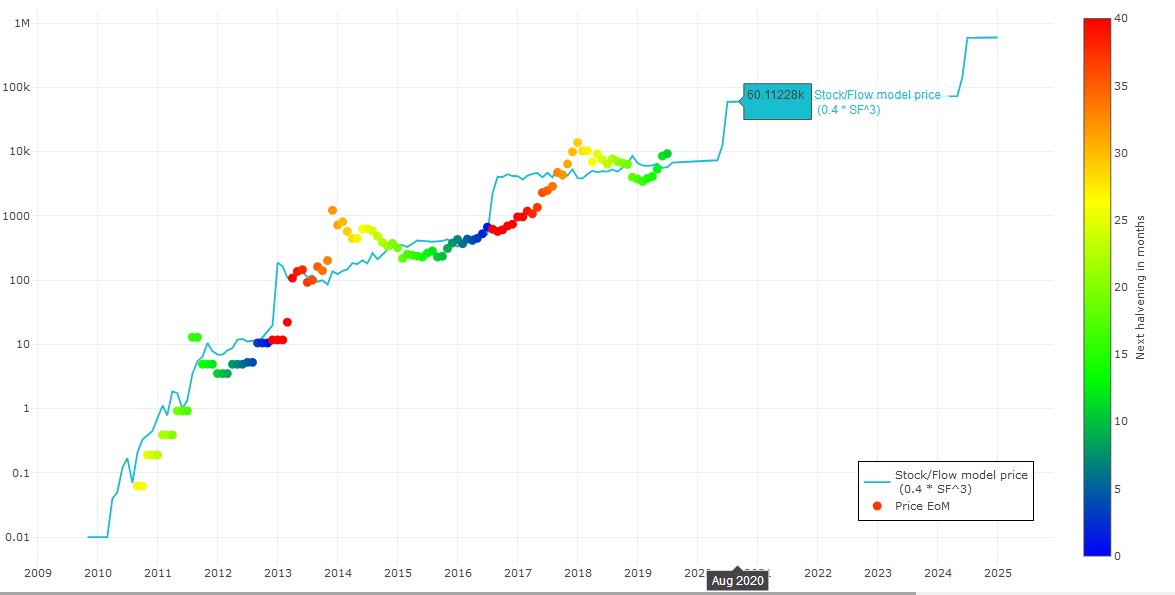

A key indicator that has been tracking bitcoin prices fairly accurately over the years has been the Stock-to-Flow (S2F) ratio model. Now, according to the recent chart analysis, it is estimated that the price of bitcoin will be around $60,000 by August 2020.

- How to successfully reach the hot spot of libra and create an atmosphere that I know very well

- Morning comment: The outbreak continues to BTC rises over 10,000 US dollars to lead the mainstream currency

- Bitcoin stood on 10,000 US dollars, gold, crude oil rose, the dollar fell

In 2020, bitcoin prices will cost $60,000.

An inventory flow ratio model for a commodity is basically the number of assets that are available or held in reserve, divided by the amount produced each year.

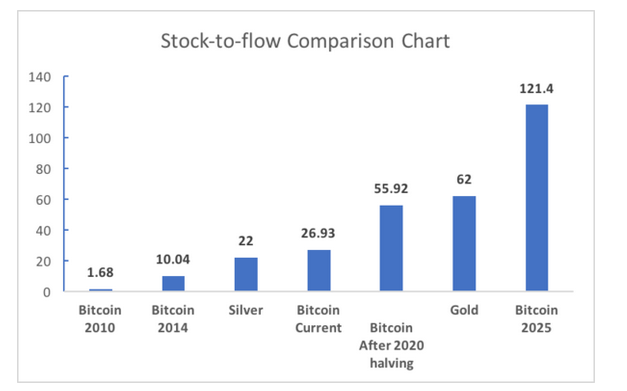

The Stock-to-Flow (S2F) ratio model is an important indicator because the higher indicator value in S2F reflects the annual reduction in inflation in the asset. Gold has one of the highest inventory flow ratios, making it the first choice for global investors due to its scarcity value.

Similarly, Bitcoin is also one of the assets with very high stock circulation rates in recent months because of its “issued size relative to current supply”. Recently, there have been reports that the market driver of Bitcoin may be the Stock-to-Flow index. At present, Bitcoin, a digital asset, is approaching gold after surpassing commodities such as silver, palladium and platinum.

Bitcoin prices are expected to rise by half in August 2020, and this expectation will also be realized in May 2020. This halving will inadvertently reduce the amount of Bitcoin, and for each additional bitcoin, the value of Bitcoin will double, which will push up the price of Bitcoin.

As can be seen from the figure, the predicted S2F index is 55.92 after halving, which will make the intrinsic value of Bitcoin very close to gold.

Recently, well-known analyst PlanB also predicted that Bitcoin could break through the market value of $1 trillion in 2028, based on the Stock-to-Flow ratio model.

Is this true?

According to CryptoGlobe, the number of active addresses on the Bitcoin blockchain exceeds one million. Shortly after the daily activity reached the 1 million milestone, the price of Bitcoin began to rise, rising from $8,450 to $9,300. Set a new high this year.

So, bitcoin prices will rise to $60,000 by 2020, is this true? Nei Shenjun believes that this is a high probability event.

The constant influx of large funds is the cause of the rise in bitcoin prices. At the end of May, Bitcoin analyst Rhythm issued a document saying that the US digital asset management company's grayscale purchased more than 11,000 BTCs in April 2019. According to the monthly mining of 54,000 BTCs, the number of BTCs purchased in grayscale accounted for BTC globally. About 21% of the monthly supply.

In addition, Bakkt, the cryptocurrency platform of the New York Stock Exchange, will be officially opened. The days of Fidelity’s plan to launch bitcoin transactions are getting closer. These large-scale institutions with strict compliance, official and strong background also promote traditional investors. Learn about cryptocurrencies.

In addition, the most critical expectation of Bitcoin's growth is that on May 21, 2020, Bitcoin production was halved for the third time.

Since the Bitcoin Creation Zone was dug up on January 3, 2009, 50 bets have been awarded as rewards, and two rewards have been halved. For the first time on November 28, 2012, the reward for digging out a block every 10 minutes was reduced from 50 bitcoins to 25 bitcoins; the second time on July 10, 2016, a block was dug up. The reward is reduced from 25 bitcoins to 12.5 bitcoins.

Every four years, Bitcoin block rewards will be halved, and each block halving will reduce the speed at which miners can dig bitcoins. Although there are many reasons for the rise in bitcoin prices, looking back, halving block rewards is often the main reason for the rise in bitcoin prices.

In 2012, the price of Bitcoin's first block reward was halved: $2.55, and the price of Bitcoin's first block reward was halved: $1,037; the increase was 405 times.

Bitcoin’s second block reward halved in July 2016, and in the following year, bitcoin prices soared nearly 10 times, from $268 to $2,525;

Bitcoin is halved every four years, and the next halving will be in 2020, with rewards ranging from 12.5 bitcoins to 6.25. If estimated by a tenfold increase, the price of Bitcoin is conservatively estimated at $90,000 (the price of bitcoin today is $9,145).

Guo Hongcaibao, who once operated Bitcoin's largest mine, gave a forecast of $1 million. John McAfee billionaires give a prediction that Bitcoin will rise to $1 million by 2020.

In any case, for the halving of bitcoin production in 2020, all parties have given a pre-judgment of the rise. Just because the price is high or low, the impact will be positive.

Not only that, the traditional international technology finance giants such as Facebook, JP Morgan Chase, Chicago Mercantile Exchange Bitcoin Futures, Intercontinental Exchange, UBS and so on have entered the encryption field, which will further push up the price of Bitcoin.

Facebook's cryptocurrency will be managed by the Libra Association, which consists of Visa, Mastercard and PayPal, Coinbase, Ebay, Mercado Pago (MercadoLibre), Women's World Bank, Uber, Vodafone, Illiad, Composition of companies such as Booking Holdings. Among them are blockchain companies, e-commerce companies, payment companies, travel companies, telecommunications companies, investment companies, and non-profit organizations. This luxury lineup has entered the blockchain field and is unmatched by existing blockchain projects.

Previously, The Wall Street Journal reported on the joint currency program of 14 international banks represented by UBS Group AG. The 14 international banks and financial institutions are: UBS, Barclays, Nasdaq, Credit Suisse, New York Mellon Bank, Canadian Imperial Bank, State Street Bank, German Commercial Bank, Santander Bank, Dutch International Bank, Belgian Union Bank, Lloyd Bank, Mitsubishi UFJ Bank and Sumitomo Mitsui Banking Corporation.

Fourteen large banks and financial institutions from the United States, Europe, and Japan invested a total of 50 million pounds (about $63.2 million) to form a joint venture called Fnality International. Fnality will manage their upcoming cryptocurrency USC (Utility Settlement Coin). The launch of USC indicates that the banking industry has entered a new phase in the use of blockchain technology.

Under the leadership of these “grey whales”, it is believed that more and more traditional companies are entering the field of encryption. At that time, it was the real spring of Bitcoin.

After bitcoin broke through $10,000, the resistance was $1,1500, $14,200 and $17,000. In particular, the last highest resistance level was 20,000 US dollars (December 2017). Once it breaks through, it will bring a new wave of FOMO (fear of missing psychology), and Bitcoin is expected to break through the historical high.

So, by 2020, how high will you see the price of Bitcoin? Welcome to leave a message below.

文 | 内参君

Special statement: ICO projects in the blockchain industry are mixed, and the investment risk is extremely high; all kinds of digital currencies are difficult to distinguish, and users need to be cautiously invested. "Intra-chain participation" is only responsible for sharing information, does not constitute any investment advice, and all investment behaviors of users are not related to this site.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin broke through $10,000 again after more than a year, and halving will probably continue to rise.

- Wallet TokenStore thunder, how to identify the funds to avoid risk?

- BTC monthly report 丨 BTC has the highest volatility relative to other assets, and derivative trading activity continues to increase

- Industry blockchain weekly news 6.15-6.21 | Thunder Group and Hong Kong University of Science and Technology jointly established blockchain laboratory

- Bitcoin is approaching $10,000: the rich will enter the market and the FOMO moment is coming soon?

- AI+ blockchain, Jarvis+ allows each community to have a personal assistant

- Bitcoin or going to the US to go public, is this the signal that the "bull market" drama kicked off?