Will Wall Street scare away crypto punks after showing interest in Bitcoin?

Will Wall Street deter crypto punks after Bitcoin piques their interest?Author: Mat Di Salvo, Decrypt Translation: hiiro, SevenUp DAO

Institutional investors are more interested in the crypto world than ever before, and now they are putting their money into it. However, some people are wondering if Bitcoin will lose its reason for existence because of this.

BlackRock, the world’s largest asset management company, couldn’t be more mainstream. This Wall Street firm, which manages $9 trillion in assets, is the epitome of “institutional.”

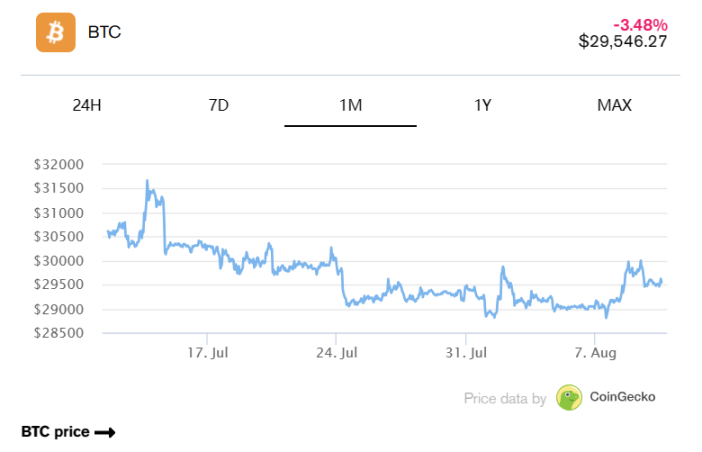

However, last month it submitted an application to the SEC for a spot Bitcoin exchange-traded fund (ETF), pushing the price of this largest cryptocurrency to its highest level in a year. Its billionaire CEO, Larry Fink, subsequently praised cryptocurrencies as “digital gold.”

- LianGuai Morning News | Bitcoin futures open interest reaches highest level since 2023

- The Bitcoin greed and fear index of Matrixport indicates that BTC will rise in the future.

- Rebound equals sell-off? What happened to Bitcoin?

Bitcoin was originally a counter-establishment initiative. Favored by crypto punks skeptical of governments, it was initially criticized by every major institution, including the European Central Bank and JPMorgan. Cryptocurrencies seemed ready to free finance from centralized shackles.

“Bitcoin was created because there were major problems with the traditional system, and making Bitcoin look like it goes against the purpose of Bitcoin,” said Rafe, a long-time contributor to the Bitcoin privacy wallet Wasabi, in an interview with Decrypt. He added that the different priorities between cypherpunks and regulated institutions “were to be expected.”

Cypherpunks typically advocate for privacy rights, hope for social change, and see Bitcoin as a tool to bypass oppressive government surveillance. Institutional investors focus on making money—Bitcoin is something they can put part of their large funds into to achieve returns.

Privacy-conscious Bitcoin users interviewed by Decrypt expressed concerns that institutional interests could ultimately lead to government restrictions, penalties, or taxation on cryptocurrency users.

Major cryptocurrency exchanges such as Coinbase and Binance have already implemented Know Your Customer (KYC) measures and widely restrict access to their platforms based on political boundaries. Legislators are also increasingly concerned with Anti-Money Laundering (AML) procedures. But the emergence of such compliance measures in the crypto space has drawn criticism from long-time privacy advocates.

Rafe suggests that “overnight wealth and the push for mainstream adoption at all costs” could force crypto users to comply with “authoritarian rules.”

He added that the combination of strict KYC rules and a lack of emphasis on privacy, given that every transaction is publicly recorded on the blockchain, could create “the largest global financial surveillance system in history.”

Harry Halpin, CEO and co-founder of Nym Technologies, said, “The fundamental innovation of cryptocurrencies comes from the philosophy of crypto-anarchism, and if you abandon that spirit, innovation in the crypto space will die.”

However, Bitcoin users continue to seek privacy solutions for Bitcoin, as the asset is fundamentally not private. Rafe told Decrypt that having a private wallet can prevent intrusion by big governments and institutions.

Some say that Wall Street is getting closer to cryptocurrency, whether people like it or not. David Schwed, COO of blockchain security company Halborn, previously told Decrypt that the anti-establishment figures in the crypto space who dislike intermediaries will eventually turn to privacy coins.

For others, the problem lies not with Wall Street, but with Silicon Valley, as they make things more centralized. Christoph Ono, a Bitcoin design contributor, said, “Meta once again proved last week, when looking at their privacy statement in the App Store for Threads, that they are ruthless in collecting all sorts of personal data.”

Meta’s new social media platform Threads was launched this month as a competitor to Twitter. It allows Instagram users to share text updates, but it is more aggressive in collecting data, especially location-related information, even when location sharing is disabled on the device, compared to Meta’s other apps.

Deleting a Threads account is also not possible unless the Instagram account is deleted at the same time.

Ono added, “Data is too tempting for the tech industry,” and there is “no way around well-established privacy tools that cannot be breached.”

So what are the solutions today? While Rafe’s work Wasabi may be too complicated for the average Bitcoin user, Karo Zagorus, who used to work for zkSNACKs, the company behind Wasabi, told Decrypt that self-custody is sufficient.

Self-custody of Bitcoin or cryptocurrencies refers to users having full control over their private keys, such as using a hardware wallet. However, hosted wallets are more popular as investors do not have to worry about seed phrases and keys. Instead, their cryptocurrencies are entrusted to third parties, such as exchanges.

“As long as individuals hold Bitcoin in a non-custodial manner, we don’t have to worry about alternative Bitcoin products on Wall Street, such as ETFs,” he said, adding that the problem only occurs when “institutions” start manipulating the ledger and inflating the supply, which can be checked through on-chain audits.

Scott Norris, co-founder of independent Bitcoin miner LSJ Ops, added that KYC is becoming an increasingly important issue for regulators, so those who want to protect the privacy of their holdings may soon have few options.

Craig Raw, developer of the Bitcoin Sparrow Wallet, said, “For mandatory KYC on an permissionless network, it would require centralized control over all our computing devices, which would ultimately be difficult to achieve.”

However, despite the differences among Bitcoin users, one shared belief is that Wall Street’s entry into this field is inevitable.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion Bitcoin ETF may push Bitcoin to new historical highs.

- Grayscale Trends are Your Friends – Managing Bitcoin Volatility with Momentum Signals

- Will MicroStrategy stop buying Bitcoin?

- Crypto is building a rule-based order and gradually allowing Old Money and retail investors to enter the market.

- Crypto+AI The Cryptocurrency Narrative of the Next Bull Market

- After Ordinals, how does the Ethereum Inscriptions protocol Ethscriptions reshape the form of NFT assets?

- Bitcoin’s ‘buyer-to-seller ratio’ soars, indicating renewed bullish sentiment.