Ethereum’s native LST adopts a two-tier staking design Lido killer?

Ethereum's LST uses a two-tier staking design, a potential Lido competitor?Original author: 0XNATALIE Original source: LianGuai

Recently, five staking service providers including RocketPool, StakeWise, and Stader Labs jointly signed a restrictive proposal, committing to limit validator shares to below 22%. However, the leading protocol Lido Finance, which holds a market share of up to 32%, has not expressed its stance on this matter. The Ethereum community is concerned about the increasing influence of Lido’s expansion in the liquid staking market, and criticism from the community is growing. Can improvements be made to the Ethereum protocol layer to directly enable liquid staking and eliminate the centralized threat posed by the large market share of applications?

The idea of Two-tiered staking was initially proposed by Ethereum Foundation researcher Dankrad in April 2023. After discussion, Ethereum Foundation researcher Mike further expanded and elaborated on it. The Two-tiered staking mechanism divides staked ETH into two tiers, Node Operator Bonds (C1) and Delegated Stake (C2), similar to graded funds. C1 may still face slashing risks, while C2 does not. The current LST ecosystem relies on users’ trust in node operators. The main purpose of doing so is to reduce the slashing risks that ordinary users need to bear when choosing validators and improve capital efficiency.

- Court ruling confirms Ripple does not own XRP ledger.

- Ethereum Researcher Minimum Viable Issuance is an Important Commitment to Regular Ethereum Users

- An Introduction to Fully Homomorphic Encryption Definition and Historical Review

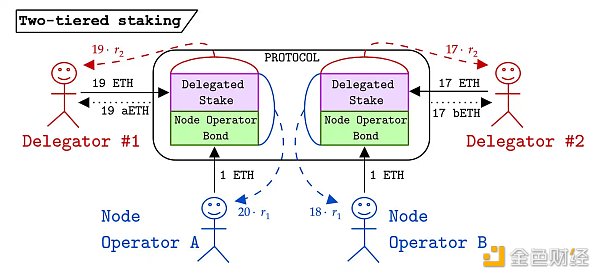

Design of Two-tiered staking

Node Operator Bonds (C1): C1 holders are node operators who provide network services and maintain network security. These bonds are slashable, and staked funds may be forfeited if node operators violate network rules.

Delegated Tokens (C2): C2 is ETH delegated by users to node operators. Unlike C1, the ETH deposited in this part cannot be slashed, and users’ funds will not be affected even if the node operator’s staked funds are slashed.

Delegation ratio (g): Each C1 is eligible to receive delegation from g C2. This parameter ensures the maximum ratio between slashable funds (C1) and non-slashable funds (C2).

r1 (interest rate for node operators): r1 is the interest rate received by node operators, which is usually higher than r2 to compensate for the operating costs and slashing risks borne by node operators. Node operators need sufficient rewards to incentivize their participation in the Ethereum network validation.

r2 (interest rate for delegators): r2 is the interest rate received by delegators, which represents the rewards they receive for their delegated staking. This interest rate is usually lower because delegators do not bear slashing risks. r2 is considered an “risk-free rate” in Ethereum, and it can be obtained by simply staking without taking any risks.

LST: Every unit of C2 generates a corresponding local liquidity staking token. These LST tokens are unique to each node operator and are minted through their delegation. Only non-redeemable ETH can be used to mint LST tokens.

These two interest rates are crucial components of the design. If r1 is set too high, the rewards for becoming a node operator may exceed the rewards for delegation, which could result in more people choosing to become node operators instead of delegating, or the emergence of LST layers based on trust assumptions like Lido. In that case, the Two-tiered staking model would lose its original purpose. If r1 is set too low, there may not be enough incentives for people to become node operators, leading to compressed profits for node operators and centralization of nodes.

Characteristics and Potential Issues of the Two-tiered Staking Model

In this model, each unit of C1 is associated with a certain amount (coefficient g) of C2. Typically, C1 can earn a higher interest rate r1 to compensate for the operational costs of node operators and the opportunity cost of holding non-liquid staking. The security of the consensus layer depends solely on C1, which must go through an activation and exit queue. On the other hand, C2 can be flexibly redelegated.

For example, there are two delegators, Delegator 1 and Delegator 2, and two node operators, Node Operator A and Node Operator B. Each node operator provides 1 ETH bond to qualify for authorization. These bonds have interest rate limitations and can be redeemed. The red and blue dotted lines in the figure below represent the interest earned by each participant. Delegator: delegated staking * r2 = interest, Node Operator: (delegated staking + bond) * r1 = interest. Node Operator A has a g value of 19, which means Delegator 1 delegates 19 ETH to Node Operator A, and A provides a 1 ETH bond to qualify for authorization. Delegator 1 earns 19 * r2 interest, while Node Operator A earns 20 * r1 interest.

Two-tiered Staking improves capital efficiency by dividing staking into two levels, allowing more ETH to be delegated and increasing liquidity. Continuing with the example above, Node Operator A has C1=1, C2=19 (collateral ratio of 1:19, leverage ratio of 19), which means that out of 20 ETH, 19 ETH is liquid, resulting in a capital efficiency of 95%. Node Operator B has C1=1, C2=17 (collateral ratio of 1:17, leverage ratio of 17), which means that out of 18 ETH, 17 ETH is liquid, resulting in a capital efficiency of 94.4%. In comparison, A has higher capital efficiency but also higher risk because a larger proportion of ETH is delegated, leaving a relatively small proportion for redemption.

Through different interest rates and reward mechanisms, this mechanism aims to encourage more people to participate in node operation and increase the decentralization of the network. However, it also raises concerns about the lower cost of attacking the network due to a portion of the staked assets in the model no longer being subject to redemption risk. In the event of a large-scale attack, the attacker may only need to attack the redeemable portion instead of the entire network, which lowers the theoretical economic security.

In addition, the proposal also raises some open questions. The community’s discussion of these issues helps researchers explore how new models interact with the existing blockchain ecosystem. Personally, I am particularly interested in whether there is a dynamic way to set interest rates and whether LST will form a monopoly or an oligopoly in the market. How to ensure diversity and competition is also a topic I look forward to more community discussions on.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- friend.tech user falls victim to SIM Swap attack. Is Verizon’s SMS verification a security vulnerability?

- Sequoia Capital The challenging moment has arrived, how should we prepare?

- What are long positions and short positions?

- Three Reasons Why Ethereum Price Cannot Break Through $2000

- The king of Web3 scams is leading Pudgy Penguin to its demise.

- LianGuaiWeb3.0 Daily | TRON Mainnet Will Soon Release Chiron Version

- Duties Embezzlement Crime in the Employee Risk Prevention of NFT Digital Collection Company