Exploring the Opportunities of Layer2

Layer2 Opportunities ExploredAuthor: ROUTE 2 FI; Translation: Huohuo/Baihua Blockchain

1. Exploring Layer2 (L2) Opportunities

Today I want to take a closer look at L2 (OP, ARB, Polygon, Base). Before EIP-4844, if I saw the price of L2 governance tokens rise, I wouldn’t be surprised, as this change is likely to attract more trading volume to these chains.

In the past few months, I have observed that certain L2 solutions have attracted a large number of transactions, and many projects have been developed on these L2s. So, what’s the big difference? What are these L2 solutions?

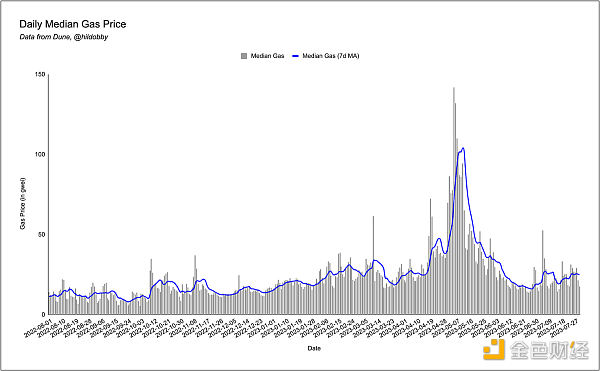

Before diving into L2 solutions, it’s important to understand the current situation of the Ethereum mainnet. As of now, the Ethereum mainnet processes an average of 12 transactions per second, and during periods of high network activity, the cost of transactions on the Ethereum mainnet has reached levels that were once unacceptable for regular cryptocurrency users. This has brought scalability issues to Ethereum. The root of the problem lies in the fact that each node in the network needs to store and verify transactions that have occurred on the network, thus forming the blockchain.

- A Quick Understanding of Zora Network, an NFT Application Chain Based on OP Stack

- Cryptocurrency Involved in Singapore’s Largest Money Laundering Case

- Stateless Client The Journey of Decentralization in Ethereum

In the past few months, I have observed that certain L2 solutions have attracted a large number of transactions, and many projects have been developed on these L2s. So, what’s the big difference? What are these L2 solutions?

To address Ethereum’s scalability issues, L2 solutions have been introduced. L2s are essentially fully independent blockchains built on top of Ethereum, inheriting the security guarantees of Ethereum itself. Each L2 solution has its own unique security guarantees and trade-offs. The most popular L2 scaling approach on Ethereum is Rollup, such as Arbitrum, Optimism, and Base.

Rollup is an L2 solution that can handle transactions on L1. General transactions on Ethereum are usually 156 bytes and have a certain level of data density. Therefore, Rollup can process many transactions at the L2 execution layer and bundle them into a concise transaction to be sent to the L1 state verification layer. By bundling multiple transactions on the L2 execution layer into one transaction, the gas fees for each transaction are greatly reduced. There are many types of Rollup, and they are not all the same, but the most popular ones are Smart Contract Rollup, namely OP Rollup and ZK Rollup.

Smart Contract Rollup is an L2 solution where users can send funds to a Rollup smart contract on L1 (Ethereum), which manages transactions and state changes. A key component of Rollup and blockchain is the Merkle Tree, which is a data structure that stores the state and transactions of each person, allowing L1 to directly verify the state on L2 without downloading the entire state. In short, users interact and transact (change state) with their funds on L2, and L2 sends the Merkle root of the state to L1 for L1 to verify the state of the chain.

However, L1 needs some form of proof to ensure that the Merkle root sent by L2 is valid, which is the difference between the two types of smart contract Rollups. The two main methods of proof are fraud proof and zero-knowledge proof.

OP Rollups such as Arbitrum and Optimism use fraud proof to ultimately determine the state.

Here is how fraud proof works:

– L2 nodes submit the Merkle root along with a small deposit to the L1 smart contract;

– The L1 smart contract defaults to trust the L2 nodes, hence the term “optimistic”. L1 optimistically believes in the updates from L2;

However, this state change does not become final within seven (7) days;

– During these seven (7) days, anyone can submit proof that the submitted Merkle root is fraudulent and then revoke the update, giving the deposited funds to the whistleblower;

– The whistleblower can now prove that the update is fraudulent by verifying all the transactions that occurred in the state root change and confirming the validity of the signatures on each transaction;

– If the state change is not disputed within the seven (7) day period, the update becomes final and immutable.

– As for zero-knowledge (ZK) Rollups, they use zero-knowledge proofs. Here is how zero-knowledge proof works:

– L2 nodes submit the Merkle root along with the proof to the L1 smart contract, proving that L2 has correctly processed the transactions and generated a new Merkle root;

– If L2 nodes attempt to submit a fraudulent update, they will be unable to generate a valid zero-knowledge proof, and therefore the L1 smart contract will not accept the new Merkle root;

Once the zero-knowledge proof is verified, the state update is immediately completed.

Now, as mentioned earlier, because the transaction/gas costs on the mainnet are too high, the existence of L2 is to solve Ethereum’s scalability problem. Let’s take a closer look at how the two main smart contract Rollups calculate the gas fees paid by users. Arbitrum and Optimism both require users to pay two types of fees for transactions: L2 gas (execution fee) and L1 calldata (security fee). L2 gas (execution fee) is similar to gas fees on the mainnet. Each transaction on L2 must pay gas/execution fees, which is equal to the amount of gas used by the transaction multiplied by the current gas price:

(L2 gas price) x (L2 gas used)

As for L1 calldata/security fee, the L1 calldata fee is used to pay for sending the transaction back to Ethereum. This is because the sequencer (the mechanism for collecting and submitting transactions to L1) must pay L1 gas to submit transactions to Ethereum. Here is how this fee is calculated:

(L1 gas price estimate) x (L1 call data size + L1 buffer)

Arbitrum and Optimism have different L2 fee pricing methods, and the most significant difference between them is how Optimism and Arbitrum calculate the cost of L1 computation. Arbitrum uses an oracle to price L1 computation, while Optimism’s L1 computation includes a dynamic overhead (scalar) variable that can be adjusted by the Optimism team to adjust the cost of L1 computation.

One important thing to note is that trading on L2 is much cheaper than trading directly on the Ethereum mainnet, which is why L2 is popular. Currently, the cost of executing and storing on L2 Rollup is low, but it is still expensive for users to publish data to L1 in order to achieve data availability.

Earlier this year, an Ethereum proposal called EIP-4844 was introduced, with plans to launch it by the end of the year. EIP-4844 proposes a new type of transaction that allows for the acceptance of data blocks. These data blocks are designed to be small enough to reduce storage costs on the mainnet. As mentioned earlier, the high transaction costs on the Ethereum mainnet are also a major cost for L2 Rollup solutions when publishing batches and verifying state changes. This proposal could significantly reduce L1 cost overhead, estimated to be about 10-50 times lower.

2. Popular L2 Solutions

1) Arbitrum

Arbitrum is an L2 solution designed to enhance the functionality, speed, scalability, and privacy features of Ethereum smart contracts.

It aims to address some of the current issues with Ethereum smart contracts, such as inefficiency and high execution costs, which have hindered the user experience and made transactions an expensive task.

Arbitrum uses the technology of optimistic rollups. Transactions are executed off-chain and then bundled into batches and submitted to the Ethereum mainnet as calldata. This process can alleviate a significant portion of the computation and storage burden currently borne by Ethereum by moving computation and storage off-chain.

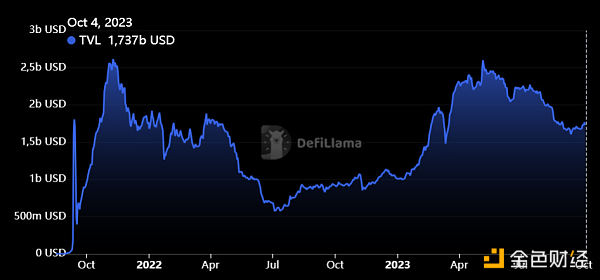

According to DeFiLlama, Arbitrum has a total locked value (TVL) of $1.73 billion.

2) Optimism

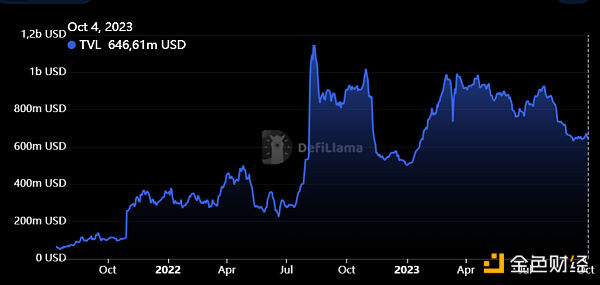

Optimism (OP) is an L2 blockchain built on top of Ethereum. Optimism achieves security from the Ethereum mainnet using optimistic rollups and extends the Ethereum ecosystem. This means that transactions are recorded on Optimism in a trustless manner but ultimately secured on Ethereum.

Optimism is one of the largest scaling solutions for Ethereum, with a total locked value (TVL) exceeding $600 million. It hosts 97 protocols, including major protocols such as the Synthetix (SNX) derivatives trading platform, Uniswap (UNI) decentralized exchange, and Velodrome (VELO) automated market maker.

3) Matic (Polygon)

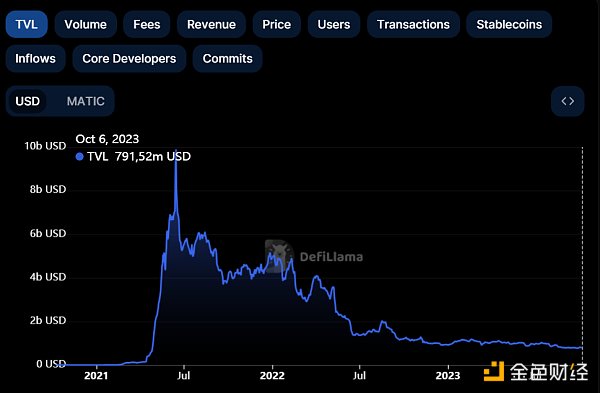

Polygon (formerly known as Matic Network) is an L2 scaling solution supported by Binance and Coinbase. The project aims to drive mass adoption of cryptocurrencies by addressing the scalability issues of many blockchains.

Polygon claims to be able to process up to 65,000 transactions per second on a single sidechain, with a notable block confirmation time of less than two seconds.

Polygon’s native token is MATIC, which is an ERC-20 token running on the Ethereum blockchain. These tokens are used for payment services on Polygon and serve as a settlement currency among users operating within the Polygon ecosystem.

Currently, the total value locked (TVL) in Polygon is approximately $800 million, with Quickswap and PearlFi being the largest native protocols.

4) Base

Base is built on top of Ethereum Layer 2 (L2) and provides the security, stability, and scalability needed to run decentralized applications. You can deploy any codebase based on the Ethereum Virtual Machine (EVM) and introduce users and assets from Ethereum Layer 1, Coinbase, and other interoperable chains. Base is built based on the MIT-licensed OP Stack in collaboration with Optimism.

The total value locked (TVL) in Base is $350 million, with Aerodrome and Friend.tech being the largest DeFi protocols. I have written a lot about Friend.tech in my communication archives and Twitter updates.

3. Summary

It is not surprising to see the price of L2 governance tokens rise before the implementation of EIP-4844, as this change is likely to attract more trading volume to these chains. My assumption here is that the number of transactions on these L2 chains will increase due to the cost-saving for users in gas fees.

However, this article represents the author’s personal opinion, please conduct your own research for security.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Trilogy of AA Products Reflections on AA Applications

- Coinbase Discloses Its Own Case How Hackers Breached Through Layers of Social Engineering

- FriendTech boom temporarily slows down, which simulation platforms are ideal for Web3 social networking?

- Founder Interview Why did Eclipse Architecture choose SolanaVM, Celestia, and Ethereum?

- Messari Friend.tech has over 300,000 users, with a daily revenue exceeding Opensea’s by 6 times, but is it sustainable?

- Only by integrating the metaverse with industries can it have a future.

- OpenAI, which wants to change everything, is being changed.