Three Reasons Why Ethereum Price Cannot Break Through $2000

3 Reasons Ethereum Can't Break $2000Author: Yashu Gola, Cointelegraph; Translation: Song Xue, LianGuai

As of 2023, the price of Ether, the native token of Ethereum, has risen by about 35%. However, its attempts to break through the psychological resistance level of $2,000 have been repeatedly rejected.

ETH/USD daily price chart. Source: TradingView

- The king of Web3 scams is leading Pudgy Penguin to its demise.

- LianGuaiWeb3.0 Daily | TRON Mainnet Will Soon Release Chiron Version

- Duties Embezzlement Crime in the Employee Risk Prevention of NFT Digital Collection Company

Let’s take a closer look at three possible reasons why the Ethereum price has failed to decisively return to $2,000 since May 2022.

Ethereum price depicts bear market fractals

Ethereum’s inability to break through $2,000 in 2023 is similar to the bearish rejection around $425 in 2018-2019.

ETH/USD weekly price chart. Source: TradingView

In both cases, Ethereum appears to be in a recovery phase while paying attention to the Fibonacci retracement level of 0.236 above the Fibonacci line.

In 2018-2019, the 0.236 Fibonacci line near $425 would limit Ethereum’s recovery attempts. In 2023, the same line near $2,000 has become a selling area again, pushing down the price of ETH.

Strength of the US dollar and Bitcoin

In recent months, the strength of the US dollar has suppressed demand for Ethereum, thereby reducing its ability to decisively break through $2,000.

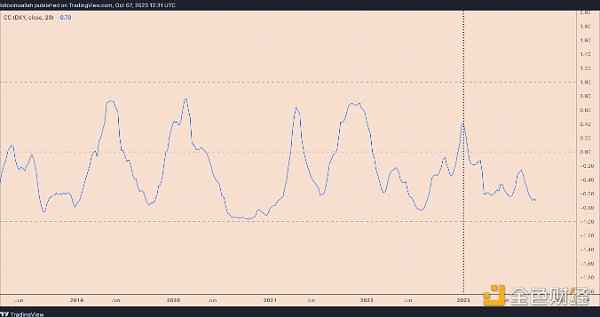

The negative correlation between top cryptocurrencies and the US dollar is the main cause. Especially in 2023, the weekly correlation coefficient between Ethereum and the US Dollar Index (DXY) has been negative, as shown in the following chart.

ETH/USD and DXY weekly correlation coefficient chart. Source: TradingView

Meanwhile, due to the ongoing speculation around a physically-backed Bitcoin ETF, Ethereum’s performance in 2023 has been lagging behind Bitcoin. For example, the widely tracked ETH/BTC trading pair has dropped 20% year-to-date (YTD).

ETH/BTC daily price chart. Source: TradingView

In addition, according to CoinShares’ weekly report, as of 2023, net capital held by investment funds related to Ethereum has decreased by $114 million. In contrast, funds based on Bitcoin attracted $168 million during the same period.

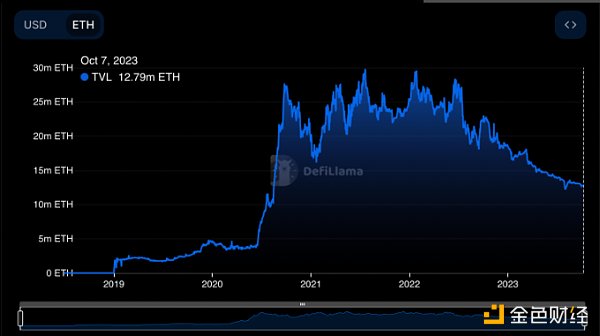

Decline in Ethereum network activity

As of 2023, the total value locked (TVL) in the entire Ethereum ecosystem has decreased from 18.41 million ETH to 12.79 million ETH. As recently warned by analysts at JPMorgan, this highlights a reduction in fund availability and a decrease in investor returns.

Ethereum TVL since 2019. Source: Defi Llama

The decrease in TVL is accompanied by a decrease in gas fees on the Ethereum network, reaching its annual low on October 5th.

According to Dapp Radar data, the number of NFTs and unique active wallets on Ethereum has also decreased by 30% and 16.5% in the past 30 days.

This includes a decrease in key metrics for popular applications, including decentralized exchange Uniswap V2, DEX aggregator 1inch Network, and Ethereum staking provider Lido.

Ethereum Technical Analysis

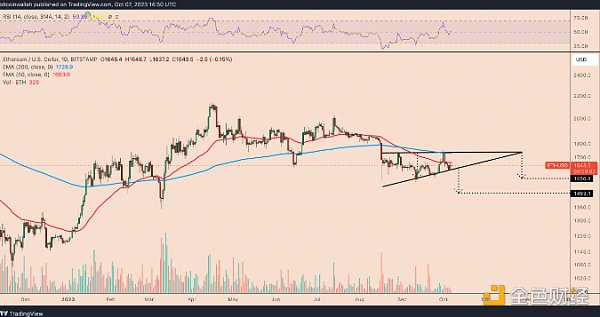

Meanwhile, Ethereum price technicals indicate a potential rebound to the 50-day exponential moving average (50-day EMA; red wave) around $1,665.

However, from a broader perspective, ETH/USD has been in a sustained bearish pattern known as an ascending triangle.

Therefore, if it breaks below the lower trendline of the triangle, the price could plummet by an amount equal to the maximum height of the pattern. In this case, the price of ETH could drop to $1,465 and $1,560 in October 2023, depending on the breakdown point.

ETH/USD daily price chart. Source: TradingView

In the short term, a breakthrough of the 50-day moving average could push the price of ETH to the upper trendline of the triangle near $1,730 in October 2023, aligning with the 200-day moving average (blue wave).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The golden age of Web3 protocol unlocking the potential of the future economy

- Decentralization and protocolization of the whole-chain game

- Introducing zkUniswap The First zkAMM

- Exploring the Opportunities of Layer2

- A Quick Understanding of Zora Network, an NFT Application Chain Based on OP Stack

- Cryptocurrency Involved in Singapore’s Largest Money Laundering Case

- Stateless Client The Journey of Decentralization in Ethereum