Sei’s ultimate marketing rule Make headlines through news, and use sunshine airdrops to sweep the cryptocurrency community.

Sei's marketing rule Make news headlines and use airdrops to reach the cryptocurrency community.Author: Xiaofei

Despite being in a fiercely competitive environment with numerous old L1s, emerging new L1s, and multiple L2 races, SeiNetwork has never lacked traffic.

To be honest, when it comes to technological innovation, ecosystem projects, on-chain data, and financing scale, Sei may not be considered outstanding at present. However, when it comes to “marketing oneself” and “managing airdrop expectations,” Sei can be said to be commendable, using a series of combination punches that make the community both love and hate.

How did Sei consistently make headlines in the news and once again rise to the forefront of attention in the crypto community during the launch of Binance Launchpool, with a delayed “sunshine airdrop”?

- 10 Ways NFTs are Boosting the African Tourism Industry

- Insights and Reflections Why is it difficult to hear the voices of female entrepreneurs in Web3?

- Exploring the Concept and Function of Layer 3 in Modular Blockchain

Controversial and attention-grabbing even before launch

In August 2022, Sei launched an incentivized testnet and announced that 1% of the total supply of SEI would be used to reward participants in the testnet. At that time, Sei’s interactive tutorials were already widely circulated in the community, and everyone couldn’t help but feel that the interactive steps of the testnet were quite cumbersome. Not only did it require multiple interactions, but after completing the five major tasks, it also required multiple form submissions and KYC verification. However, the “Luma Mao Studio” adhered to the principle of “the more troublesome, the more we should do” and continued to participate in the interactions.

On May 27, 2023, Sei officially tweeted that the Discord upgrade of the project had been completed, and users could now obtain the “Verified Seilor” role through Humanode facial recognition verification. It is reported that “Verified Seilor” is a badge of authenticity for users, proving that they are real people on the Internet.

As soon as this news came out, the community exploded, with a flurry of accusations that it violated the spirit of Web3, and that facial recognition was required to receive the airdrop?

However, on June 15, the Sei Foundation clarified in a tweet that the misunderstanding that “Sei testnet incentives or airdrops require facial recognition” is unfounded. Participating in Sei’s testnet incentives or airdrops does not require facial recognition or KYC verification. After receiving feedback about a large number of bot attacks on Sei’s Discord, a third-party facial recognition tool was added to Discord, but Sei will not use any form of facial recognition or KYC. Sei is an open-source, permissionless Layer 1.

Although there was no practical change in the back and forth, Sei gained attention and popularity through media and social media discussions.

Schrodinger’s Airdrop and an Anxious Community

Afterwards, rumors circulated in the community that Sei would soon be listed on Binance, until August 1, when Binance announced that Sei would be listed on Binance Launchpool and trading would start on August 15. The token details are as follows: Total token supply: 10,000,000,000 SEI; Initial circulating supply: 1,800,000,000 SEI (18% of the total token supply); Mining supply: 300,000,000 SEI (3% of the total token supply).

However, what the community is dissatisfied with is that even though the launch of Launchpool has been clearly stated, Sei has not yet announced the airdrop details and quantity, only publishing a brief economic model. In response to the questions raised by community members, Mod only replied: There is an airdrop plan, everything is subject to official announcements.

On August 11th, the Sei Foundation stated: The mission of the Sei Foundation is to support the decentralization of the Sei blockchain from the very beginning. The mainnet includes Sei airdrops and incentivized testnet rewards. The initial major token distribution aims to identify loyalty and enhance the global influence of Sei blockchain as the best place to build Web3 applications.

At this time, many people in the community have noticed that in Sei’s official statement, the words “airdrop” and “testnet incentives” have always been separated, and they do not seem to be equivalent.

It wasn’t until the night before the launch that Sei finally released detailed tokenomics: 48% of tokens allocated to the ecosystem; 20% of tokens allocated to the team; 20% of tokens allocated to investors; 9% of tokens allocated to the foundation; 3% of tokens allocated to Launchpool; among them, 48% of tokens allocated to the ecosystem are used for collateral rewards, ecosystem initiatives, and Sei airdrops and incentives. Season 1 airdrop will distribute 3% of the SEI token supply to reward community users.

However, the specific rules for the airdrop have not been announced.

Cross-chain blind box airdrop ignites the community again

And it wasn’t until the day SEI went live on Binance for trading that the airdrop rules came unexpectedly late, igniting community discussions once again and becoming a hot topic.

Sei announced that it will conduct a “cross-chain” airdrop to active users in six major ecosystems when the LianGuaicific-1 mainnet is launched. The specific rules are as follows: Active users on Solana, Ethereum, Arbitrum, Polygon, BNBChain, Osmosis, and other chains have the opportunity to be selected for the airdrop whitelist. To claim the airdrop, users need to create a Sei wallet after the mainnet launch and bridge specified assets to the Sei network.

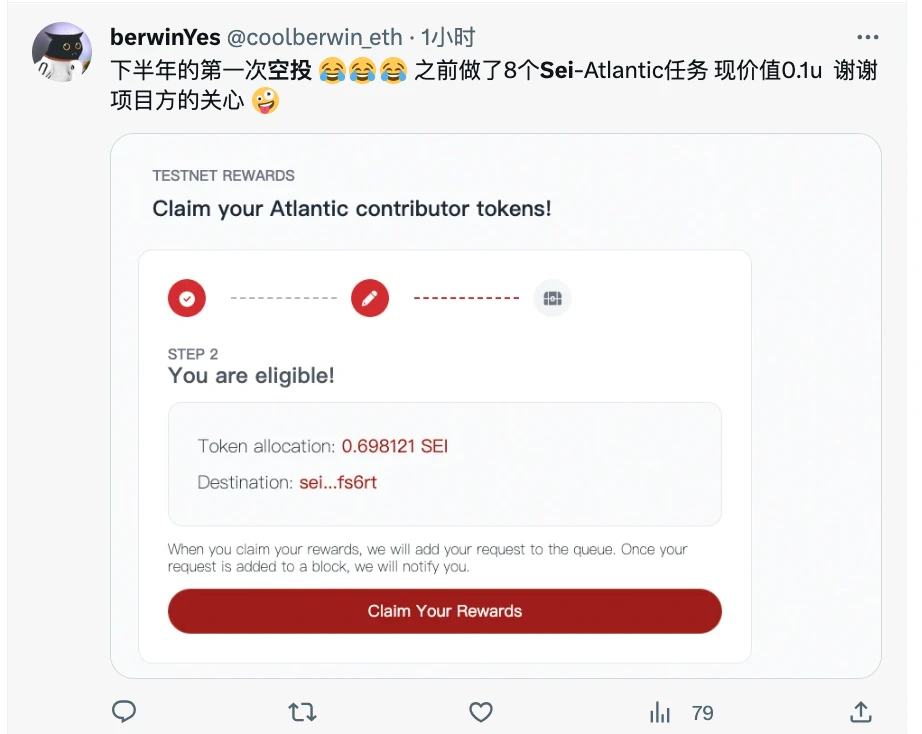

Those who participated in Sei’s Atlantic 2 testnet and/or ambassador program have different reward rules, and they are not called “airdrops”.

This seemingly “sunshine-filled” airdrop rule has caused a stir in the community. However, some users have expressed that this set of rules is similar to Cosmos’ cross-chain operations, similar to the evmos airdrop in the past. It is not common to see airdrop rules in public chains, but it is not surprising as the Sei team itself comes from Cosmos.

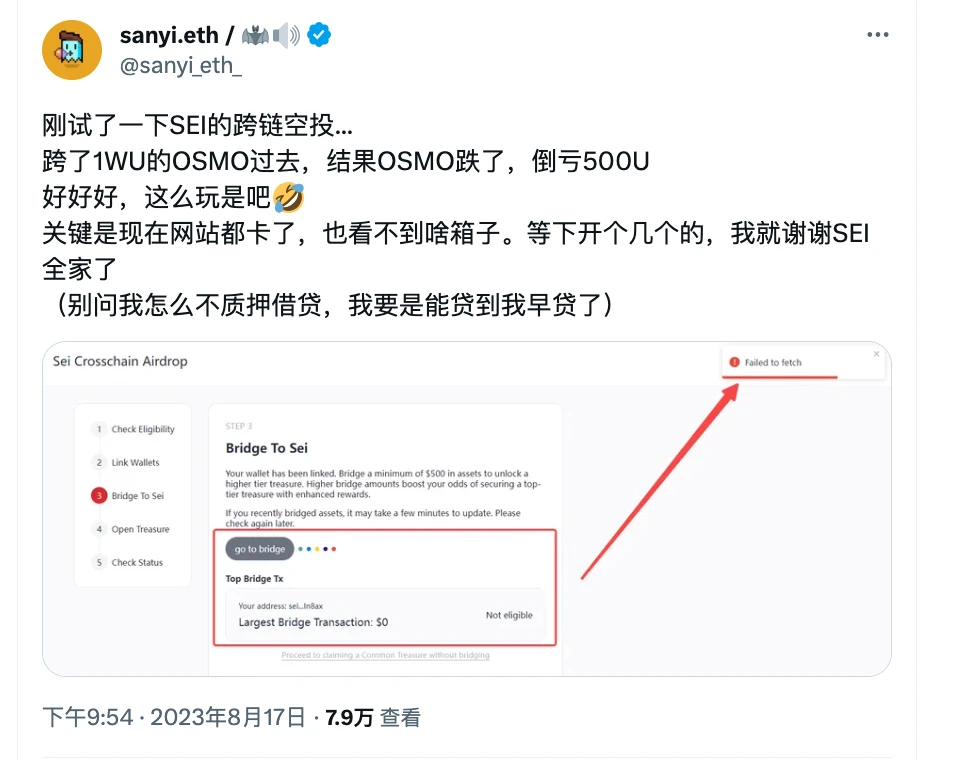

Community testing has found that when claiming the SEI airdrop, users can choose between the “airdrop treasure chest” and the “cross-chain treasure chest”. Users who choose the “cross-chain treasure chest” will receive at least $500 worth of ETH or USDC and other crypto assets bridged to Sei, and will receive a certain amount of SEI based on the value of the bridged assets.

This gameplay of whitelisting active addresses on multiple chains and randomly distributing airdrop quantities has sparked intense discussions in the community on how to obtain more airdrops. The conclusion reached is:Basically, the more money whitelisted addresses participate in cross-chain, the more airdrops they receive. The screenshot of someone receiving over 10,000 SEI in airdrop has motivated more people to join, and many people have borrowed for cross-chain transactions.

Later, Sei announced that due to strong demand, the Sei Foundation will increase the number of eligible wallets for cross-chain airdrops from 500,000 to 1.5 million, allowing more people to participate. Because many people choose the relatively niche Osmosis for cross-chain transactions, and they must hold more than 500U to receive the airdrop, the price of OSMO temporarily increased.

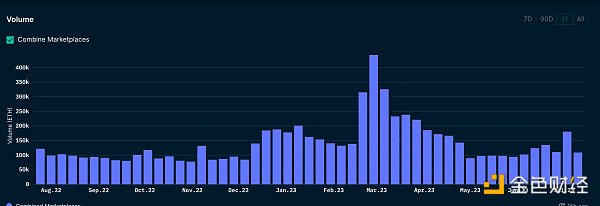

Of course, except for a few big whales, most people only received a small reward, while Sei’s cross-chain data soared.

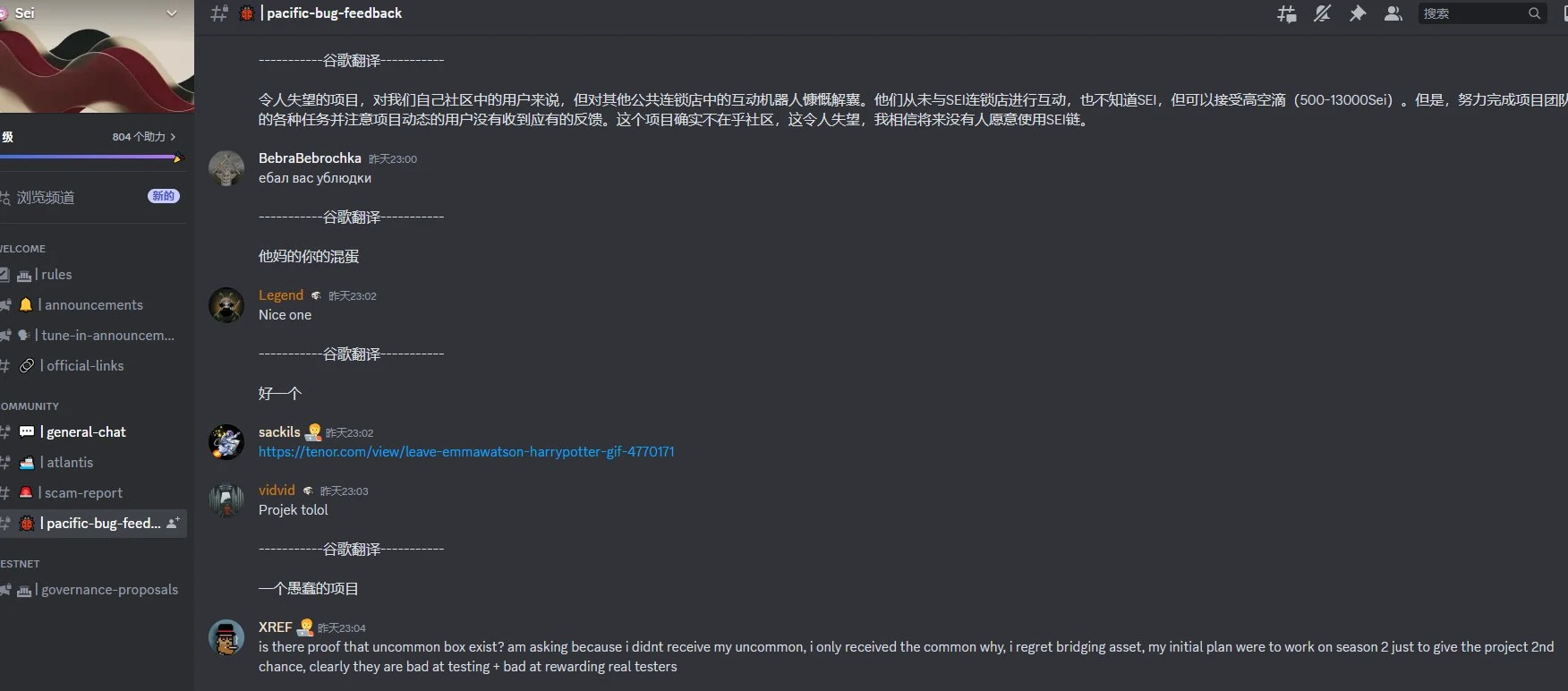

Many people praised Sei for being attentive and innovative in its mechanisms, but this also caused dissatisfaction among some users. First, users who had completed complex incentive tasks on the testnet felt that their efforts were not as valuable as those of the big cross-chain holders, and they felt that the project team did not value the community. Second, some users complained that they had a significant amount of cross-chain transactions but received very few rewards. They criticized the blind box mechanism and expressed their dissatisfaction on Discord.

Last night, due to the overwhelming demand for airdrop claims, the network was congested. Many community users reported that they got stuck on the third step of the LianGuaicific-1 webpage when claiming the cross-chain airdrop, and the page remained stuck for a long time, preventing them from completing the claim process smoothly.

To make matters worse, Bitcoin, which had been trading sideways for a long time, plummeted last night, dropping nearly $4,000 in a short period of time. Naturally, other tokens also fell in response. Some users expressed on social media that they borrowed money to participate in cross-chain transactions in order to claim Sei’s airdrop, but while they were stuck on one side, their positions were liquidated on the other side. Even for those who were not liquidated, the rewards they received might not be enough to cover the decline in token prices…

Final Thoughts

Regardless, Sei’s case seems to be a “success” in terms of its mechanisms and innovative design, generating a lot of discussions. However, in the long run, it may also be a form of consumption and overdraft in another dimension, and it is crucial for subsequent operations to keep up.

Whether the project team should conduct airdrops and how to establish rules and standards has long been a recurring topic in the cryptocurrency industry.

Originally, airdrops were meant to incentivize active users and achieve a cold start, but under the incentive of becoming rich overnight, countless opportunists have joined in with dreams of freedom. This has led to the emergence of many studios, which has forced project teams to be on guard and gradually become trapped in a dilemma of seduction, tug-of-war, love-hate, and mutual destruction.

In the current situation where the market continues to decline and project parties tighten their belts, it is becoming increasingly difficult to “get rich through airdrops”. According to recent media reports, many airdrop studios are struggling to make ends meet and have closed down due to lack of support.

Indeed, this is also the result of industry reshuffling and iteration. DeFi OG Mindao once bluntly stated on Twitter: Nowadays, airdrop farmers have become industrialized, and the airdrop rules are so predictable that witch resistance is simply impossible. Forgive me for being frank, it is best to completely give up airdrops, or distribute more tokens to ordinary liquidity mining after TGE.

However, so far there is no convincing conclusion to this discussion. Perhaps we can only hope for the market to improve again and new traffic to enter, forming a healthy ecological cycle in the industry.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of Seven Bills that Could Determine the Future of Cryptocurrency in the United States

- Bybit Compensation Manager’s Self-Embezzlement Analysis Vulnerabilities and Improvements in Blockchain Enterprise Financial Management

- The integration of blockchain and AI is a natural demand analysis of relevant use cases.

- Interview with Linea product manager ConsenSys entering the crowded Layer2 race, what is unique about Linea?

- Legal Perspectives on Blockchain Issues and Pathways

- Exploration of Full-Chain Games Freedom, Liberation, Authenticity, and the On-chain Deployment of Game Core

- How does the on-chain intelligence platform Arkham accurately target ICP?