Sequoia Capital The challenging moment has arrived, how should we prepare?

Sequoia Capital Preparing for the Challenging MomentAt a critical moment of severe test, learning to pause and think is the most important.

Sequoia Capital warned at an internal sharing session:

The biggest change in recent times is that “capital” has gone from being free to being expensive. Assets that used to perform the best have now become the worst performers.

In simple terms, the world is reevaluating what kind of business models are valuable when capital becomes expensive.

- What are long positions and short positions?

- Three Reasons Why Ethereum Price Cannot Break Through $2000

- The king of Web3 scams is leading Pudgy Penguin to its demise.

At a critical moment of severe test, learning to pause and think is the most important. Only those who are best at responding to changes will survive.

Unlimited growth will no longer be recognized. The era of unlimited growth for returns is over. This recovery will not be a V-shaped reversal, but a long-term repair process.

Below are the key points of the sharing session:

As a venture capital firm behind Google, Apple, and Airbnb, Sequoia Capital has won a reputation in the tech industry as “Cassandra” (the Trojan princess in Greek mythology who could predict the future) by sharing presentations and memos with its portfolio companies during economic crises.

In a 52-slide presentation titled “Adapting to Endure,” Sequoia Capital listed the current turbulent financial markets, inflation, and geopolitical conflicts as key factors of uncertainty and change. Sequoia Capital told founders not to expect a swift economic rebound like the one that happened after the pandemic began, because “the monetary and fiscal tools that drive economic recovery have been exhausted.”

At the same time, Sequoia Capital also advised founders to take prompt action to extend the runway and thoroughly examine whether there are excessive costs in their businesses. “Do not consider ‘valuation cuts’ as negative factors. It is a way to save cash and grow rapidly, which can help you go further.”

There will be no more “V-shaped recovery” this time

Although the U.S. economy experienced a downturn in March 2020 due to the pandemic, it quickly rebounded afterwards, which economists called a V-shaped recovery. Sequoia Capital believes that this situation will not happen again. The report points out that monetary and fiscal policies have been exhausted, and persistent inflation and geopolitical conflicts further limit the ability to solve problems at the macro level.

In order to cope with the pandemic, governments around the world have implemented fiscal and monetary stimulus measures to fill the huge gap caused by the pandemic. This has helped prevent a severe recession, but it has also brought serious consequences. This “flooding” is reflected in asset prices, especially in stocks of remote work and e-commerce companies that align with the pandemic theme.

Federal Reserve Balance Sheet, Image: Sequoia

The market downturn will have an impact on consumer behavior, labor market, and supply chain, among others. This crisis will be a longer cycle, and although the duration cannot be predicted, it is still necessary to be prepared. The Federal Reserve’s two core tasks are to maximize employment and control price stability, but they do not seem to have done well so far. Not only Sequoia feels the crisis, but also well-known venture capital firm Light Speed mentioned in a blog post, “The unquestionable prosperous era of the past decade has ended.”

Who can survive?

1. So, who can survive in this situation?

The answer is survival of the fittest:

It is not the most powerful species that survive, nor the most intelligent, but those who are best at adapting to change.

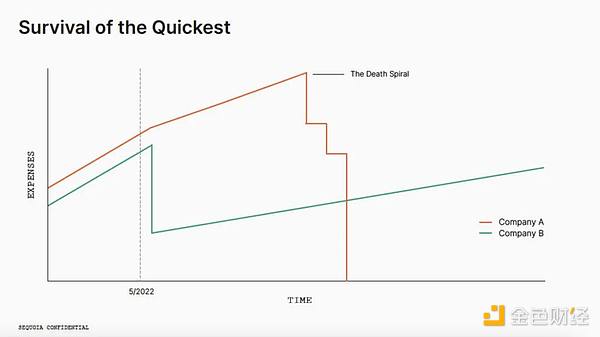

Just like the two companies A and B in the above image, company B, which responds the fastest, has more cash flow and is more likely to avoid the death spiral.

So we suggest that you calculate various cost-saving methods, such as shutting down some projects, stopping research and development, reducing market expenses, or others. This does not mean you have to take immediate action, but you need to know that if you need it within the next 30 days, you are prepared.

We have seen that in 2008, companies that reduced expenses ultimately fared better.

Do not see expense reduction as a negative thing, but as a way to save cash and run faster.

In addition, think about the decisions you plan to make and their relationship to the decisions you wanted to make initially.

When you only have six months of cash flow left, focus and decision-making will become very difficult, so start thinking now no matter how much money you have left.

Overtaking is more suitable on rainy days

Crisis = danger + opportunity. F1 driver Ayrton Senna once said: you can’t overtake more than 15 cars when the weather is good, but you can in rainy weather. For startups, recruiting fairs become easier during economic downturns, and there will be fewer competitors.

So, a crisis is also an opportunity. You can also consider the present as a rare opportunity, and surviving will make you stronger.

So, what kind of people can not only survive but also win?

They are founders who face reality, respond quickly, have discipline and principles, and do not regret.

Moreover, in the coming period, recruiting fairs will become easier, and there will be fewer big companies competing with you.

So, take the present as an once-in-a-lifetime opportunity, play your cards right, and you will ultimately become stronger.

In such a crisis, how can you become stronger? Opportunities are only for those who are well-prepared.

Founders need to face reality, overcome fear, and make timely adjustments. Just like companies that grow slowly but still make profits now have financial flexibility, they can reallocate resources from cash-burning companies and witness changes in the status of growth stocks and value stocks. Crises are often turning points for everything.

Great companies in history were born in crises, such as Amazon and Google after the 2001 dot-com bubble; Twitter, Uber, Airbnb, and Okta after the 2008 financial crisis. Sequoia believes that in the next few years, the best and most determined startups will quickly dominate the market against the trend.

How to prepare?

We will provide a framework that has been used in some very tricky crisis moments before and has been continuously improved over the years.

1. Firstly, you must be mentally prepared.

① Face reality: This is the most difficult step.

Every collapse starts with founders not truly facing the harshest reality; as a founder, as a CEO, you must face reality; your team or board can only help so much.

② Face fear.

Now that you have faced your reality, you must prevent yourself from falling into a negative spiral.

You must break free from this negative emotional cycle in order to truly know how to get us out of the predicament.

③ Have the courage to overcome fear.

Courage is a choice, so choose to be courageous.

Whatever we will face today will not be worse than the uncertainty we faced at the beginning of the COVID-19 pandemic. We will overcome everything.

④ From crisis to opportunity.

The Chinese word for “crisis” consists of two characters. One represents danger, and the other represents opportunity. Separated, this word is the point where danger and change meet. It was previously used by President John F. Kennedy as danger plus opportunity, making it a very popular term.

In fact, when there is a crisis, the point of change becomes more interesting. With the opportunity for change, the strong can become weak, and the weak can become strong.

Growth stocks that were once coveted are being sold off, while value stocks are being coveted. Companies that grow slowly but still make profits now have financial flexibility and can reallocate resources from cash-burning companies.

If you clearly see the opportunity and are prepared to seize the moment, then this turning point will be a new opportunity.

2. Secondly, prepare your team.

① Start with “why” and reaffirm your mission vision/values.

This is very important for the loyal followers you hire.

② Demonstrate your leadership.

Understand your audience: customers, employees, investors, etc. They all need to be reminded why they joined your vision for the future. They are all looking to you for direction and expecting you to take decisive action.

③ Finally, keep your team consistent, demand their commitment and contribution, or…politely ask them to leave and lighten the lifeboat’s load.

3. Prepare your company.

Tightening of capital, greater emphasis on corporate profitability

When liquidity is abundant, the best performing companies are those that consume capital, such as technology and some new IPO companies. But now the market is reevaluating what business models are valuable when wallets tighten. As liquidity tightens, these companies become the worst performers. Among all software, internet, and financial companies, 61% of companies currently have market values lower than their pre-pandemic prices in 2020. This is despite the fact that most of these companies have doubled their revenue and profits in the past two years.

Sequoia believes that the main ways to help startups survive the winter include:

-

Reorganize the team: Reaffirm the company’s mission, vision, and values, retain valuable employees

-

Focus on cash flow: Pay attention to the fuel tank at all times

-

Increase profitability: Expand profit channels, improve economic models, lay off employees

-

Raise funds or take on debt: Even if the cost is high

-

Focus on core business: Stay away from undisciplined and principle-less market pursuits, such as Airbnb cutting most of its products but increasing investment in key hosting and long-term accommodation businesses

-

Innovate thinking: Focus on finding better solutions to problems rather than throwing money at the problem. Changing in the face of problems is the only choice.

This is a turbulent era.

Cisco after the 1987 financial crisis, Google and LianGuaiyLianGuail (an American online payment service provider) after the bursting of the dot-com bubble in 2000, Airbnb (an American vacation rental company) during the 2008 financial crisis, and Doordash (an American food delivery company founded by three Chinese Americans) during the COVID-19 pandemic in 2020.

But we also believe that the victory in the next few years will depend on whether companies can make decisive choices to deal with the challenging issues that have been caused by the inflation and distortion of free capital in the past two years, which may be uncomfortable.

The primary goal of this sharing is to change our mindset.

We are in a moment full of uncertainty and need to make changes, and your decisions at this difficult time will have a significant impact on your company.

This is a turbulent era, and managing change is everyone’s job and task.

The purpose of our gathering here today is not to be anxious together. On the contrary, we believe that the most outstanding, ambitious, and determined individuals will create truly extraordinary businesses against the odds.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuaiWeb3.0 Daily | TRON Mainnet Will Soon Release Chiron Version

- Duties Embezzlement Crime in the Employee Risk Prevention of NFT Digital Collection Company

- The golden age of Web3 protocol unlocking the potential of the future economy

- Decentralization and protocolization of the whole-chain game

- Introducing zkUniswap The First zkAMM

- Exploring the Opportunities of Layer2

- A Quick Understanding of Zora Network, an NFT Application Chain Based on OP Stack