ETH skyrockets A discussion on the future trends of the inscription pathway

ETH surge Future trends in inscription pathwayAuthor: AL.D

Today’s article is mainly about some of my personal thoughts on the future of the inscription track.

In the current inscription market, I am particularly concerned about a few things.

-

The phenomenon of “imaginary enemies” generated by different community members, brc20 and eths

-

The attitude and actions of the B side (here referring to centralized platforms) towards eths and brc20

Regarding the phenomenon of “imaginary enemies”

With the recent popularity of eths, when collecting fragmented information on Twitter, you can always see some content that establishes an antagonistic relationship between “eths” and “ordi”. Slightly, there is disdain for brc20, and more seriously, there is a desire for a life-and-death struggle between the two; more objective is to compare the various disadvantages of ordi with the various advantages of eths.

In my humble opinion, we are all from the same root, why rush to kill each other.

I have mentioned before that when investing in a project, we need to analyze it from an objective perspective in multiple ways, which is a responsible approach to our own funds. Any one-sided subjective judgment will put funds at the risk of permanent loss.

When writing an article, I also thought about the comparison between ordi and eths. Here, I will share my thinking logic at that time.

“Funds Activity”

At this moment, the trend of cryptocurrencies depends on the face of BTC, but at this stage, it is the main battlefield of eth.

Whether it’s base or l2, it is undeniable that a large amount of retail funds are actively gathering on eth.

In terms of the activity of funds, eths currently has the advantage over brc20, while in the bear market phase, smart whales tend to seek stability, not to mention any new projects. Buying ETH is a disrespect to BTC (not representing everyone).

But this is only one of many factors. If this factor alone can determine the outcome, then I think BTC has long been surpassed by ETH.

“Technological Genes”

The underlying technical issues of BTC and ETH have determined the different development trends of the two. It’s like the distinction between science and humanities students, each with its advantages but not competitive.

eths, as a rising star, has almost fully utilized the technical advantages of eth. Therefore, it can quickly implement the technology in a short period of time.

This is the advantage of timing.

“Community Atmosphere”

ETHS community is one of the high-quality communities I have seen so far. It is obvious that many OGs of brc20 are participating in it. Everyone learns from past experiences and makes reasonable use of all network resources. Even the founder has become a barbecue uncle in Zibo, without any lying down, forced to work. This is harmony among people.

Through the above thinking, I deduced the development trend of ETH in the previous article. It can only be said that at the current stage, the narrative value of BTC is much less compared to ETH.

However, even so, Brc20 is not without its merits. As the only new narrative value, Brc20 faces long-term technical development issues. The longer the time, the more amazing it will be;

On the other hand, as ordi continues to decline, there are many factors, but in my eyes, it is a healthy path, just not the right timing. If ordi goes to zero, will ETH not be affected?

Rationally consider the differences between the two, allow humanities students to be unable to solve math problems, and allow science students to not understand classical Chinese. This is a kind of respect for the essence of things.

Therefore, at this moment, and even in the next period of time, the ETH ecosystem will have a technical advantage, but objective consideration is about time and space.

Who knows whether ETH or BTC will be the leader in the next bull market? What if BTC has a big dive at this moment?

“Reaction of the B-side community”

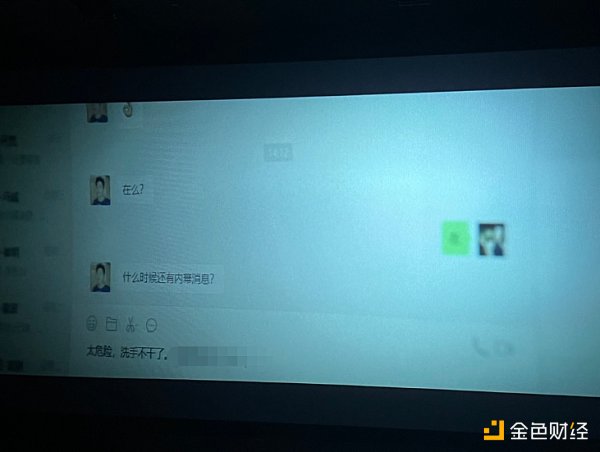

As mentioned in the previous article, when a project goes online, the role of unscrupulous bosses naturally appears. This is a rule.

In the current environment, eths, this newborn baby, unlike Brc20, does not have a powerful order maintainer to give protection; there has not been a figure who can shoulder the industry norms.

But fortunately, users remember the pain and will avoid some upcoming risks through lessons learned.

The difference in the number of active users between eths and BTC is huge. These flows are enough for an emerging exchange to seize the opportunity and become a top player. As for who will become the industry standard setter this time, let’s wait and see.

Future Perspectives

What eths faces next is how to expand its influence through centralized exchanges. Regardless of the outcome, based on the current popularity and size of eths, it cannot hide the fact of its strong development potential.

The split of eths at this moment will be a great opportunity to expand its influence. With the operation of centralized exchanges, the probability of being on par with Brc20 is very high. Perhaps in the current stage where ETH is king, it is also very likely for eths to surpass ordi. After all, inscriptions do not represent BTC and ETH, it is a prediction of the development of ordi and eths under the timing, geographical advantage, and human factors.

However, Brc20 is not standing still. The wave of token plays has witnessed too many drawbacks, but it has provided good reference data and thinking for the creation of excellent products in the future. (As well as ETHS)

Official actions of ordinals have begun to move towards new attempts. Whether it will become the new narrative of Brc20 is worth our continuous attention.

The seemingly detailed adjustments by the magic official are also constantly conveying the intention of deep polishing the product, optimizing user interaction experience, and perhaps preparing for the future.

MABC, the dark horse recently released by the official, as the first NFT with an open graphic design in BRC20, with its high-quality and exquisite official website design and innovative Film-fi gameplay, can it become the next BAYC?

Although I didn’t understand what technology damo’s latest tweet was talking about, the project team is doing something!

Compared to traditional industries, it takes many years to generate returns from investing in a project. The cryptocurrency world can really be considered a paradise.

(What? You want to double or increase tenfold in two days? Look at the chart)

Looking at the entire inscription track, under the fading enthusiasm, many people are still moving forward with heavy burdens.

Therefore, my friends, let go of your biases and imaginary enemies, there is no right or wrong in the financial market. Rationally evaluate each project at different stages of development.

It is not a game between market makers, and there is no need to fight to the death for personal interests (the funds between us do not constitute that scale, why risk everything for a 2000u matter, harmony brings wealth?).

Whether it is BRC20 or ETHS, both have their own development space and direction in the future. The interaction between the two founders on Twitter is also a form of information transmission. The two complement each other, and the inscription track can only become a huge reservoir of funds in the future.

Whether you are a b or an e, the inscription flourishes, and both b&e have responsibilities.

The above content is my personal opinion and does not constitute any investment advice.

Please analyze and judge the investment based on multidimensional data and trends, and be responsible for your own wallet.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Rebound equals sell-off? What happened to Bitcoin?

- Opinion Bitcoin ETF may push Bitcoin to new historical highs.

- Grayscale Trends are Your Friends – Managing Bitcoin Volatility with Momentum Signals

- Will MicroStrategy stop buying Bitcoin?

- Crypto is building a rule-based order and gradually allowing Old Money and retail investors to enter the market.

- Crypto+AI The Cryptocurrency Narrative of the Next Bull Market

- After Ordinals, how does the Ethereum Inscriptions protocol Ethscriptions reshape the form of NFT assets?