Forget about NVT and currency exchange equations, this has a new model for crypto asset valuation.

We recently released our first comprehensive research report on digital assets. In this report, we present an upgraded version of the cryptographic asset valuation methodology. This article we hope to share with a wider audience. We welcome any feedback, especially the well-founded criticism, because we firmly believe that the valuation model for digital assets is still at an early stage of development.

How to value cryptocurrencies is a key challenge for traditional investors, who have only recently begun to pay attention to this new asset class. But the valuation method is still very lagging today.

The stock market has a history of four centuries. After 130 years of operation on the New York Stock Exchange, the discounted cash flow (DCF) model became the mainstream method of stock valuation. So far, no one really knows how to value a crypto asset that has been around for 10 years, which is not surprising. Although some research fanatics have tried, the mainstream valuation methods have not yet developed.

In this article, we present our approach. We believe that this approach has taken a meaningful step in the valuation of cryptographic assets. We assume that the reader already has a certain knowledge background, familiar with the network value-to-transaction ratio (NVT) proposed by Willy Woo and refined by Dmitry Kalichkin, and based on the currency exchange equation (rooted in monetary quantification theory). The absolute valuation method, which was proposed by Chris Burniske and Brett Winton, respectively.

- Is traditional bank and DeFi isolated from each other? No, Linen allows non-encrypted users to borrow on encrypted assets.

- Zhu Min: Libra may bring 4 kinds of subversion, 7 opportunities

- Starting to sell 8 bitcoins in 2 hours, is Bakkt’s bull market myth gone?

Chain smell note:

- The NVT indicator proposed by Willy Woo can be found at https://www.forbes.com/sites/wwoo/2017/09/29/is-bitcoin-in-a-bubble-check-the-nvt-ratio/#66224c526a23

- Dmitry Kalichkin's rethinking of NVT indicators can be found at https://medium.com/cryptolab/https-medium-com-kalichkin-rethinking-nvt-ratio-2cf810df0ab0

- Chris Burniske's cryptographic asset valuation model https://medium.com/@cburniske/cryptoasset-valuations-ac83479ffca7

- The cryptographic asset valuation model proposed by Brett Winton https://medium.com/@wintonARK/how-to-value-a-crypto-asset-a-model-e0548e9b6e4e

First, we believe that at least at the current level of public chain development, NVT cannot be used to evaluate networks because this ratio is only a function of a single specific variable, the speed of circulation. We will deduce a simple formula to prove this.

Secondly, we will introduce the valuation method we use internally. This method is also based on the exchange equation, but unlike the models of Burniske and Winton, it can explain all the development stages of a blockchain from today to the future. We will use the INET Universal Token Model to compare the results obtained with our method with those obtained by the methods used by Burniske and Multicoin Capital.

Chain Note: The online version of the INET Universal Token Model can be found at https://docs.google.com/spreadsheets/d/1ng4vv3TUE0DoB12diyc8nRfZuAN13k3aRR30gmuKM2Y/edit#gid=1912132017

Come, starting from NVT, NVT is the ratio of the market value of a network to its daily volume. If we use the exchange equation to name it, then the network value (NV) is equal to the size of the asset base (M). In other words, according to the definition NVT = M / Tdaily , where T represents the sum of all transactions on the chain. Recall that the P*Q on the right side of the exchange equation is also defined as the transaction volume of a blockchain, such as M*V = P*Q = Tannual, where P represents a commodity or service provided by the blockchain. Price, Q represents the amount of such resources. Thus, M / Tannual = 1/V, where V represents the annual circulation rate of an asset.

The daily trading volume, and the resulting NVT ratio, are very unstable. To smooth the fluctuations in the NVT, Dmitry Kalichkin recommends using a moving average of the volume. However, there is another way to smooth NVT, which is to use the tracking annual volume as the denominator of the ratio. We call it NVTannual . In this case, NVTannual = M / Tannual, we get a very simple formula:

NVTannual = 1/V

This brings us some very important conclusions. Due to the different usage scenarios, the circulation speeds of different currencies are likely to be different, so we cannot use the NVT ratio to compare these currencies. Moreover, we cannot use the NVT ratio to compare the same currency at different stages of its blockchain development, as its circulation speed may change over time.

In this way, NVT is only suitable for mature blockchains with relatively stable circulation speeds. The NVT valuation method can only be used to assess the intrinsic value of the current active blockchain, just as the P/E ratio can only be used to assess profitable entities.

We introduce a new concept: the ratio of network value to future transactions (NVFT) , which may be a better way to estimate cryptocurrency .

Traditional finance values the ratio of price to future earnings, not the ratio of price to historical income. By the same token, it makes more sense to use NVFT to value cryptographic assets. However, using NVFT also means more unknowns. The cryptocurrency market must become mature enough to allow analysts in the blockchain to estimate their future trading volume and reach consensus forecasts. So we will accept it as a concept now.

In any case, with the NVT/speed equation, we can make a more reasonable judgment of the NVT ratio. If we can't determine a specific value for speed, we can't get a fair value for that ratio, but making assumptions based on more easily available speeds is easier than speculating on the value of the abstract NVT ratio. For example, application tokens should have a higher circulation speed, so their NVT should be lower. If a token is changed every day, its annual circulation rate is equal to 365, and NVT is equal to 1.

HASH CIB valuation method

Now let's focus on the main goal of this paper, the absolute valuation method .

The Burniske and Winton models actually only consider a subjectively selected future time period, which is the most troublesome for us. The model predicts the CUV (current utility value) of a public chain for all years before the network matures (ie, reaches its assumed market share ) . The model then discounts only the CUV of its subjective selection for a certain year, virtually ignoring all intermediate and subsequent CUVs, making all the complex calculations used to derive them irrelevant.

Let's consider a situation where the initial adoption curve of a network is steep and the initial curve of another network is flat. In the year we selected for discounting, both have the same CUV, then the calculation in the model Their valuations will be the same. This is obviously unfair.

This model also assumes that the velocity of money is constant, but this is clearly not realistic. Of course, this is not a major drawback, because the biggest problem is that this method only considers a certain period in the future, and only pays attention to the speed in this period. This also leads us to believe that if we only focus on one time period and ignore all other time, then modeling the speed of dynamic change does not make much sense. Alex Evans also discusses the update of the initial model. .

All in all, in order to make the valuation method more robust, we must consider all the periods in which a blockchain exists. In our opinion, the direct summation of all discounted intermediate periods is purely a repetitive calculation and fundamentally wrong. We see that Multicoin Capital has used this method to value 0x . We believe that the target price of their model is unreasonably raised.

We present our internal evaluation method, which is our modification of the Burniske/Winton model. It considers all stages of a blockchain development and assumes that the speed is dynamically changing, thus being able to cope with the various issues discussed above. Since the model is only applicable to currencies with practical value and blockchains under development, we are not willing to refer to the numbers generated by this method as “target” or “fair” prices. We would like to call this a “ reasonable ” " Rational Network Value " (RNV) .

We believe that the reasonable utility value of the network is not only the future CUV discount of a certain year, nor the sum of the CUV discounts of all forecast years. We believe that a better way to model the rational utility value of a blockchain is today's utility value plus the annual discounted additional current utility value (ACUV) to infinity. The ACUVt of the t year is equal to the difference between the CUVt of t years and the CUVt-1 of t-1 years.

ACUVt = CUVt — CUVt-1

The following simple example can explain the similarities and differences of our method. Imagine that a network matures after 5 years, and has since grown at an annual rate of growth. By the end of t, the utility value of the network is represented by CUVt. Then, the additional utility value ACUVt of period t is equal to CUVt — CUVt-1. The TV at the end of the fifth year is equal to ACUV6 / (rg) = ACUV5 * (1 + g) / (rg). This is a classic formula for calculating the final value, where r is the discount rate.

In this example, the RNV is as follows:

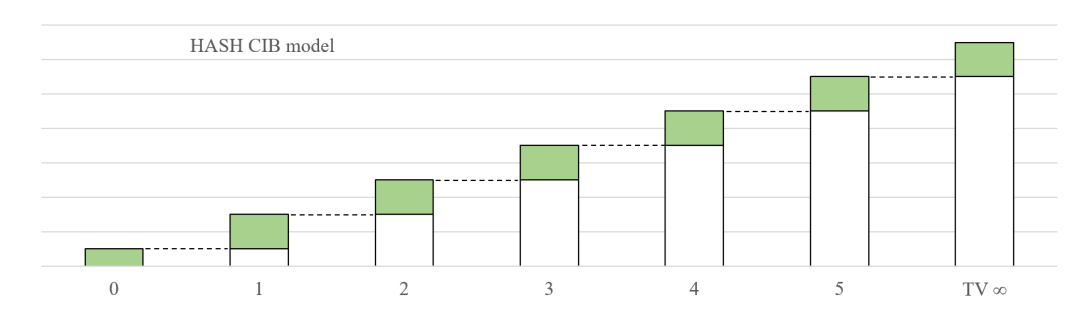

The following figure shows which CUVs are considered for each of the three models:

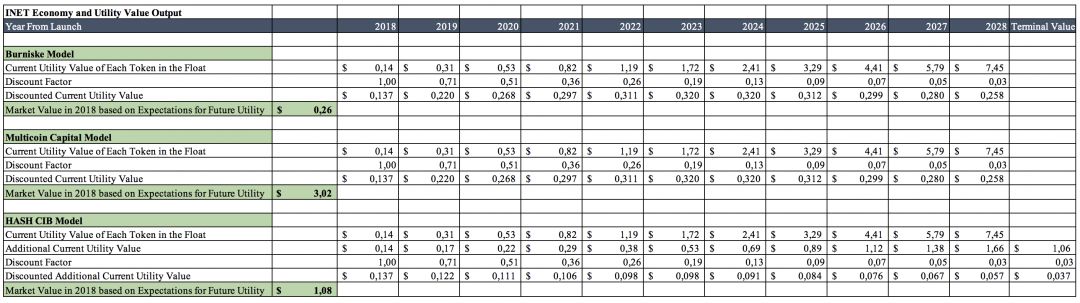

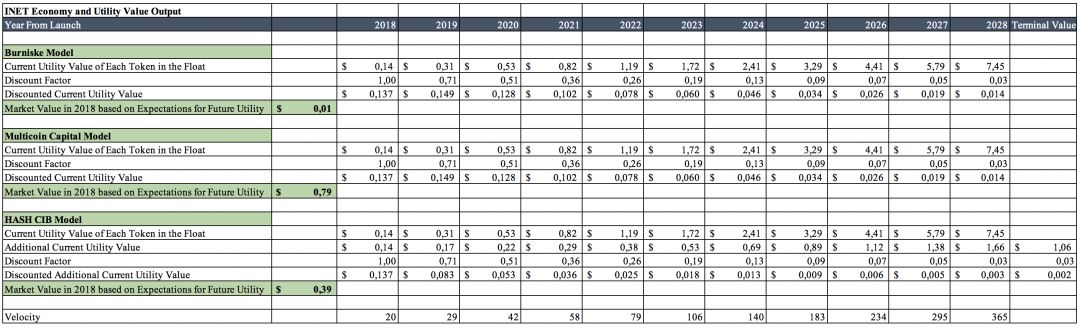

For further comparison, we used Burniske's generic INET token model to calculate the target price for the three valuation methods. Since we have not changed any of the presets, the Burniske method gives the same valuation as before, or $0.26. We then used Multicoin Capital's method to summarize the discounted CUVs for all cycles in the Burniske model, resulting in a valuation of $3.02. The difference between the two valuation methods has increased the target price by nearly 12 times! Using our method, the result is a price of $1.08 per INET token, which is still more than 4 times higher than the original target price. However, in this case, we used constant velocity for all three models. If the dynamic rate of change is used in our model, then the target price is $0.39.

ACUVt = CUVt – CUVt1

Constant velocity model

The speed at which a crypto asset is circulated is likely to increase as its trading volume increases and the blockchain matures. John Pfeffer reasonably believes that a practical blockchain, if in equilibrium, will have a very high rate and its PQ will equal the cost of the computing resources needed to run the network. Even if some of the useful tokens are held forever, such as a bet in the PoS Consensus, the rest of the tokens should change hands frequently, which will increase the overall circulation rate.

In our internal model, we use dynamic and growing speed to evaluate the value of encrypted assets. The reason is simple. Only investors, not end users, will purchase tokens during the ICO period and subsequent secondary markets, and only investors will hold tokens while the blockchain is in development and maturity. We believe that even if they trade, the average holding time will be months, not days. Therefore, in the initial phase of the project, the circulation speed is relatively low. If the project is successful and the network is up and running, end users will join in and use the token for their primary purpose. At this time, end users have gradually replaced investors as token holders, and the transaction speed has also increased.

In our model, based on the logistic S-curve, we assume that the speed of cryptographic assets is increasing synchronously with the adoption of the blockchain. People can freely adjust the steepness of the S-shaped curve, depending on their assumptions about the future success of the blockchain, but the general rule is that the transaction speed and adoption rate have similar S-shaped curves. If we still use the INET model to perform the same calculations for the three methods as before, the rate will increase from 20 in 2018 (originally in the INET model) to 365 in 2028 (ie, the token changes daily) , we will get The following three target prices: $0.014 for the Burniske model; $0.79 for the Multicoin Capital model; $0.39 for the HASH CIB model.

Dynamic rate model

HASH CIB Valuation Method Practice To help you finally digest our valuation methodology, we want to show how it works on an extremely simple model. The move is to explain our approach clearly, so we don't make complex assumptions about a hypothetical blockchain project, its circulation tokens, and so on.

We believe in the KISS principle .

Suppose there is a blockchain project called UT that aims to provide decentralized storage services that will account for 10% of the global storage market share by 2028.

Assumptions are as follows:

- The global storage market is expected to be $30 billion in 2018 and is expected to grow 13%-22% between 2018 and 2028.

- According to the classical logistic function (or S-curve) , UT's market share has increased from 0% in 2018 to 10% in 2028.

- The circulation speed of UT coins increased from 0 in 2018 to 365 in 2028, while UT's market share also increased according to the same S-curve.

- UT has 50 million tokens in circulation, with an annual inflation rate of 5%.

- Discount rate is 40%

First, we derive the market share of UT for each period based on the logistic function. Next, we calculate the UT's annual trading volume as a result of its market share and total storage market. In our valuation model, this trading volume is CUV. Third, calculate the ACUV value and final value (TV) for each period from 2019 to 2028. Fourth, we get the annual circulation speed of UT tokens. Then we get the number of tokens circulating in each period. Sixth, we calculate the ACUV discount rate for each period and the TV for 2028, and divide by the corresponding token quantity and speed value. Finally, we summed up the original CUV in 2018 and all the values derived from the previous step, and came to the reasonable value of the UT token at the end of 2018.

Universal HASH CIB model (miniature version).

Written by: Rustam Botashev, Senior Analyst, HASH CIB Compilation: Zhan Wei Source: Chain Wen

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bakkt officially launched, taking stock of the advantages of Bakkt, why is the bull market still not coming?

- Bakkt is officially open for trading, there are 5 things you don't know.

- Dutch oil and gas giant Dietmann uses blockchain platform to simplify the deployment of projects on the chain

- Funds Fair Win and imitation led to the congestion of Ethereum in the past few days, and the number of confirmed transactions was as high as 120,000.

- Demystifying the airdrop ecology of “nothing to be born”: Some people bought a house, and some people got nothing.

- Ethereum 3.0 plans to surface, resisting quantum computing attacks

- Non-serious discussion on blockchain finance from "self-tearing" (3): reality and future