LianGuaiWeb3.0 Daily | People’s Court Daily Virtual currencies are legal property protected by law

LianGuaiWeb3.0 Daily | People's Court Daily Virtual currencies are legally protected property.DeFi Data

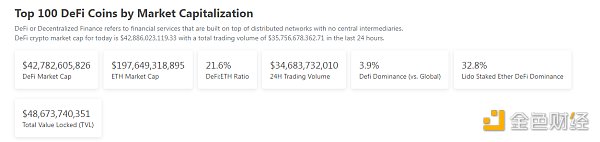

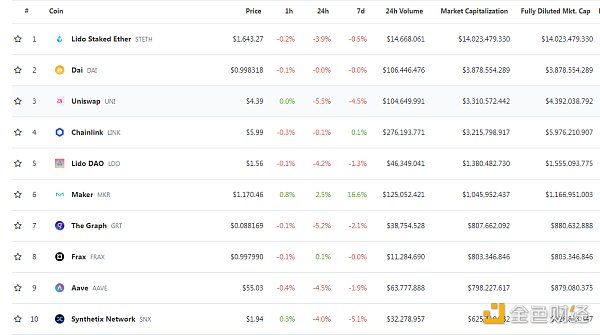

1. Total Market Value of DeFi Tokens: $42.782 billion

- Homomorphic Encryption Research What Changes Will it Bring to Web3 without the Need for Decryption?

- CYBER token surged after the DWF action.

- Besides Unibot, what other potential new Telegram Bots are worth paying attention to?

Data source: Coingecko

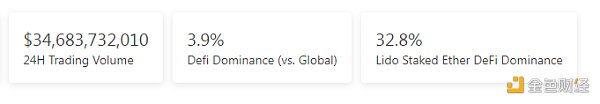

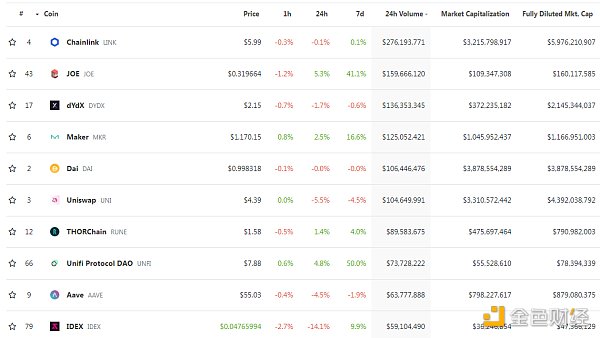

2. Trading Volume of Decentralized Exchanges in the Past 24 Hours: $3.4683 billion

Data source: Coingecko

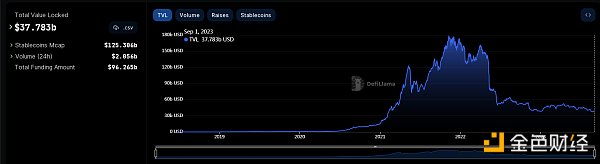

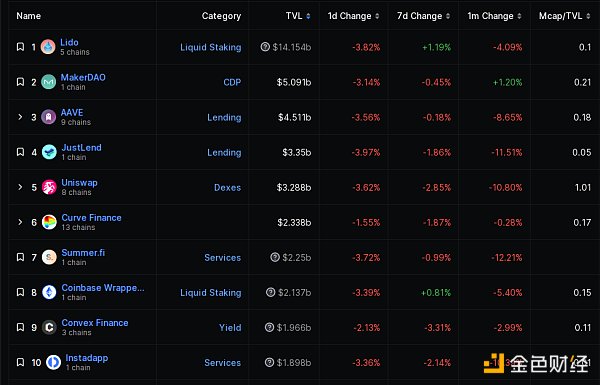

3. Locked Assets in DeFi: $38.779 billion

Data source: Defillama

NFT Data

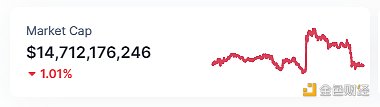

1. Total Market Value of NFTs: $14.712 billion

Data source: Coinmarketcap

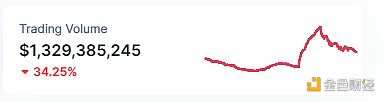

2. 24-hour NFT Trading Volume: $1.329 billion

Data source: Coinmarketcap

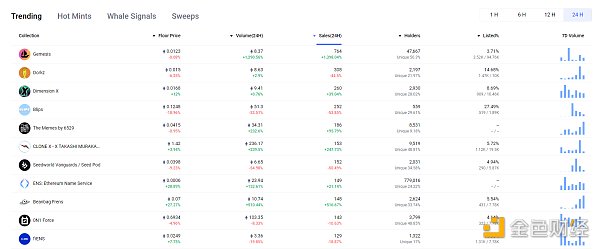

3. Top 10 NFT Sales in the Past 24 Hours

Data source: NFTGO

Headline

China’s People’s Court Daily: Virtual Currency is Legal Property and Protected by Law

LianGuai reported that the People’s Court Daily of China released the “Determination of the Property Nature of Virtual Currency and the Disposal of Involved Properties” which has several opinions on the criminal law nature of virtual currency in practice:

1. Some opinions believe that virtual currency is only electronic data stored in a computer system and is currently circulating as illegal currency in the “black market” in China, mostly serving as illegal criminal payment methods, medium for illegal funds entering the country, and other “gray” roles. In the absence of explicit legal provisions, it should not be recognized as property in the criminal law sense.

2. Some opinions believe that virtual currency belongs to virtual goods, has economic value, and based on the provisions of judicial interpretations regarding theft, robbery, and prohibited drugs, virtual currency should also be recognized as property in the criminal law sense. However, considering that the current policy in China prohibits the circulation of virtual currency, it should not be recognized as legal property and protected.

3. Some opinions believe that virtual currency is property in the criminal law sense and is legal property. Unless it is used for illegal criminal activities by the holder or directly derived from the holder’s illegal criminal activities, the property rights and interests of virtual currency holders should be protected.

NFT/Digital Collectibles Hot Topics

1. Base: Genesis Builder NFT has been airdropped to over 100 APP and service providers who supported Base during its launch

On September 1st, Coinbase’s L2 network Base announced that it has airdropped Genesis Builder NFT (Golden tier) today. The airdrop is targeted at the APP and service providers who supported Base’s blockchain during its launch, totaling over 100.

The NFT series, designed by @KlaraVollstaedt, aims to recognize early contributors of the Base blockchain as valuable members of the Builder community. The teams eligible for this NFT qualification must have deployed to the Base blockchain during its launch and must be APP, infrastructure, or service providers. Independent token or NFT projects do not meet the eligibility criteria. Genesis Builder NFT holders will gain Discord privileges and connect with other community members.

2. “People’s Collector – Yuanyuan” Second Edition of Digital Collectibles Overseas Version goes on sale again

LianGuai reports that the second edition of “People’s Collector – Yuanyuan” digital artwork, issued by Lingjing People’s Art Museum, went on sale again on September 1st. After purchasing on the overseas event website of “Yuanyuan,” users can trade on the overseas trading platform Opensea. The overseas edition of “Yuanyuan” is priced at 0.1 ETH, equivalent to approximately $170 (as of 5:00 PM Beijing time on August 31st).

In addition, for users who already own “Yuanyuan,” Lingjing People’s Art Museum will adjust the authorization transfer time for “People’s Collector – Yuanyuan” digital artwork starting from September 1st. After holding “Yuanyuan” for 24 hours, users can register for authorization transfer and sign the authorization transfer agreement.

3. Data: Ethereum NFT sales in August amounted to approximately $226 million, the lowest record since July 2021

LianGuai reports that according to cryptoslam data, Ethereum NFT sales in August amounted to approximately $226 million, the lowest record since July 2021. Additionally, there were 1,083,115 Ethereum NFT transactions in August, with 140,881 independent buyers and 113,211 independent sellers.

4. Bitcoin NFT sales on the chain experienced a significant decline in August, reaching a new low since March

On September 1st, the latest data from CryptoSlam shows that Bitcoin NFT sales on the chain experienced a significant decline in August, reaching approximately $11.85 million, an 81.7% decrease compared to July’s $64.9 million, and hitting a new low since March 2023. Additionally, there were about 53,000 Bitcoin NFT transactions on the chain in August, with 14,888 independent buyers and 11,614 independent sellers. DeFi Hot Topics

1. Matter Labs Co-founder: Ethereum wins in the L1 competition, some things can only be achieved by L1

LianGuai reports that Alex, the co-founder and CEO of zkSync development team Matter Labs, stated in an interview that some things can only be achieved by L1, and they are crucial for the value created by blockchain, including decentralization, scalability, and censorship resistance. L1’s role is to fulfill these responsibilities, and in my opinion, Ethereum does it better than anyone else.

Ethereum is the winner of the L1 competition. Everything else, including scalability, privacy, and user experience, can and will be addressed by L2 and is irrelevant compared to L1.

2. Lybra Finance, an interest-bearing stablecoin protocol, launches Lybra V2

On September 1st, Lybra Finance, an interest-bearing stablecoin protocol, announced the launch of Lybra V2. Users are required to migrate V1 LBR to V2 LBR before 8:00 on October 1st. There is no set deadline for migrating V1 eUSD, and the V2 mining plan will start on September 7th.

Previously, Lybra launched the Lybra V2 testnet on July 20th, which includes new features such as full-chain functionality, expanded options for using LST as collateral, improved fund security, and a new mechanism that maintains the peg to eUSD while supporting the value of LBR. On Lybra V2, users will have two different ways to mint eUSD and peUSD, with peUSD being the full-chain version of eUSD.

3. Aave community holds an on-chain vote to fund Aave robots for automated governance V2 proposal

On September 1st, the Aave community conducted an on-chain vote to fund Aave robots for governance V2 automation, which will end on September 3rd. The proposal aims to use LINK tokens from the Aave Collector contract to fund the operational costs of Aave robots, which will automate certain permissionless actions in Aave governance and enhance its overall effectiveness.

4. Latest Ethereum ACDE Meeting: Testing the Cancun upgrade hard fork in the order of Holesky, Goerli, and Sepolia testnets

On September 1st, Tim Beiko, an Ethereum core developer, summarized the latest Ethereum ACDE (All Core Developers’ Execution) meeting. The meeting discussed the latest developments in the Dencun test network, as well as the Verkle Trie and State Expiry roadmap.

Tim Beiko also mentioned that the Cancun upgrade hard fork will be tested in the order of Holesky, Goerli, and Sepolia testnets. The next ACDE meeting is scheduled for September 14th at 22:00 Beijing time.

5. Ethereum liquidity staking providers agree to impose a 22% limit on all validators

According to LianGuai, at least five Ethereum liquidity staking providers have implemented or are working to implement self-imposed rules, committing not to have more than 22% of the Ethereum staking market. This is seen as a measure to ensure the decentralization of the Ethereum network.

According to Superphiz, an Ethereum core developer, Ethereum staking providers that have committed or are committed to self-imposed rules include Rocket Pool, StakeWise, Stader Labs, and Diva Stake. The liquidity staking service company Puffer Finance has also announced its commitment to self-imposed rules.

However, Ethereum liquidity staking provider Lido Finance voted against self-imposed rules in June with a majority of 99.81%. According to data from Dune Analytics, Lido currently dominates the Ethereum staking market, accounting for 32.4% of all staked Ethereum, while Coinbase accounts for 8.7% of the market.

Metaverse Highlights

1. China Mobile launches the world’s first metaverse-ready 5G super network

On August 31st, China Mobile announced the world’s first metaverse-ready 5G super network at the Beijing Internet 3.0 Innovation and Ecological Development Conference. To meet the high bandwidth, low latency, and high computing power requirements of metaverse services, China Mobile has developed technologies such as 5G base station business perception, intelligent data offloading, flexible resource management, and edge collaboration rendering. The 5G super network has successfully achieved real-time 100Mbps user experience and frame-level network transmission latency below 20ms on the existing 5G network, fully meeting the requirements of immersive high-interaction XR services with 4K resolution and 90 frames per second. In addition, the network provides the GTVerse experience center in the Workers’ Stadium metaverse, where users can enter the digital space of the Workers’ Stadium metaverse using their own 5G smartphones and enjoy various metaverse services and applications, including digital football, metaverse live streaming, metaverse socializing, and official metaverse digital characters.

Disclaimer: LianGuai, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish a correct investment concept and always be aware of the risks involved.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Capital After Friend.tech, how will Base ecosystem continue?

- Rapid rebound = giving money to traders? An analysis of 4 tokens with the best performance in volatility.

- Coinbase Unlocking the Future of NFTs – Exploring ERC-6551 Token-Bound Accounts

- Without looking at the process but focusing on the result, what problems can the most dominant architecture of Web3, Intent-Centric, solve?

- AMA with Alex, co-founder of Matter Labs The Final Battle of zkSync

- What can the Intent-Centric architecture, the most domineering architecture of Web3, solve without looking at the process?

- Kansas Fed Huge Losses May Result from Purchasing Cryptocurrencies through Cryptocurrency ATMs