Latest Progress of Wormhole After a Long Silence, Can It ‘Regain Its Dominance’?

Wormhole Makes a Comeback Can It Regain Dominance?Wormhole is one of the most well-known cross-chain interoperability protocols. It was acquired by Jump Trading in 2021 and later compensated with 120,000 ETH (approximately $326 million) by Jump Crypto after being hacked in 2022. It has surpassed competitors like LayerZero in the competition for the official governance bridge of Uniswap.

After the collapse of Terra, the development of Wormhole has been lukewarm. In fact, the Wormhole team has been working on project updates, and there have been recent developments, such as the announcement of the establishment of the Wormhole Foundation and the first-time support for new public chains Aptos, Sui, and Sei. They have also developed an automated relay to help developers build dApps. Wormhole hopes that these measures can break the deadlock.

Supporting 23 chains, TVL stable at around $324 million

According to the Wormhole official website, as of August 31st, Wormhole has supported 23 chains.

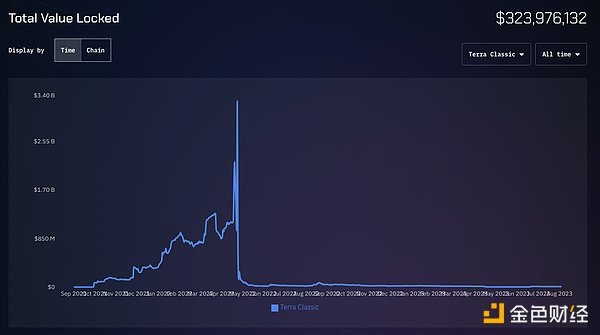

Since Wormhole uses a lock & mint method for cross-chain transactions, it is meaningful to track the Total Value Locked (TVL) on the source chain. As of August 31st, the sum of TVL on various chains for Wormhole is $324 million, with a historical high of $3.8 billion on May 12th, 2022. Recently, the TVL has been relatively stable.

- LianGuaiWeb3.0 Daily | People’s Court Daily Virtual currencies are legal property protected by law

- Homomorphic Encryption Research What Changes Will it Bring to Web3 without the Need for Decryption?

- CYBER token surged after the DWF action.

Breaking it down to each chain, the chains with the highest locked assets are Ethereum with $259 million, Solana with $23 million, Binance Smart Chain with $16 million, Terra Classic with $8 million, and Near with $8 million. The assets with the highest value locked on Ethereum are USDC with $62 million, HXRO with $49 million, WETH with $45 million, USDT with $20 million, and WBTC with $17 million. Most of them are mainstream coins, which are relatively reliable.

Looking back at the historical data of Terra Classic, during the peak period on May 12th, 2022, out of the total $3.8 billion TVL of Wormhole, $3.25 billion came from Terra Classic. The crash of LUNA/UST started on May 8th, so the surge in TVL on May 12th might be due to the oracle not updating the price of UST in time, resulting in inflated data. Before May 8th, the TVL on Terra Classic increased significantly, with $1.13 billion on May 6th, and a stable TVL before that. On May 7th, the TVL rose to $1.71 billion, and on May 8th, it rose again to $2.18 billion. After that, due to the decline in the price of LUNA, on May 9th, the TVL dropped to $1.84 billion, and on May 11th, it dropped to $988 million.

Two days before the collapse of LUNA/UST, the abnormal surge of cross-chain funds from Terra Classic may be the cause of the collapse of LUNA/UST, which is quite possible.

Recent Progress of Wormhole

The development of interoperability protocols is not achieved overnight. With the continuous launch of new public chains, it is necessary to support these chains as quickly as possible to seize the market. In terms of functional iteration, in addition to the initial cross-chain asset transfer, it is also necessary to have cross-chain message transmission and cross-chain Apps, and simplify these functions as much as possible. According to the recent official update from Wormhole, the team has made the following progress.

Establishment of Wormhole Foundation

On August 15th, Wormhole Foundation officially announced its establishment. The foundation is jointly led by Robinson Burkey and Dan Reecer from the Wormhole team. The plans of Wormhole Foundation include three directions:

-

xGrants: Provide resources for open-source software development and research, with a special focus on cross-chain protocols and applications.

-

Cross-chain ecosystem fund: Launch a $50 million fund to support Web3 applications integrated with Wormhole.

-

Wormhole Association: Establish a global active Wormhole community to contribute technically, develop educational content, translate, organize online and offline activities, etc.

In addition, although the official did not mention it, usually such foundations will launch governance tokens and reserve some tokens to promote ecological development. This also means that Wormhole may issue governance tokens. Currently, Wormhole lacks income and provides free services to users. When Uniswap evaluates the cross-chain bridge, the Uniswap Cross-Chain Bridge Evaluation Committee also recommends that Wormhole implement “protocol-level mechanisms” to solve the problem of “validator passivity”. Incentivizing validators (Guardians in Wormhole) through governance tokens is a common practice.

Launch of Automatic Relayers

Current cross-chain protocols are no longer limited to cross-chain asset transfers, but also include cross-chain message transmission and cross-chain Apps built on top of the cross-chain protocols. Wormhole has also begun to apply it in cross-chain Apps, such as Wombat using Wormhole’s relayers for cross-chain message transmission and building cross-chain liquidity pools. This feature is expected to be launched on September 6th.

Wormhole has also launched Automatic Relayers. In order to build cross-chain Apps, developers usually need to build on-chain components and off-chain relayers to pass messages from one chain to another. It is difficult to build, manage, and maintain off-chain relayers. Wormhole has separated this part of the work and developed automatic relayers. Developers can use pre-configured relayer networks without setting up, running, or maintaining relayers, simplifying the development of cross-chain Apps.

Support for Cosmos, Polkadot, Base, etc.

For application chains in the Cosmos and Polkadot ecosystems, although there are XCMP and IBC to facilitate cross-chain transactions within the ecosystems, there are still security issues when it comes to cross-chain transactions from other chains such as Ethereum to Cosmos and Polkadot. Multiple projects in the Polkadot ecosystem have been affected by the transfer of Multichain funds.

For the Cosmos ecosystem, Wormhole recently launched the Wormhole Gateway, which connects the liquidity on supported blockchains to Cosmos through IBC. For Polkadot, Wormhole allows the seamless transfer of Wormhole assets to the Polkadot ecosystem through Moonbeam’s routing liquidity.

Current issues: Daily cross-chain fund limitations and inconsistent cross-chain liquidity

Wormhole was acquired by Jump Trading and relies on Jump’s investment and market value management. Although Wormhole has deep integration with some emerging public chains or projects on public chains, it has remained stagnant in recent developments.

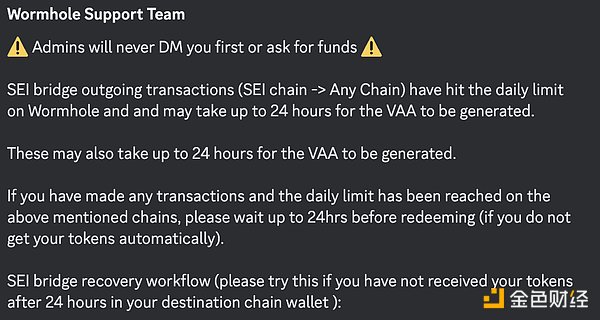

With the launch of Sei Network and the formulation of airdrop rules, the problems of Sei and Wormhole have been exposed. According to Sei’s airdrop rules, the more assets cross-linked to Sei, the higher the probability of obtaining rare treasure chests and more SEI airdrops. As a result, many users choose to cross-chain more than $100,000 to Sei through Wormhole. However, when withdrawing funds, Wormhole imposes daily fund limits for each chain, which has caused many users to be stuck in the process of transferring funds from Sei through Wormhole and they have to wait for more than 24 hours.

According to Wormhole’s 2022 Year in Review, the security feature called Governor was launched in August 2022 after being hacked. It allows Wormhole Guardians to limit the cross-chain value of each chain. Currently, the daily limit for withdrawing underlying assets from Ethereum is $50 million, and for Solana, it is $25 million, with even lower limits for other chains.

In the Wormhole community, there have been frequent reminders about reaching the cross-chain amount limit, as shown in the figure below. The speed of fund arrival is also an important evaluation criterion for cross-chain protocols. In most cases, the daily limits set by Wormhole can meet the demand and the arrival speed is fast. However, due to the surge in cross-chain demand caused by Sei’s airdrop rules, the experience of waiting for 24 hours for withdrawal is poor.

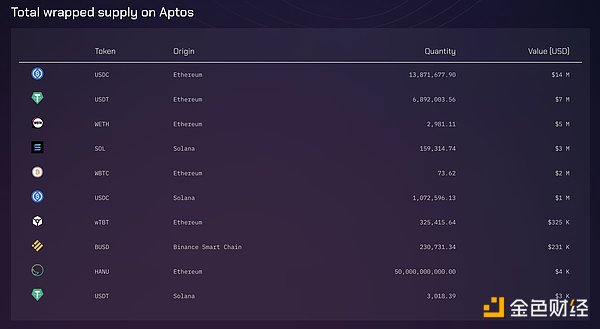

In addition, the cross-chain assets on Wormhole are too complex. For example, although USDC on various chains can be cross-linked to Aptos, only USDC cross-linked from Ethereum to Aptos is supported on LianGuaincakeswap and Thala on Aptos. Does this mean that Ethereum mainnet must be used to meet the conditions? Actually, it is not necessary. There is also a cross-chain asset called USDCet on Solana forged by Wormhole, and there is sufficient liquidity for the USDC/USDCet trading pair on DEX. For ordinary users, withdrawing USDC to Solana and then exchanging it for USDCet through an aggregator can achieve the same effect with lower fees. It is also worth noting that although Aptos supports USDC cross-linked from Ethereum or USDCet cross-linked from Solana, Sei requires the use of native USDC on Solana for calculating Solana airdrops, which can easily cause confusion with different assets. Competitor LayerZero does a better job in this regard, as only supported assets can be seen on the front end.

In March of this year, Wormhole integrated Circle’s cross-chain transfer protocol (CCTP). Theoretically, by using different chains such as Ethereum and Solana, USDC on the underlying assets of Aptos can be cross-chain transferred, and all are issued by Circle. If Wormhole can unify liquidity, the user experience will be improved.

With the collapse of Terra, the glory of Wormhole also disappeared, and Swim Protocol, the ecological project providing cross-chain liquidity, announced a suspension after a series of subsequent events. However, the Wormhole team has recently been frequently updating the product functions, and although the project still has many problems, they hope that Wormhole can create glory again.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Besides Unibot, what other potential new Telegram Bots are worth paying attention to?

- LD Capital After Friend.tech, how will Base ecosystem continue?

- Rapid rebound = giving money to traders? An analysis of 4 tokens with the best performance in volatility.

- Coinbase Unlocking the Future of NFTs – Exploring ERC-6551 Token-Bound Accounts

- Without looking at the process but focusing on the result, what problems can the most dominant architecture of Web3, Intent-Centric, solve?

- AMA with Alex, co-founder of Matter Labs The Final Battle of zkSync

- What can the Intent-Centric architecture, the most domineering architecture of Web3, solve without looking at the process?