Ethereum SAAS Staking One-Week Data Record

Ethereum SAAS Staking 1-Week DataAuthor: darkforest; Source: mirror

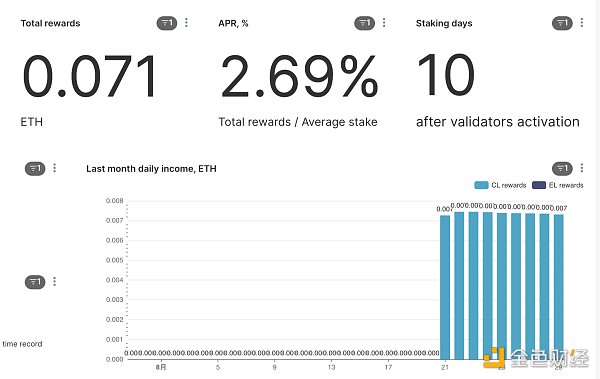

About a month and a half ago, I staked a batch of Ethereum through SAAS. After a long wait of 36 days, it has been online for a week now. Let me show you the specific data, which can be compared with LSD to give you a clearer understanding of Ethereum’s POS staking.

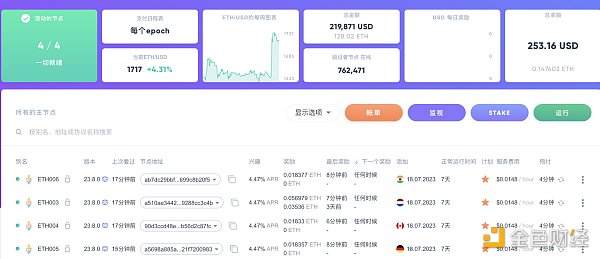

I personally diversified the risk by staking through two different staking service providers, P2Pvalidator and Allnodes. Based on the operation of the nodes this week, there is basically no significant difference in using either operator.

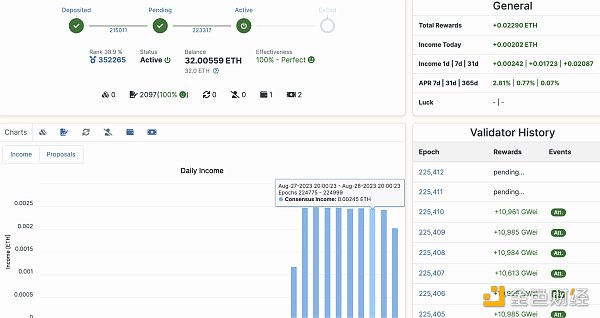

Each staking service provider has its own staking monitoring dashboard, but personally, I think the best one is the third-party beaconcha.in. It provides more detailed data and more intuitive statistical charts.

- DeFi Regulatory Woes Uniswap in Heaven, Tornado Cash in Hell

- MEKE public beta countdown ends, focusing on derivative trading in the DeFi sector.

- Hubei Court rules that the virtual currency mining contract is invalid due to the purchase of IPFS storage servers for mining Filecoin.

P2Pvalidator’s dashboard content is very concise, but it has less information compared to beaconcha.in, and the visualization is not as good.

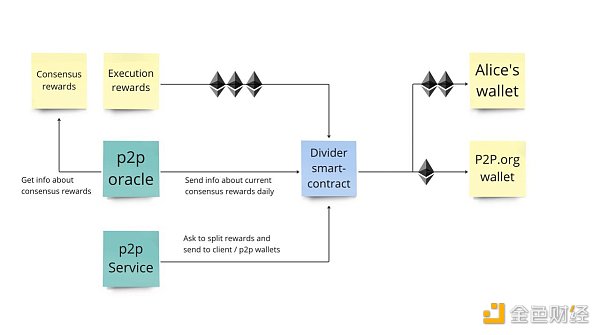

Regarding P2P’s fees and the charging methods adopted by many staking service providers, they usually deduct 10% of your total earnings from your execution layer rewards. I was confused about how they charge at first, but later the customer service gave me a very detailed explanation, and they also wrote an article specifically addressing this issue, which is very clear.

https://p2p.org/economy/beyond-boundaries-large-scale-eth-staking-for-institutions/

Here I have to mention that P2P’s customer service system is very good. Before staking, I asked a lot of questions about validator key storage methods, and the customer service would connect me with dedicated technical personnel to provide timely answers.

Regarding the fee collection, P2P has an oracle that specifically calculates the consensus layer earnings you receive each day. When you propose a block and receive execution layer rewards one day, P2P will calculate 10% of all earnings and deduct it from your execution layer rewards. This method is more accurate than other staking service providers that adopt a fixed percentage, and it does not cause hidden excessive fees.

Allnodes’ dashboard is relatively simple. It is clear at a glance how much Ethereum you have earned and how much it is worth in USD. Because Allnodes charges in prepaid USD, it actually avoids the trouble of fees mentioned above. Your staking earnings are all in your hands. $10 per node per month is very cheap at the current Ethereum price, not to mention when Ethereum reaches tens of thousands of dollars in the next bull market, this fee will be negligible.

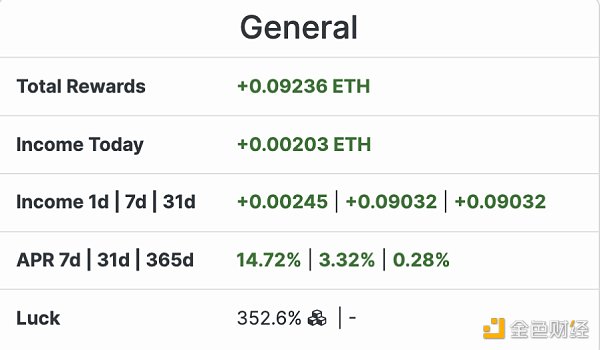

Basically, the staking earnings of about 2 days can cover the monthly fee, and the remaining 28 days of earnings are all yours. According to beaconcha.in, it is more intuitive and clear. A 32 ETH node will receive approximately 0.00245 ETH in earnings from the consensus layer every day. Based on my own calculations, the annualized APR is about 2.7%. Basically, regardless of which staking service provider, the consensus layer earnings are similar, but this APR is significantly lower than the earnings of various LSD projects. The difference lies in the execution layer rewards, which are rewards that only validators selected as proposers will receive, and obtaining these rewards has a certain probability.

Before staking, I didn’t have a very intuitive understanding of these two types of rewards. However, on the fourth day of staking, a supernode I was running got lucky and proposed a block. This is equivalent to mining a block in the Bitcoin mining era and receiving a reward of 50/25 bitcoins. However, in the Ethereum POS proposal blocks, it is a committee whose number of members is determined by the algorithm. As more and more nodes participate in staking, the chances of being selected decrease slowly.

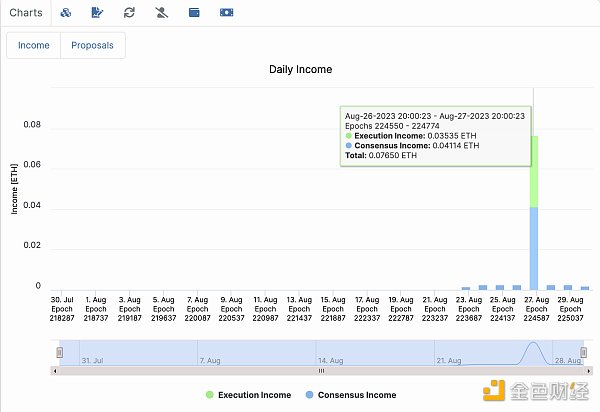

But once selected, the income is quite substantial. Just compare it with a graph.

The previous daily income of 0.00245 ETH is no longer worth mentioning compared to this proposal. The income for that day reached 0.0765 ETH, which is 31 times the income of a normal day at the consensus layer. It should be noted that the income at the execution layer is closely related to Ethereum network activities. In a bull market with gas fees of over a hundred, priority fees and MEV income will skyrocket. At that time, being selected once will bring explosive income.

After the rewards from this proposal at the execution layer, the 7-day annual percentage rate (APR) reached 14.72%.

There is also a “LUCK” value, which was over 2000% on the day of the big explosion. The specific algorithm is unclear, but it can be understood that it was very lucky.

From the above data, we can also understand the differences between SAAS staking and LSD staking. Regardless of the staking method, there is almost no difference in the income at the consensus layer. The difference lies in when your staking node can receive rewards at the execution layer.

LSD is like eating from a big pot. For example, among all the nodes running on Lido, only a small number of lucky ones submit blocks and receive rewards at the execution layer. These lucky ones cannot be happy because they have to “share the wealth” with all other stakers. When the pool is large enough, everyone’s income will be smoother and more predictable.

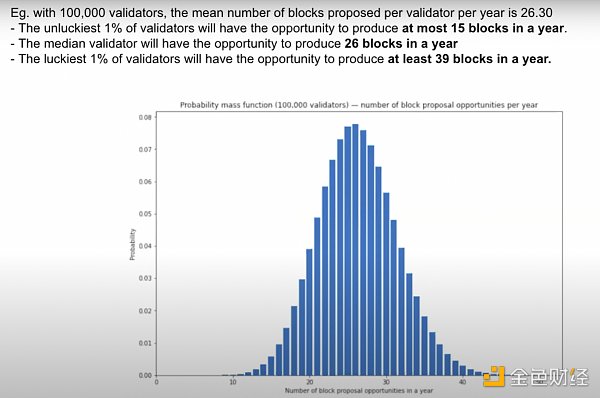

In contrast, SAAS staking means you are actually running a staking node, and when you can be selected as a proposer is a matter of luck. The number of times selected as a proposer in a year follows a normal distribution. The difference in rewards at the execution layer between the luckiest validator and the unluckiest validator can be significant. The luckiest validator can submit 39 blocks, while the unluckiest validator can only submit 15. This is reflected in the significant difference in APR between different staking protocols over a period of time.

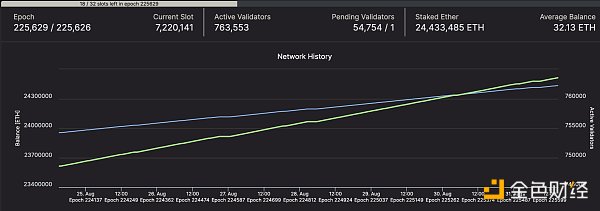

The above data is the probability distribution for this level of 100,000 validators. In reality, the current number of active validators has already exceeded 760,000, and the number of blocks that can be submitted each year will be greatly reduced. However, the distribution pattern should be similar.

Profit Withdrawal

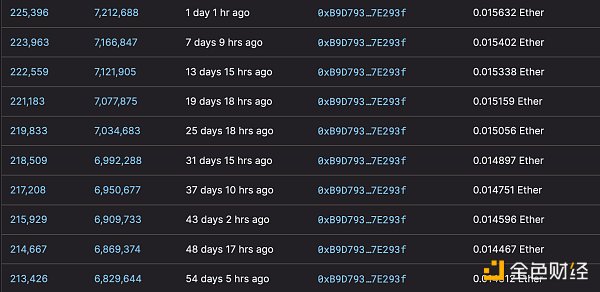

Each staking node will distribute the surplus balance of more than 32 ETH to your designated withdrawal address approximately every six days. The automatic withdrawal of your consensus layer earnings is not an on-chain activity and does not consume gas fees. It is fully automated from the beacon chain to the Ethereum mainnet, and you cannot view it on etherscan. You can only see it on beaconcha.in. Execution layer earnings will be sent to you by the builder or MEV-BOOST who packaged your block, and you can view related activities on etherscan.

In my opinion, this is like an unmanned machine tirelessly printing money. When you have such a machine and have the technical ability to protect this asset, the passive income it generates can cover your daily expenses. At that point, you can truly achieve financial freedom.

In my opinion, this is a new form of financial freedom based on the blockchain, endorsed by mathematics and algorithms.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- NGC Ventures Is the AI track still worth starting a business now?

- Why is identity verification so important for Web3?

- NGC Ventures Is the AI track still worth starting a business in?

- Web3 people facing AI replacement anxiety Don’t panic, can’t smash my rice bowl, can’t ruin my job.

- Don’t miss out on the four giants of APT, ARB, and other airdrops, and don’t miss out on MEKE.

- After Friend.tech, what will be the future of the Base ecosystem?

- I heard that the Wenyin Yiyuan App has topped the charts, so it’s necessary to conduct a comprehensive test.