Analysis: Bitcoin rushes to 20,000, at least $ 5 billion needed

According to our analysis, Bitcoin has been flourishing in the past 10 years, and it is related to the rapid influx of large amounts of funds and users. Therefore, if the price of Bitcoin hits a new high, it will require more funds and user admission. If the price of Bitcoin doubles to $ 20,000, at least $ 5 billion would be needed. If you expect Bitcoin to have a market value of more than one trillion dollars, the number of Bitcoin users worldwide should be at least 100 million.

These two goals are not out of reach, but they are also difficult to achieve. We are generally optimistic about the bitcoin market, but we still do not recommend excessively raising the wealth effect by half.

1. Who gave you the courage to predict $ 100,000?

Prophecies about the price of bitcoin have risen one after another, but most have only results and no logic.

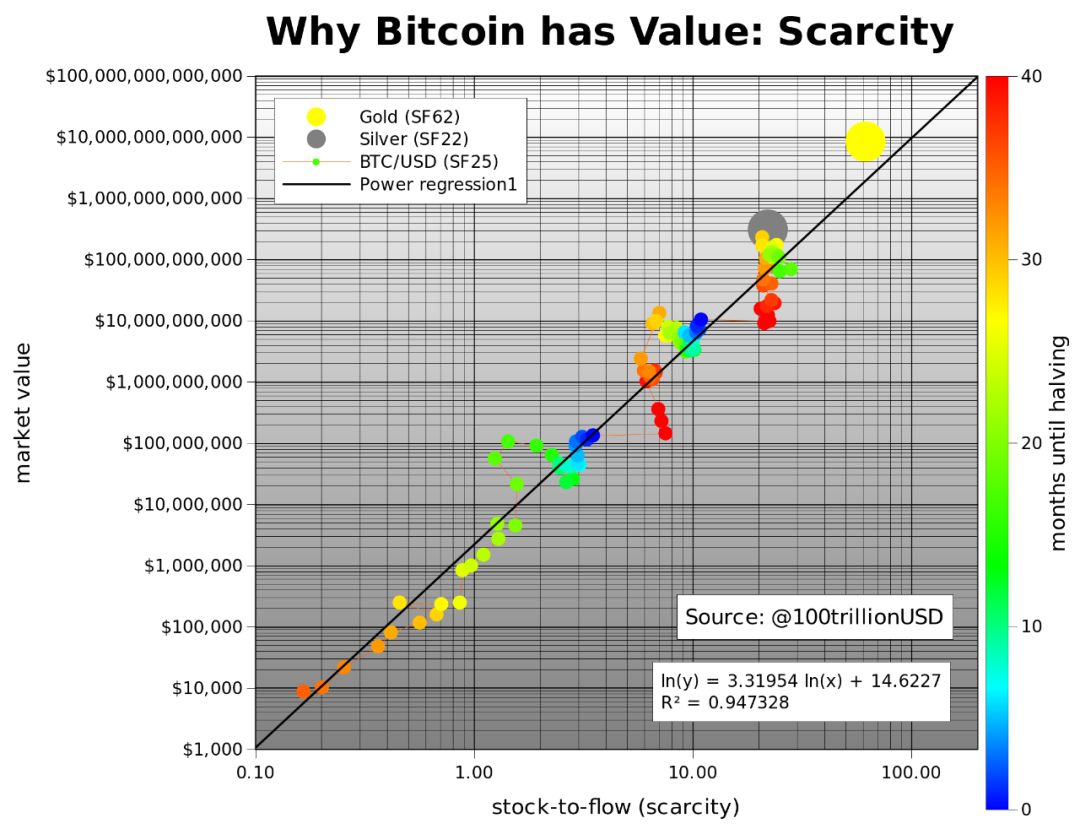

Only a few people speak of prediction logic. Analyst PlanB uses the Bitcoin Scarcity (S2F) model, which fits the historical data of Bitcoin well, and then predicts that the price of Bitcoin is expected to reach $ 100,000 by 2024.

- Views | Coronavirus forces hundreds of millions of RMB of cash to be disinfected, outbreak may accelerate DCEP launch

- Is DeFi a moth again? Ethereum smart wallet application Authenticeum exposed to fatal vulnerability

- Tiger's founder Wang Ruixi talks about hedging attributes is one of the most important attributes of Bitcoin | Chain Node AMA

Encouraged by this model, many people watch multi-bitcoin. Since the model was proposed in March 2019, it has been translated into at least 21 languages. Deutsche Bank, Forbes, CNBC, VanEck and other well-known institutions have mentioned the model in reports or reports.

Although everything is possible, implementation requires prerequisites. It cannot be assumed that it can accurately predict the future because it explains the past well.

Therefore, our team analyzed the S2F model of bitcoin scarcity, trying to explain the reason for the high degree of fitting, and the premise of the prediction.

Bitcoin scarcity S2F was proposed by analyst PlanB. S2F is calculated by dividing the amount of bitcoin in stock by the annual production of bitcoin, which is Stock / Flow. The Bitcoin scarcity S2F model mainly includes two pieces of content:

01.The relationship between Bitcoin market value and scarcity

At present, the bitcoin scarcity value is about 27, and the market value is about 180 billion US dollars, which belongs to the hundreds of billions of dollars. According to this model prediction, after halving the output of bitcoin in 2020, the value of bitcoin scarcity will rise to about 56. At that time, the market value of bitcoin will reach the trillion dollar level, and the bitcoin price will exceed $ 50,000.

via PlanB

02.The relationship between Bitcoin price and scarcity

The bitcoin scarcity S2F model, after fitting bitcoin's historical data, considers the bitcoin price = 0.18 * (S2F ^ 3.3). The fitting results and historical price data of Bitcoin are shown in the figure below. After halving bitcoin in 2020, the S2F value will rise to about 56. According to this formula, the price of bitcoin is expected to reach $ 100,000.

via.PlanB

Since the S2F model of Bitcoin scarcity was proposed, there have been many concerns and many questions. PlanB responded many times, "all models are wrong, but some are useful!"

via.PlanB

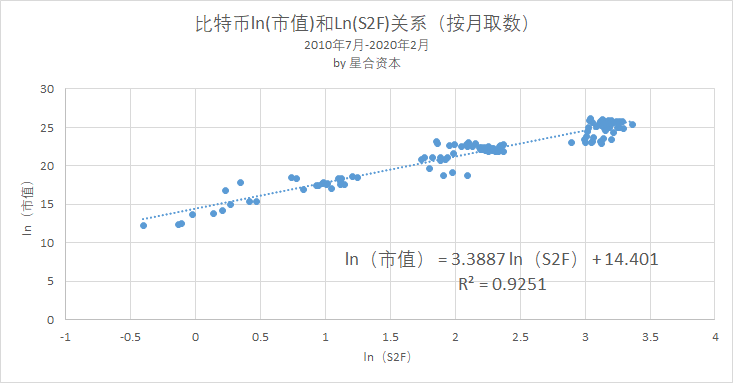

The satellite joint venture re-collected data and reproduced the S2F model. For details, see the appendix. Although the results are slightly different from PlanB, the error is small enough to negate the Bitcoin scarcity S2F model.

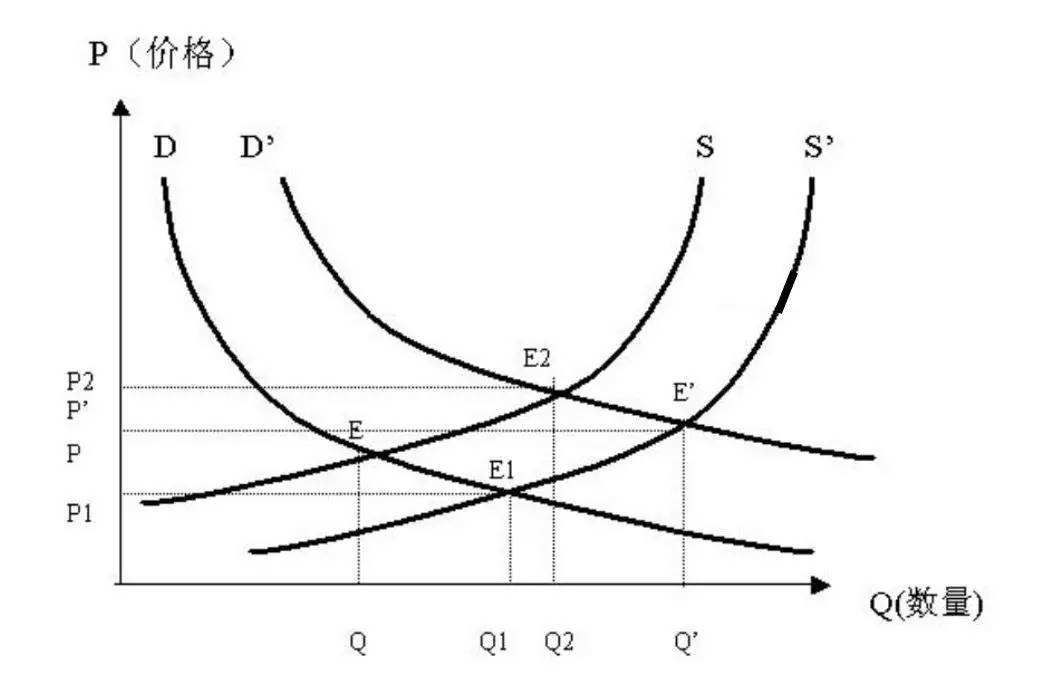

Second, the premise of currency being scarce: more money and less money

The premise that the bitcoin scarcity S2F affects prices is value and demand, because even the scarce garbage is still garbage.

Therefore, the bitcoin scarcity S2F model provides a new perspective, but we can't be superstitious about its price prediction. Demand-side analysis is the key.

Moreover, the S2F model is very "aggressive" because it shows the relationship between logarithm and power law, and an error result will be an order of magnitude worse.

Anyone familiar with the history of the development of the Internet knows that when a explosive product first appeared, the number of users and valuations may grow explosively in the short term. However, if the early exponential growth is regarded as the norm, and its realistic basis is ignored, and it is simply used as the basis for future planning, it is easy to make mistakes.

According to the simple supply and demand curve, we can understand the basic logic of Bitcoin price increase. At present, there are about 18 million bitcoins in stock. After halving this time, the new output will be less than 60,000 in one year, and will continue to decrease in the future. Therefore, the supply curve for Bitcoin is quite steep. Once the Bitcoin demand curve rises, the price of Bitcoin may rise sharply.

The rise of the Bitcoin demand curve means that more people recognize Bitcoin, and everyone is willing to spend more money to buy Bitcoin. To observe whether the Bitcoin demand curve has changed, at least two indicators can be used, namely the number of Bitcoin users and the total amount of admission funds.

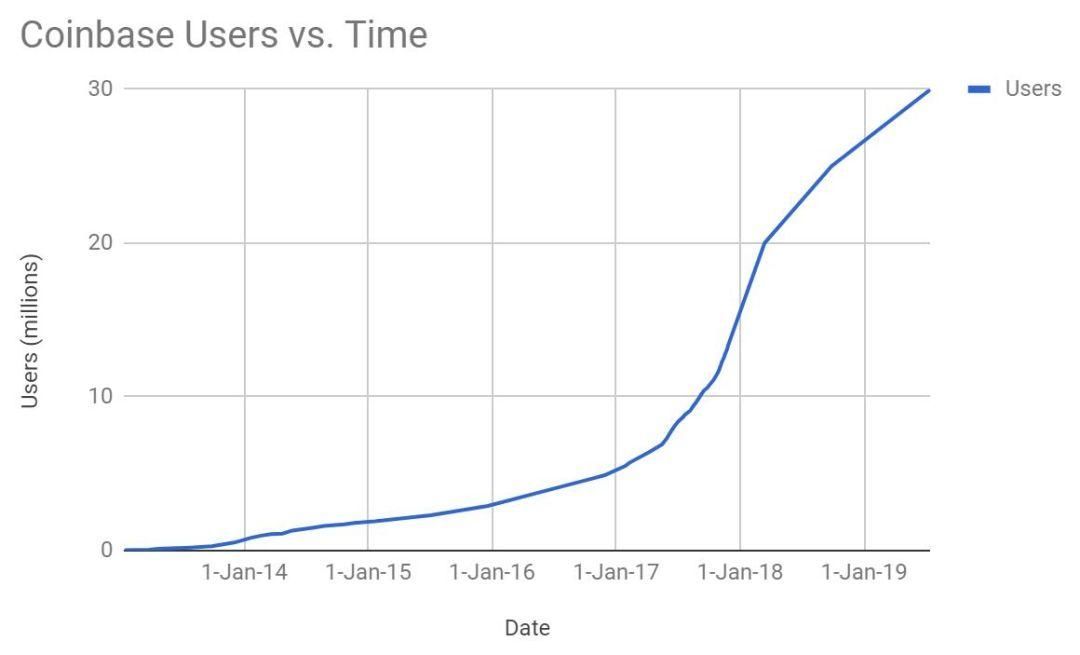

1. The exponential growth of the number of Bitcoin users. Although Bitcoin is a distributed product, Bitcoin still needs to be promoted by a centralized organization, especially a legal, convenient, and secure digital asset exchange. Therefore, compared with the number of anonymous active Bitcoin wallet addresses, the number of exchange users is more valuable.

Coinbase is one of the largest exchanges in the United States. In January 2017, it received a Bitcoin license (Bitlicense) issued by the New York Financial Services Department. Due to the strict KYC requirements of Coinbase users, due to the change in the number of users, it can be used as a microcosm of the change in the number of Bitcoin users.

Since its establishment in June 2012, Coinbase has accumulated 13 million users in 5 years, and the growth rate is relatively flat. Similarly, after the bitcoin market value exceeded US $ 1 billion in 2013, it exceeded US $ 10 billion in 2016.

In 2017, the number of Coinbase users increased rapidly, and the number of users exceeded 30 million. As can be seen from the figure below, from 2017, the user inflow is accelerating, and the number of users increased by more than 10 million in that year. It was in 2017 that Bitcoin's market value broke through from $ 10 billion to $ 100 billion.

Therefore, if the market value of Bitcoin is to reach the trillion dollar level, the number of Coinbase users can be used as a leading indicator, which should at least double the current level, that is, 60 million users.

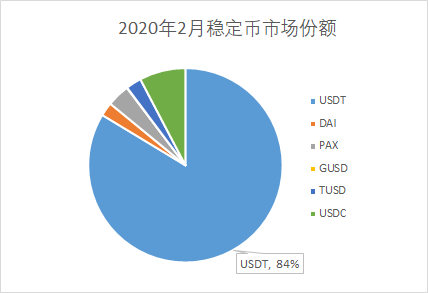

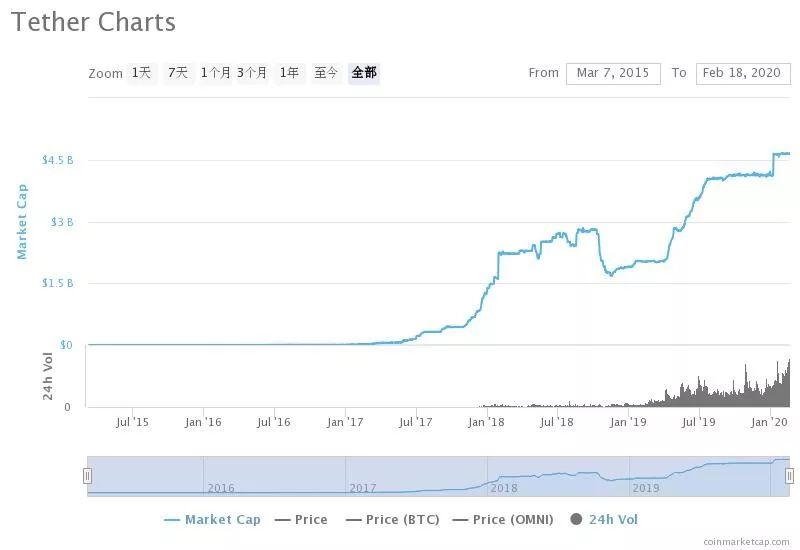

2. Funds quickly poured into the digital currency market. For the deposit funds of the digital currency market, there is no effective dynamic indicator, but the USDT market value can be used as a reference.

USDT is a digital currency anchored by the US dollar (USD) by Tether. It promises that USDT and USD can be exchanged 1: 1. For every USDT token issued, its bank account will be guaranteed with USD 1. Despite being questioned, USDT is still the absolute leader of the stablecoin market.

via.coinmarketcap

Coinmarketcap data shows that since the USDT was issued in 2015, the market value in the first two years has been less than 100 million US dollars. After 2018, its market value once approached 3 billion U.S. dollars. As of February 2020, the market value of USDT exceeds USD 4.6 billion. Based on its market share, at least US $ 5.6 billion in equivalent fiat currencies have entered the digital currency market.

via.coinmarketcap

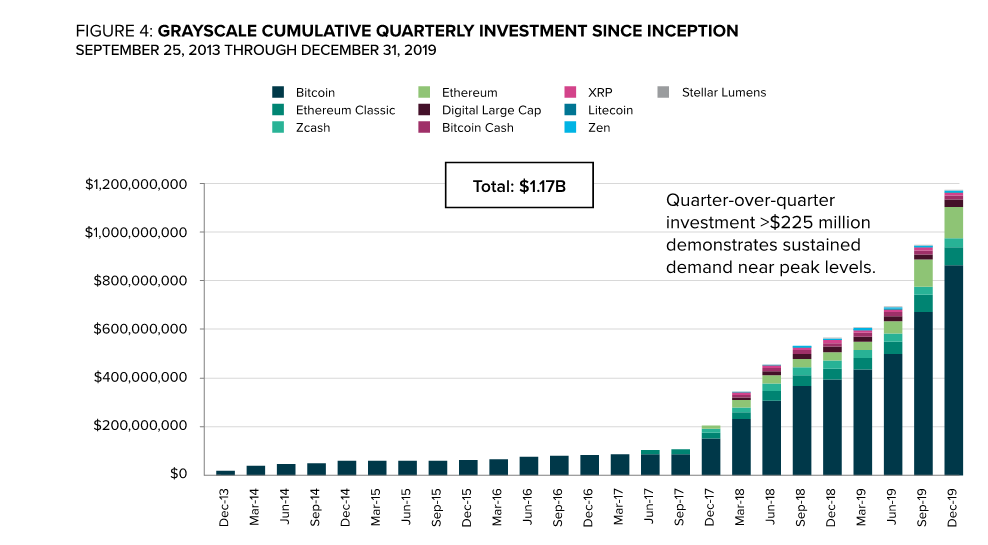

As the world's largest cryptocurrency management company, Grayscale's 2019 performance report shows that capital is accelerating into the digital currency market. Grayscale Capital raised US $ 600 million in 2019, exceeding the total amount raised from 2013 to 2018. And, a quarter of the funds raised in 2019 came from new investors.

via.Grayscale 2019 Annual Report

Data from USDT and Grayscale Capital show that more than 2 billion U.S. dollars were admitted to digital currencies in 2019, which is also the basis for the rise in Bitcoin prices in early 2020.

At present, global admission funds are close to 10 billion US dollars. Expect bitcoin prices to double to $ 20,000, and possibly another $ 5 billion in admission.

Third, the conclusion

The demand side is the ultimate factor that determines the price of Bitcoin.

As of mid-February 2020, Bitcoin's market value is about $ 180 billion. In the next 4 years, about 1.3 million new bitcoins will be added, accounting for only 7%. Since then, the market value of bitcoin has increased, mainly due to the increase in unit price, which depends on how much incremental funds enter the market to bid for increasingly scarce bitcoins.

The market value must be composed of value and bubbles, but only when the "hard" indicator comes up can Bitcoin price have a "hard" basis.

In fact, we may consider bitcoin as a company that provides global value transfer and storage services. The business model is similar to "global Alipay + digital gold". Alipay has 1.2 billion users and a valuation of $ 150 billion. In contrast, Bitcoin has only tens of millions of users, and its market value is already on the same level as Alipay. It can be seen that Bitcoin's service premium is higher.

When Bitcoin users exceed 100 million people, it may not be far from a market value of more than 1 trillion US dollars.

Bitcoin was born in the last financial crisis. It was born from reflection on the financial crisis. Perhaps the value of Bitcoin can be tested only after another financial crisis, at which point the beginning of a new round of Bitcoin bull market.

Bitcoin is a safe haven for real risks, not to say that it benefits from disaster. Rather, if disaster is unavoidable, and if there is an alternative, the future may be better.

references:

1. The original number of PlanB on GitHub

2. PlanB personal twitter

3. Nick: The drunkard value of Bitcoin

original

Translation

4.Checkmatey: Currency premium, can competing coins compete with Bitcoin?

original

Translation

5. PlanB: Efficient Market Hypothesis and Bitcoin S2F Model: Predicted Translation of Bitcoin Value

6. SwissRex AG: Stock to Flow Model Proof of Non-linearity

7. Grayscale Annual Report 2019

8. Appendix 1: S2F Model Process

9. Appendix 2: Other Verifications and Questions about the S2F Model

Appendix 1: S2F model process

Because the S2F model fits too well, it is not simple for us. At first, it was questioned about the model, for example, it was particularly worried that PlanB had manipulated the data. Since the reproduction of S2F is not complicated, the joint venture company independently collected data for reproduction.

Since PlanB uploaded the model's original data on GitHub, after checking, the joint venture established the data collection rules as follows:

First, the data collection range was from July 2010 to February 2020, and the data was collected from bitinfochats.com and blockchain.com.

Second, in order to maintain the same caliber as PlanB, the data collection standards are as follows:

1. Take the 1st of each month as the collection day, and collect the Bitcoin network block height, Bitcoin price and market value data once a month.

2. The difference between the number of Bitcoins on the 1st and the 1st of the following month is taken as the monthly output of the current month, and then multiplied by 12 as the annual output to calculate S2F.

Again, we also make slight adjustments to PlanB's data:

1. Bitcoin data start time. Before July 2010, there was no fair price data. The starting point of the verifiable Bitcoin transaction price was July 18, 2010. At this time, Bitcoin has been online for over a year. PlanB's processing of this previous data is that he refers to some events. For example, in October 2009, 1309 bitcoins were exchanged for 1 US dollar. In March 2010, the quote on BitcoinMarket was $ 0.003, and programmer Hanyecz used 1 Ten thousand bitcoins bought two pizzas (worth $ 41), added those prices to the model, and inserted some values. In this regard, we believe that these data have limited reference significance and have not been used.

2. PlanB's method for liquidity adjustment is to deduct 1018750 bitcoins that were mined before August 2009, and Star Joint Ventures chose to directly deduct 1 million whole bitcoins in the recurrence.

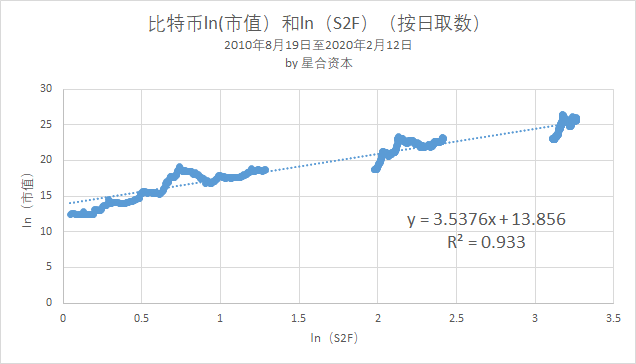

- About the relationship between Bitcoin S2F and market value:

PlanB's trend line is:

ln (y) = 3.31954ln (x) +14.6277, R² = 0.947328

The S2F trend line reproduced by the joint venture is:

ln (y) = 3.3887ln (x) +14.401, R² = 0.9251

Whether it is the PlanB version or the recurring version of the joint venture, the model is basically close, and R² is above 0.90, indicating that the degree of fitting is relatively high.

Since PlanB's market value / S2F model uses monthly data, in order to further verify the S2F model, the joint venture will obtain the daily market value from blockchain.com from August 19, 2010 to February 12, 2020 on a daily basis. S2F data, test again.

The results are basically consistent with the PlanB model and the monthly access model, which further confirms the reference value of the S2F model. This means that there is a significant linear relationship between the logarithm of bitcoin market value and the logarithm of scarcity. The more scarce bitcoin is, the higher its market value.

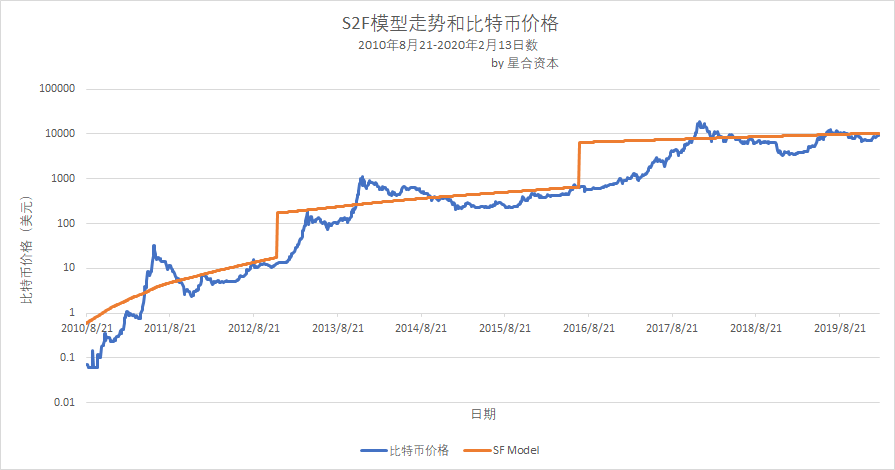

- About the relationship between Bitcoin S2F and price:

The Star Joint Venture team collects daily price data of bitcoin from August 21, 2010 to February 13, 2020, indicated by the blue line; at the same time, it calculates the daily value of 0.18 * S2F ^ 3.3, which is represented by the orange line. Then calculate the relationship between the two through the Excel correlation coefficient function CORREL. The correlation coefficient is 0.75, which is quite eye-catching.

Appendix 2: Other verifications and questions about the S2F model

An analyst Nick verified the S2F model with statistics, and the results support the S2F model. A detailed article can be found in the appendix.

Nick wrote at the end of the paper, "All these models have failed to deny the hypothesis that" stock-to-flow is an important non-false predictor of the value of Bitcoin " … If we consider the value of Bitcoin as a drunkard, Then stock-to-flow is not his real follower, but more like his path. "

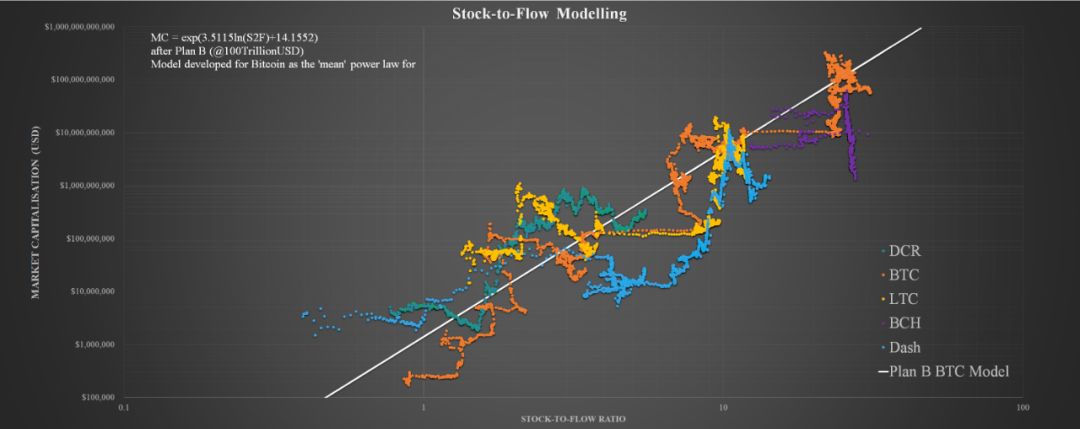

Another analyst, Checkmatey, took a different approach. Because halving production is not a phenomenon unique to Bitcoin, he chose other digital currencies with halving production, such as BCH and LTC, and analyzed the relationship between its market size and S2F. As a result, The market value of other halved coins can still be explained by S2F.

via.Checkmatey

Of course, the S2F model is also challenged because of its "too optimistic" outlook for future prices.

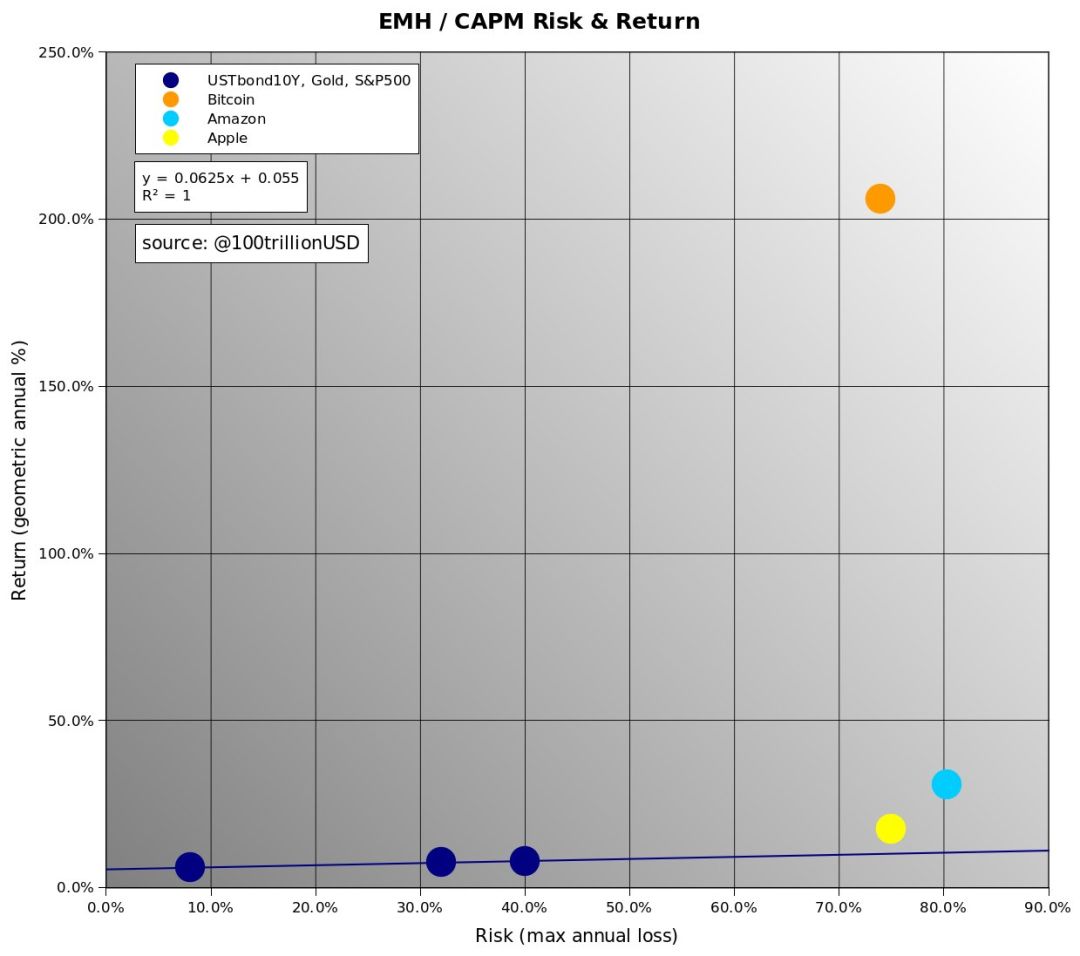

First, based on the skepticism of the EMH, this is also the only rebuttal to which PlanB has responded in writing, calling it "the best argument against the S2F model." The argument claims that the S2F model is based on publicly available information, so analysis and conclusions have been factored into the price.

In response, PlanB believes that "the efficient market hypothesis and no arbitrage guide us into the risk & return model". He used the annual maximum loss ratio as the risk and the long-term annualized return rate as the return. In PlanB's latest Twitter, , He gives the following figure, and gives instructions:

"The current bitcoin market is indeed quite effective, because there is no easy arbitrage opportunity. Historical risk and return data on bonds, gold and stocks and bitcoin indicate that the bitcoin market overestimates risk. Bitcoin returns are not in line with risk, but It fits very well with the S2F model. Bitcoin options and futures markets do not expect prices to halve or rise after halving. The market may still overestimate future risks. "

via.PlanB

In other words, even if the Bitcoin market is an effective market, compared with other investment targets, the market generally overestimates Bitcoin risk, which may be due to the market's lack of understanding of Bitcoin.

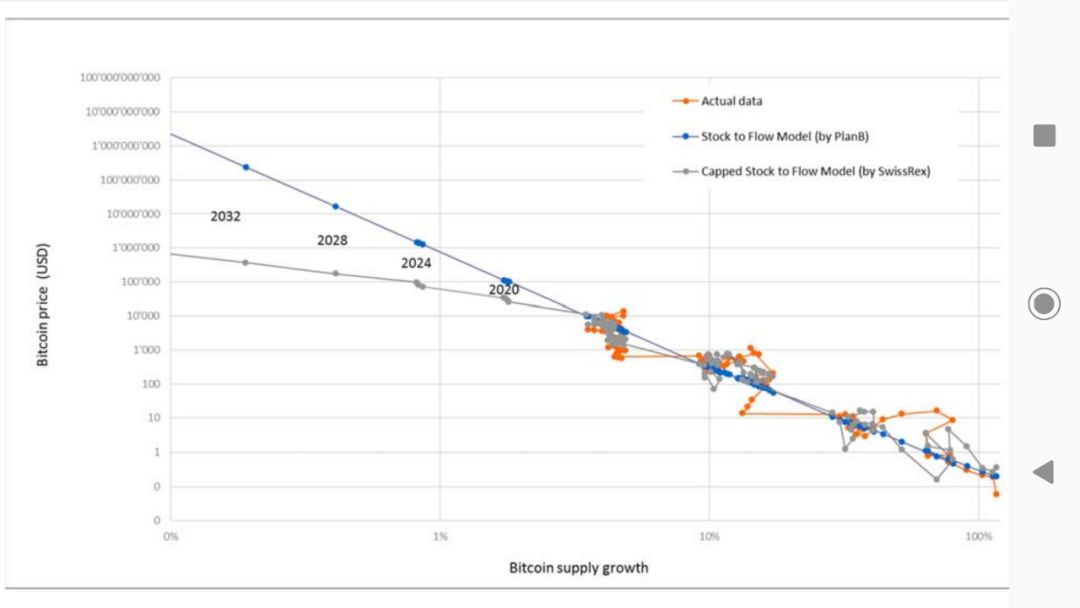

The second representative challenge was raised by SwissRex AG, a Swiss cryptocurrency analysis company, who also introduced an improved S2F model, the Capped Stock to Flow Model.

The core point of SwissRex is that there is an upper limit to the impact of S2F on the market value of bitcoin, and the increase in the rate of return on bitcoin investment will become smaller and smaller, that is, the marginal income will diminish. Now.

SwissRex believes that the nature of the value shown by the S2F model is that Bitcoin is replacing other value stores, such as gold, and such substitution will eventually face saturation. Therefore, for the prediction of Bitcoin price, there should be an upper limit.

Compared with PlanB's S2F model, which predicts that the average price in May 2020-2024 will reach $ 100,000, SwissRex's CS2F model predicts that Bitcoin is expected to reach $ 25,000 in 2020, and is expected to reach $ 70,000 in the next half year in 2024 .

Note: This article is an original analysis by Ye Jian and Zhang Daqi, research fellows of Star Joint Venture. For more opinions, please contact us by email.

[email protected]; [email protected].

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin's Secret History: Who Drived the Early Propaganda of Bitcoin?

- Defi protocol bZx was attacked twice in one week, highlighting industry concerns

- Cloud giant Microsoft Azure embraces commercial blockchain

- Analysis | This technical indicator implies that Bitcoin will rise to $ 26,000 when halved

- Weizhong Bank releases WeCross white paper for open source blockchain cross-chain collaboration platform (full text)

- Bitcoin reappears as a "golden cross", is it hard to see Bitcoin below $ 10,000 anymore?

- Decentralization + Finance Ethereum killer application? Li Qiwei: DeFi is terrible