Comment: BCH halving time is earlier than BTC, will it be involved in the death spiral?

Some readers worry that the halving time of the BCH block reward is earlier than BTC, which may cause BCH to become involved in the "death spiral". They think this:

Because the halving time is earlier than BTC, when the halving comes, 50% of the computing power of BCH will be cut off, and the average block production time of BCH will be significantly lengthened. The output of mining BCH with the same computing power is lower than BTC, resulting in The computing power is cut away, and more computing power is cut away, resulting in longer block production time … thus getting involved in the "death spiral".

Are they right?

Let's talk about this topic today. Before discussing the "death spiral", let's talk about the halving time of BTC and BCH and the distribution of computing power.

- Analysis: Bitcoin rushes to 20,000, at least $ 5 billion needed

- Views | Coronavirus forces hundreds of millions of RMB of cash to be disinfected, outbreak may accelerate DCEP launch

- Is DeFi a moth again? Ethereum smart wallet application Authenticeum exposed to fatal vulnerability

01 half time

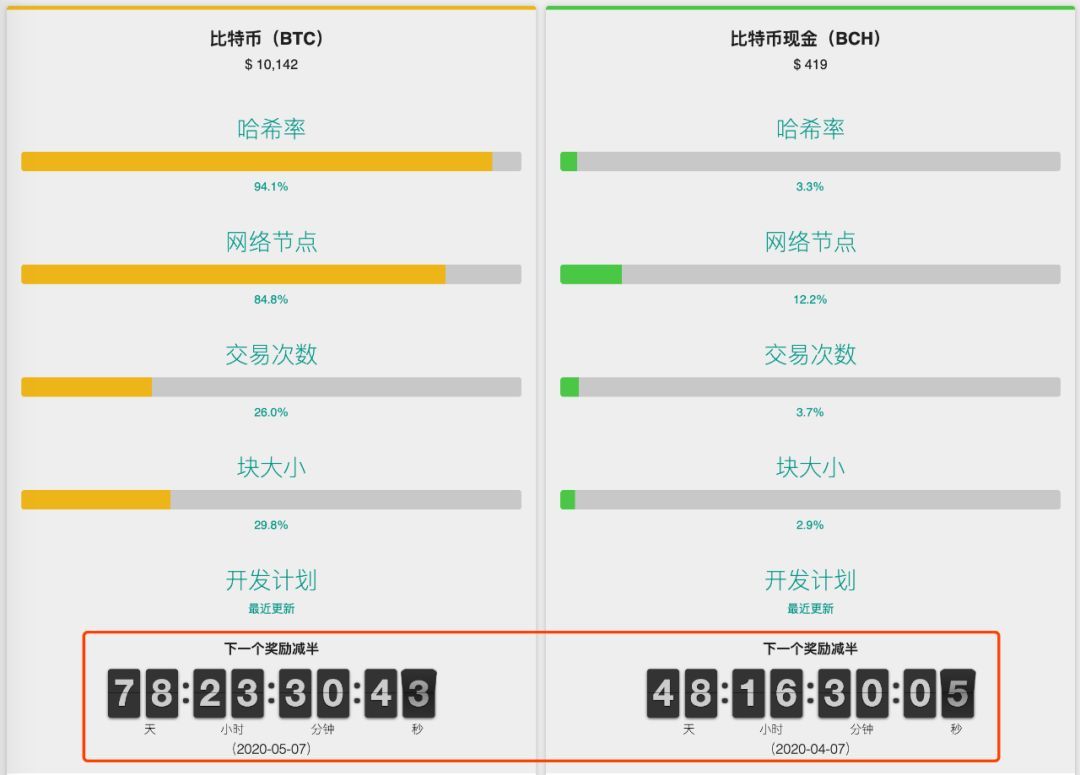

Users who are slightly concerned about BTC and BCH basically know that the halving time of BCH will be about 30 days earlier than BTC:

△ Data comes from https://coin.dance

The halving rules for BTC and BCH are the same. When the block height is 630,000, the block reward is reduced from 12.5 to 6.25.

BCH's block height is approximately 4,900 blocks ahead of BTC. One block is produced on average every 10 minutes. The BCH halving time is approximately 30 days earlier than BTC.

02Hashing power distribution and currency prices

The mining algorithms of BTC and BCH are the same, and the computing power between them can be freely switched. The purpose of miners' mining is to obtain benefits. Mining is a fair and freely competitive market. Therefore, no matter whether the same computing power is mining BTC or BCH, theoretically the return should be flat. In other words, the ratio of the total computing power of BTC and BCH to the price of their respective currencies should be at the same level, and their price ratio is equal to their network-wide computing power ratio . If the difference in the price of the two currencies varies greatly, this balance is instantly broken, and the machine gun mining pool will soon smooth this spread. The flow of computing power to high-yielding places is an economic law. In short: the higher the price of currency, the greater the proportion of computing power, the distribution of computing power is directly proportional to the price of currency.

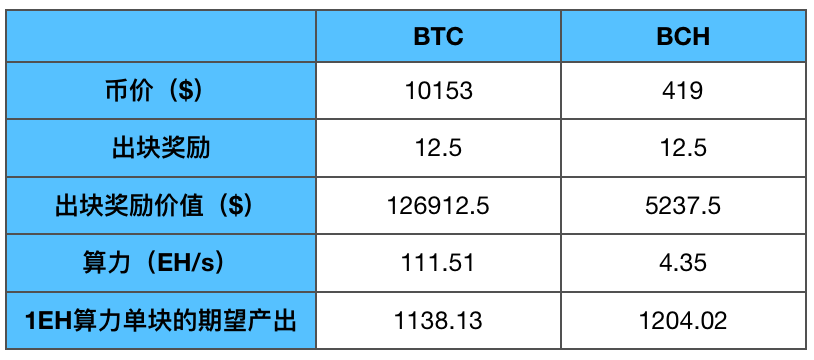

First look at a set of data:

△ Under the same computing power, BTC and BCH miners are basically the same

Take BTC as an example. The computing power of 111.51EH / s and the competitive value of $ 126912.5 are rewarded. For each block mined, the output value of 1EH / s is expected to be $ 1138.13. In the long run, the output of the unit computing power of the two The output is basically the same. Even if there is a situation of imbalance in the return within a short period of time, the machine gun pool will cut the power to smooth this spread.

Uncoordinated halving time will break this balance.

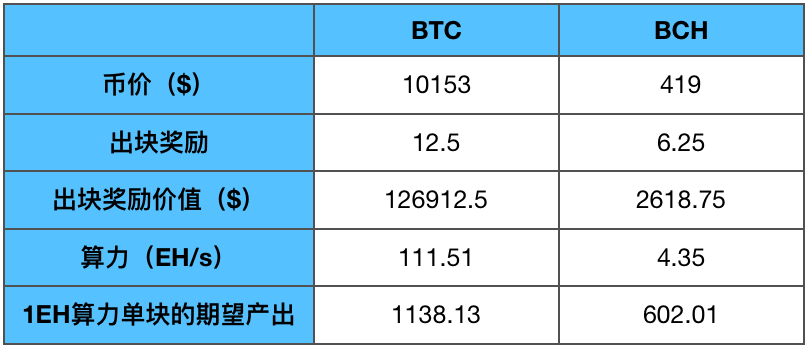

BCH block rewards are halved approximately 30 days earlier than BTC. Let's first assume that the currency prices of both are unchanged (or the price ranges remain the same), and the computing power is also maintained at the current level. At the moment when the BCH block reward is halved, the balance of BTC and BCH mining revenue is instantly broken:

△ The balance is broken, the same computing power, BCH miners' income is half of BTC miners

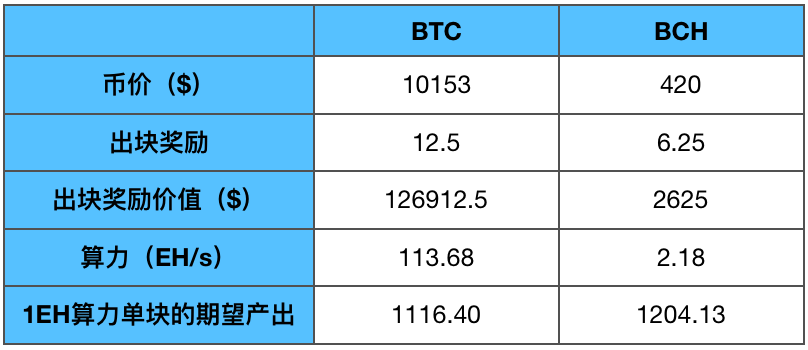

In the real game, miners will not wait for the BCH block reward to be halved before they start cutting their hashrate. When mining block 629999, the miners will immediately cut about half of the BCH hashrate to BTC (this is built on BTC) Under the assumption that the price of BCH coin is the same as the price of BCH), a new balance is reached:

△ Dynamic game of miners, computing power flow, and build a new balance

Even if the rare event of not halving the time occurs and the computing power flows to high-yielding places, this economic law is still valid. Miners also like to build a new balance by quickly switching computing power.

03 Will BCH get involved in the "death spiral"?

In order to avoid the loss caused by BCH halving earlier than BTC, miners will have about 50% of the BCH computing power cut to BTC when the BTC and BCH rise and fall are basically the same.

As a result, the computing power of BTC has increased by about 2%, which can neglect the impact of BTC's block production speed and mining difficulty. Without a halving time and no synergistic effect, BTC often has a computing power increase of more than 5% in a difficulty adjustment cycle .

Let's return to the topic at the beginning of the article. The BCH computing power dropped by 50% in an instant, and the "death spiral" that netizens worry about:

50% of the computing power is cut off, and the average block production time of BCH is greatly lengthened. The output of mining BCH with the same computing power is lower than that of BTC, resulting in more computing power being cut away, and more computing power being cut away, resulting in Blocking time is pulled longer … thus getting involved in the death spiral.

Will the "death spiral" really happen?

The above logic seems correct, but it is actually wrong. They may not understand the difficulty adjustment algorithm of BCH, thinking that the BCH difficulty adjustment algorithm is the same as BTC, and the 2016 block adjustment is only one difficulty. In fact, the BCH difficulty adjustment algorithm is improved .

BCH's mining difficulty adjustment algorithm is an improved DAA algorithm. In simple terms, it has the following characteristics:

1. Adjust the mining difficulty block by block;

2.The mining difficulty of each block is adjusted based on the hash power of the 144 blocks in front of it;

3.When the computing power changes according to the exponential law, the network will quickly adjust the difficulty to ensure fairness.

4. Avoid feedback oscillation caused by the mismatch between current computing power and target difficulty.

…

The above characteristics of the DAA algorithm ensure that even if the computing power drops by 50% instantaneously, it will only have a short-term impact on the block production speed of the BCH. The DAA algorithm can quickly adjust the difficulty according to the actual computing power to bring the block production time back to a normal level.

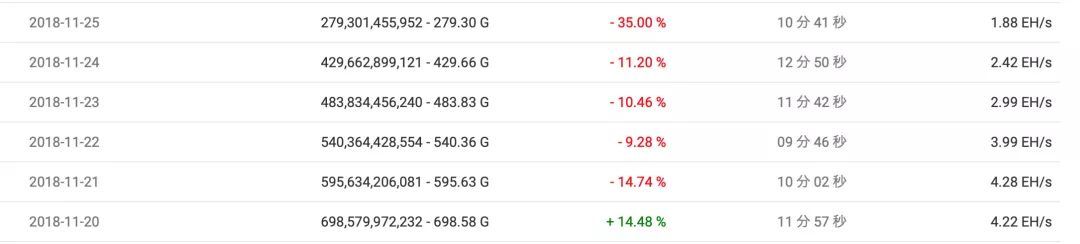

Withdrawing a large amount of computing power from BCH, there are practical cases to consider:

The most typical example is the "computing war" during the BSV split. The BCH computing power has declined sharply for several consecutive days, with a cumulative decline of more than 50%. The average block production time of BCH can still be stable at about 10 minutes.

△ Data source: btc.com

Facts have proved that in the case of rapid withdrawal of a large amount of computing power, the DAA algorithm can quickly adjust the difficulty according to the actual computing power, so that the average block production time recovers and stabilizes at about 10 minutes. It can be seen that even with the withdrawal of 50% of the computing power, the impact on the BCH block time is short and slight, and there is no risk of being involved in the death spiral.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tiger's founder Wang Ruixi talks about hedging attributes is one of the most important attributes of Bitcoin | Chain Node AMA

- Bitcoin's Secret History: Who Drived the Early Propaganda of Bitcoin?

- Defi protocol bZx was attacked twice in one week, highlighting industry concerns

- Cloud giant Microsoft Azure embraces commercial blockchain

- Analysis | This technical indicator implies that Bitcoin will rise to $ 26,000 when halved

- Weizhong Bank releases WeCross white paper for open source blockchain cross-chain collaboration platform (full text)

- Bitcoin reappears as a "golden cross", is it hard to see Bitcoin below $ 10,000 anymore?