Facebook's "blockchain revolution": Entering the field of cryptocurrency payment, is it really ready?

From February 14th, JP Morgan Chase and the cryptocurrency "Valentine's Official Announcement", to today's enthusiasm for Facebook to enter the cryptocurrency payment system, the giant figure appeared more frequently in the blockchain market.

The entry of the giants is certainly an overall positive for the blockchain industry, but at the same time, to some extent, the giants are "reforming their own lives." This "revolution" determination is the key to whether the giant can really lay out the blockchain and promote the development of blockchain technology.

Beginning in 2018, news about Facebook’s intention to introduce cryptocurrencies has gone.

- China rushes to the highlands and publishes the world's first telecommunication industry blockchain application white paper

- Jinshajiang Capital Completes Investment in tZERO, Overstock or Delisting from Nasdaq

- BTC stands out, the second line or the relay

According to the New York Times reported in December last year, Facebook plans to introduce a cryptocurrency anchored with a basket of legal tenders, and is ready to apply it to WhatsApp for users to send and receive funds between peers.

Recently, Facebook's currency program has made the latest progress. On May 3, the Wall Street Journal quoted sources as saying that Facebook's cryptocurrency payment system project, Project Libra, has been secretly promoted for more than a year. Currently, Facebook is seeking to work with a number of financial companies and online e-commerce companies such as Visa and MasterCard. According to other information, Facebook has obtained the "Libra" trademark from a cryptocurrency tax company on April 20, local time.

We can't help but ask: What is the real reason why Facebook is so keen on blockchain and digital currency? What is the strategic layout? Can it cause a huge change in the blockchain industry?

1. When a giant walking on a leg talks about Facebook, the first thing that comes to mind is “social”, and secondly it may be “advertising”.

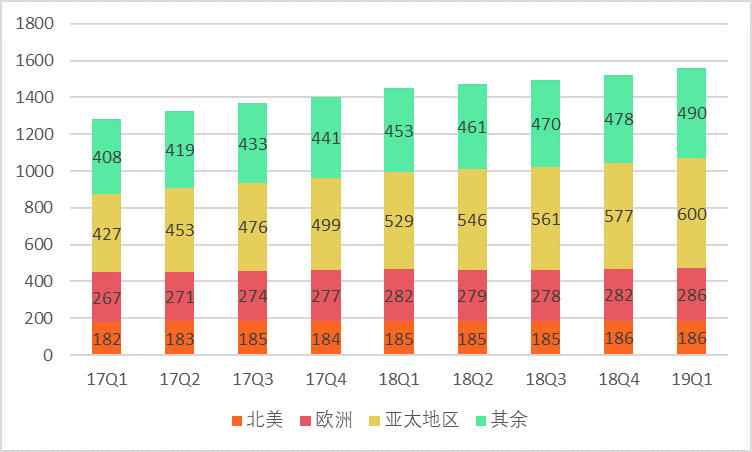

Social is the basic property of Facebook. The strength of this property has brought a huge amount of users and data to Facebook. According to the financial report data released on April 24, local time, Facebook's daily active users in the first quarter was 1.56 billion, an increase of 8% year-on-year; the number of active users per month was 2.38 billion, an increase of 8%.

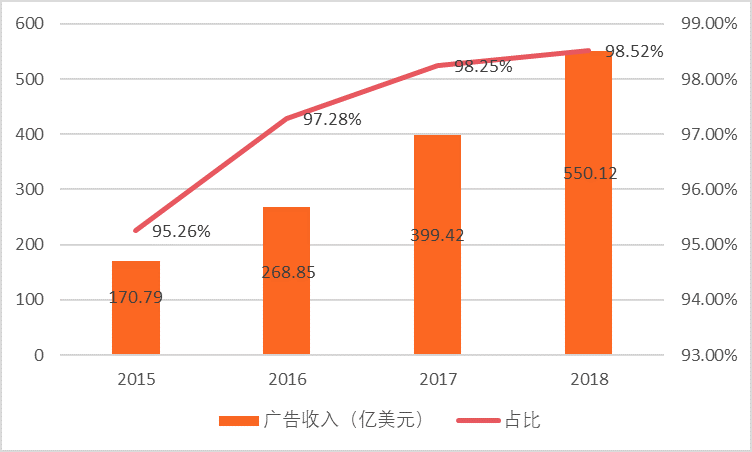

And advertising is Facebook's current main monetization channel and source of income. According to financial report data, Facebook's revenue in the first quarter of 2019 was US$15.08 billion, of which advertising revenue was US$14.912 billion, accounting for 98.9% of the company's total revenue. Mobile advertising revenue accounted for 93% of overall advertising revenue, up from 91% in the same period last year.

It can be said that Facebook relies on "social" and "advertising" to become one of the richest companies in the world.

In 2018, Facebook's annual revenue was 55.84 billion US dollars, net income was 22 billion US dollars, and the company's total market value was as high as 550 billion US dollars. In the "Top 2020 World Brands" released by the World Brand Lab in December 2018, Facebook ranked 11th.

However, revenue models that are highly dependent on advertising revenue are also becoming a potential crisis for Facebook. As can be seen from the above data, the current revenue of Facebook is almost entirely from advertising. The revenue share of other businesses such as online games is decreasing year by year, and emerging businesses such as Oculus are unable to bring huge revenue in the short term.

Although in the first quarter of 2019, Facebook's advertising business performance is still eye-catching, it is like the company's call in a conference call with analysts: the company will face huge resistance in advertising in the second half of the year.

This kind of resistance comes from both internal and external aspects: internal data security and privacy issues occur frequently, which has gradually led to the loss of trust of users, affecting the effectiveness of advertising; external Google, Amazon and other strong enemies, especially in recent years. Digital advertising is a sudden emergence. With high conversion rate and accurate delivery, it is increasingly favored by advertisers. In the fourth quarter of 2018 alone, Amazon's advertising revenue exceeded $5 billion, a growth rate of 97%, almost doubled. Although it is still far from Facebook, Amazon is actually changing the original pattern of the digital advertising market.

Facebook is like a giant walking on one leg. The surface is infinite, but it is difficult. Zach Berg is in desperate need of finding "another foot" for Facebook, which can bring about a "foot" of considerable revenue and balanced revenue structure. For now, Zach Berg chose the blockchain and cryptocurrency.

2. The crisis of trust continues to brew

Facebook described this in the 2018 Annual Report: "Facebook is a social media that relies entirely on advertising to make money and loses everything when it loses users."

If the single revenue structure may put Facebook at risk, then data security and user privacy issues may directly shake the roots – losing users.

As a network and database of massive data on one-third of the world's population, Facebook is critical to the eyes of global users and regulators.

These data are even enough to influence the election of a country. In March 2018, Facebook was exposed to allow a data agency called Cambridge Analytica to take advantage of the data of as many as 87 million users acquired via Facebook. These intimate user data were used during the 2016 US presidential election, the Trump campaign team's targeted political propaganda for the public, and other political activities. The scandal has raised concerns among global Facebook users about the privacy of personal data.

Later in September, Facebook was again hacked due to security system vulnerabilities, revealing more than 30 million users' personal information, and 14 million users' sensitive information was obtained by hackers.

By December of last year, Facebook was exposed to software vulnerabilities and could lead to the disclosure of private photos of 68 million users.

In 2018, it was a tough year for Facebook. Data security and user privacy issues alone are difficult to deal with. The time was set to 2019, but the haze did not dissipate. Data security and user privacy issues are still the sword of Damocles hanging over Facebook.

In April 2019, Facebook was fined $47 by the local court for failing to tell Russian regulators exactly where to store Russian users' data. Although the amount of $47 is not worth mentioning for Facebook in terms of amount, this fine may eventually lead to the Russian government's ban on Facebook's normal operations in the country.

In addition, Facebook faces the responsibility of European multinational regulators including Ireland, Belgium and Germany. The US Federal Trade Commission (FTC) is currently negotiating with Facebook. In addition to the possible financial penalties of up to $3 billion to $5 billion for Facebook, the FTC may also be directly accountable to its founder, Zach Berg, on the grounds of leadership oversight.

Facebook, which has been attacked by the enemy, can only choose to “break the money”: In its first quarterly earnings report for 2019, Facebook has set aside $3 billion as a possible fine for emergency measures.

If the $3 billion penalty can offset past scandals, Facebook "does not make a profit." But in fact, the user's trust crisis for Facebook cannot be dissipated by the fines of the regulatory authorities.

In order to regain user trust, Facebook announced that it will establish an independent privacy oversight committee within the company, and Zach Berg will personally act as the “designated compliance officer” responsible for the implementation of the company's privacy policy. At the same time, Zach Berg announced in April that Facebook will turn to building a "simpler platform, privacy first", from the current sharing of a large number of information flow mode to a more intimate friend chat mode, and burned after reading. But these changes take years to be truly operational, and trust cannot be reconstructed in the short term.

User data security and privacy issues may also be one of the reasons Facebook is currently focusing on blockchain and digital currency. After all, the blockchain is known as the “trust machine” and has a unique advantage in terms of user privacy and privacy protection.

3, long journey: from social to payment

Zach Berg has always been friendly to blockchain technology. For now, Facebook not only wants to use blockchain technology to solve privacy problems, but is prepared to enter the payment field by issuing digital currency to enrich its business level.

After all, entering the payment scene is something Facebook has always dreamed of, but it is always difficult to repay.

Why is Facebook so persistent about paying? ——Facebook wants to build a complete closed-loop ecosystem, and get rid of the current revenue model that relies too much on a single business. Payment is the most important basic scenario.

Taking the game business as an example, the social-based and driving mode of game scene development has been proved to be feasible and effective by Tencent. According to the data of Tencent Financial Report in 2018, the revenue of Tencent's mobile game business in 2018 was 77.8 billion yuan, a year-on-year increase of 24%, accounting for 41% of the annual revenue, which is an important source of Tencent's revenue.

Facebook has billions of users, and it is more user-friendly than the App Store, which lacks social elements, and can drive potential players to join. Why can't you generate revenue for Facebook?

In this regard, there are foreign media that question the obstacles for Facebook to expand its game business because of the lack of payment channels. Bloomberg has also said that the lack of payment tools will become a key obstacle for Facebook to generate revenue through mobile games, which is believed to force it to rely on Apple and Google's payment channels to cut its profits in the game business.

In addition to the game, whether it is the new product shopping function of Instagram mentioned in the 2019 Facebook Developer Conference or the sale of smart hardware, it is also inseparable from the payment of this basic scenario.

Some analysts believe that Facebook is preparing to issue digital currency and enter the payment scene in an attempt to become a global "payment treasure." However, Binary Finance believes that if there is another Chinese Internet company that Facebook deserves, it must be Tencent or Tencent’s WeChat.

First of all, the basic business of the two companies is the same, that is, social. This is different from Alipay's e-commerce-based development model. Although Alipay has been vigorously developing its social business in recent years, it has been slow.

Secondly, WeChat currently builds a complete ecological closed loop across communication, social, media, e-commerce, payment and many other scenarios, and has become an indispensable part of Chinese users' work and life. And this model is exactly what Facebook is currently trying to lay out. In recent years, Facebook has also consciously "impersonated" WeChat: it has been on the line with stickers, corporate public number, media content number and other similar WeChat functions.

Therefore, Facebook wants to become an international version of "WeChat."

Then why does Facebook not simply imitate WeChat in the payment field, but choose to use cryptocurrency to build a payment system?

Analysts believe that simple imitation can only be left behind, and Zach Berg obviously does not want to make Facebook a "piracy WeChat", so he needs to be one step ahead in the most critical and basic payment process:

First, the use of cryptocurrency as a payment system to achieve peer-to-peer (P2P) payments is easier to reach users than traditional mobile payments, and is a lower-level direct economic system;

Second, from the current public information, the cryptocurrency issued by Facebook will be anchored with the value of a basket of legal tender. This stable cryptocurrency has obvious advantages in payment scenarios, especially cross-border payment, which can effectively reduce the cost of the payment system and enhance the trust between payment entities. This is not possible with WeChat mobile payment.

4. Things you have to know about "Project Libra"

The above has basically explained why Facebook and Zach Berg are so popular with blockchain technology and will choose to build a payment system using cryptocurrency. So, what are the points of concern for the key cryptocurrency payment system project “Project Libra”?

To understand the essence of a new thing, you must first know what it is. The most basic question: Is the digital currency that Facebook is about to issue a stable currency? – Since it will be anchored to a basket of legal currency values, its price must also be stable. From this perspective, it is a stable currency. It differs from the mainstream stable currency on the market mainly in the use of scenarios.

But as Pan Chao, the head of the MakerDAO Chinese community, said in an interview with Zero Finance and Binary, “The currency itself is divided into classes, and so is the stable currency. In different strata, the stable currency needs to be solved in different scenarios. Different issues." From this point of view, the mainstream stable currency such as USDT and USDC is the trading stable currency, JPM Coin of JPMorgan Chase is the settlement stable currency, and Facebook's stable cryptocurrency is the payment stable currency.

Facebook's cryptocurrency will be mainly used to build a payment network. While eliminating credit card fees, it will eliminate the problem that the price of cryptographic assets such as BTC and ETH is too large to be used for daily payment. At the same time, these cryptocurrencies will be fused into their core advertising system for future user behavior, similar to "see advertising is mining."

Facebook is actively integrating its three major communication social platforms, WhatsApp, Facebook Massager and Instagram, in the hope that future cryptocurrencies and payments will cover these huge user groups.

According to Bloomberg News reported in December 2018, Facebook's cryptocurrency may be the first to be released in India, and WhatsApp users can use cryptocurrency to send money to India. Analysts believe that Facebook's choice of India's "starting" may be due to the following considerations: India has the world's largest Facebook user; India has a huge remittance market, according to data released by the World Bank, global remittance finance in 2017 was 613 billion US dollars, Of this, 69 billion came from remittances sent by Indian residents to their hometowns.

At the same time, Facebook is also negotiating with Visa and MasterCard, and is also negotiating with financial information service company first data and some e-commerce platforms.

However, no solution can be perfect, as is the blockchain and cryptocurrency. Facebook wants to build a payment system through cryptocurrencies, but the advantages exist, but there are also some problems.

What everyone cares most about and most often talk about is how much control does Facebook have as an issuer on cryptocurrency? Insufficient control, it is difficult for Facebook to profit from the transaction fee of the cryptocurrency; if fully controlled, this cryptocurrency will become a fully centralized cryptocurrency that is centrally issued and controlled, which is considered to be a violation of the zone. The basic vision of the blockchain. Zero Financial. Binary believes that people with such concerns are more or less a little bit of blockchain feelings. But in reality, WeChat does not control the renminbi, and can also benefit from the payment business; so even if Facebook does not control the cryptocurrency issued, it can get revenue from its extended scenario. Payment is only the foundation, the key is to build a business ecosystem with continuous hematopoietic capacity around social and payment.

In addition, some analysts worry that the cryptocurrency issued by Facebook cannot be trusted in the decentralized encryption community. Zero Financial, Binary believes that this is not a concern. First of all, Facebook itself has billions of users, and the user scale is completely crushed to centralize the encryption community. Secondly, Facebook's cryptocurrency may be issued by a centralized organization based on the alliance chain, and the current encryption community is more based on public Spontaneously formed by the chain project. Therefore, there is no necessary connection between the two, and Facebook does not need to please the encryption community.

But like other cryptocurrency items, compliance and regulatory issues are always lingering. How Facebook guarantees that its cryptocurrency is not a tool for criminals and hackers. In addition, due to the globalization of the blockchain and cryptocurrency, Facebook also needs to obtain permission from multinational regulators. Therefore, the issue of digital currency by Facebook will surely make the road bumpy under the current regulatory situation.

More critically, the use of blockchain and cryptocurrency is to some extent a giant in the "life of his own life", is Facebook really ready?

The reason why the Internet giant has become a giant is largely due to the monopoly of data, while the blockchain returns the user's personal data to the user. Moreover, in the current situation where regulation is still unclear, the use of cryptocurrencies is extremely risky. Although Zach Berg is very optimistic about blockchain technology, he also said in a conference call, "I am very convinced that power should be delegated to individuals. One of the ways we talk about decentralization is independent encryption and messaging. There is indeed a very broad meaning. But as a company with a market capitalization of $550 billion, Facebook is no longer a private item of one person, involving countless stakeholders. The attitudes of shareholders and users may be somewhat more important than the attitude of the founders.

So, not only Zach Berg, is the whole Facebook really ready? Even in the "revolution."

Author: Mr.J

Source: Zero Finance · Binary

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Behind the JPM Coin hotspot: JPMorgan Chase is quietly playing the next big game

- Venezuela mining excavation

- Blockchain + Supply Chain Finance: Market Competitive Product Analysis

- HashQuark CEO Li Chen: Staking economy faces centralization risks, PoW+PoS is the mainstream

- Viewpoint | The most amazing passage in The Bitcoin Standard (below)

- Getting started with blockchain | Why hacking the trading platform without attacking Alipay?

- The hacker is keeping a close eye on the currency exchange: 5 were killed and 8 were "Lai Lai"