CYBER token surged after the DWF action.

CYBER token surged after DWF action.Author: 0xScope Labs Translation: Shanolba, LianGuai

In Web3, no matter how challenging the market is, opportunities always exist. In this report, we will reveal a series of actions taken by these savvy investors in the past week, aiming to provide you with potentially insightful insights.

The data provided in this article is only from the transactions of Smart Money from August 24th to August 31st, 2023. This means that any purchases and holdings made before August 24th are not taken into account.

- Besides Unibot, what other potential new Telegram Bots are worth paying attention to?

- LD Capital After Friend.tech, how will Base ecosystem continue?

- Rapid rebound = giving money to traders? An analysis of 4 tokens with the best performance in volatility.

Best Performing Tokens

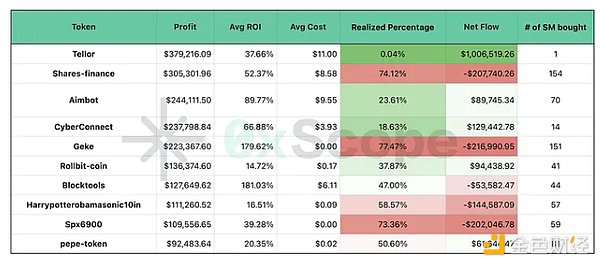

This table will provide you with insights into the tokens that Smart Money has captured value from this week. These tokens are ranked based on the profit amount of Smart Money, and we also include more detailed figures:

-

Net Flow: The net amount of the token that Smart Money has bought or sold in the past 7 days.

-

Average Cost: The average price at which Smart Money bought the token.

-

Cashed Out Percentage: The percentage of tokens bought by Smart Money that has been sold.

-

Average Return on Investment: The average return on investment achieved by Smart Money through holding the token.

In this report, we first focus on CyberConnect (CYBER), especially its recent price surge in DWF Labs’ recent transactions. Every move of DWF Labs on the blockchain creates ripples in the market, and this time is no exception. After DWF received 170,000 CYBER tokens from Binance a few days ago, the price of CYBER quickly rose from $5 on August 30th to around $9 on August 31st.

According to Scopescan data, 14 Smart Money addresses have profited from CYBER tokens, totaling $237,800. In addition, half of the addresses with the highest profits this week have made profits from trading CYBER. Their average purchase price is $3.93, and so far, they have only sold 18.63%. We also highlighted the major transactions involving CYBER in two recent articles published on X’s Scopescan account.

Meanwhile, Tellor (TRB) saw a 57% price increase this week, impressively ranking high in our recent rankings. Our system captured that the owner of an address (0xf70f50dd2ff9b769839d3a3c14abde88aae2f41d) withdrew 91.5k TRB from Binance in bulk on August 26th (worth $1.1 million at the time). The price of TRB rose from just below $10 to around $11 that day, and subsequently reached as high as $16. Due to this price movement, the address owner made nearly $380,000 from their holdings. Perhaps this address knows something we don’t. If TRB has also sparked your curiosity, why not pay close attention to the next moves of Smart Money?

In the ranking above, the third token of interest is AIMBOT. If you are familiar with utility tokens like Unibot, you may also recognize this token. This week, AIMBOT’s value has seen an astonishing 260% increase, rising from $5.50 to about $20. According to our analysis, 70 smart money addresses purchased AIMBOT this week at an average price of $9.55.

The owners of the addresses (0x2f1fa8487927e96b071b8f86a0670cf83d8d56b8) (0x87a6871ab533b6a27c4b2a527ef4bd9162b614e6) profited the most from this rally. Starting from August 24th, they began buying AIMBOT with ETH and conducted multiple trades on Uniswap, earning over $69,000 from AIMBOT trades this week. On average, these smart money addresses achieved an investment return of approximately 90% through trading AIMBOT. It is worth noting that only 23.6% of the tokens have been sold after purchasing AIMBOT. Please keep a close eye on this token as smart money has not chosen to sell AIMBOT yet.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Coinbase Unlocking the Future of NFTs – Exploring ERC-6551 Token-Bound Accounts

- Without looking at the process but focusing on the result, what problems can the most dominant architecture of Web3, Intent-Centric, solve?

- AMA with Alex, co-founder of Matter Labs The Final Battle of zkSync

- What can the Intent-Centric architecture, the most domineering architecture of Web3, solve without looking at the process?

- Kansas Fed Huge Losses May Result from Purchasing Cryptocurrencies through Cryptocurrency ATMs

- After Friend.tech, how will Base ecology continue?

- What does the US court’s friendly judgment on Uniswap mean for DeFi regulation?