Financing Monthly Report: The financing market is cold in November, the global blockchain financing amount was cut from the previous month

Text | Zhou Wenyi Editor | Bi Tongtong Source | PANews

PA Monthly Insights:

In November, there were more than 70 investment and financing incidents in the global blockchain industry, involving a total capital of more than 460 million US dollars;

Affected by the risks of regulatory uncertainty at home and abroad, the amount of financing in November shrank by more than half, a decrease of 54.3% from the previous month;

- Free and easy week review 丨 AI algorithm cross-border participation in Bitcoin mining? Ethereum successfully completes Istanbul upgrade

- Babbitt column 丨 Patent or open source, how to choose a blockchain project?

- Ukraine approves final version of anti-money laundering law to regulate virtual asset transactions in accordance with FATF guidelines

The heat of exchanges has fallen sharply, and capital is increasingly inclined to the underlying technology and industry applications;

In November, there were more than half of the million-level financing incidents, and there were only 8 financing incidents above the tens of millions;

M & A events have jumped sharply, and the industry has a bright future, but some companies face development difficulties;

The blockchain scenario has landed and developed, and industry application financing events have continued to rise.

PANews combed the information on the amount, amount, and distribution of financing in the blockchain field from November 2019 (November 1 to November 30) in order to understand the current status of project financing. This report focuses on the analysis of the amount of financing, financing amount and financing classification of the blockchain investment and financing projects disclosed in November 2019, in order to understand the true status of current project financing, and observe the key track and future direction of industry development. Reference sources include PA Weekly, PAData, Coin Schedule, Enterprise Search, Orange, and official websites of various companies.

Report body:

1. November financing amount shrank by more than half, down 54.3% month-on-month

According to incomplete statistics from PANews, from November 1 to November 30, 2019, the global blockchain industry disclosed more than 70 investment and financing incidents, involving a total of more than USD 465.2 million. Compared with October, the number of investment and financing events decreased by 14.4% month-on-month, and the financing amount decreased by 54.3% month-on-month. The monthly financing amount shrank by half from the previous month.

From the perspective of financing scale, the number of financing events above the million level has shrunk sharply. In November, there were more than half of the million-level financing events, and there were only eight financing events above the tens of millions.

Different from October, eight M & A incidents are noticeable, which also means that existing companies have begun to deploy the industry ecology, and the Matthew effect may gradually become prominent.

In addition, the development of blockchain scenarios has been accelerating, and industry application financing events have continued to rise, closely following cryptocurrencies. In addition, the number of underlying technologies, cryptocurrencies, industry applications, and other ecological financing events tends to develop in a balanced manner in the overall ratio distribution state, with multiple persons simultaneously.

It is worth noting that China's supervision has become stricter again. Due to the phenomenon of serial policies suppressing illegal transactions and fraud of virtual currencies, cryptocurrencies have become hot potato from overnight. Since the end of October, there have been continuous warnings of hype and fraud in the industry, and then the regulators have made heavy efforts to clear up the fraud and money laundering in the industry. The Dongguan Financial Work Bureau issued a notice on "Precautions against Risks of Illegal Fund Raising in the Name of" Virtual Currency "and" Blockchain "". Shanghai has rectified the virtual currency-related activities in its jurisdiction. The Shenzhen Municipal Bureau of Financial Supervision issued an announcement saying that it had exhausted 39 enterprises suspected of carrying out illegal activities of virtual currencies. Multilateral policies have released signals, and the cryptocurrency market has become a sensitive area.

The heat of exchanges has fallen sharply, and capital is increasingly inclined to the underlying technology and industry applications. (Related article: I'm doing blockchain this month, witnessing from the air vent to the "gun muzzle "

2. Half of the unannounced specific financing amount was mostly announced as millions of dollars

According to incomplete statistics from PANews, from November 1 to November 30, 2019, there were more than 70 financing events in the global blockchain industry, involving a total of more than USD 465.2 million.

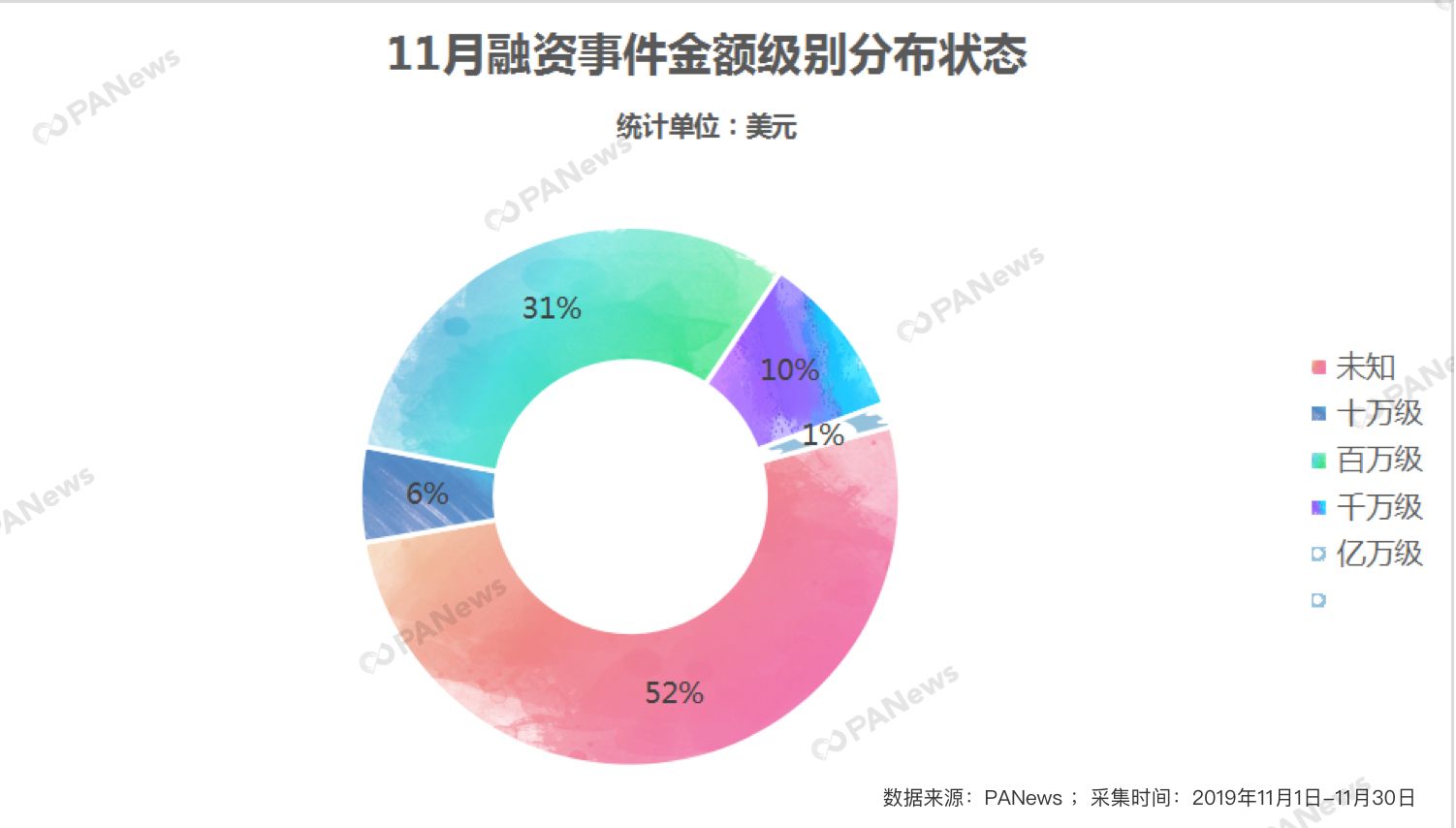

Figure 11 Distribution of Amounts of Financing Events in November

In November, from the perspective of investment and financing levels (excluding 37 undisclosed financing amount projects), the million-level is still the mainstream of the blockchain industry's investment and financing events, accounting for 31%; accounting for 31% It accounted for 10%, with a total of 7 cases, which was half of that in October; billion-level projects accounted for 1%, with a total of 1 case. In addition, there were 4 cases of 100,000-level investment and financing projects, accounting for 6%.

In November, of the eight projects with a level of 10 million or more, the largest amount was Coinbase's acquisition of New York cryptocurrency broker Tagomi for $ 150 million. From the perspective of type, industry application projects are more welcomed by investors in this level, which is consistent with the actual needs of industry scenario applications. Among them, DeFi project Compound Labs received US $ 25 million in Series A investment; Brazilian online payment platform Neon received US $ 94 million in Series B financing, as well as payment applications, and MoneyGram received US $ 20 million in Ripple; Chain Games Mythical Games received US $ 19 million Financing.

In addition to industry applications, the underlying technology still occupies an important position in the tens of millions and above levels, and investors invest heavily in the development and construction of the underlying infrastructure of the blockchain. In November, Makeup Chain received a strategic investment of USD 60 million from YOUTH FOUNDATION, which is mainly used for product traceability and supply chain logistics information services. Blockchain infrastructure provider Bison Trails also completed Series A funding this month.

3. Half of strategic investment mergers and acquisitions jumped sharply

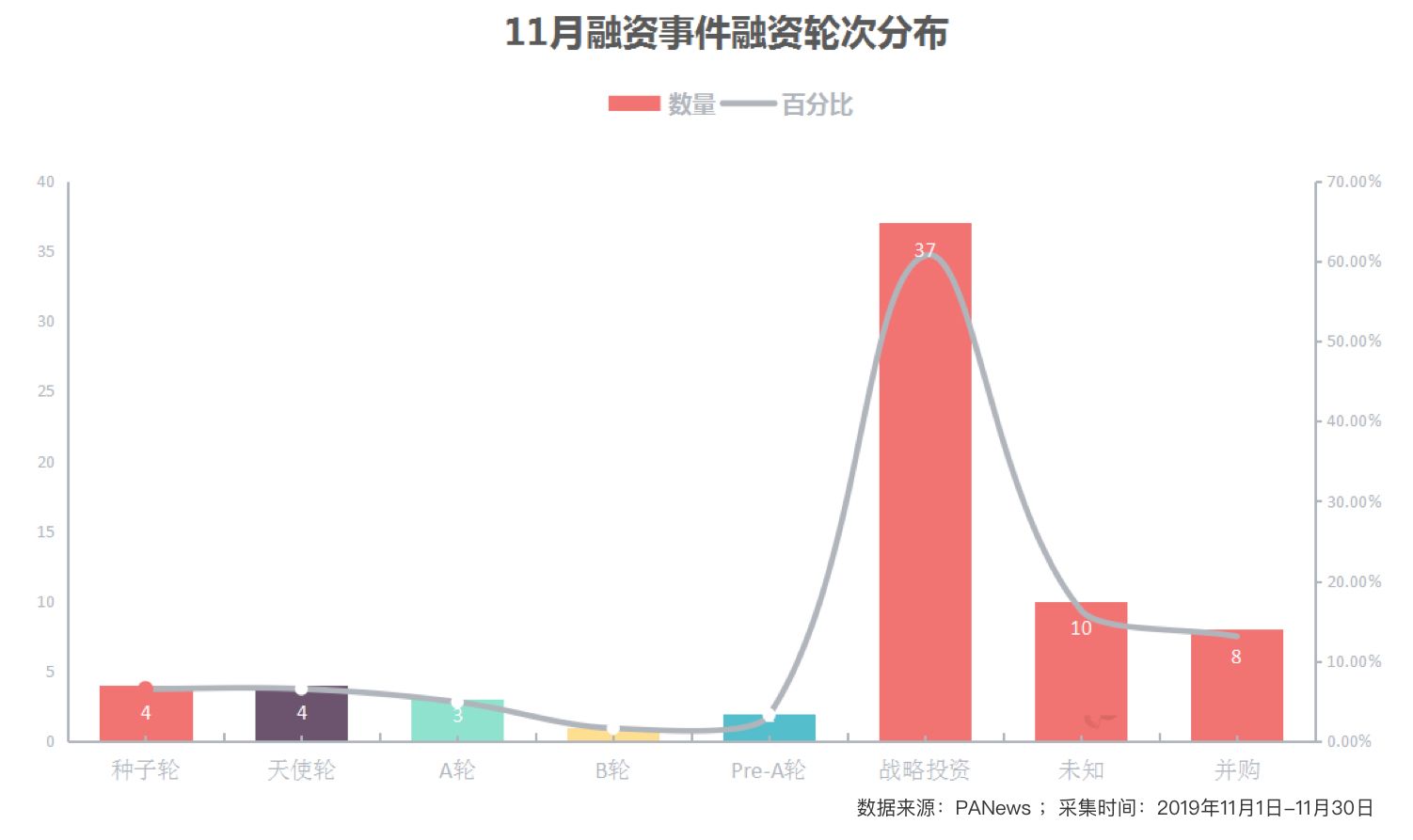

According to statistics, there were 61 cases of equity financing, 1 case of debt financing and 8 cases of mergers and acquisitions in November. Among them, it is worth noting that the number of strategic investments is the largest, with more than half, and this type of financing is more to seek the support of resources. In addition, 8 mergers and acquisitions were disclosed in November.

Figure 11. Distribution of rounds of financing events in November

In addition to strategic investment, the number of seed round financing events followed closely, with 4 cases. There were 3 rounds of financing in November, 2 in Pre-A, and only 1 in round B. On November 20th, Brazilian banks Banco Votorantim and General Atlantic led a round B financing of about $ 94 million in Brazilian online payment platform Neon.

From the perspective of the distribution of financing rounds, despite the diversified distribution of financing rounds, the overall financing scale is small, and the proportion of high-level financing events in October has fallen compared to October. Faults appear at levels C and above.

Examples of acquisitions include eToro's acquisition of portfolio tracking tool Delta; Ripple's investment unit Xpring announced the acquisition of Strata Labs; COINBIG's formal acquisition of digital currency exchange CNEW, and Coinbase's acquisition of New York cryptocurrency broker Tagomi for $ 150 million.

It is worth noting that although it is not included in the statistical scope, 11 IPO financing has also occurred. On November 21, the first share of Blockchain Canan successfully bells in Nasdaq in the United States and is issued in the form of ADS in Nasda. GEM went public with a trading code of "CAN" and raised $ 90 million. (Related reading: The Coronation Time of Jia Nan )

4. Industry application financing events continue to rise

According to incomplete statistics from PANews, the 70 financing events that occurred in the global blockchain industry in November 2019 involved multiple fields, starting with investment and financing events, including technical services, public chains, protocols, Dapp-DeFi, DApp-Games, and payments. , Content platforms, exchanges, wallets, integrated management of digital assets, security, media, research, community, and information services.

The blockchain scenario has been developed with ground floor storage, industry application financing events have continued to rise, the industry's ecological construction has become more perfect, and it has developed in a balanced manner.

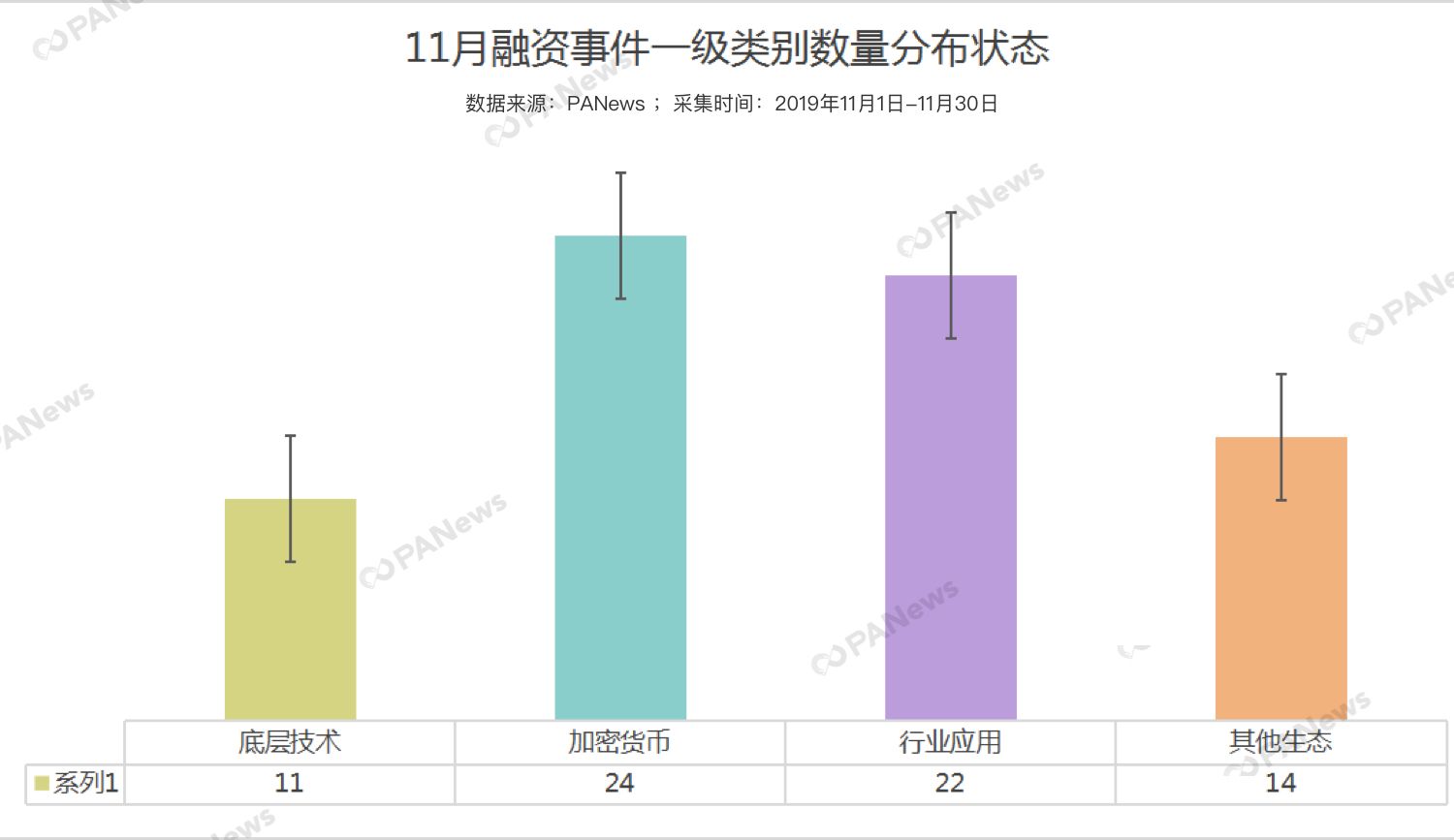

In November, the blockchain scenario was launched and the power was developed, and industry application financing events continued to rise, closely following the cryptocurrency category. In addition, the number of underlying technologies, cryptocurrencies, industry applications, and other ecological financing events tends to develop in a balanced manner in the overall ratio distribution state, with multiple persons simultaneously.

From the perspective of the development status of major categories, among the four first-level categories of underlying technology, cryptocurrency, industrial applications, and other ecology, cryptocurrency projects and industrial application projects still have prominent advantages in market capacity performance, with equal fanfare, and cryptocurrency. In November, 24 financing events and 22 industrial application events occurred, respectively. Since then, there have been 11 cases of the underlying technology and 14 cases of other ecology, and more projects have emerged in other ecology.

Among them, the underlying subcategories of the two major categories of underlying technology and cryptocurrency have a large difference in development, showing a single point of breakthrough, and the state of development of Zhongxing Gongyue. In contrast, the two major categories of industry applications and other ecosystems are well-balanced in the development of sub-segments, with sub-categories scattered and cooperating.

Among the sub-categories, technical services, exchanges, game applications, and information services have become the most promising sub-categories in the four first-level categories. Among them, the exchange ranked first among all the subdivided sub-categories, with a total of 15 monthly events, accounting for 21.13%; the game application category ranked second, with 9 cases, 12.68%; There are 5 cases of technical service project and DeFi project.

It is worth noting that in exchange-type financing events, Australia's BB.VIP exchange received the largest amount of investment in this category, $ 5 million. In addition, the HomiEx Red Rice Exchange has obtained several strategic investments from multiple parties, including investors from Jidou Capital, Red Chain Capital, and Genesis Capital. And in the amount of financing.

In the popular game application, the total amount of financing publicly disclosed in this category in November was 24.986 million US dollars, and Mythical Games became the biggest winner of such projects with 19 million US dollars. Sky Mavis, BetProtocol and other projects also received million-level financing in November. In addition, CAME received a total of 4 multi-party strategic investments in November.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What did five academicians and scholars attend this academic conference called “blockchain palace”?

- Babbitt Site | Academician Zheng Zhiming of the Chinese Academy of Sciences: The establishment of China's national sovereign blockchain basic platform is imminent

- People in the central bank: access to the “regulatory sandbox” must be licensed for Beijing 46

- Leopard in the tube, through these various IPFS applications, do you smell anything?

- The virtual currency futures contract market has become a monster and urgently needs regulatory compliance

- Which Ethereum successor is strong? ——A picture to understand the blockchain

- Domestic chain reform case sharing-electronic certificate deposit based on blockchain