Opinion Bitcoin ETF may push Bitcoin to new historical highs.

Bitcoin ETF could boost Bitcoin to all-time highs.Source: beincrypto Translation: Shanooba, LianGuai

Summary

-

The stability of Bitcoin and the upcoming ETF decisions, especially the filing of ARK 21Shares, could be catalysts for an unprecedented high in Bitcoin price.

-

Market experts emphasize the increasing acceptance and potential of Bitcoin, with major companies like BlackRock seeking ETF approval, indicating this.

-

Bitcoin remains tightly consolidated around the $29,000 mark, but the upcoming decisions could disrupt the current calmness.

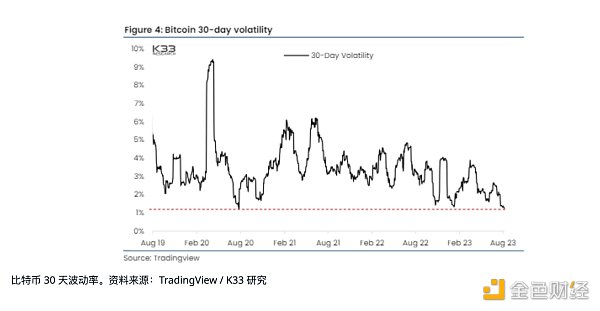

While Bitcoin (BTC) continues to hover around the $29,000 mark, the market is keenly watching for the highly anticipated catalyst, the exchange-traded fund (ETF), which could push it to unprecedented highs. With the 30-day volatility dropping to a new low and trading volume seemingly interrupted, the catalyst we have been waiting for is likely to be imminent.

Bitcoin’s sustained performance has created a stable surface, leading to a decrease in the implied volatility index of options. Meanwhile, the stable market has stimulated the upward trend of perpetual open interest contracts. In this context, leverage has been increasing, indicating that volatility may surge.

Bitcoin Catalyst

ARK Invest CEO Catherine Wood said, “I think if the SEC approves a Bitcoin ETF, it will approve multiple Bitcoin ETFs at the same time.” This seems to be imminent with the upcoming ETF decisions.

The U.S. Securities and Exchange Commission (SEC) is about to make a decision on the ETF application of ARK 21Shares. Previous events have shown the significant impact of ETF momentum on the market, especially during the rebound in June after BlackRock submitted its ETF application.

Currently, theories about whether the SEC will approve, reject, or merely delay its decision are all mere speculation. ARK’s application is likely to affect market volatility. However, current indicators suggest a delay, as the SEC’s focus remains divided and its attention is also focused on the Grayscale lawsuit.

Historically, the SEC tends to utilize the entire span of its 240-day decision window. The ruling expected from ARK 21Shares is anticipated to be released between August 11th and August 13th, and market activity and volatility may experience a significant increase.

Furthermore, ARK is not the only player in this game. There will be more deadlines for future ETFs, with Bitwise’s decision expected on September 1st, followed by another decision on September 2nd. The market is already in a highly anticipated state and may see an increase in trading volume and price fluctuations due to these upcoming rulings.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Crypto+AI The Cryptocurrency Narrative of the Next Bull Market

- After Ordinals, how does the Ethereum Inscriptions protocol Ethscriptions reshape the form of NFT assets?

- Bitcoin’s ‘buyer-to-seller ratio’ soars, indicating renewed bullish sentiment.

- Bitmain’s Market Director Lin Han PoW Ecological Construction, Preparing for the Next Bull Market

- IMF Working Paper How to Tax Cryptocurrencies?

- LD Capital Cryptocurrency exchanges are frequently deploying Layer2 solutions, carrying ambitious visions for the future market.

- Bankless Cryptocurrencies are entering the final cycle