After Friend.tech, what will be the future of the Base ecosystem?

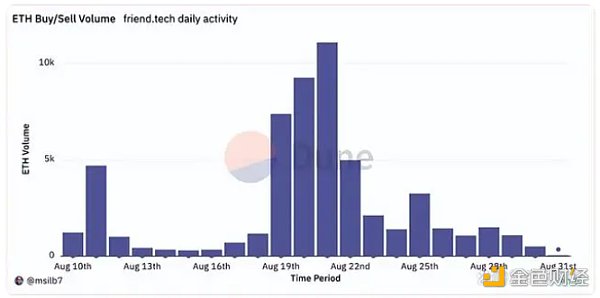

What's next for the Base ecosystem after Friend.tech?Two weeks after the launch of Friend.tech on the Base chain, user activity gradually declined, and there was even a net outflow of ETH from the contract on August 22nd. Currently, the total amount of ETH remaining in the contract is around 3,500 coins, worth about $5.8 million. Apart from Friend.tech, how is the development of the Base chain ecosystem?

Author: Jaden, LD Capital

Two weeks after the launch of Friend.tech on the Base chain, user activity gradually declined, and there was even a net outflow of ETH from the contract on August 22nd. Currently, the total amount of ETH remaining in the contract is around 3,500 coins, worth about $5.8 million. Apart from Friend.tech, how is the development of the Base chain ecosystem?

1. On-chain data

1. TVL

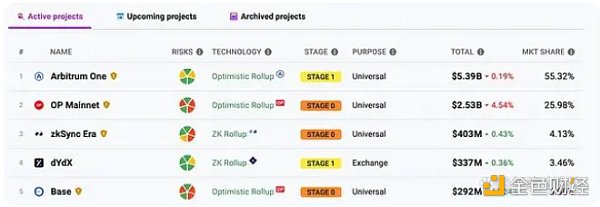

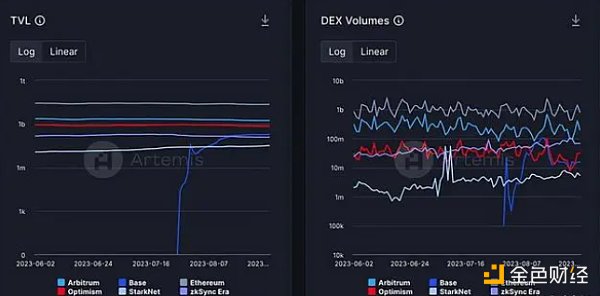

As of August 27th, the TVL of the Base chain reached 292 million, ranking 5th in the Layer 2 network and accounting for 3% of the Layer 2 market share. Both Base and zkSync have experienced slow TVL growth and relative stagnation.

- I heard that the Wenyin Yiyuan App has topped the charts, so it’s necessary to conduct a comprehensive test.

- NGC Ventures Exploring the path of MEV redistribution

- Google’s slacking off artifact is here AI conference substitute launched, one-click summarization, questioning, and speaking.

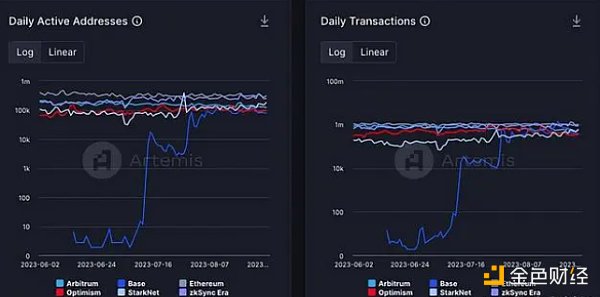

2. Trading volume and active addresses

There were two rapid growth periods in daily active addresses and daily trading volume, corresponding to the launch of the Base chain mainnet and Friend.tech. As of August 31st, the daily active trading addresses were 77,000 and the daily trading volume was 356,000 transactions, both lower than Layer 2 networks such as Arbitrum, Optimism, and zkSync.

The trading volume on the Base DEX reached a low point on August 3rd after the end of the meme coin market, and then there was a rebound in trading volume with a series of new project transactions on-chain. However, after the market downturn on August 16th, the trading volume began to shrink again.

2. Ecosystem projects

As of August 27th, the official website of Base has included a total of 143 projects/partners. Defillama has included 69 projects, and there are only 23 projects with TVL exceeding 1 million, of which 12 are DEX.

DEX

The initial DEX with a large trading volume on the Base chain was Leetswap and Rocketswap, but both experienced security incidents.

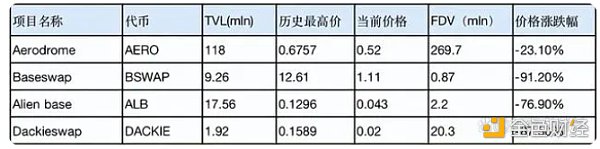

Currently, the leading native DEX is Aerodrome, which is in a fragmented first-tier state in terms of TVL. This DEX has just launched liquidity mining and provides a higher APY. Aerodrome is a Base liquidity layer developed jointly by Velodrome, Base team, and partners. The initial supply is 500M AERO, of which 450M (90%) will be locked as veAERO. The initial circulation of AREO is 10M, and the weekly release volume will increase by 3% based on the previous week’s release volume from the 1st to the 14th week. From the 14th week to approximately the 67th week, the weekly release volume will decrease by 1%. Overall, AERO is a mining coin, and its circulating supply has grown rapidly in a short period of time. After the launch of Baseswap and Alien base on Aerodrome, the TVL and price have both declined.

Lending

Currently, the largest lending protocol on the Base chain is Compound, with a TVL of 23.35 million. The next is Moonbeam’s native lending protocol Moonwell, with a TVL of 19.42. Aave voted and launched on the Base chain on August 20th, with a current TVL of 1.68 million.

The deployer of the largest native lending protocol on the Base chain, Magnate Finance, is associated with the solfire scam. The Twitter account of the project has been deactivated. The TVL of the remaining lending protocols, Grannay Finance and UncleSam protocol, is less than $1 million. Compared to the well-established lending protocols Compound and Aave, they have no competitive advantages in terms of brand, security, and liquidity.

Derivatives

EDEBASE has set up a hybrid liquidity mechanism that allows ELP holders to provide liquidity through a smart router. 45% of the protocol’s revenue is distributed to ELP token holders and stakeholders, similar to GMX. The current TVL is 0.19 million.

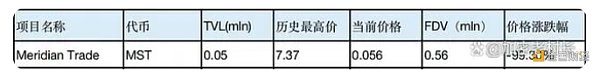

Meridian Trade provides interest-free stablecoin lending, leverage trading, and zero slippage trading. Users can trade whitelist cryptocurrencies with up to 50x leverage and obtain interest-free overcollateralized loans in ETH. The current TVL is $50,000.

Social Platforms

Friend.tech caused a sensation and attracted a large amount of fund inflows in mid-August. However, starting from August 22nd, there has been a phenomenon of fund outflows from Friend.tech, and trading activity has significantly decreased.

Games

LianGuairallel is a collectible card game that raised 50 million US dollars in funding in 2021, with a valuation reaching as high as 500 million US dollars at one point. At the end of July, the game’s beta testing went live, and the game put its NFT cards on the Base chain for forging.

Summary

Many native projects on the Base chain have experienced rug incidents. From a price performance perspective, there is higher risk in secondary participation. In terms of ecosystem development, popular projects like Unibot are still actively joining the Base ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Fidelity Feasibility study on Ethereum as a digital asset and potential income asset

- Thailand airdrops billions of yuan worth of virtual currency Web3.0 gradually becomes a slogan for politicians in various countries.

- Latest Progress of Wormhole After a Long Silence, Can It ‘Regain Its Dominance’?

- LianGuaiWeb3.0 Daily | People’s Court Daily Virtual currencies are legal property protected by law

- Homomorphic Encryption Research What Changes Will it Bring to Web3 without the Need for Decryption?

- CYBER token surged after the DWF action.

- Besides Unibot, what other potential new Telegram Bots are worth paying attention to?