Bankless Cryptocurrencies are entering the final cycle

Bankless Cryptocurrencies in final cycleAuthor: David Hoffman, Bankless; Translator: LianGuaixiaozou

If you observe carefully, you will find signs indicating that cryptocurrency is entering its final market cycle and will eventually complete its development stage, entering a long-term era of maturity, stability, and growth.

“The next cycle will be the last one” is almost a common saying in the crypto field. I’m not going to make a definite prediction about this. I’m just connecting some dots spread around the crypto field, ultimately pointing to a new stage for crypto after the bear market ends.

1. Regulation and institutional approval

- Bankless Co-founder The crypto market has entered the last cycle before maturity

- If room temperature superconducting materials can be realized, will it have a negative impact on the cryptocurrency market?

- Why the crypto community should pay attention to room-temperature superconductivity

Cryptocurrency is going through the largest regulatory battle in history. In fact, this has always been inevitable. As an industry based on currency and finance, we cannot easily enter the mainstream without the recognition of regulatory agencies. In order for the major players to freely navigate in Web3, they need to ensure that their countries actually allow them to do so.

“Becoming mainstream” means that cryptocurrency can withstand regulatory scrutiny.

Don’t be afraid. Cryptocurrency is a winner no matter what. What we need to do is wait for everything to be over. It can only last for so long.

Crypto is an unstoppable force, and nations are not invincible. Gary Gensler will let us register, Elizabeth Warren will stomp her feet, and banks will try to stifle us.

Ethereum will still produce the next block.

History is ultimately defined by technological trends. The blows from regulatory agencies and legislators resisting cryptocurrency will eventually be offset by the power of the free market.

The current phase of cryptocurrency should not be seen as “the nation’s attack on cryptocurrency,” but as “the nation’s oppression of disruptive technology.”

Ripple just made Gary Gensler sit down calmly. Blackrock, Fidelity, and all other major traditional financial players have just sent a signal to the authorities to calm down. Major brands largely ignore financial regulation and continue to explore the path of cryptocurrency.

There will still be lawsuits, bills will be drafted, voted on, rejected, and then voted on again. It will be frustrating and painful. But there will be an end someday. Regulatory agencies will eventually sit down. What we need to do is wait. We have time.

Once regulatory measures are behind us, cautious curiosity about mainstream interest in cryptocurrency will turn into a frenzy of gold rush, because the signal released by regulation is: there is fertile ground. And the path to enter these new areas is clear enough, and the risks are acceptable.

2. Protocol maturity

At the same time, we can begin to see the dawn of regulation, and we can also see the end of many protocols that this industry relies on.

Many protocols that Web3 needs are evolving into their final forms. We haven’t reached that point yet, but the end is near.

In the Web3 world, we will soon have more available data than we know what to do with.

EIP4844 will commodify access to the most secure block space in the world.

Thanks to zk-rollups, transactions will be instant. Shared ordering blurs the boundaries between chains. All of these technologies are pursuing the same goal: to make blockchain invisible.

When the next bull market arrives, the computational cost of Web3 will reach its theoretical minimum. High gas fees and slow block times will no longer be bottlenecks for decentralized protocol adoption. The responsibility for innovation will shift to application developers, who will be tasked with leveraging the abundant computing resources provided by protocol developers.

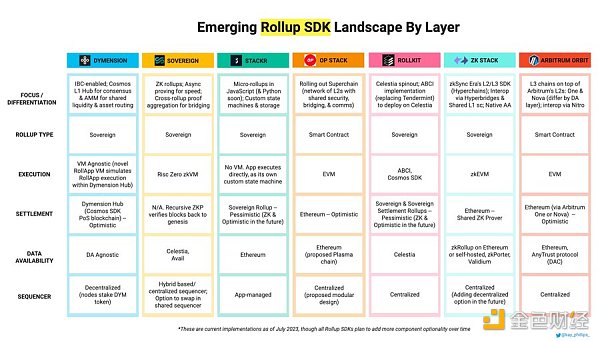

The next bull market will not be constrained by scalability limitations. No one will use “high cost” and “immature protocols” as reasons not to integrate with Web3 systems anymore. Ethereum’s “rollup-centric roadmap” will have enough expressiveness and customizability to easily tailor proprietary chains to fit any curious player’s use case.

This will open the door to a long tail of crypto use cases. When Web3 is slow and expensive, the only viable use cases are currency, finance, and high-value assets. If it costs tens or hundreds of dollars, the supported rational activity will be worth thousands of dollars or more.

When the cost of participating in Web3 is low enough, it becomes reasonable for platforms to subsidize their users. Once users receive subsidies from competing platforms for their transactions, the full range of crypto use cases will be open to everyone.

What else can we do when Web3 becomes freely accessible? What new applications can we develop? What new user groups can we attract?

The answer is: everything, everyone, and every person.

3. Ethereum’s Long Arc

In 2015, Ethereum set out an ambitious roadmap for itself. Over time, the ambition of that roadmap has only grown, much faster than the rate at which its completeness has improved. It turns out that Ethereum’s expectations for itself are much more complex than originally imagined.

Around 2019, something shifted. A significant amount of research and some important engineering breakthroughs opened a new chapter for Ethereum. “Ethereum 2.0” or “Serenity” (now collectively referred to as “Ethereum”) had a clearly defined roadmap, with only testing and code writing left to complete.

From 2019 to 2023, the code was written and released. Ethereum transformed from a single PoW chain to a modular, expressive PoS chain, spawning one network after another.

Promises keep appearing and are also kept.

What is most amazing about the development curve of Ethereum is its commitment to the initial vision set in 2015. Although there have been changes in the implementation details and the path itself is unknown, the original intention of Ethereum has never wavered.

Throughout the entire history of Ethereum, the reverse bets of the development trajectory of Ethereum and the Ethereum developers have never been surpassed. With the release of EIP4844 later this year (I estimate it might be around this time), Ethereum will lock in a perfect commitment record.

The commitment and persistence of Ethereum’s vision to the outside world indicate that the ongoing construction is driven by faith, intention, and purpose. We are not madmen – we have been striving towards the same vision for 8 years.

Prior to this, when the outside world looked at Ethereum, they might have seen a group of confused monkeys jumping around in chaos. But now, when Ethereum finally develops into what the world needs – a decentralized value computation layer Internet – people will see beauty in the chaos: a network of networks.

4. ETH

Accompanying the vibrant development of Ethereum is the narrative curve of ETH. In 2015, Ethereum was a complete garbage coin, and the protocols that ran with it made corresponding progress. From high inflation and arbitrary 5 ETH per block in 2015, ETH has now evolved into a native asset with algorithmic monetary policy. It has real returns, no human intervention, and is in stark contrast to the monetary policy of the US dollar and the drama of the Federal Reserve.

Apart from MEV burn (which further strengthens the currency strength of ETH), the monetary policy of ETH has not been further upgraded.

If there is something that big capital likes, it is the rate of return. The rate of return on ETH is much higher than other tokens. ETH investors receive returns while ETH itself is in deflation. The nominal rate of return for bondholders is positive, but the actual rate of return is negative – “actual” is more important here!

In contrast, it is widely believed globally that the real value of the US dollar and US Treasuries must decline in order to keep the global financial system stable, so the future of Ethereum will naturally unfold.

The evolution of Ethereum towards the throne of ultra-stable currency shows the outside world that the crypto industry has some unique new things. Through cryptography and networks, we can create unprecedented financial assets. No, the narrative curve of crypto assets with strong value propositions will not stop at Bitcoin… we will not be satisfied with “digital gold”. We are exploring new territories, and assets like ETH can integrate well into existing psychological models of asset value while being completely different from all previous assets.

The summary of Ethereum and ETH maturity can be summed up by the growing network effect and success in unknown areas. As society’s attention turns back to cryptocurrencies, people will see a protocol and its assets that have been making consistent progress towards a vision that has never wavered since its inception.

The legitimacy gained by the Ethereum ecosystem will drive it to become a “safe” enough cryptographic asset for people to consider it as a profession and start recommending to “research it” at higher levels.

This opens the door for ETF – a rolling ball.

5. ETF is Coming

The competition for ETFs has already begun. As mentioned in the regulatory section above, all we have to do is wait. The arc of history is defined by technology. Gary can only close the door to crypto ETFs for so long – eventually the forces of the free market will come into play.

It seems like the sooner, the better. Once Bitcoin opens the door to crypto asset ETFs, it will be hard to stop other assets from getting their own ETFs.

We will have BTC ETF, and ETH ETF won’t be far behind. If they coincide with the upcoming bull market, the capital pipeline between cryptocurrencies and the outside world will be the largest in history. By the end of the upcoming cycle, the stock codes B-T-C and E-T-H will be common stocks second only to Apple and Amazon, for all major brokerages around the world.

6. In any case, the cycle is shortening

For years, Bitcoin’s return rate has been suppressed. If you bought Bitcoin like crazy in 2010, congratulations, because the rise in 2011 was the sharpest growth in Bitcoin’s history. Each subsequent cycle has taken more time to achieve lower returns.

That’s obviously the case.

One of the biggest topics in society is that crypto assets are too volatile. However, with each cycle, the volatility of crypto assets is at an all-time low, while the volatility of traditional stock and bond markets is at its highest in over 30 years.

The trading market simply accepts this volatility. The crypto market was born from it, and shaped by it! Now, with the Fed’s hands-on nature, our market is moving towards stability, while the trading market is in turmoil.

With the easing of regulatory pressure and the maturity of network infrastructure making crypto networks attractive for sustainable, non-speculative adoption, much of the volatility in cryptocurrencies can be dampened. After all, the bigger the ship, the less likely it is to rock.

And our crypto ship is ready to scale to any size society needs.

The ark is ready, it’s time to board!

7. Development of Cryptocurrency Civilization

Cryptocurrencies will always exist in the Wild West. Putting the genie back in the bottle is impossible – once you provide society with permissionless finance, the exploration towards the West cannot be stopped. With ERC20, anyone can create meme coins, but thanks to OP Stack, in the next market cycle, anyone can create meme chains.

In the current cycle, we will witness the establishment of Eastern civilization. The security and protection of civilization. The East and the West are in opposition to each other. Those who seek freedom and adventure will go west to escape the authoritarianism and oppression of civilization. But some people desire the security and protection of civilization! The mainstream adopts the need for roads, pipelines, laws, and police. The boundaries of cryptocurrency will move westward, but the subject of cryptocurrency will evolve into a predictable, reliable, and regulatory-approved environment, where less adventurous individuals will feel safe.

Some cryptocurrencies will begin to be considered secure enough, and Web2 standards will feel secure here. Smart contract wallets with account recovery functionality, proven applications, high-traffic L2, Base… these will become the cryptocurrency civilization and a place where less adventurous individuals can still safely participate in the crypto world.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Changtui 7 major predictive indicators suggest that the market may be fully bullish.

- Wu said Zhou’s selection Hong Kong regulatory agency opens retail trading, Curve hacked, Binance US Department of Justice progress and news Top10 (0729-0805)

- Which is more important, encrypted narrative or product construction?

- LianGuai Observation | Understanding the July Cryptocurrency Market in 7 Pictures DeFi Unaffected by Curve Vulnerability

- Infinite ‘Bullets’? Discussing the Hidden Concerns of the Largest BTC Listed Company MSTR

- War against Coinbase MEKE forays into the Binance Smart Chain Layer 2 market.

- The only opportunity to participate in the speculative frenzy in the cryptocurrency circle.