Fed acknowledges digital dollar outlook, US will issue new regulations on digital currency payments

Source: Guosheng Blockchain Research Institute

Summary

Fed members believe that the digital dollar will help the United States maintain its advantage in global trade. Federal Reserve Board nominee Judy Shelton said at a Senate hearing on February 13 that the United States needs fintech innovation to stay ahead, and digitization may help maintain the dollar's advantage in global trade. Judy Sheldon said the dollar is now the world's dominant reserve currency, but it can't stop there. Some competitors are looking for alternatives to the dollar, so the US must stay ahead to ensure that the dollar continues to provide the world's best currency.

- EOS retail: BM is like a dream young man

- Blockchain and artificial intelligence company "Light Tree Technology" received tens of millions of RMB in Series A financing, the investor is Yanfeng Qiyun

- The first vote of the year! Metaverse DNA is jointly blessed by dozens of institutions in the Nova Club Investment Agency Alliance

US Treasury Secretary: New regulations on encryption and digital payments will soon be released. According to Bloomberg, Treasury Secretary Steven Mnuchin said the United States will soon announce new regulations related to cryptocurrencies and digital payment systems. At a Senate Finance Committee hearing, Stephen Mnuchin said that the Treasury's Financial Crimes Enforcement Network is developing rules to increase transparency and prevent the use of cryptocurrencies as "secret bank accounts." He said that the US Treasury Department will introduce new regulations to clarify transparency requirements so that law enforcement officers can clearly see where the funds go and ensure that the money will not be used for money laundering.

JP Morgan Chase is discussing the merger of its blockchain division Quorum and ConsenSys to stimulate a strong rebound in Ethereum. Reuters reports that JPMorgan Chase & Co. (JPM.N) is in talks to merge its blockchain division, Quorum, with Ethereum developer ConsenSys. The transaction is expected to be formally announced within the next six months, but financial terms are unclear. There are currently around 25 people working on the Quorum team worldwide, and it is unclear whether they will join ConsenSys after the merger. Stimulated by this news, Ethereum ushered in a notable rebound. As of February 17, the price exceeded 250 US dollars. On February 15, 2019, JP Morgan announced that it would begin testing JPM Coin, which is based on the Quorum platform. There is no doubt that traditional financial institutions such as JP Morgan Chase will continue to advance pragmatically and steadily in blockchain advancement.

The State Administration of Foreign Exchange will strengthen the construction of a cross-border financial blockchain service platform. On February 15, the State Council held a press conference on the joint prevention and control mechanism for pneumonia epidemic of new coronavirus infection. Xuan Changneng, deputy director of the State Administration of Foreign Exchange, introduced the measures taken by the State Administration of Foreign Exchange to support the resumption of production and production of enterprises. He said that on the one hand, it is necessary to strengthen the construction of cross-border financial blockchain service platforms and alleviate the problems of financing difficulties and expensive financing for SMEs. On the other hand, continue to simplify the procedures for revenue and expenditure of goods trade of small and micro cross-border e-commerce enterprises, further facilitate cross-border e-commerce settlement, guide bank payment institutions to provide market entities with electronic payment services under current accounts based on transaction electronic information, and further facilitate small, medium and micro enterprises Link cross-border e-commerce trade settlement to improve the efficiency of fund settlement for small, medium and micro enterprises.

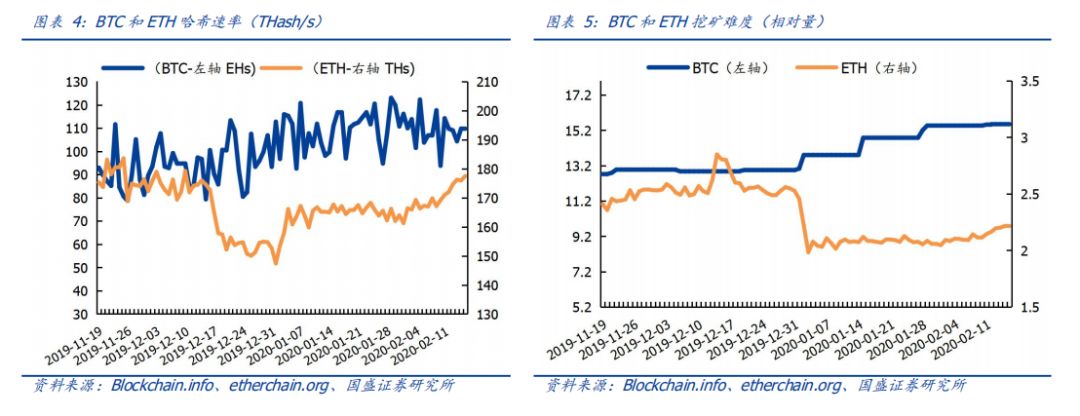

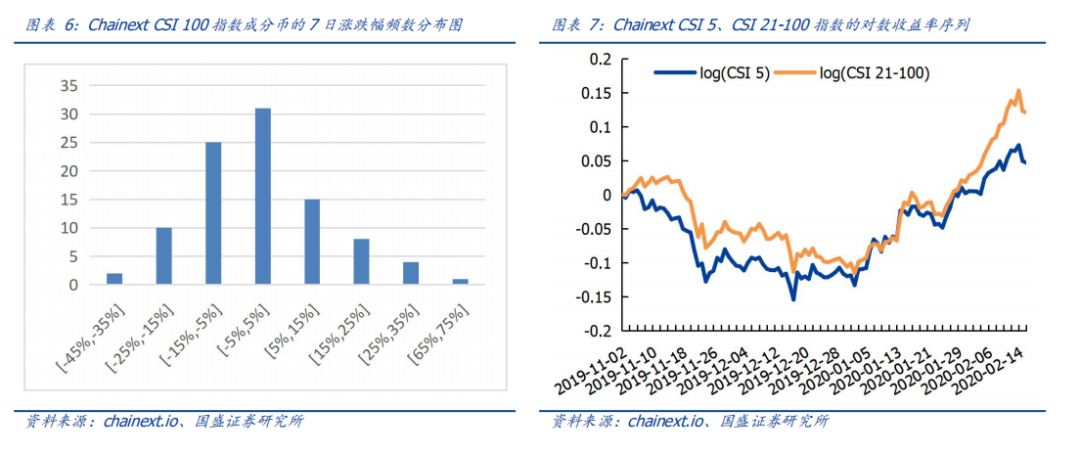

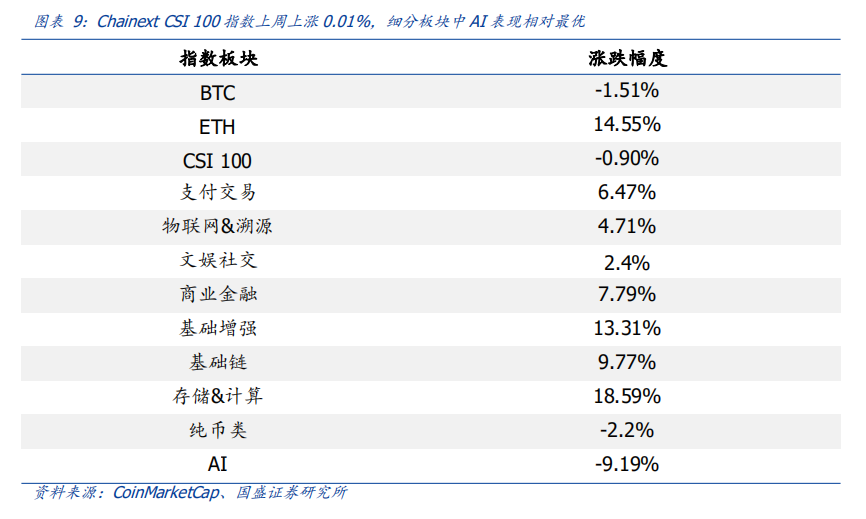

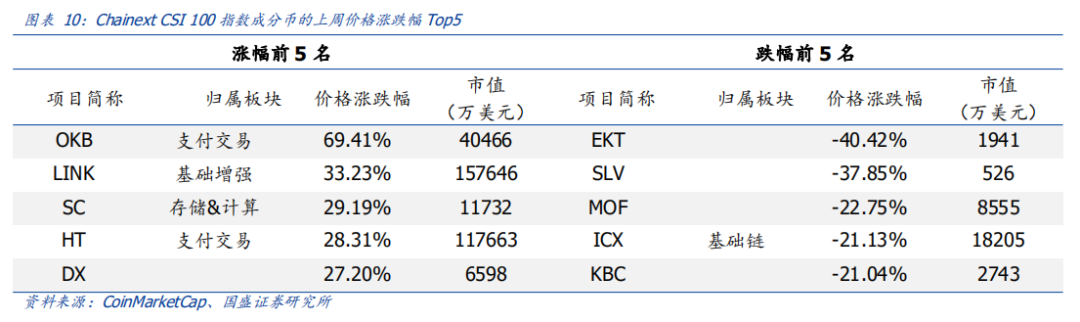

Last week's market review: Chainext CSI 100 fell 0.90%, and the storage & computing performance in the segment was the best. From the perspective of segmentation, payment transactions, IoT & traceability, entertainment and social, commercial finance, infrastructure enhancement, infrastructure chain and storage & computing performance all outperformed the Chainext CSI 100 average levels of 6.47%, 4.71%, and 2.4%, respectively. , 7.79%, 13.31%, 9.77%, 18.59%; pure currency and AI performance were inferior to the Chainext CSI 100 average level, respectively -2.2% and -9.19%.

Risk Warning : Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

Fed members believe that the digital dollar will help the United States maintain its advantage in global trade. Federal Reserve Board nominee Judy Shelton said at a Senate hearing on February 13 that the United States needs fintech innovation to stay ahead, and digitization may help maintain the dollar's advantage in global trade. Judy Sheldon said the dollar is now the world's dominant reserve currency, but it can't stop there. Some competitors are looking for alternatives to the dollar, so the US must stay ahead to ensure that the dollar continues to provide the world's best currency. In addition, Judy Shelton also said that "digital dollars" are extremely important issues, and this must be considered. Judy Shelton has been a gold standard advocate and opposed the Fed's soft monetary policy.

US Treasury Secretary: New regulations on encryption and digital payments will soon be released. According to Bloomberg, Treasury Secretary Steven Mnuchin said the United States will soon announce new regulations related to cryptocurrencies and digital payment systems. At a Senate Finance Committee hearing, Stephen Mnuchin said that the Treasury's Financial Crimes Enforcement Network is developing rules to increase transparency and prevent the use of cryptocurrencies as "secret bank accounts." He said that the US Treasury Department will introduce new regulations to clarify transparency requirements so that law enforcement officers can clearly see where the funds go and ensure that the money will not be used for money laundering. In addition, Steven Mnuchin also revealed that he and Federal Reserve Chairman Jerome Powell believe that the United States does not need to consider the issuance of digital currency by the central bank, but this may be considered in the future. The US Federal Reserve, the Treasury, and the SEC have continued to increase their focus on digital currencies, and it is expected that more favorable policies will be introduced in the future.

JP Morgan Chase is discussing the merger of its blockchain division Quorum and ConsenSys to stimulate a strong rebound in Ethereum. Reuters reports that JPMorgan Chase & Co. (JPM.N) is in talks to merge its blockchain division, Quorum, with Ethereum developer ConsenSys. The transaction is expected to be formally announced within the next six months, but financial terms are unclear. There are currently around 25 people working on the Quorum team worldwide, and it is unclear whether they will join ConsenSys after the merger. Stimulated by this news, Ethereum ushered in a notable rebound. As of February 17, the price exceeded 250 US dollars. On February 15, 2019, JP Morgan announced that it would begin testing JPM Coin, which is based on the Quorum platform. There is no doubt that traditional financial institutions such as JP Morgan Chase will continue to advance pragmatically and steadily in blockchain advancement.

The State Administration of Foreign Exchange will strengthen the construction of a cross-border financial blockchain service platform. On February 15, the State Council held a press conference on the joint prevention and control mechanism for pneumonia epidemic of new coronavirus infection. Xuan Changneng, deputy director of the State Administration of Foreign Exchange, introduced the measures taken by the State Administration of Foreign Exchange to support the resumption of production and production of enterprises. He said that on the one hand, it is necessary to strengthen the construction of cross-border financial blockchain service platforms and alleviate the problems of financing difficulties and expensive financing for SMEs. On the other hand, continue to simplify the procedures for revenue and expenditure of goods trade of small and micro cross-border e-commerce enterprises, further facilitate cross-border e-commerce settlement, guide bank payment institutions to provide market entities with electronic payment services under current accounts based on transaction electronic information, and further facilitate small, medium and micro enterprises. Link cross-border e-commerce trade settlement to improve the efficiency of fund settlement for small, medium and micro enterprises.

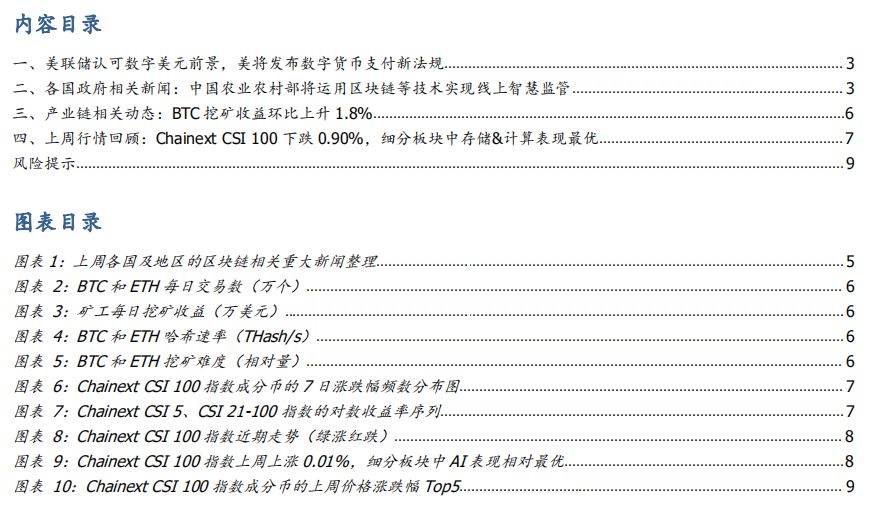

India : The Indian Election Commission has partnered with IIT Madras to develop a new blockchain-based technology that will enable voters to vote from distant cities without going to designated polling stations in their respective constituencies. After the voter identity is created, the system will generate a blockchain electronic ballot. Another official said that the project is currently in the research and development stage and aims to develop a prototype.

Bahamas : On February 13, the President of the Bahamas Central Bank John Rolle confirmed that the Bahamas Central Bank's digital currency will be launched in the second half of 2020. Since December 2019, the first pilot of the "Sand Dollar" project in Exuma has made good progress. The central bank governor believes that the digital Bahamian dollar will help accelerate the provision of financial services needed to support the recovery of the business sector.

France : On February 13, the French Financial Markets Authority (AMF) stated in a report that the European Commission is required to formulate a digital strategy for European financial services, and recommended that the EU allow the issuance and Trading financial instruments. The AMF pointed out that, given the unique nature of the blockchain industry and its decentralized nature, special regulatory regulations should be formulated for assets on the blockchain. On February 12, a recent study released by the Bank of France discussed the possibility of the European Central Bank launching a CBDC. Studies have shown that the issuance will depend on the selected asset criteria, as it needs to be integrated into existing regulations to avoid a revision of the legal text. If the issuance of the CBDC goes beyond "technical processes", the ECB will have two main options to facilitate implementation. The first option is to equate the CBDC with a digital banknote, which will allow the CBDC to function as and mirror the banknote. This situation will greatly limit and limit the characteristics of the CBDC; the second option will allow tokenized assets as currency Business collateral is accepted.

EU : The European Commission is gathering feedback from citizens, businesses, regulators and other stakeholders to establish a regulatory framework for crypto assets and markets across Europe. According to reports, the consultation will start in December 2019 and will continue until March 19, 2020. The finalization of the cryptocurrency regulatory framework is expected to be carried out in the third quarter.

United States : On February 10, U.S. President Donald Trump released a budget proposal of $ 4.8 trillion for fiscal year 2021, aimed at expanding the Treasury's cryptocurrency by reintroducing the Secret Service to its jurisdiction , The report said that the adjustment will "create new efficiencies" in the Secret Service's investigation into criminal acts involving cryptocurrencies and financial markets. On February 13, the Internal Revenue Service (IRS) recently revised the wording on its web page, and US taxpayers have been released from tax obligations for gaming transactions using cryptocurrencies. On February 13, US Treasury Secretary Mnuchi said that the Financial Crimes Enforcement Network (FinCEN) of the Treasury Department is preparing to introduce new regulations on cryptocurrencies, but he did not specify any new requirements. A statement by the U.S. Department of Justice stated on February 14 that "attempting to cover virtual currency transactions with a mixer is a criminal offense", which means that Bitcoin makers simply have to exercise privacy May be prosecuted. It is reported that Bitcoin owners legally use coin mixers to merge their transactions with those of other users, providing a degree of privacy protection. But mixers can also be used by criminals for the same purpose.

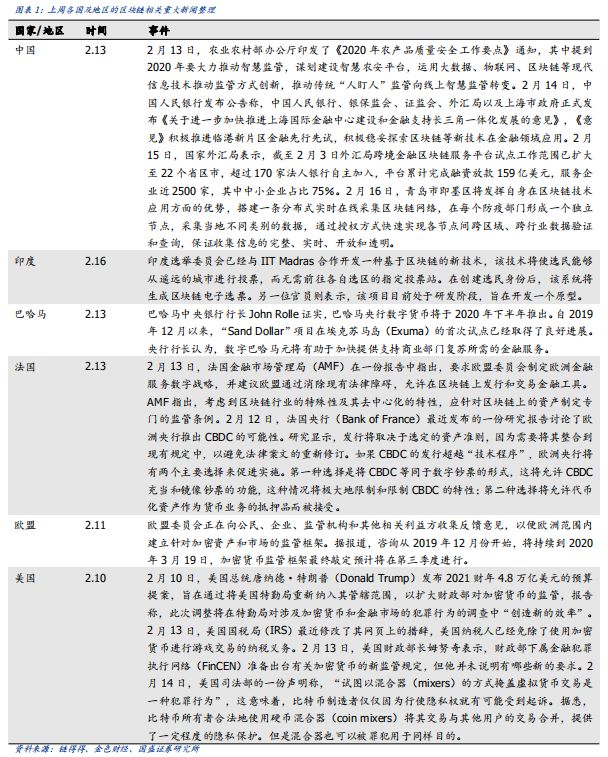

Last week, BTC added 2.29 million transactions, a decrease of 0.2% from the previous month; ETH added 5.07 million transactions, an increase of 18.6% from the previous month.

Last week, the average daily income of BTC miners was 19.79 million US dollars, an increase of 1.8% from the previous month; the average daily income of ETH miners was 2.85 million US dollars, an increase of 23.9% from the previous quarter.

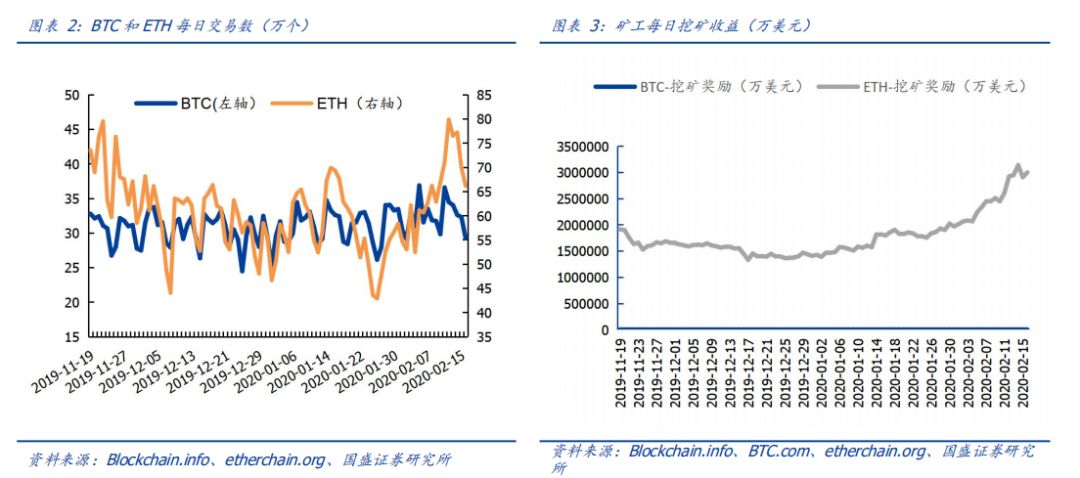

Last week's BTC network-wide mining difficulty was 15.55T, an increase of 0.4% from the previous month; the next difficulty adjustment date is February 25, and the expected difficulty value is 15.27 T (-1.77%); last week, the average ETH mining difficulty was 2.18T, an increase of 3.6% from the previous month.

The development of blockchain infrastructure failed to meet expectations. Blockchain is the core technology for solving supply chain finance and digital identity. At present, the blockchain infrastructure cannot support high-performance network deployment. The degree of decentralization and security will have a certain restriction on high performance. The blockchain infrastructure exists The risk of developing less than expected.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research on the Construction of Emergency Logistics Based on Blockchain——From the Perspective of "New Crown Pneumonia" Epidemic Prevention

- After analyzing 133,000 Ethereum names, we discovered these "terror" secrets

- Bytom and OKChain reached a cooperation to build an ecosystem in DeFi, cross-chain and other fields

- Lawyer Reviews | FCoin Thunderstorm: Users' Rights Protection Is Difficult

- Lightning loan: what can an Ethereum transaction do?

- Gavin Wood on Kusama: What is the difference between Kusama and Boca Mainnet and how will it develop?

- Wuhan launches “East Lake Big Data Resumption Intelligent Management System”, Babbitt provides blockchain technology