Four words explain why bullish bitcoin: from now 50 years, that monetary base will be it

This article is about 17,000 words, and it takes about 40 minutes to read the full text.

As bitcoin prices soar to new highs in 2017, the reasons for investors to bullish bitcoin may seem obvious at a glance, no need to explain. On the other hand, investing in a digital asset without any commodity or government endorsement seems stupid, and its price increase has prompted some to compare it with tulip fanaticism or the Internet bubble. The above two statements are wrong; the reasons for bullish bitcoin are convincing, but far from obvious. There are significant risks in investing in Bitcoin, but as I said, there are still huge opportunities.

In the history of the world, it is impossible to transfer value between two people without relying on trusted intermediaries (such as banks or governments). In 2008, Satoshi Nakamoto, who has never been known until now, published a nine-page plan that solved the long-standing problem of Byzantine generals in the field of computer science. Nakamoto's solution and the system he built, Bitcoin, allow people to transfer value quickly and remotely in a way that is completely untrustworthy for the first time in history. The creation of Bitcoin has had a profound impact on both economics and computer science, so Nakamoto should be the first person to qualify for the Nobel Prize in Economics and the Turing Award.

- May 7th Twitter Featured: Switzerland's largest stock exchange launches IDO, Coinbase hosted tokens over 30

- Market analysis on May 7th: The market is prosperous and the USDT exchange rate crisis is highly suspended.

- April cryptocurrency financing monthly report: IEO replaced ICO as the main mode but the total amount still dropped by 70%

For investors, the prominent fact of the invention of the Bitcoin system is that it has created a brand new scarce digital commodity, Bitcoin. Bitcoin is a negotiable digital token, and the process of creating it on a bitcoin network is called "mining." Bitcoin mining is roughly similar to gold mining, except that its production follows a well-designed, predictable schedule. According to the design, only 21 million bitcoins are waiting to be mined, most of which have already been dug up – at the time of writing (note: this article was published on March 2, 2018), about 16.8 million bitcoins have been mined. Every four years, the number of bitcoins produced by mining will be halved, and the production of new bitcoins will be completely completed in 2140.

Bitcoin does not endorse any physical goods and is not guaranteed by any government or company. This raises an obvious question for new bitcoin investors: Why is Bitcoin valuable? Unlike stocks, bonds, real estate, and even commodities such as oil and wheat, Bitcoin cannot be valued through standard discounted cash flow analysis or through demand for the production of higher-end goods. Bitcoin belongs to a completely different category of goods, called monetary goods, whose value is set by game theory, that is, each market participant's valuation of goods is based on how they value other participants. Evaluation. To understand the game theory nature of money, we need to explore the origin of money.

In the earliest human society, trade between people was carried out through barter trade. The incredible inefficiency inherent in barter trade has greatly limited the scale and geographic extent of trade. Barter trade-based trade has one major drawback, the double coincidence of demand issues. For example, apple farmers may wish to trade with fishermen, but if fishermen do not want apples at the same time, the transaction will not happen. Over time, people began to desire to own certain collectibles because of their rarity and symbolic value (such as shells, animal teeth and meteorites). In fact, as Nick Szabo said in his wonderful paper on the origins of money, human desire for collectibles is more of an early human being than its closest biological competitor, Neander. Special offers a unique evolutionary advantage.

The primary and final evolutionary function of the collection is as a medium for storing and transferring wealth.

Collectibles can be used as a “primitive currency” by trading between other hostile tribes and allowing wealth to be transferred between generations. In the Paleolithic society, the trading and transfer of collectibles was rare, and these goods were more like a “value store” than our “transaction medium” as perceived by modern currencies. Saab explained:

Compared to modern currencies, the flow of the original currency is very low – it may only be transferred several times during the lifetime of the average person. Despite this, durable collections, which we call today heirlooms, can last for many generations and add substantial value to each transfer – often making the transfer possible.

When deciding which collections to collect or create, early humans encounter an important game theory dilemma: what other people would want? By correctly predicting the collectable value of what items people will need, the holder can complete the transaction and gain wealth and get huge benefits. Some Native American tribes, such as the Narragansetts, specialize in making collections that are not used by others, simply because of their value in trade. It is worth noting that the earlier the expectation of the demand for collectibles in the future, the greater the advantage given to its owners; it can be obtained cheaper than when it is widely demanded, and as the population of expanding demand grows, Its trade value will appreciate. In addition, it is hoped that a commodity will be acquired as a future value store, thus accelerating its adoption. This cycle is actually a feedback loop that prompts society to condense into a single value store. In game theory terms, this is called "Nash Equalibrium." A Nash equilibrium that achieves value storage is a great boon for any society because it greatly promotes trade and division of labor and paves the way for the emergence of civilization.

For thousands of years, with the development of human society and the development of trade routes, the value stocks that have emerged in various societies have begun to compete with each other. Merchants and traders will face the choice of storing their trading proceeds in the value store of their own society, or in the value store of the society in which they trade, or in a balance between the two. Maintaining the benefits of storing in foreign value stores enhances the ability to complete trade in relevant foreign societies. Merchants stored in foreign value stores also have the incentive to adopt it in their own society, as this increases the purchasing power of their savings. The benefits of importing foreign value stocks are not only in the importers but also in society itself. The two societies are concentrated in a single value store, and the cost of completing each other's trade will drop dramatically, followed by trade-based wealth growth. In fact, the 19th century was the first time in most parts of the world to gather in a single value store – gold – the largest trade explosion in world history. In this quiet period, Lord Keynes wrote:

That era is an extraordinary chapter in the economic progress of mankind… Anyone with the ability or some characteristics can exceed the average level and enter the middle and upper classes; that era with low cost and least trouble Providing convenience, comfort and enjoyment for their lives, even beyond the level of the richest and most powerful monarchs of other eras. Residents of London can sip his morning tea on the bed while ordering the various products that he considers to be appropriate in number, and reasonably expect them to be delivered to his door early.

When value stores compete with each other, a particular property of a good value store allows a certain value store to stand out at the margin and increase its demand over time. While many items are used as value stores or "original currencies," there are certain attributes that are particularly desirable, and items with these attributes will outperform others. The ideal value store will be:

- Durable: The item cannot be easily rotted or easily damaged. Therefore wheat is not an ideal value store.

- Portable: The item must be easy to transport and store, preventing loss or theft and making it easy to trade long distances. Therefore, a cow is not as good as a gold bracelet.

- Interchangeable: Any one of the items should be interchangeable with another equivalent item. Leaving interchangeability, the coincidence of demand remains unresolved. Therefore, gold is better than diamonds, and the shape and quality of diamonds are irregular.

- Verifiable: The item must be easy to identify and verify quickly. Simple verification increases the confidence of its recipients in the transaction and increases the likelihood that the transaction will be completed.

- Dividable: The item must be easy to subdivide. While this attribute is not as important in early trade with infrequent trade, it is becoming increasingly important as trade flourishes and the number of exchanges becomes smaller and more precise.

- Scarce: As Nick Saab said, money must have "unforgeable costs." In other words, the quantity of goods is not rich or easy to obtain or produce in large quantities. Scarcity may be the most important attribute of value storage because it takes advantage of the nature of human desire to collect rare items. It is the source of the original value of value storage.

- A long history: The longer the item is considered valuable by society, the greater its appeal as a value store. A long-established value store will be difficult to replace with a new one, unless by the power of conquest, or if the upstart has a significant advantage in the other attributes mentioned above.

- Anti-censorship: Anti-censorship is a new attribute that is becoming more and more important as we monitor the ubiquitous modern digital society. That is to say, for an external party such as a company or a country, it is difficult to prevent the owner of the item from retaining and using it. Some regimes are trying to implement capital controls or prohibit all forms of peaceful trade. For these people, items with censorship are ideal choices.

The table below ranks Bitcoin, Gold, and French currency (such as US dollars) based on the attributes listed above, and then explains each level one by one:

Durability:

Gold is the undisputed king of durability. The vast majority of gold that has been mined or cast, including the pharaoh's gold, still exists today and is likely to be available after a thousand years. Gold coins used as currency in ancient times still maintain important value today. French and Bitcoin are basically digital records and may take physical form (such as banknotes). Therefore, the physical performance of its durability should not be considered (because the dilapidated US dollar bills can be replaced with new ones), but the durability of the institution that issued them. In the case of legal currency, many governments have passed away for centuries and their currencies have disappeared. The paper mark, the rent mark and the empire mark of the Weimar Republic no longer have value, because the institutions that issued them no longer exist. If you follow historical guidelines, it is foolish to think that the currency is persistent in the long run—in this respect, the dollar and the pound are relatively abnormal. Bitcoins without an issuer can be considered persistent, as long as the network protecting them still exists. Given that Bitcoin is still in its infancy, it is too early to draw strong conclusions about its durability. However, there are encouraging signs that although countries have been trying to regulate bitcoin, hackers have been attacking it for years, and the network continues to play a role, showing a very high degree of “anti-vulnerability”.

Portability:

Bitcoin is the most portable value store in human history. The private key representing hundreds of millions of dollars can be stored in a small USB flash drive and easily carried anywhere. In addition, the amount of the same value can be transmitted instantly between people at both ends of the globe. The currency is basically digital and very portable. However, government regulation and capital controls mean that a large amount of value transfer usually takes days or even impossible. Cash can be used to avoid capital controls, but subsequent storage risks and transportation costs become large. The density of physical gold is extremely large and is by far the least portable. There is no doubt that most gold bars have never been shipped. When a gold bar is transferred between the buyer and the seller, usually only the ownership of the gold is transferred, not the physical bar itself. Transporting physical gold over long distances is expensive, dangerous and time consuming.

Interchangeability:

Gold provides a standard for interchangeability. When melted, one ounce of gold is essentially indistinguishable from another ounce, and gold has been traded on the market in this way. On the other hand, the currency is only interchangeable by the currency allowed by the issuing institution. Although merchants who accept statutory banknotes usually treat each banknote the same, in some cases large denominations are handled differently than small banknotes. For example, when the Indian government tried to destroy India's untaxed gray market, it completely de-monetized its 500 rupees and 1000 rupees. This non-monetization allows 500 rupees and 1000 rupees of notes to be traded at a price below their face value, which makes them no longer interchangeable with their lower denomination notes. Bitcoin is interchangeable at the network level, which means that each bitcoin is identical on the bitcoin network when it is transmitted. However, since bitcoin is traceable on the blockchain, certain bitcoins may be contaminated by their use in illicit trade, and merchants or exchanges may be forced to accept such contaminated bitcoins. If you don't improve the privacy and anonymity of Bitcoin's network protocols, you can't think Bitcoin is interchangeable like gold.

Verifiability:

In general, verifying the authenticity of both French and gold is relatively easy. However, despite the ability to prevent counterfeiting on their banknotes, countries and their citizens still face the possibility of being cheated by counterfeit banknotes. Gold is also not immune to being forged. Sophisticated criminals use gold-plated tungsten to trick gold investors into buying fake gold. On the other hand, bitcoin can be verified with mathematical certainty. Using a cryptographic signature, the owner of Bitcoin can publicly prove that he has what he calls bitcoin.

Severability:

Bitcoin can be split into one billionth of a bitcoin and transmitted in such a small amount (but network costs can make microtransports uneconomical). The legal currency can usually be divided into small pockets with little purchasing power in the pocket, which makes the French currency sufficiently divisible in practice. Although gold is physically fragmentable, it becomes difficult to use when it is divided into small enough quantities available for low-value daily transactions.

Scarcity:

The most distinguishing distinction between Bitcoin and French currency and gold is its predetermined scarcity. By design, you can create up to 21 million bitcoins. This allows the owner of Bitcoin to know that they are a percentage of the total available supply. For example, people with 10 bitcoins will know that up to 2.1 million people on Earth (less than 0.03% of the world's population) may have as many bitcoins as they do. Although gold is still very scarce in history, it is not immune to the increase in supply. If new mining or gold acquisition methods become economical, the supply of gold may rise sharply (such as undersea or asteroid mining). Finally, although the French currency is only a relatively new invention in history, it has been proven that its supply is increasing. Countries have shown a continuing tendency to expand their money supply to address short-term political issues. The inflationary tendencies of governments around the world have made the value of savings for legal currency holders likely to decrease over time.

historical:

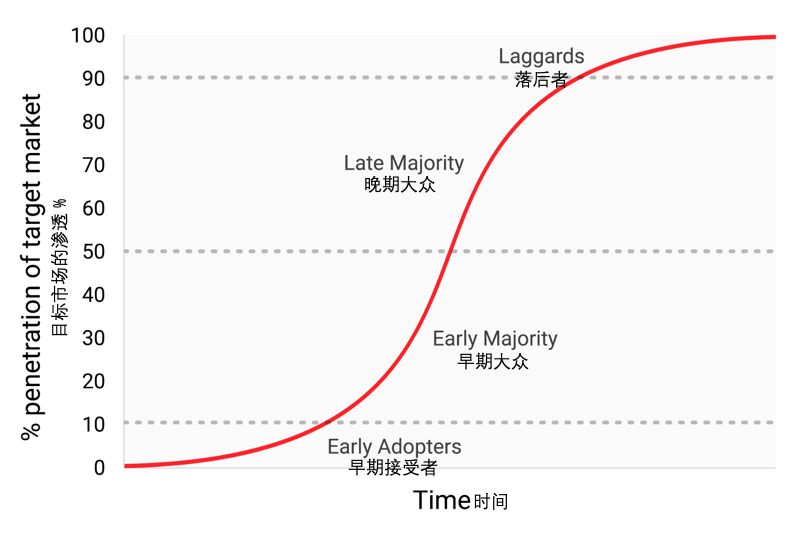

The history of no other currency is as long and legendary as gold. As long as human civilization exists, gold will always be regarded as valuable. Coins cast in distant ancient castings still retain important value today. This is not the case with legal currency, it is a relatively new anomaly in history. From the beginning, French currency has almost always tended to return to zero. The use of inflation as an insidious means of intangible taxation of citizens has always been a temptation that few countries in history have been able to resist. If the 20th century, where the currency dominates the global monetary order, establishes any economic truth, it cannot be trusted that the law can maintain its value in the long run and even in the medium term. Although bitcoin has a short time, it has already withstood enough tests in the market, and it is likely that it will not disappear as a valuable asset soon. And, the Lindy Effect shows that the longer Bitcoin remains, the greater the confidence that society will have for a long time to continue in the future. In other words, the trust of society in a new currency is essentially asymptotic, as shown in the following figure:

If Bitcoin has existed for 20 years, then people will have the confidence that it will last forever, just as people think the Internet is a permanent feature of the modern world.

Anti-censorship:

One of the most important sources of early bitcoin demand is their use in the illegal drug trade. Many people later mistakenly speculated that the main demand for bitcoin was due to their apparent anonymity. However, Bitcoin is far from anonymous currency; every transaction transmitted on the Bitcoin network is permanently recorded on the public blockchain. The history of the transaction allows for later forensic analysis to identify the source of the flow of funds. It is by this analysis that the famous MtGox thieves are brought to justice. Although a person who is careful and hardworking can hide his identity when using Bitcoin, this is not why Bitcoin is so popular in the drug trade. The key attribute that makes Bitcoin valuable for prohibited activities is that it is “no license” at the network level. When Bitcoin is transmitted over the Bitcoin network, there is no human intervention to decide whether the transaction should be allowed. As a distributed peer-to-peer network, Bitcoin is essentially designed to be resistant to censorship. This is in stark contrast to the statutory banking system in which state-regulated banks and other money transfer gatekeepers report and prevent the illegal use of currency products. A typical example of regulated currency transfers is capital controls. For example, wealthy millionaires may find it difficult to transfer their wealth to a new home if they wish to escape an oppressive regime. Although gold is not issued by the state, its physical nature makes it difficult to spread long distances, making it more susceptible to state regulation than bitcoin. India's “golden control law” is an example of such regulation.

Bitcoin excels in most of the attributes listed above, enabling it to transcend modern and ancient currency products at the margins and provide a powerful impetus for its growing popularity. In particular, the effective combination of censorship and absolute scarcity has been a powerful incentive for wealthy investors to allocate some of their wealth to the new asset class.

Modern monetary economics is obsessed with the exchange of money. In the 20th century, countries monopolized the issuance of money and continually undermined its use as a value store, creating a false belief that money was primarily defined as a medium of exchange. Many people have criticized Bitcoin for not being used as a currency because its price is too unstable to be suitable as an exchange medium. However, this is the end of the cart. Money always evolves in stages, and the role of value storage precedes the role of the medium of exchange. William Stanley Jevons, one of the founders of marginalist economics, explained:

Historically, … gold seems to be used first as a valuable commodity for decorative purposes; second, as a stored wealth; third, as a medium of exchange; and finally, as a measure of value.

In modern terms, the evolution of money always follows the following four stages:

- Collection . In the first phase of its evolution, money will be based entirely on its unique attributes, often becoming the owner's whim. Before turning into a more well-known currency role, shells, beads and gold are collectibles.

- Value storage : Once its traits are needed by enough people, money is seen as a means of maintaining and storing value over time. As an item is widely viewed as a suitable value store, its purchasing power will increase as more people demand it for this purpose. The purchasing power of a value store will eventually reach a stable level when it is widely held and it is expected to use it as a newcomer to the value store.

- Exchange medium : When money is fully established as a value store, its purchasing power will stabilize. After stabilizing purchasing power, the opportunity cost of completing a transaction using currency will be reduced to a level suitable for use as a medium of exchange. In the earliest days of Bitcoin, many people did not understand the huge opportunity cost of using bitcoin as a medium of exchange rather than initial value storage. This confusing is illustrated by the famous story of 10,000 bitcoins (worth $94 million at the time of writing) for two pizzas.

- Accounting unit . When money is widely used as a medium of exchange, goods are priced. That is, most commodities will have an exchange rate for this currency. People often mistakenly believe that many commodities today have bitcoin prices. For example, although bitcoin can be used to purchase a cup of coffee, the listed price is not a true bitcoin price; rather, at the current dollar/bitcoin market exchange rate, the dollar price desired by the merchant is converted to the bitcoin price. If the price of Bitcoin against the US dollar falls, the number of Bitcoins required by the merchant will increase accordingly. Only when a merchant is willing to accept bitcoin payments without considering the exchange rate of Bitcoin against French currency can we truly believe that Bitcoin has become a unit of account.

A currency that has not yet become a unit of account may be considered “partial monetization”. Today, gold has played such a role as a value store, but it has been deprived of its role as a medium of exchange and accounting units by government intervention. An item may also play the role of exchange medium for money, while another item plays other roles. This is usually the case in countries with dysfunctional countries such as Argentina or Zimbabwe. Nathaniel Popper wrote in his book Digital Gold:

In the United States, the dollar seamlessly serves three functions of money: the exchange medium, the unit that measures the cost of goods, and the assets that can store value. On the other hand, in Argentina, the peso is used as a medium of exchange – for everyday purchases – and no one uses it as a value store. Saving with a peso is equivalent to throwing money. So people change the pesos they want to save into dollars, and their ability to hedge is stronger than the peso. Since the peso is very unstable, people usually remember the price in dollars, which provides a more reliable measure.

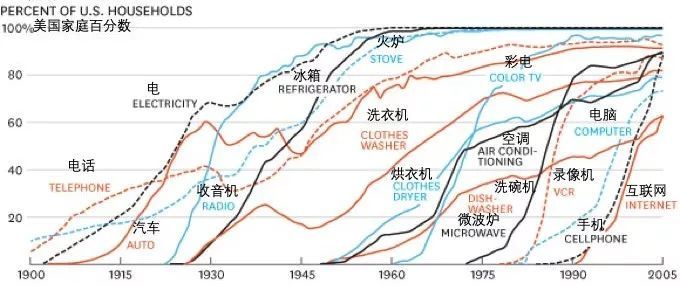

Bitcoin is currently transitioning from the first phase of monetization to the second phase. It may take several years for bitcoin to change from an initial value store to a true exchange medium, and the path required to achieve this goal is still full of risks and uncertainties. It is worth noting that the same transitional gold also takes centuries. No one has seen real-time monetization of an item (just as bitcoin is happening), so we have little experience with this monetized road.

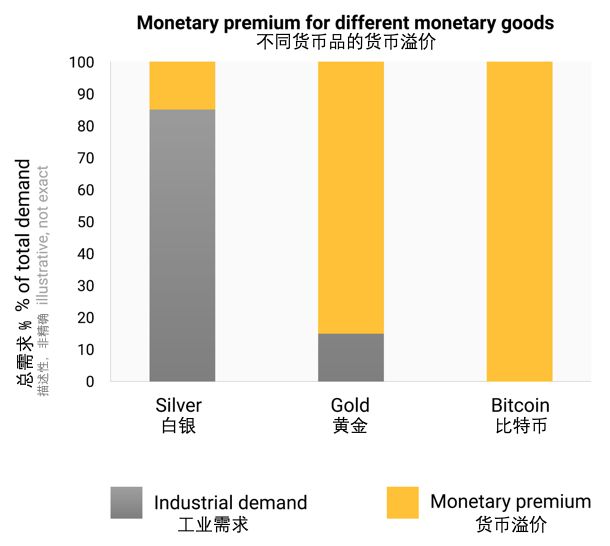

In the process of monetization, the purchasing power of money products will soar. Many people commented that the increase in the purchasing power of Bitcoin has created a "bubble". Although the term is often low to indicate that Bitcoin is heavily overvalued, it is certainly appropriate. A common feature of all currency products is that their purchasing power is higher than the purchasing power as evidenced by their value in use. In fact, many currencies in history have no use value. The difference between the purchasing power of a currency product and the exchange value indicated by its intrinsic use can be considered a "currency premium." As the currency changes in the monetization phase (listed above), the currency premium will increase. However, the premium is not a straight, predictable line. An item X that is being monetized may be defeated by another item Y that is more suitable as a currency, and the currency premium of X may drop or disappear completely. The currency premium of silver almost completely disappeared in the late 19th century, when governments around the world basically abandoned it as a currency and turned to gold.

Even without external factors such as government intervention or other currency competition, the currency premium of the new currency will not follow a predictable path. Economist Larry White observed:

Of course, the problem with the bubble theory is that it is consistent with any price path and therefore does not explain a specific price path.

The process of monetization is game theory; each market participant attempts to predict the aggregate demand of other participants to predict future currency premiums. Since currency premiums are not affected by any intrinsic use, market participants often default to past prices when determining whether currency products are cheap or expensive and whether they are purchased or sold. The link between current demand and past prices is called “path dependence,” and it may be the most confusing place to understand changes in the price of money.

When the purchasing power of a currency increases as the adoption rate increases, the market's expectations for “cheap” and “expensive” will change accordingly. Similarly, when the price of a currency product collapses, it is expected to change, and the previous price is generally considered to be “irrational” or excessively exaggerated. The words of the famous Wall Street fund manager Josh Brown illustrate the path dependence of the currency:

I bought [bitcoin] for about $2,300 and doubled it immediately in my hand. Then I started saying, "I can't buy more," because it went up, even though it was just an anchored opinion, and there was no basis other than my initial purchase price. Then, because China’s banned exchanges fell last week, I began to say to myself: “Oh, well, I hope it will be killed, so I can buy more.”

In fact, the concepts of “cheap” and “expensive” are basically meaningless in terms of currency goods. The price of a currency product does not reflect its cash flow or its usefulness, but rather measures how widely it can bear the various functions of the currency.

Further complicating the path dependence of money is that market participants are not only calm observers, but also predict the movement of money premiums in the future, while buying and selling, they also act as active evangelists. Since there is no objective and correct currency premium, it is more effective to advocate the superior nature of money products than to promote ordinary goods. The value of ordinary goods ultimately depends on cash flow or usage requirements. We can observe the religious enthusiasm of Bitcoin market participants in various online forums where the holders actively promote the benefits of Bitcoin and the wealth that can be earned through investment. When observing the bitcoin market, Leigh Drogen commented:

You will realize that this is a religion – a story we all tell and agree to each other. Religion is the acceptance curve we should consider. It's almost perfect – once someone comes in, they will tell everyone and go out to preach. Then their friends came in and they began to preach.

Although it may bring a sense of irrational belief to Bitcoin in comparison with religion, for individual holders, evangelism is a superior monetary product, and for the whole society, it is tested by standards. It is completely rational. Money is the foundation of all trade and savings, so using high-quality money has enormous multipliers for all members of society to create wealth.

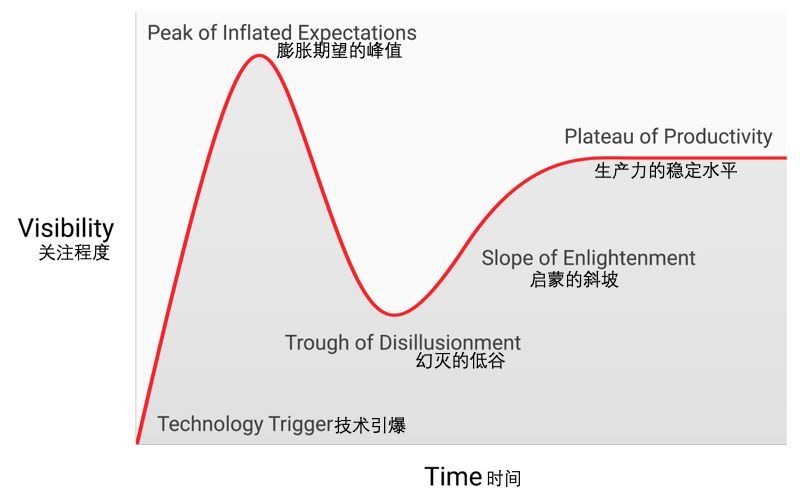

There is no a priori rule for the path taken by a currency in the process of monetization, but a strange pattern emerges in the relatively short history of bitcoin monetization. Bitcoin prices appear to follow a growth-level fractal pattern in which each iteration of the fractal matches the classic shape of the Gartner hype cycle.

In his article " Predulative Bitcoin Acceptance/Price Theory, " Michael Casey argues that the ever-expanding Gardner hype cycle represents a different phase of adoption of a standard S-curve, a number of transformative technologies that are commonly used in society. Both follow this curve.

Each Gardner hype cycle begins with a passion for new technologies, and prices are increased by market participants who are “reachable” during the iteration. The earliest buyers in the Gardner hype cycle often have a strong belief in the technological transformation of their investments. The enthusiasm of the final market is gradually increasing, because the supply of new participants that can be reached in the cycle has been exhausted, and purchases have become more dominated by speculators, and speculators are more interested in fast-tracking than basic technology.

After the peak of the hype cycle, prices fell rapidly, and speculative enthusiasm was replaced by the feeling of despair, public ridicule and no change in technology. The final price bottomed out and formed a platform where a group of new teammates who could withstand the pain of the crash and appreciate the importance of the technology joined the original investors with strong beliefs.

The plains will last for a long time, as Casey said, forming a "stable, boring trough." During the plains, public interest in the technology will be reduced, but it will continue to grow and a strong group of believers will grow slowly. This is followed by a new foundation for the next iteration of the hype cycle, as external observers will realize that technology will not disappear and that investing it may not seem as dangerous in the cycle of the cycle. The next iteration of the hype cycle will bring a larger acceptance group and is much larger in magnitude.

Those who participate in the Gardner hype cycle iterations will rarely correctly predict how high the price will be in the cycle. In the early stages of the cycle, prices usually reach levels that seem absurd for most investors. When the cycle ends, the media usually blames the crash for a hot reason. Although the reason (such as an exchange bankruptcy) may be a trigger event, it is not the root cause of the end of the cycle. The Gardner hype cycle ended because the market participants that were reachable during this cycle were exhausted.

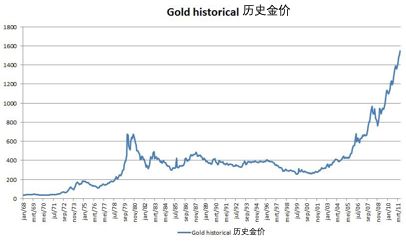

This shows that from the late 1970s to the beginning of the 21st century, gold follows the classic model of Gardner's hype cycle. One might speculate that the hype cycle is a social dynamic inherent in the process of monetization.

Since the first exchange price in 2010, the Bitcoin market has witnessed four big Gardner hype cycles. In hindsight, we can accurately determine the price range of the previous hype cycle in the bitcoin market. We can also qualitatively determine the group of investors associated with each iteration of the previous cycle.

0 USD – 1 USD (2009 – March 2011): The first hype cycle in the bitcoin market was dominated by cryptographers, computer scientists and cyberpunks who first recognized the importance of Sakamoto's breakthrough inventions. Sex, and first determine that Bitcoin's protocol has no technical flaws.

$1 – $30 (2009 – July 2011): The second cycle attracted early adopters of new technologies and a steady stream of ideological investors who dumped the potential of a stateless currency. Liberals like Roger Ver are attracted to Bitcoin, because if new technology is widely adopted, anti-institutional activities will become possible. Wences Casares is a talented and widely-connected serial entrepreneur. He is also a member of the second Bitcoin hype cycle, preaching to some of Silicon Valley's most prominent technologists and investors. Bitcoin.

$250 – $1,100 (April 2013 – December 2013): The third hype cycle witnessed the entry of early microfinance and institutional investors who bravely faced the extremely complex, liquidity risky bits Currency purchase channel. The main source of market liquidity during this period was the MtGox exchange in Japan, which was run by the notorious and misbehaving Mark Karpeles, who later played a role in the bankruptcy of the exchange. I spent some time in prison.

It is worth noting that in the above-mentioned several hype cycles, the increase in bitcoin prices is mainly related to the increase in liquidity and the difficulty of investors buying Bitcoin. In the first hype cycle, there were no exchanges available, and Bitcoin was mainly mined by mining or directly with people who had already dug Bitcoin. In the second hype cycle, basic exchanges became available, but getting and storing bitcoin from these exchanges was still too complicated for everyone except the most tech-savvy investors. Even in the third hype cycle, there are still major obstacles for investors to transfer funds to MtGox to acquire bitcoin. Banks are reluctant to deal with exchanges, and third-party suppliers that facilitate transfers are often incompetent, unethical, or both. In addition, many people who did manage to transfer funds to MtGox eventually suffered financial losses when the exchange was hacked and subsequently shut down.

Only after the collapse of the MtGox exchange, the bitcoin market price has matured and deepened after two years of calm, such as regulated exchanges such as GDAX and off-market such as Cumberland Mining. Dealers. By the start of the fourth hype cycle in 2016, small investors can purchase and store bitcoin relatively easily.

$1,100 – $19,600? (Year 2014-?) :

At the time of this writing, the Bitcoin market is experiencing its fourth hype cycle. The small and institutional investors that Michael Casey called "the early public" dominated the current hype cycle.

As liquidity sources become more sophisticated and mature, large institutional investors now have the opportunity to participate in regulated futures markets. The existence of a regulated futures market paves the way for the creation of a bitcoin ETF, and will also usher in “late masses” and “lagers” in the subsequent hype cycle.

Although it is impossible to predict the exact magnitude of the current hype cycle, it is reasonable to speculate that during this cycle, the peak will reach between $20,000 and $50,000. If it is above this range, Bitcoin will account for a large portion of the total market value of gold (at the time of this writing, if the price of Bitcoin is about $380,000, gold and Bitcoin will reach the same market value). A large part of the market value of gold comes from the needs of the central bank, and the central bank or countries are unlikely to participate in this particular hype cycle.

When countries begin to hoard bitcoin as part of their foreign exchange reserves, Bitcoin will open the final Gardner hype cycle. The market value of Bitcoin is currently too small to be considered as a viable complement to most national reserves. However, as interest in the private sector increases and the market value of Bitcoin approaches $1 trillion, its liquidity will become large enough for most countries to enter the market. The first entry into the country that officially added Bitcoin to its reserves could trigger a surge in other countries. If Bitcoin eventually becomes the global reserve currency, the first country to accept Bitcoin will get the most benefit on its balance sheet. Unfortunately, the country with the strongest executive power – a dictatorship like North Korea – may be the fastest on the bitcoin. The reluctance to see these countries improve their fiscal position, as well as the weak administrative departments inherent in Western democracies, will cause them to hesitate and lag behind in the bitcoin as a reserve.

Ironically, the United States is currently one of the most open countries for bitcoin regulation, while China and Russia are the most hostile countries. If Bitcoin replaces the US dollar as the world's reserve currency, the geopolitical position of the United States will face the greatest downside risks. In the 1960s, Charles de Gaulle criticized the United States for obtaining "excessive privilege" from the international currency order established by the 1944 Bretton Woods Agreement. The Russian and Chinese governments are not aware of the geostrategic interests of Bitcoin as a reserve currency and are currently focusing on their possible impact on the internal market. In the 1960s, Charles de Gaulle threatened to rebuild the classical gold standard in response to the US's excessive privileges. Like him, China and Russia will see the benefits of putting a large portion of their reserves in a non-sovereign value store. As bitcoin computing power is concentrated in China, China has a clear advantage in increasing the potential of Bitcoin in its reserves.

The United States prides itself on being an innovative country, and Silicon Valley is the jewel in the crown of the US economy. To date, Silicon Valley has largely dominated what positions regulators should take on Bitcoin. However, the banking industry and the Fed have finally learned that if Bitcoin becomes the global reserve currency, it will pose a survival threat to US monetary policy. The Wall Street Journal, known as the Fed’s megaphone, published a commentary on the threat posed by Bitcoin to US monetary policy:

There is another danger, which may be even more serious from the perspective of the central bank and regulators: Bitcoin may not collapse. If the speculative enthusiasm for cryptocurrency is simply a precursor to its widespread use as a substitute for the dollar, it would threaten the central bank’s monopoly on the currency.

In the next few years, Silicon Valley entrepreneurs and innovators (who will try to keep bitcoin out of state control) with the banking and central banks (they will do their best to regulate bitcoin to prevent their industry and money-issuing power from being destroyed) There will be a fierce struggle between them.

Money goods cannot be transitioned to a generally accepted exchange medium (the standard economic definition of “currency”) until they are widely considered valuable, in other words, goods that are not considered valuable will not be accepted in the transaction. In a process that is widely considered to be valuable—and therefore used as a value store—the purchasing power of money products will soar, creating the opportunity cost of abandoning its use in exchanges. Only when the opportunity cost of abandoning a value store falls to an appropriate low level can it be transformed into a generally accepted medium of exchange.

More precisely, a currency is suitable as a medium of exchange when the sum of the opportunity cost and the transaction cost of using it in the exchange is lower than the cost of not completing a transaction.

In a barter-based society, even if the purchasing power of money products increases, the transition from value storage to exchange media may occur because the transaction costs of barter transactions are very high. In developed economies with low transaction costs, it is possible to use new and fast-valued value stores like Bitcoin as a medium of exchange, albeit within a very limited scope. One example is the illicit drug market, where buyers are willing to sacrifice the opportunity to hold bitcoin in order to minimize the risk of using drugs to purchase drugs.

However, in developed societies, an emerging value stock has to become a generally accepted medium of exchange, and there are still large institutional barriers. Countries often use the powerful means of taxation to protect their sovereign currency from the impact of competitive currencies. Sovereign currency not only enjoys the advantage of continuing sources of demand, but can only use it to pay taxes, but competitive currency goods are taxed as long as they are valued at the time of the transaction. The latter tax creates a huge friction in the use of a value store as an exchange medium.

However, the disadvantages of market-based money products are not an insurmountable obstacle to their use as a generally accepted medium of exchange. If people lose confidence in a sovereign currency, its value will collapse in what is called hyperinflation. When a sovereign currency has hyperinflation, its value to the most liquid commodity in society (such as gold or the US dollar, if any) will collapse first. If there is no liquidity commodity or its supply is limited, the currency of hyperinflation collapses in kind (real estate, commodities, etc.). The typical image of hyperinflation is an empty grocery store because consumers have fled their national currency, which is rapidly depreciating.

Eventually, when confidence is completely lost during hyperinflation, no one will accept sovereign currency, society will turn to barter, or monetary units will be completely replaced by a medium of exchange. An example of this process is the replacement of the Zimbabwean dollar with the US dollar. The replacement of sovereign currency by foreign currency has become more difficult due to the scarcity of foreign currencies and the lack of foreign banking institutions to provide liquidity.

Because Bitcoin can be easily transported across borders and does not require a banking system, Bitcoin has become an ideal currency for those suffering from hyperinflation. In the next few years, as the currency continues to follow its historical trend and go back to zero, Bitcoin will become an increasingly popular choice for global savings. When a country's currency is abandoned and replaced by bitcoin, bitcoin will change from the value store of the society to a generally accepted exchange medium. Daniel Krawisz coined the term "hyperbitcoinization" to describe the process.

Much of this article focuses on the monetary nature of Bitcoin. With this foundation in place, we can now come up with some of the most common misconceptions about Bitcoin.

Bitcoin is a bubble

Like all market-based currency products, Bitcoin also has a currency premium. The currency premium has caused widespread criticism that bitcoin is a "bubble." However, all currency products will have a currency premium. In fact, this premium (the part that exceeds the usage-demand price) is the decisive feature of all currencies. In other words, money is always a bubble whenever and wherever. Paradoxically, a currency is either a bubble or an undervalued if it is in its early stages of being accepted as a currency.

Bitcoin is too unstable

Bitcoin price volatility is an emerging feature. In the first few years, Bitcoin behaved like a low-priced stock, and any big buyer, such as the Winkleworth brothers, could cause price spikes. With the increase in acceptance and liquidity over the years, the volatility of Bitcoin has decreased accordingly. When the market value of Bitcoin exceeds gold, it will show similar levels of volatility. Since Bitcoin exceeds the market value of gold, its volatility will be reduced to a level suitable as a widely used trading medium. As mentioned earlier, the monetization of Bitcoin takes place in a series of Gardner hype cycles. In the stable period of the hype cycle, the volatility is the lowest, and during the peak period and the collapse period, the volatility is the highest. The volatility of each hype cycle is lower than before because the liquidity of the market has increased.

Transaction fee is too high

A recent criticism of the Bitcoin network is that the increased cost of transmitting bitcoin makes it unsuitable as a payment system. However, the increase in costs is healthy and in line with expectations. The transaction fee is the cost of paying the Bitcoin miner to secure the network by verifying the transaction. Miners can pay through transaction fees or block rewards, which are an inflation subsidy borne by the current Bitcoin owner.

Given that Bitcoin has a fixed supply plan – a monetary policy that makes it ideal for value storage – block rewards will eventually fall to zero, and the network must ultimately be covered by transaction fees. A "low" fee network is a network that is low security and easy to externally review. Those who touted the low cost of bitcoin substitutes unknowingly stated the weaknesses of these so-called "cottage coins."

Criticism of Bitcoin "high" transaction fees has a plausible root, that is, Bitcoin should first become a payment system before it can become a value store. As we have seen from the origin of money, this belief is in the end. It becomes an exchange medium only when Bitcoin becomes a sound and sound value store. Moreover, once the opportunity cost of trading Bitcoin reaches a level that is suitable as a medium of exchange, most transactions will not occur on the Bitcoin network itself, but on a much lower cost "second tier" network. The second layer of networks, such as the Lightning Network, is equivalent to a promissory note that transfers gold ownership in the 19th century. Banks use promissory notes because the cost of transferring the underlying gold bars is much higher than the transfer of notes representing gold ownership. However, unlike promissory notes, Lightning Networks will allow Bitcoin to be transferred at low cost with little or no trust from third parties such as banks. The development of Lightning Network is a very important technological innovation in the history of Bitcoin, and its value will be developed and adopted in the next few years.

competition

As an open source software protocol, people can always copy Bitcoin software and imitate its network. Over the years, many imitators have been born, from copying the Litecoin to complex variants like Ethereum, which promise to allow the use of distributed computing systems to perform arbitrarily complex contractual arrangements. A common investment criticism of Bitcoin is that since we can easily create competitors and absorb the latest innovations and software features, Bitcoin cannot maintain its value.

The paradox of this argument is that the large number of bitcoin competitors created over the years lacked the "network effect" of the first and leading technology in the field. The network effect – the value of using bitcoin is growing only because it is already the dominant network – is a feature in itself. For any technology with network effects, network effects are its most important feature.

The network effects of Bitcoin include the liquidity of its market, the number of people holding it, and the developer community that maintains and improves its software and its brand awareness. Large investors, including countries, will seek the most liquid markets so they can quickly enter and exit the market without affecting prices. Developers will flock to the development community with the best talent to strengthen the community. Brand awareness is self-reinforcing because people who claim to be Bitcoin competitors are always mentioned in the context of Bitcoin itself.

Bifurcation of the road

One trend that has become popular in 2017 is to not only emulate Bitcoin's software, but also to replicate the entire history of its past transactions (known as the blockchain). Copying the bitcoin blockchain to a specific point and then splitting it into a new network, this process is called "forking", so that Bitcoin competitors can solve the token The problem of distributing to a large group of users.

The most important of these branches took place on August 1, 2017, when a new network called Bitcoin Cash (BCash) was born. Those who hold N bitcoins before August 1, 2017 will have N bitcoins and N BCash tokens. The community of BCash supporters is small but huge. They named their new network and launched a campaign to persuade novice Bcash in the bitcoin market to be “real” bitcoin, tirelessly trying to make bitcoin brand awareness. It is for yourself. These attempts have largely failed, and this failure is reflected in the market value of the two networks. However, for new investors, there is still a clear risk: a competitor may clone bitcoin and its blockchain and successfully surpass it in market capitalization, thus becoming the de facto bitcoin.

From the main forks of Bitcoin and Ethernet networks, an important rule can be drawn. Most market capitalization will fall on the network of the highest level of retention and the most active developer community. Although Bitcoin can be seen as an emerging currency, it is also a computer network built on software that needs to be maintained and improved. If a network has no developer support or developers have insufficient experience, buying a token is similar to buying a Microsoft Windows system without Microsoft's best developer support. From the history of the fork in 2017, it is clear that the best and most experienced computer scientists and cryptographers are committed to developing the original bitcoin, rather than creating more and more imitators.

Although the common criticism of Bitcoin in the media and economics circles is inappropriate and based on misunderstanding of money, investing in Bitcoin does have real and notable risks. Before considering investing in Bitcoin, it is wise for future Bitcoin investors to understand and weigh these risks.

Agreement risk

The Bitcoin protocol and the cryptographic primitives it uses may be found to have a design flaw or may become unsafe as quantum computing evolves. If a defect is found in the protocol, or if some new calculation method makes it possible to crack the cryptography that supports bitcoin, the trust in bitcoin may be seriously damaged. In the early stages of bitcoin development, the agreement had the highest risk. Even for experienced cryptographers, it was not clear at the time whether Nakamoto had actually found a solution to the Byzantine general problem. Concerns over serious flaws in the Bitcoin agreement have dissipated over the years, but given its technical nature, protocol risk will always exist in Bitcoin, even if the probability is low.

Exchange closing

The design of Bitcoin is decentralized, and it has shown great resilience in the face of repeated attempts by governments to regulate or close it. However, the exchange of Bitcoin against French currency is highly centralized and easy to be regulated and closed. Without these exchanges, no banking system would be willing to do business with them, and the process of monetization of Bitcoin would be severely hampered if it was not completely stopped. Although Bitcoin has other sources of liquidity, such as over-the-counter traders and decentralized markets that buy and sell bitcoins (such as localbitcoins.com), the key process of price discovery occurs on the most liquid exchanges, and they are centers. Chemical.

Judicial arbitrage reduces the risk of closing an exchange. The famous exchange, which was founded in China, was transferred to Japan after the Chinese government stopped its business in China. (Note: Later, I left Japan for policy reasons.) Governments are also worried about killing an emerging industry that may be as important as the Internet, giving other countries a huge competitive advantage.

Only by coordinating the global closure of the Bitcoin exchange can the monetization process be completely stopped. Competition has begun, bitcoin acceptance is so widespread, and complete closure becomes politically infeasible as completely shutting down the Internet. However, the possibility of such closures still exists and must be considered when investing in Bitcoin. As discussed in the previous section on countries entering the market, governments have finally realized the threat of non-sovereign, anti-reviewed digital currencies to their monetary policy. It is an open question whether Bitcoin becomes so ingrained that political action against it is proven to be ineffective before they take action to deal with it.

Interchangeability

The openness and transparency of the Bitcoin blockchain makes it possible for countries to mark certain bitcoins as "pollution" by their use in prohibited activities. Although Bitcoin's anti-censorship at the protocol level allows the transmission of these bitcoins, they may become worthless if there is a regulatory prohibition on exchanges or merchants using such contaminated bitcoins. Bitcoin will lose a key attribute of the currency: interchangeability.

In order to improve the interchangeability of Bitcoin, improvements at the protocol level are needed to improve the privacy of the transaction. Although there are new developments in this area, led by digital currencies such as Monroe and Big Zero, there is a significant technical trade-off between the efficiency and complexity of Bitcoin and its privacy. The ability to add privacy-enhancing features to Bitcoin without otherwise damaging Bitcoin's availability as currency remains an open question.

Bitcoin is a budding currency that is transitioning from a monetized collection phase to a value store. As a non-sovereign currency, Bitcoin is likely to become a global currency at some stage in the future, just like the gold in the 19th century classical gold standard. Accepting Bitcoin as a global currency is the reason for bullish bitcoin. As early as 2010, Nakamoto said in an e-mail exchange with Mike Hearn:

If you imagine it is used as part of the world of business, and the world will only have 21 million coins, the value of each unit will be higher.

The outstanding cryptographer Hal Finney was the first recipient of Bitcoin sent by Satoshi Nakamoto shortly after the release of the first bitcoin software, and he made this reason even sharper:

Imagine Bitcoin succeeded and became the main payment system used around the world. Then the total value of money should equal the total value of all wealth in the world. The current total global family wealth is estimated to be between $100 trillion and $300 trillion. A total of 20 million coins, then each coin is worth about 10 million US dollars.

Even though Bitcoin is not a full-fledged global currency that can only compete with gold as a non-sovereign value store, it is currently largely undervalued. The market value of the existing gold supply (about $8 trillion) is mapped to the largest bitcoin supply (21 million), and each bitcoin is worth about $380,000. As we saw in the previous chapters, Bitcoin is superior to gold in every property except for a long history of attributes that make money products suitable for value storage. Over time, the Lindi effect continues to work, and a long history will no longer be a competitive advantage for gold. Therefore, it is not unreasonable to expect Bitcoin to approach and possibly exceed the market value of gold in the next decade. One caveat in this article is that a large portion of the gold market value comes from the central bank as a value store. In order for Bitcoin to meet or exceed the market value of gold, it will be necessary for countries to enter the market. Whether Western democracies will participate in the holding of bitcoin is unclear. More likely, and unfortunately, lame dictatorship and thieves rule will be the first countries to enter the bitcoin market.

If no country participates in the bitcoin market, Bitcoin still has a bullish reason. As a non-sovereign value store for small and institutional investors only, Bitcoin is still in the early stages of adopting the curve – the so-called “early masses” are now entering the market, and the late masses and laggards still take years to enter. market. With the large participation of small investors, especially institutional investors, it is possible to have a price between $100,000 and $200,000.

Having Bitcoin is one of the few asymmetric bets that people around the world can participate in. Just like a call option, the investor's downside is limited to less than one-fold, while the potential upside is 100 times or more. Bitcoin is the first truly global bubble, and its size and scope depend on the desire of world citizens to protect their savings from the poor management of the government economy. In fact, bitcoin has risen like the phoenix nirvana from the ashes of the 2008 global financial disaster, a disaster caused by the policies of central banks such as the Federal Reserve.

In addition to financial reasons, the rise of Bitcoin as a non-sovereign value store will have far-reaching geopolitical consequences. A global, non-inflation reserve currency will force countries to shift their main financing mechanisms from inflation to direct taxation, which is much less politically desirable. The size of each country will be reduced to match the political pain of transitioning to taxation as its sole source of funding. In addition, the solution to global trade will satisfy De Gaulle’s desire that no country should have any privileges for other countries:

We believe that it is necessary to establish international trade on an undisputed monetary basis before the great misfortune of the world, and this foundation does not have any specific national emblem.

From now 50 years, that monetary base will be bitcoin.

– END-

Vijay Boyapati

This article is compiled from the original letter of the coin, the original link: https://medium.com/@vijayboyapati/the-bullish-case-for-bitcoin-6ecc8bdecc1

The copyright of this article belongs to the original author, only represents the author's own point of view, does not represent the viewpoint or position of the letter.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain privacy development company QEDIT completed $10 million in Series A financing, Ant Financial

- Switzerland's largest stock exchange SIX plans to issue native digital assets and propose a new concept IDO

- The cryptocurrency version of "Game of Thrones", if BTC is a dragon mother, who is the ghost?

- Blockchain Policy April Report: Domestic support policy information rose by 53.33%, Guangdong, Zhejiang and Guizhou were positive

- In the final battle of "Reunification 4", the winner turned out to be… Lightning Network!

- Research: Bitcoin inflation loopholes still exist, 60% of Bitcoin is or affected by the entire node

- Bitcoin in an old gunhole: The currency system works because people want it to work