Ethereum is up 5% in the day, and all the outbreaks have already erupted. It is time to take the next step.

[BTC] March 07 Trading Guide

March 03 Trading Guide

Bitcoin, the above picture shares a 4-hour trend chart. First of all, from the perspective of the general trend, the simpler the trend is, the better, the characteristics of the market can not be too big, determine the formation of a trend, and easily turn around. Then it is obvious that Bitcoin has not yet turned around.

- Webster Ratings: Ethereum is the hot spot and it will lead the industry

- Aviation giant Honeywell will use blockchain platform GoDirect Trade to track aviation parts, and Boeing has provided $ 1 billion in parts support

- Crypto merchants in Australia set a monthly record of 74K USD, BCH payment rate reaches 97%

The pressure of the early reminder 2: 8960, the highest counterattack to 6964 at 6 am, the pressure 2 has been tested, which indicates that the market has a long counter-attack strength, and the bulls are more serious, but this does not mean that the market has started to reverse, and it is still after the health correction. Rebound. The key support for the opening of the space below is: 8230 ~ 8530. There is still a trend of up and down movements in the short-term. It may still break through the 8960, but the intensity will not be too much. It is the key to see the rally and not chase the upside. Heaven, the construction of the upper shadow line is perfect, and alert to the risk of a broken waterfall. The spot arrangement is temporarily dependent on whether to give the opportunity to open a position next week, but it is not absolute.

Reference pressure: 8960, 9230

Reference support: 8230 ~ 8530 range 7600 ~ 7210.

March 05 Trading Guide

Counterattack again, but still do not break the key point, around 9200, the market direction continues to choose, the profit position was triggered to track, and has left the market. As for how to do the following real-time order, there is not much involved here. The real-time order is mainly mustard. Grasp the key interval of 9100 ~ 9230, stabilizing and rebounding. Unsettled, where to come from, where to go.

March 07 Trading Guide

Pay attention to the two key points of the top and bottom, which is very instructive to the short-term direction of the market outlook.

Above: Near 9210

Below: Near 8920

Among them, the guidelines around 9210 to the short to medium term mainly depend on whether it has broken upwards and stabilized. 8920 is a short-term effect, mainly concerned with whether to break down and stabilize.

In the general direction, the analysis and development of the 0303 period is still maintained. In theory, without heavy volume, it is approaching the end of the rebound.

[EOS] March 07 Trading Guide

March 01 Trading Guide

The sharp retracement of Yuzucoin in the past round is already a perfect preview. The next trend will focus on the strong pressure of 3.7 ~ 3.95. Without a counterattack for a long time, the expected evolution will be as shown above, breaking 3.0.

Reference short-term pressure: 3.7 ~ 3.95

March 02 Trading Guide

At present, the price has rebounded to 3.61, and it is getting closer to 3.7 ~ 3.95. The upward pressure on the market has gradually strengthened. At the same time, it is paying attention to its hourly chart trend. The market is running in a triangle shock. Using it as a guide, Yuzu is expected to go out of a new low trend. After breaking the triangle downwards, you can appropriately stop the short ambush to ambush the short position and grab the break trend. The pressure range yesterday remained unchanged.

March 05 Trading Guide

The analysis and deduction are still valid, with emphasis on the effective stabilization of 3.7 ~ 3.95.

The spot is temporarily to be broken 3.0 successive batch interval layout.

March 07 Trading Guide

At present, the price is still within the strong pressure range of 3.7 ~ 3.95 given by No. 1. The direction selection is very close. Whether to continue the downward trend in accordance with the past trend or to repeat the trend and follow the trend. Pay more attention to the trend in the next few days. answer.

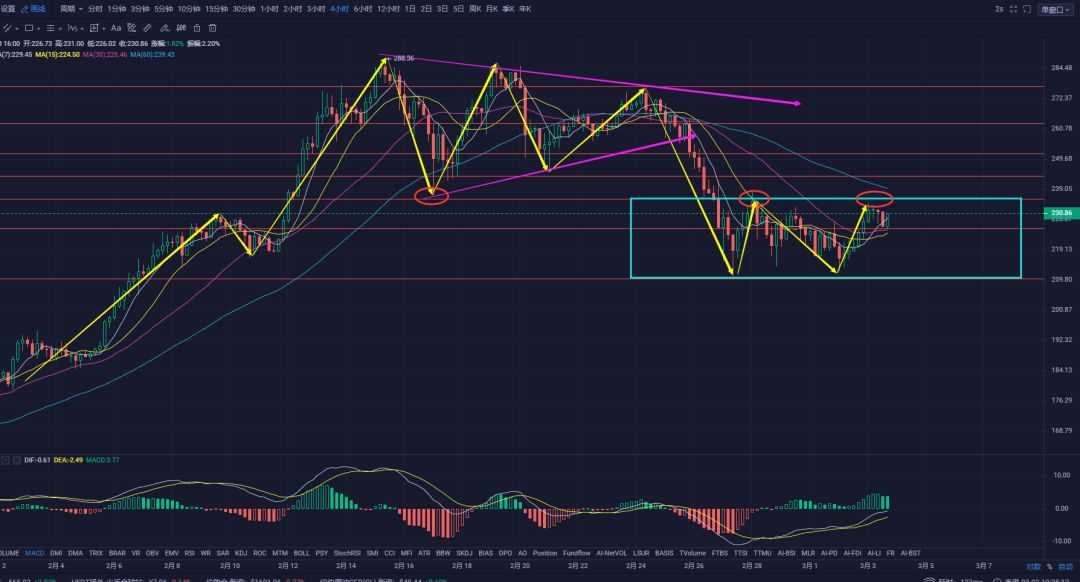

[ETH] March 07 Trading Guide

March 03 Trading Guide

Ethereum's continuous rising structure from the early stage turned into a triangle shock. After breaking the waterfall, it entered the shock trend. The high point of the shock was around 235. The 235 ~ 240 position in the earlier stage as a pressure band is still valid. In the short term, there is still a chance to attack. According to the current analysis in the medium term, there is no effective idea of stabilizing more than 240 and the main idea is to use high altitude.

Reference pressure: 235 ~ 240 unchanged

March 05 Trading Guide

235 was not even in touch, up to 234.11, the shock trend after the callback, the market outlook is relatively stable according to the breakthrough, but mainly short-frequency fast, short-term is to capture the shock, after the profit, the idea of tracking stop loss get on.

March 07 Trading Guide

The highest counterattack price of No. 6 was 241.39, which perfectly entered the range of 235 to 240. Today is the emergence of random trends, that is, based on the analysis, it went out of the small high market the next day. According to the transaction, it is already a feasible point Position range, half of the random market trend, 80% of the opportunity to enter the market, risk control is controlled around the extreme of the random market near 252, small stop loss and big profit are always born in the random market.

[BCH] March 07 Trading Guide

March 07 Trading Guide

In the direction of Bitcoin Cash, this round is still relatively standardized and operates strictly in accordance with the trend. The focus of the picture is the recent trend of shocks. The market is most likely to choose the direction after breaking the small blue box. 352 as the support of the previous trend, the pressure in the current phase. The direction of the market outlook can be roughly understood as the effective breakout, the chance of assault 400, the continued inability to break above 352, and stabilization, then it will be able to break through the position 300, which is expected to reach the lower spot spot range. Therefore, it is still based on the idea of the Buddhist system.

The spot was hanged at 30% in 255 ~ 245, the Buddha department considered.

[LTC] March 07 Trading Guide

March 07 Trading Guide

The identification of trends, sometimes thinking too much, does not have much meaning, which is reflected in Litecoin to the extreme. Once the operation in one direction is formed, it will continue. According to the current trend, the key point of the market is that around 65, as long as the price does not rise and break through 65, it is a bounce short. Once the price crosses the 65 threshold and stabilizes, the market will no longer short.

Spot consideration still starts from below 50.

[XRP] March 07 Trading Guide

Follow-up is tentatively below 0.2, and the idea of batch access is 0.05.

The above points do not have trading conditions, they are only for exchange and sharing. The currency market is risky and trading needs to be cautious.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain weekly news of listed companies: 2 companies start new business, 8 companies disclose new progress of old business

- New crown virus epidemic war, what can the blockchain do?

- The new pattern of staking: exchanges enter the market to explore the boundary, the pledge amount of service providers is not proportional to the income provided

- Eat Reason Rationally | Who is the real winner of the Steem incident?

- Comprehensive comparison of Chainlink, NEST, MakerDao oracles

- Wanxiang Blockchain Public Welfare Hackathon is coming to an end, Station B will broadcast the final road show live throughout

- Viewpoint | Blockchain technology has become a new impetus for the development of "new infrastructure"