Exclusive Interview with Solv Co-founder Meng Yan DeFi and Public Chains Still Have Huge Development Potential, Perfecting Infrastructure is the Key to Mainstream Adoption

Exclusive Interview with Solv Co-founder Meng Yan DeFi and Public Chains Still Have Huge Development Potential, Infrastructure Key to Mainstream Adoption.

NO.1, Can you give a brief introduction about yourself?

Hello everyone, I am Meng Yan, co-founder of Solv Protocol and co-author of the ERC-3525 token standard. Currently, I am mainly responsible for the development of the ERC-3525 ecosystem, focusing on research areas such as on-chain structured finance, programmable payment networks, digital certificates, and account abstraction.

Since joining the blockchain field in 2015, I have been engaged in the dissemination, training, and consulting of blockchain knowledge, until I founded Solv in 2020. In 2019, I had the honor of being named one of the top ten blockchain education teachers in China. At that time, I focused on the dissemination, preaching, and research of token economics, and achieved some small achievements.

I am widely recognized in the domestic blockchain community for proposing the translation of the English word “token” to “通证” (token) and advocating for in-depth research on token economics. I established the theoretical framework for token economics in the early days, so I have a certain influence in the industry. At the same time, I have been invited to renowned domestic universities such as Tsinghua University and Peking University to exchange and teach related knowledge systems and information to students.

- Hive Digital CEO Blockchain and AI can mutually benefit each other

- Why is Ethereum’s position as the king of public blockchains difficult to shake?

- a16z AI combined with blockchain creates four new business models

NO.2, Can you share your entry into the industry experience?

I believe I have three experiences of entering the industry. The first time was in 2015 when I was working at IBM. That year, IBM underwent significant changes, and an Indian technical expert, Arvind Krishna, replaced the venerable John Kelly III as the helm of IBM’s technology and research. After taking office, he quickly announced that blockchain would be included in IBM’s global technology strategy, which had a great impact on me. Because such a clear reform action could be seen as a criticism of the previous strategy. Why change the strategy so eagerly? I became interested in this decision, so I delved into the study of blockchain and was deeply attracted to it. I was originally one of the earliest smartphone software development engineers in China, and later switched to the field of corporate strategic communication and studied politics, economics, finance, and other fields. Combining my technical background with this knowledge, I found that blockchain and digital currencies fit well with my interests, even though it was still just a hobby or professional direction at the time. I wanted to work in the blockchain field, so I studied cryptography courses from Stanford and the University of Maryland, as well as specialized courses on Bitcoin and cryptocurrencies from Princeton University in my spare time.

In April 2017, I entered the industry for the second time and decided to leave IBM to specialize in blockchain and AI-related work. At first, I was involved in both fields, but by August 2017, I decided to fully focus on blockchain. In the first few years, I mainly engaged in dissemination, preaching, training, and consulting work, and achieved good results until 2020.

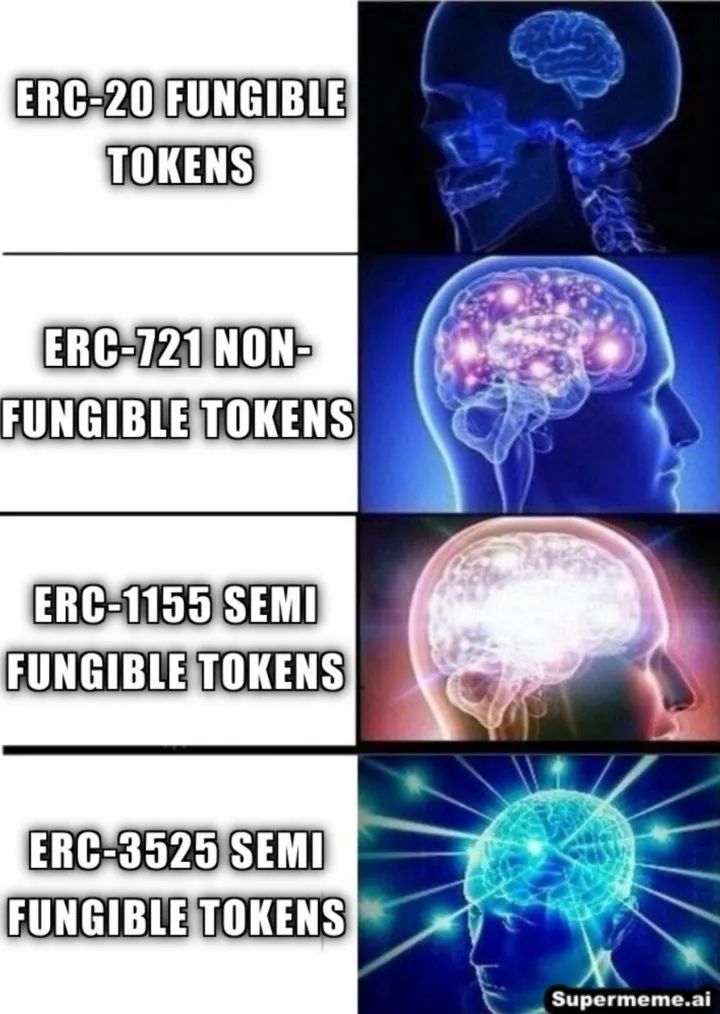

During the epidemic, I had rare breathing time to calm down and carefully consider my next plan. In my previous work, I often traveled on business trips and had meetings almost every week, leaving little time to think and explore new things. But in 2020, I had time to reflect and realized that I should create something new. So, in October 2022, I launched a new project called Solv with my partners. This is my third experience in the field, as I have mainly been engaged in evangelism and related work in the blockchain field before. This time, I decided to fully devote myself to the blockchain field. This decision made me feel the transformation of roles, requiring extra courage and determination. Our project initially aimed to create a new type of financial application NFT, named “Financial NFT”. We realized that existing token standards such as ERC-20 and ERC-721 could not meet our needs in the financial NFT space. Therefore, we decided to develop a new token standard ourselves. So, starting in October 2022, we put in 23 months of effort until September 2022, and our token standard finally gained approval from the Ethereum community and core developers, becoming an industry standard named ERC-3525.

Key Content: The first time I entered the field was in 2015 when I was working at IBM. The company underwent significant changes and introduced blockchain technology as one of its strategies. I developed a strong interest in this and delved into studying and learning related knowledge, hoping to switch to the blockchain field. So, in 2017, I entered the field for the second time, leaving IBM to focus on blockchain work and continuously develop in this field. Finally, in October 2022, I launched the Solv project with my partners, dedicated to creating a new type of financial NFT and developing the new token standard ERC-3525, which gained approval from the Ethereum community and core developers. This is my third experience of fully immersing myself in the blockchain field.

NO.3, Can you explain ERC-3425 and Solv in detail?

ERC-3525 is a new type of token standard. Tokens created based on this standard are called semi-fungible tokens (SFT), which are the counterpart of NFT. Initially, our plan was to create financial NFTs, but during the development process, we found many areas that could be improved, gradually forming the standard for SFT. It went through four major revisions and finally obtained approval and became an industry standard in its fourth version.

So, what exactly does ERC-3525 do? In simple terms, ERC-3525 is used to represent digital bills. This concept exists in Chinese but does not have a direct equivalent in English. Digital bills are extremely common in daily life and business, including invoices, receipts, bills, promissory notes, IOUs, lease agreements, and more. There are also non-financial types of bills, such as vouchers, coupons, discounts, and membership cards. They are even more common in the financial and business fields, such as commercial acceptance bills, bank acceptance bills, bills of lading, warehouse receipts, delivery orders, letters of credit, and even cash and stocks can be seen as a type of bill. There are also more complex structured assets, such as options, futures, asset-backed securities, CDOs, MBS, and more.

In late 2020, we found that there was no standard in the blockchain field for expressing digital bills. Therefore, we decided to develop a new token standard called ERC-3525, also known as SFT, for expressing digital bills. This standard has the following characteristics: first, unlike ERC-20, it is visual and similar to NFT, with a face and rich information. ERC-3525 is able to better express complex financial bill information, such as maturity date, interest rate, interest payment schedule, etc., making it more intuitive and artistic. Second, it is divisible, mergeable, and computable. Like NFT, it can display a lot of information, but unlike NFT, ERC-3525 has the feature of being freely divisible. For example, you can split a bond with a face value of 1000 into one with a face value of 700 and another with a face value of 300, which is beneficial for financial calculations and transactions. Third, it is a container that can package various other assets. You can package different types of assets such as Bitcoin, Ethereum, BNB, etc. into the same ERC-3525, enhancing its inclusiveness and packaging capability. At the same time, as a container, it can independently receive and process asset transfers without the need for a wallet or smart contract. The last advantage is its composability, it can combine multiple ERC-3525 tokens into a larger composition, further increasing the flexibility and diversity of its applications. ERC-3525 is a very flexible token standard that can package other assets and combine with other ERC-3525 tokens to form larger structured and financial structured assets. This makes it a very powerful industry-level token protocol, especially good at expressing and processing complex financial assets such as bills.

As the technical inventors of Solv team, we can see that the application space of this protocol is almost unlimited. However, we cannot develop all the applications at once. We need to choose a clear direction and develop one or two demonstrative products to show the advantages and characteristics of ERC-3525 to attract more partners and developers to use ERC-3525 to develop various applications, whether in gaming, finance, or social aspects. We hope that the products we develop are not just prototypes, but truly valuable applications that can help solve problems and create value. Our goal is to provide truly valuable applications in the market and contribute to the development of the entire blockchain ecosystem.

In the Solv team, we have developed three products, of which the first two were exploratory in nature. Now we mainly focus on an active fund management platform. Active funds are managed by a fund manager (whether human, robot, or algorithm), and investors (including institutions and retail investors) can purchase fund shares to invest with the fund manager. After receiving the funds, the fund manager can actively invest and manage the funds, and distribute the profits to the investors, which is similar to traditional funds that we are familiar with.

However, in the field of blockchain, active funds face some security issues, such as improper behavior by fund managers that may lead to investor losses. To address these problems, we have built a powerful risk control system to ensure that fund managers comply with risk control requirements while safeguarding the safety and interests of investors.

In traditional industries, funds are usually divided into two types: decentralized passive funds and active funds. In blockchain, decentralized passive funds are managed automatically by algorithms. Investors can collateralize their funds (such as Bitcoin, Ethereum, or USDC) in Compound, and the algorithm will calculate the returns based on predefined rules and automatically distribute them to the investors. The returns of these funds are usually not high, and single-digit percentages are common. Recently, there has been an issue of inverted yield curve in US treasury bonds, further lowering the returns of these funds. On the other hand, active funds are managed by a person or a quantitative algorithm to actively adjust positions in order to seek higher returns. However, these funds are exposed to security risks, such as improper behavior by fund managers, running away, or engaging in non-standard transactions, which may result in investor losses. To address these issues, a comprehensive risk control system needs to be built. This risk control system should ensure that fund managers use strategies to achieve higher returns while also ensuring the security and risk control of the funds. Transparency and monitoring are crucial in this process, and there should be emergency measures in place, such as redemption or liquidation.

The product launched by the Solv team is an active fund, which will be launched on March 20, 2023. Through our powerful risk control system, we allow quantitative teams, market makers, and skilled investment managers to issue funds on our platform and raise funds from institutions or retail investors. These fund managers can achieve higher returns through active investment strategies, and we will subject them to strict risk control and monitoring to ensure the safety of funds and protect the interests of investors. Thanks to the successful establishment of our risk control system, our product has achieved remarkable results in the bear market of DeFi protocols and is expected to rank among the top ten.

Key content: We have developed a new token standard ERC-3525, called SFT, for expressing digital bills. This standard features visualization, splitting, merging and calculation, containerization, and composition capabilities. Currently, we focus on a product called “active fund,” which ensures the safety and interests of investors through a powerful risk control system. Our product has achieved remarkable results in the blockchain industry and ranks among the top ten in DeFi protocols.

NO.4, What is your most memorable experience in Web3?

My belief in blockchain and digital assets is closely related to my personal experience. I focus on innovation and view innovation and entrepreneurship as value investment, while being cautious about speculation. This belief is mainly the result of two aspects of my experience.

First of all, after joining the blockchain industry, I experienced a rise and then a loss. At that time, I invested in Ethereum and caught a big increase in early 2017. I thought if it continued to rise like this, I would achieve financial freedom.

However, the ICO boom in 2017 put me in a state of euphoria. I invested in many projects, some from entrepreneurs with prestigious backgrounds, teams from companies like Google and Tencent, as well as some mysterious hacker teams. Some projects were even endorsed by famous figures in the industry. Like many others, I blindly pursued these projects and ended up losing all the money I earned through Bitcoin and Ethereum in five to six investments. From this, I realized that even in a bear market, diversifying investments does not guarantee making money. Even assets as resilient as Bitcoin and Ethereum experience fluctuations, and those with impressive backgrounds may not necessarily understand blockchain or take the industry seriously. Although they may have a deeper technical background and even have succeeded in the Web2 domain, high-quality projects in the blockchain and Web3 domain have unique characteristics. They value community building and require an open community, rather than placing too much emphasis on the background of investors or founders, especially educational background. Instead, it is important to judge the other party’s multiple speculative mentalities very clearly. Upon reflection, I found that many such founders have a weaker understanding and belief in blockchain compared to my own persistence and dedication. They came to make a fortune during the industry’s boom and then gave up due to a lack of persistence and a deep understanding of the industry. In fact, they were just opportunistic entrepreneurs. On the contrary, many successful project teams do not have impressive educational backgrounds, but possess strong practical abilities, profound insights, and a firm grasp of the direction of decentralization. In fact, this is also the source of creating value.

Secondly, over the years, I have made friends with various people in the crypto community and observed their experiences. Although I cannot mention individuals or events specifically, after long-term observation, I have a deep feeling that very few people can come out unscathed in the gambling world or consistently profit in the trading market. Although some people may make huge profits in the short term, such as by catching one or two meme coins or leveraging trading for high returns. When they are proud, they often promote some ideas that are destructive to common sense, but at that time they truly have a triumphant air and a domineering manner, which can influence many people and lead to a distortion of values. However, in the long run, the vast majority of these people will not become ultimate winners. They may go bankrupt in the market’s drastic fluctuations, end up in prison or become fugitives, or more likely, gradually lose all their money and exit the stage. I used to envy those who made huge profits, but eight years of observation made me understand that speculation, especially bottomless speculation and market manipulation, is a game of raising insects. The majority of people’s mentality is severely affected by the market’s drastic fluctuations, gradually losing rationality and principles, and entering a game of mutual harm. This is not the career I want to be involved in.

So I underwent a great change in my investment and wealth concept. On the one hand, it happened to be at this time that I read some classic books on value investing, which sparked my thinking. Warren Buffett has an important concept called the “circle of competence”. Buffett believes that within this circle of competence, one can potentially beat the market. However, building this circle of competence requires long-term accumulation and learning, and establishing sufficient knowledge and beliefs.

So I started to stay away from speculation and focused more on innovation and entrepreneurship. I believe that through innovation, not only can we create value for the entire industry and community, but we can also build our own circle of competence, which is the foundation for success. Through persistent efforts and deep understanding, I believe I can achieve more success in this industry. Therefore, I now devote more energy to innovation and entrepreneurship, considering it as my own value investment approach, believing that this is a reliable path to wealth growth.

Now, I believe that hard work pays off. “Fortune comes from luck, real wealth comes from one’s own efforts and sweat”. In fact, contrary to the beliefs of most people in this industry, I stick to my beliefs. Many people think that the blockchain industry is gambling and speculation and mock me as a nerd, a bookworm. However, I don’t pay much attention to these comments. I have chosen a path that suits my personality and beliefs, creating truly useful and valuable things for this industry and community through innovation and hard work, while building my own circle of competence and investing within it. In this industry, there may be relatively few people with the same beliefs as me. But I have unwavering faith in my beliefs and demonstrate them through practical actions.

Key points: My beliefs and experiences are closely related. After experiencing ups and downs, I have become more cautious and no longer blindly follow investment trends. I believe that wealth comes from the circle of competence, from one’s own understanding and abilities, rather than relying on luck. Innovation and practice are the ways I build my own circle of competence, and I only invest within that circle.

NO.5, what do you think are the potential development tracks in Web3 in the future?

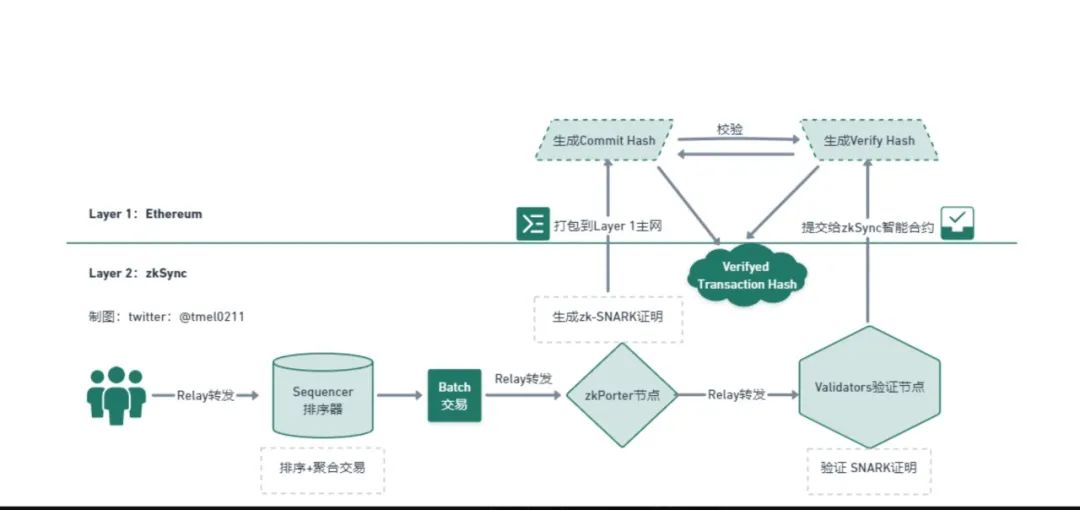

I am very optimistic about the DeFi and public chain tracks. Especially L2 and ZK, I believe they have great prospects at the infrastructure level. ZK can achieve optional and controllable privacy protection while achieving almost unrestricted performance scalability, which is a key technology for the future mainstream applications of blockchain.

The second track I am optimistic about is account abstraction, which is smart contract wallets. This technology will allow us to use digital assets and Web3 applications in the future as easily, conveniently, and interestingly as using ordinary mobile applications, thus reducing the difficulty for ordinary users to use blockchain and digital assets. This will attract billions of ordinary users to join the revolution of the blockchain industry, which I think is a very promising track.

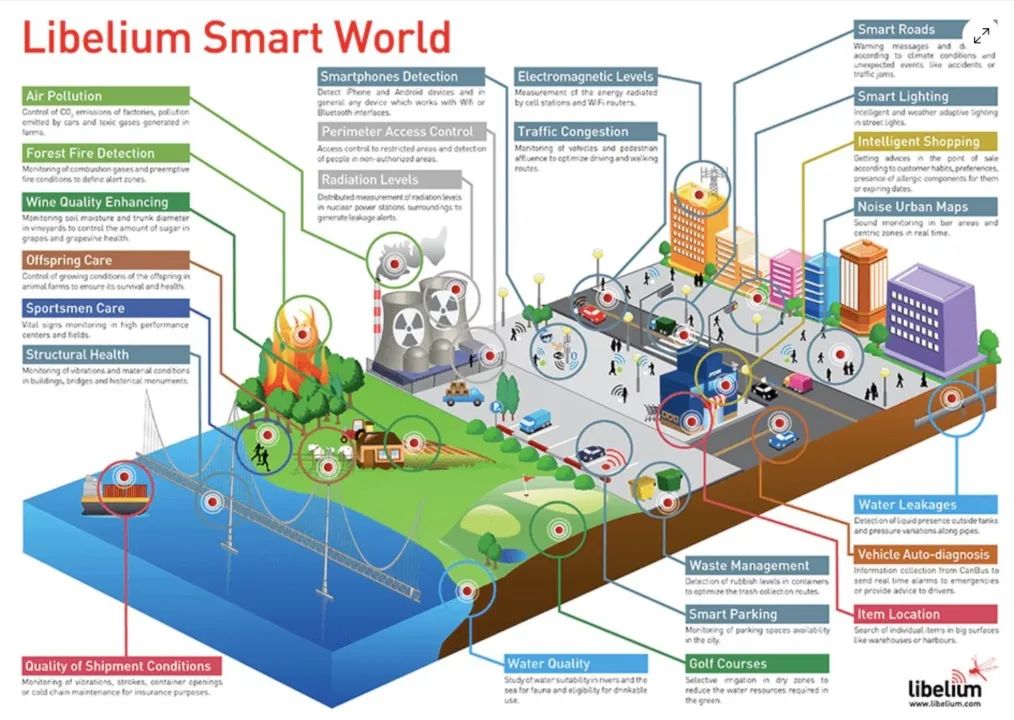

The third track that I am optimistic about is RWA. This track involves mapping real-world assets onto the blockchain, turning them into programmable digital assets that can be regulated and have liquidity. Through blockchain technology, these traditional offline assets can become more convenient, mortgageable, and tradable. I believe that in the future, trillions of dollars of real-world assets will exist in the form of digital assets, making it the largest, most sustainable, and most impactful direction in the industry.

As for Web3 social, although I think it also has great potential, I have not yet seen an ideal solution. I hope to see someone provide a convincing design architecture that can reshape aspects of the internet such as the account system, traffic system, information sharing, and privacy protection. Although this track may develop in the future, I don’t think it will emerge quickly. Currently, there is still a lack of theoretical and academic research results in this field, which requires more time and effort to achieve.

Core content: I am very optimistic about the DeFi and public chain tracks, especially L2 and ZK technologies. They have great prospects at the infrastructure level and can achieve privacy protection and performance scalability. In addition, I believe that account abstraction and the RWA track also have potential. The former can reduce the difficulty of using blockchain and attract more users to participate, while the latter can map real-world assets onto the blockchain to achieve regulation and liquidity. As for the web3 social track, although it has great potential, there is currently a lack of ideal solutions, which requires more time and research to achieve.

NO.6, What are your future plans?

My current focus is on the layout of the RWA track, because our 3525 serves as a digital bill, it has many potential applications not only in the field of encryption and digital assets, but also in the field of Web3 and pure digital assets, as well as in areas such as gaming. Especially in the RWA field, we have incubated a company that specializes in digital invoicing solutions for central bank digital currencies and programmable stablecoins to issue real-world assets. This company has successfully entered the top 14 projects in the Australian central bank’s digital currency pilot project and has been highly praised. Of course, I am also paying attention to the tokenization of national debt projects. We are focusing on how to tokenize national debt in a compliant manner. This includes combining national debt with stablecoins to make it more efficient with the support of 3525 technology.

The second is digital certificates and programmable currencies. I have always believed that payments are the number one application scenario for blockchain. Musk once said that as long as blockchain can solve the payment problem, it will be super useful. In terms of blockchain payments, I think there are two advantages. The first is borderless real-time settlement, and the second is programmability. The former has now been widely applied, but it needs to be combined with the progress of CBDC and RWA to enter the real economy and daily payments. The latter is the most powerful weapon for blockchain payments. We are also studying how to use 3525 technology to express various qualification certificates, such as tickets, business licenses, licenses, and qualification certificates. Even digital assets like invoices are, to some extent, a type of certificate. I believe that ERC-3525, combined with digital certificates, can become one of the best solutions to achieve a secure, open, and programmable currency system.

The third is account abstraction. We are exploring how to combine technology 3525 with technology 6551 to develop the next generation of smart contract wallets, providing richer functionality and more powerful capabilities.

The fourth direction is in the field of environmental protection, involving carbon emission control, waste plastic management, and garbage classification and recycling. These are areas in the real economy that require strong support, and blockchain and technology 3525 provide very suitable solutions. These directions allow us to use technology 3525 in the expression and management of real-world assets, which is a very meaningful application scenario.

Core content: Currently, I am focusing on the RWA track and have incubated a company that provides a digital invoice solution for central bank digital currencies and stablecoins to issue real-world assets. In addition, I am interested in applications in digital certificates, programmable currencies, account abstraction, and environmental protection. These directions have great prospects in using ERC-3525 technology to express and manage real-world assets.

NO.7, what are your thoughts on attracting newcomers?

When it comes to attracting newcomers, I am more concerned about how to bring these high-quality users and funds/assets into this industry. In my opinion, there are two main aspects to this.

One is responsibility. Now, some people, including regulatory agencies, hope that the entire blockchain industry can innovate responsibly. This statement may sound harsh and may not be readily accepted by many friends, but I think it is a very correct proposition. It means innovating responsibly and considering what purpose you want to achieve with what you do. Is it to tap into the greed and ugliness of human nature, exploit the weaknesses of human nature, or promote the advantages of human nature and contribute to society or the economy? This includes contributing to organizations. I know this may sound idealistic, but it is my genuine belief.

Actually, if you had talked to me about this three years ago, I wouldn’t have said these things because my understanding of this matter was not at this level back then. But now, I truly believe that there are many people who are aggressive and talk to you about how to make money, how to get rich quickly, and they make you feel that they are genuine, not pretentious or talking about high-level concepts. Many people sell this kind of image and criticize those who talk about values as hypocrites. Then they tell you, “I’m just here to help you make money.” Many inexperienced people feel that this kind of person is sincere and naturally develop a sense of trust. But in reality, based on my observation over the years, these people are mostly scammers. I have hardly seen anyone who does this with particularly good results because they have lost themselves in the process.

Returning to this topic, I still believe that we need to introduce higher-quality users, institutions, and funds. From this perspective, I think the value proposition of Web3 is to bring our accounts, data, and social relationships back into our own hands, which is a just concept. We do RWA to enhance the liquidity of assets, so that small and medium-sized enterprises and individuals can obtain financial rights and no longer rely on intermediaries such as banks. These are very just and positive goals, and we should strive to do these things well, attract high-quality users, institutions, and funds to enter this industry, and let it grow healthily and sustainably.

I want to emphasize again that those who show their teeth and claws and seem to enjoy revenge often do not have good results. I have seen many such people, and I used to envy them and even wanted to go in their direction, but in the end I realized that their outcome was not optimistic. Some end up in poverty, hiding and running, and some even end up in jail. I don’t envy this kind of life at all, so I choose a more responsible and sustainable development path, not because of my personal moral integrity, but based on my observation of the industry, this is the right direction, a hopeful and sustainable direction for growth.

Ultimately, our goal is to enhance asset liquidity, promote social and economic development, provide more opportunities for small and medium-sized enterprises and individuals, and enable everyone to obtain their rightful financial rights. We hope to attract more responsible, visionary users and funds to jointly promote the development and progress of the entire industry.

Key points: I am very concerned about introducing high-quality users, institutions, and funds into this industry. Responsible innovation is important and should consider contributions to society and the economy. I believe that the concept of justice in Web3 can attract more people to participate, enhance asset liquidity, and promote small and medium-sized enterprises and individuals to obtain financial rights. Choosing a responsible and sustainable development direction is a wise decision. Ultimately, our goal is to make a positive contribution to the development of society.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interview with Sui’s Vice Chief Information Security Officer at Mysten Labs Considerations, Design, and Practice of Sui Blockchain Security

- Sei’s ultimate marketing rule Make headlines through news, and use sunshine airdrops to sweep the cryptocurrency community.

- 10 Ways NFTs are Boosting the African Tourism Industry

- Insights and Reflections Why is it difficult to hear the voices of female entrepreneurs in Web3?

- Exploring the Concept and Function of Layer 3 in Modular Blockchain

- Inventory of Seven Bills that Could Determine the Future of Cryptocurrency in the United States

- Bybit Compensation Manager’s Self-Embezzlement Analysis Vulnerabilities and Improvements in Blockchain Enterprise Financial Management