From the perspective of ecology, income, advantages and disadvantages, what does the Staking concept bring to the industry?

Staking is a popular concept in the recent blockchain world. As an interest in the PoS consensus mechanism, it mainly refers to the process of the user obtaining the system reward by pledge Token to the node. At present, Staking's high income has attracted many players to enter.

In fact, Staking is not a new concept. It has been around since the PoS algorithm was invented. In order to let everyone have a clearer understanding of Staking economy, this report will analyze the development process, ecological role, income model, settlement method and advantages and disadvantages, and try to show you the comprehensive and in-depth Staking economy industry research.

First, Staking market overview

1.1 Concept definition

Stake can be translated into pledge. In the PoS consensus, the holders participate in the block and ecological governance through pledge, voting, delegation of authority and lock-in, in order to obtain the benefits of block rewards, governance voting rewards and transaction fees. The way the user gets revenue from the node Token through Stake is called Staking economy.

In Staking mode, nodes must lock their Tokens as collateral, seeking to become a verification node, and the system uses the algorithm to elect the blocker for each block, which will have a chance to get a fixed block reward. If the certifiers do evil, they will not be able to get the Staking reward as a punishment, or even lose the mortgage, the unique penalty mechanism Slash in PoS.

- The bank sent Bitcoin to employees and is now serving cryptocurrency companies.

- How to mitigate the effects of manipulation when investing in cryptocurrencies?

- Babbitt column | Central bank digital currency is a kind of "nickel coin"

1.2 Market size

According to Stakingrewards data, as of 20:30 on August 1, 2019, there were 47 participating Staking projects, the total market value of global crypto assets was 274.26 billion US dollars, and the total market value of participating in Staking was 16.24 billion US dollars, accounting for the total value of encrypted assets. 5.9%. The total market value of the locked Token in Staking is $6.17 billion, and their average Staking ratio is 38%. The website shows that the current average Staking yield is 12.92%. From the above data, we can see that Staking is a huge market. Under the stimulation of economic factors, this market will continue to grow with the increase of projects and the increase in the number of mortgage assets.

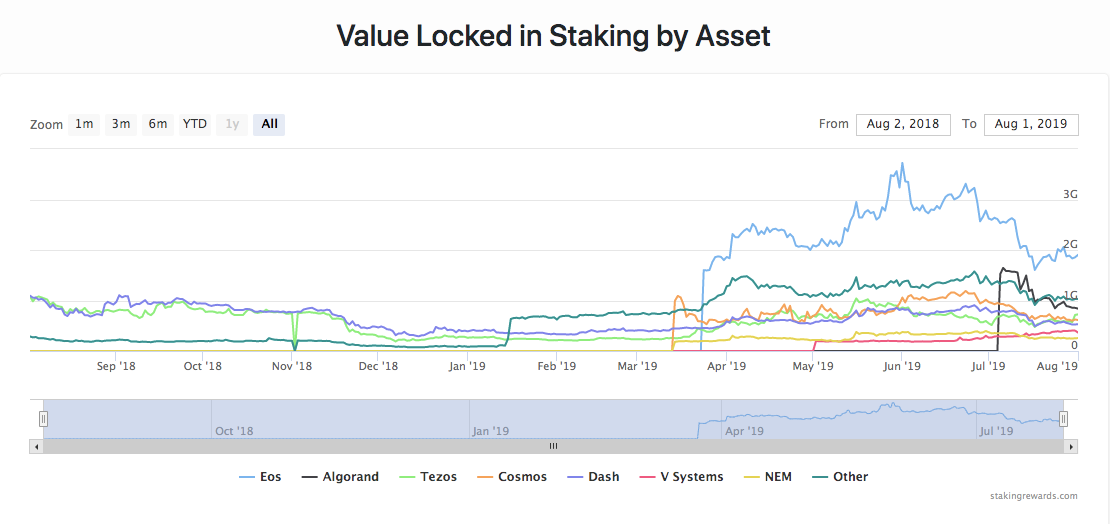

According to Figure 1, it can be seen that the value of Staking Lock is maintained at around $1.8 billion. It began to decrease in November 2018, and then fell to $600 million. It rose to around $1.2 billion in mid-January 2019, and has not changed much since then. It began to increase gradually until mid-March. Currently Staking accounts for 5.9% of the total market value of crypto assets.

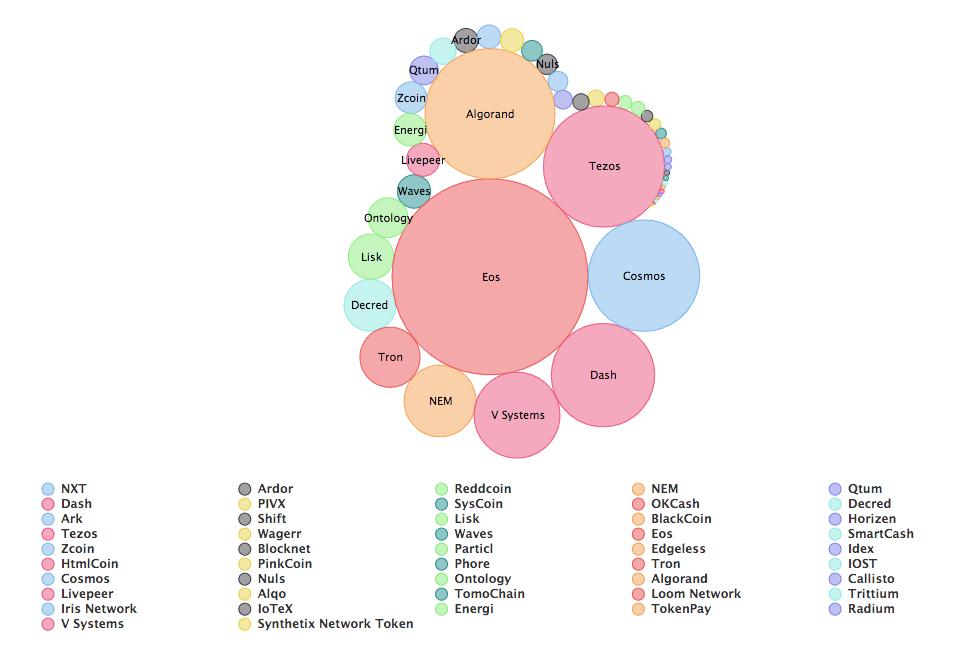

According to Charts 2 and 3, it can be seen that the current value of the coins participating in Staking is EOS, Algorand, Tezos, Cosmos, and Dash.

Figure 1, Staking's lock value trend

Figure 2, the lock-in value of major currencies in Staking

Figure 3, the current lock value of each currency Staking

1.3 Development history

Before we understand Staking economy, we need to first understand the development path of PoS (Proof of Stake) PoS.

The consensus mechanisms currently widely used by the underlying public chain are mainly Proof of Work (PoW), Byzantine Fault Tolerance (BFT) and Proof of Equity (PoS) and their respective derivative consensus, such as Debt Proof of Entitlement (DPoS).

Thanks to PoW's innovative mechanism model design, the BTC network has been successfully operated for ten years, and mining has become an effective driving force for maintaining the stable development of the entire commercial network from pure profit-seeking behavior. However, with the advent of professional mining machines, it exposed weaknesses such as slow transaction processing and low energy efficiency. In addition, the concentration of power is still the sword of Damocles hanging over the top of the public chain security.

As a result, PoS consensus is increasingly appearing in the design of blockchain projects. In 2011, a user named Quantum Mechanic first proposed Proof of Stake in the famous bitcoin community Bitcointalk Forum. The article presupposes a lot of solutions that are still in use, such as the weight of the currency instead of the entrusted equity. , reward distribution, etc. In 2012, the first PoS-based project-based point coin (PPcoin) was born. During the period, it also experienced mixed development, pure PoS, BFT+PoS and other development stages, and derived from DPoS, LPoS and other variants.

PoS (Proof of Stake) is the proof of equity. Compared with the PoW consensus, the miners try to get the hash function target by competing calculations to have the block right. The new block of the PoS chain is created by the node selected by the specific algorithm in the system. The coin holder will take the coin to obtain the block right, package the transaction at the specified time, and broadcast it out. After verification, the new block is generated. Compared with PoW, the PoS consensus improves the energy efficiency of the system and increases the transaction processing speed.

After several years of development, PoS has produced many variants. Cardo proposed the Uroporos algorithm to randomly select block nodes by directly generating random numbers. EOS's DPoS mechanism allows the holders to be super nodes instead of each. The method of voting by block reduces the difficulty of voting by the holders and increases the participation rate of voting. The LPos used by Tezos and the Tendermint used by Cosmos are also innovations of existing PoS mechanisms, and the development of incentive mechanisms. , the mortgage mechanism, the slash mechanism, etc., in order to deal with the "Nothing at Stake" and long-range attacks that were discovered when PoS was first proposed.

At present, the PoS consensus and its derivative types are constantly exploring in terms of throughput, delay, speed, energy consumption, etc., and the performance is getting better and better. Ethereum has gradually changed from PoW to PoS, and many public chain projects are also adopting PoS mechanism. The application of PoS's public chain is surpassing PoW in terms of quantity and quality.

Second, the Staking ecological role

There are two most important roles in the Staking economy: verification nodes and holders.

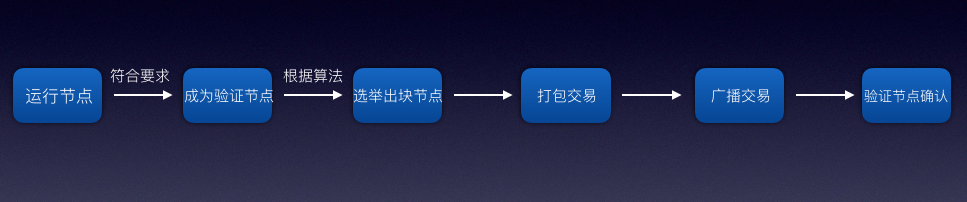

In general, there are six basic steps to create a block under the PoS Consensus: Run Node – Become a Verify Node (Miner) – Elect Block Node – Package Transaction – Broadcast Transaction – Verify Node Confirmation. In PoS, in addition to being responsible for the block, the miner also acts as a verification node. Before becoming a block node, the holder needs to run the node client to become an access point in a blockchain distributed network, also called a node. A node that meets the system requirements can become a verification node (ie, a miner), and the system will use a specific algorithm to elect an outbound node for each block from the verification node. Stake is a means of achieving verification node requirements.

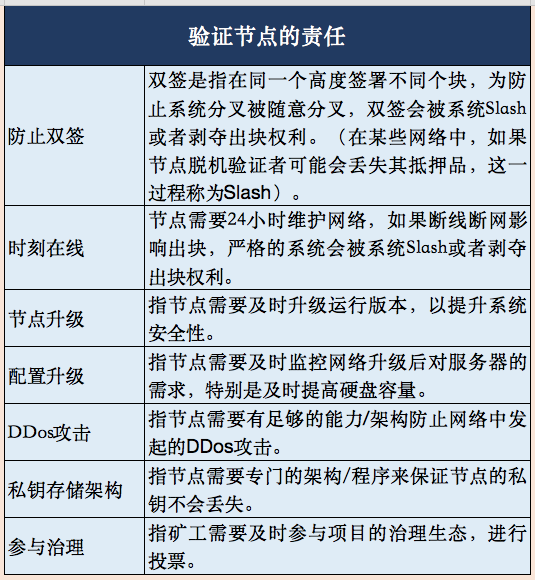

In addition to creating new blocks, the verification nodes are also involved in chain governance. The creation of new blocks is to protect the continuity of the blockchain, and the governance on the chain determines the parameter settings of the entire blockchain system. These parameters determine the running direction of the entire network, and the verification node can be said to shoulder the heavy responsibility.

To become a verification node, you need to meet the requirements of the system. Not only do you need a certain hardware configuration, but you also need to maintain the minimum number of mortgage tokens. You must also upgrade and ensure 24h online full connection to avoid being punishable. For most of the holders, they don't have the time and energy to run the nodes, nor do they reach the required number of Tokens. They need to be entrusted to the third-party node operator to earn revenue.

2.1 node threshold

2.1.1 Hardware Threshold:

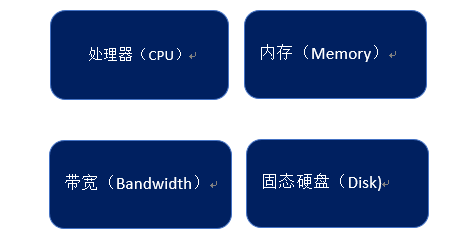

The general system does not have a very high configuration for miners, except for projects that use the Byzantine fault-tolerant hybrid algorithm or projects that tend to be alliances. For an open blockchain project, the hardware threshold will be different according to the project's specific consensus mechanism and key technical requirements. The general required configuration is as follows:

In general, bandwidth requirements are slightly higher, because some blockchain projects require nodes to be online for a long time, and high bandwidth allows communication between nodes to remain normal. The hard disk needs to be dynamically expanded. As the block data increases, the block node needs to save the complete block data. Therefore, when the hard disk capacity is insufficient, the hard disk needs to be expanded in time. In addition, if the running node exposes the RPC service externally, the corresponding parameter configuration needs to be determined according to the call status of the RPC service. Of course, the initial configuration of the project and the projects that have been developed more powerfully require different configurations, and the configuration of the latter needs to be higher.

Take the Ethereum hardware configuration as an example:

In addition, some projects are also exploring the idea of achieving more decentralization, making nodes easier to run. Both Polkadot and Chian X mentioned that everyone can download and run computer client maintenance nodes in the future; Tezos mentioned that future running nodes get Rewarding is as simple as an app. By then, the hardware threshold for node participation will be greatly reduced.

There are two main ways to configure the server:

Self-built server – buy hardware servers yourself, connect electricity, network, and run services. The cost of self-built servers is relatively short, taking into account hardware costs, site costs, and operating labor costs. Moreover, it takes 24 hours to continuously power and continuously network, which has higher requirements on the environment. The advantage is that some service support can be directly adjusted.

Cloud Server – Buy off-the-shelf cloud servers, dynamically configure parameters, and run services. The advantages of cloud servers are flexibility and low cost. At present, most of the nodes are still on the cloud server, such as Amazon's AWS, Google's cloud service, Ali's cloud service, etc., with the above server, you can run the node according to the official configuration tutorial. Of course, this has been criticized for a long time in the decentralized community, because all the decentralized network node services are still built in the hands of the world's IT giants.

2.1.2 Mortgage Token Threshold:

The biggest cost of miners is actually the amount of mortgages, not operating costs. The rules of each chain in the PoS domain are different. In order to increase efficiency, there are usually certain restrictions on the number of nodes and the mortgage of the chain.

For example, EOS and Tron are set up with a fixed number of super nodes/representatives, ranked by the number of votes. EOS has 21 outbound nodes, and the number of Tron nodes is 27. Cosmos has only the top 100 nodes with revenue rights. The system specifies a fixed number of outbound nodes. The blockers are voted by the holders. The voting rate is sorted from high to low. The system selects the specified number of exporters according to the highest to lowest, and then randomly orders the outbounds. select.

In another case, it is a certain requirement that the node needs to meet the public chain setting, but there is no restriction on the number of nodes. Generally, it is required to pledge a predetermined number of Tokens and satisfy the computer configuration of the node running. For example, Tezos does not limit the number of nodes, but the threshold of nodes is 10000 xtz. Cardano requires that the node be a mining pool, and the amount of currency (including the commission amount) needs to reach 1% of the total currency.

2.1.3 Other soft thresholds:

In addition to hard requirements and mortgage requirements, some projects also have some soft strength requirements for the verification node, such as verifying that the node needs to be a team or a company; requesting that the cloud server cannot be used; requiring a certain reputation in the community; requiring voting to reach a certain level Quantity and so on. If you do not understand, you may not be able to become a verification node due to non-requirements.

2.2 Verifying Node Operators

2.2.1 Currently the main node operators:

(1) Wallet: Wallet is a tool for managing multi-chain assets. It has enough user base and is a tool that naturally helps users participate in Staking. At present, many official wallets and decentralized wallets have been able to support delegation to different verifier nodes. The holder has the right to select the appropriate node. In the wallet, the holder can find the commission button and entrust a certain amount of coins to the favorite. node. You can also mortgage redemption, one-click re-investment, and query your daily earnings.

(2) Mining pool: The major mining pools have gathered a group of miners who have a better understanding of the blockchain mechanism. They naturally coincide with the Staking user attributes, so the mining pool is also the main node operator. Just as the power reserve pool attracts miners to carry the computing power, they also encourage the holders to put the voting rights of their coins in their own mining pools to support the Staking project, competing for the right to block and share the proceeds. At present, the OK mine pool has launched the lock storage function of the eos, and Staking for other projects is also expanding.

(3) Exchange: The exchange uses the internal user's deposit to conduct Staking and enjoy the annual increase. This will be an additional benefit to the exchange in addition to the transaction service fee and the currency fee. When users begin to value the equity gains in the currency, the exchange that can provide the Staking service and the user can receive the reward will be better than the exchange without the Staking service.

(4) Community nodes: Community nodes are usually those who pay close attention to project development and make positive contributions to project governance. They can further influence the development direction of the project and participate in the project's additional benefits by participating in the node. .

(5) Investment institutions: Early investors or institutions of the project are more likely to hold a large number of Tokens. If the investment institution is very optimistic about the project being invested, it can directly become a node after receiving the Token and continue to contribute to the project.

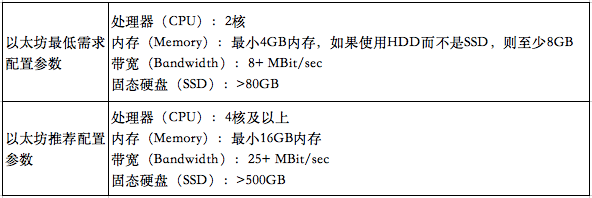

2.2.2 Node Operator Type

The holder of the currency has the “ownership” and “authority” of the certificate. According to whether they will lose control of the Token during the Staking delegation process, the current Staking node operators can be divided into two categories, namely decentralized mode and centralized mode.

Decentralized mode:

The decentralization mode is that the holder of the currency retains the “ownership” of the asset and gives the “authority” to the node. The token pledge (Staking) to the node is a chain entrusting action. In fact, the ownership of the Token is still in the user's personal address. The change is that the user transfers the PoS mining power to the node, and the node generates revenue on behalf of the user. It is then assigned to the holder by the node or chain.

At present, the node operator in the decentralized mode has a decentralized wallet, and the holder must only ensure that his private key is secure. The decentralized wallet is divided into a web-side wallet and a client-side wallet. The web-side wallet stores the private key in the browser cache, and then uses it for signature when it is signed; the client wallet stores the private key in the user. In the local environment of the mobile phone, the direct comparison of the two clients is relatively safe, and the webpage wallet is more likely to be attacked by the phishing website.

Centralization mode:

The centralized mode holders give the “ownership” and “delegation rights” of the currency to the centralized organization. They will not create a personal wallet address for you. Instead, they will use the common address plus the address tag to identify the user account. The node generates revenue and distributes it to the holder. At present, the node operators of the centralized mode have exchanges, centralized wallets, and mining pools.

Third, Staking income model

3.1 Source of income

The Bitcoin Genesis Block only contains 50 BTC, and the next day it will issue 7200 BTC, halving every four years. This increase in bitcoin will continue to be halved every four years, until 2140, bitcoin will stop inflation, the number is infinitely close to 21 million. This distribution has become an incentive, and the source of incentives for miners is the block rewards and transaction fees.

New projects based on the PoS consensus often raise funds through the sale of Token, and all Tokens will be created in the creation block. Then the incentive of PoS can't be rewarded by the remaining total amount like Bitcoin, but by the system issuance. The additional issuance will cause the public chain to form an inflation rate. At present, EOS annual inflation is 5%, Comos annual inflation is 6.94%, and Vsys annual inflation is 5.5%. In order to encourage the holders to participate in Staking, the annual growth rate of the existing mainstream PoS public chain is on average more than 5%.

After the creation of a large amount of coins in the creation block, the system will continue to issue a certain amount of coins, and issue a portion of the Token as a block reward. The other parts will be rewarded or destroyed as a governance vote, depending on the project. Some projects also require users to have transaction fees. Therefore, the sources of node rewards are: block rewards, governance voting rewards, and transaction fees. Therefore, although the source of incentives for Staking users is the inflation rate built into the PoS network, the node yield is not necessarily the rate of increase. In addition, the Staking rate of return is not equal to the node's rate of return, because the part of the holder who is not involved in Staking is unable to enjoy the node's return.

Of course, there are still some special situations in the real world, such as the penalty for not being blocked, and the real reward situation will be slightly different according to the node ability. Depending on the PoS network and related parameters (including participation rate and time), Staking returns range from 5% to 50% per year, which means that if the holder does not choose Staking, the value of the Token will be due to network expansion. Depreciation.

Staking means that the user entrusts his or her own rights to the node operator to help the client exercise his rights and receive system rewards. The node will charge the user a fee as a service fee, so that the node operator can receive the reward of accepting the entrusted service in addition to the reward of his own Staking.

The formula for calculating the revenue of the node operator and the holder is as follows:

Node Revenue = Block Reward + Governance Voting Reward + Transaction Fee

Revenue before a node operator does not assign rewards to users = node revenue * Total number of Staking for this node / Total Staking for all nodes

Node operator revenue = node unassigned reward to user before revenue * node charged service fee ratio

The holder's income = the node's undistributed reward to the user's earnings* (1-node charges the service fee ratio)

3.2 Node and user revenue settlement mode

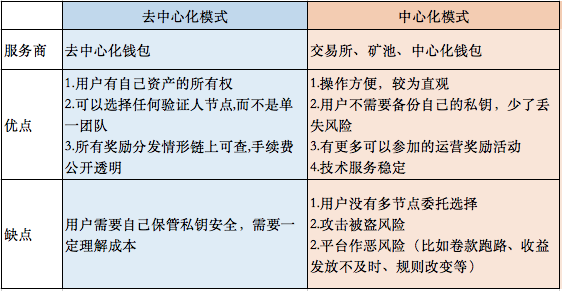

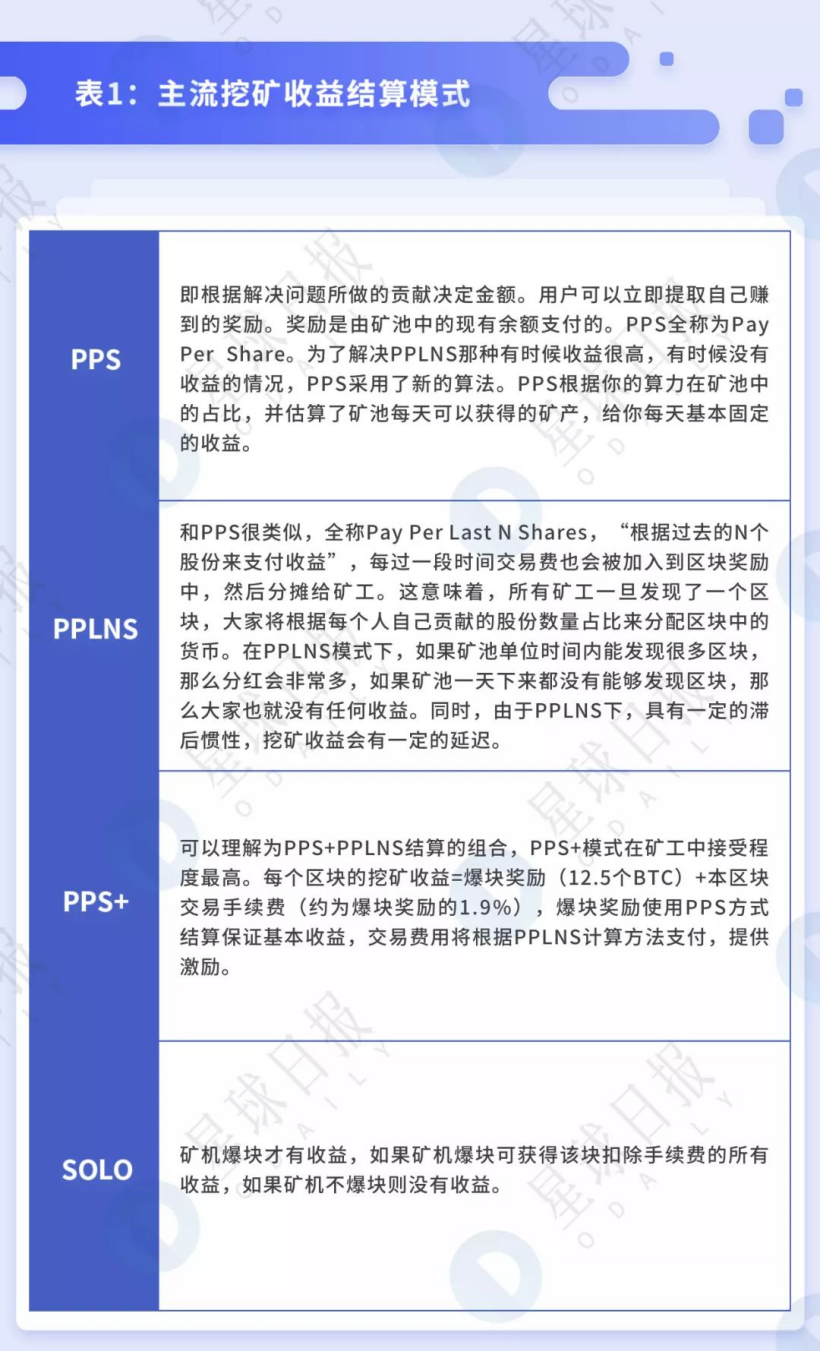

First of all, look at the PoW, because of the trend of miners' demand, several mainstream mine pool models have been derived:

Image from (Mining Research Report: Industry Turning Point and Economic Cycle of Bitcoin Mining)

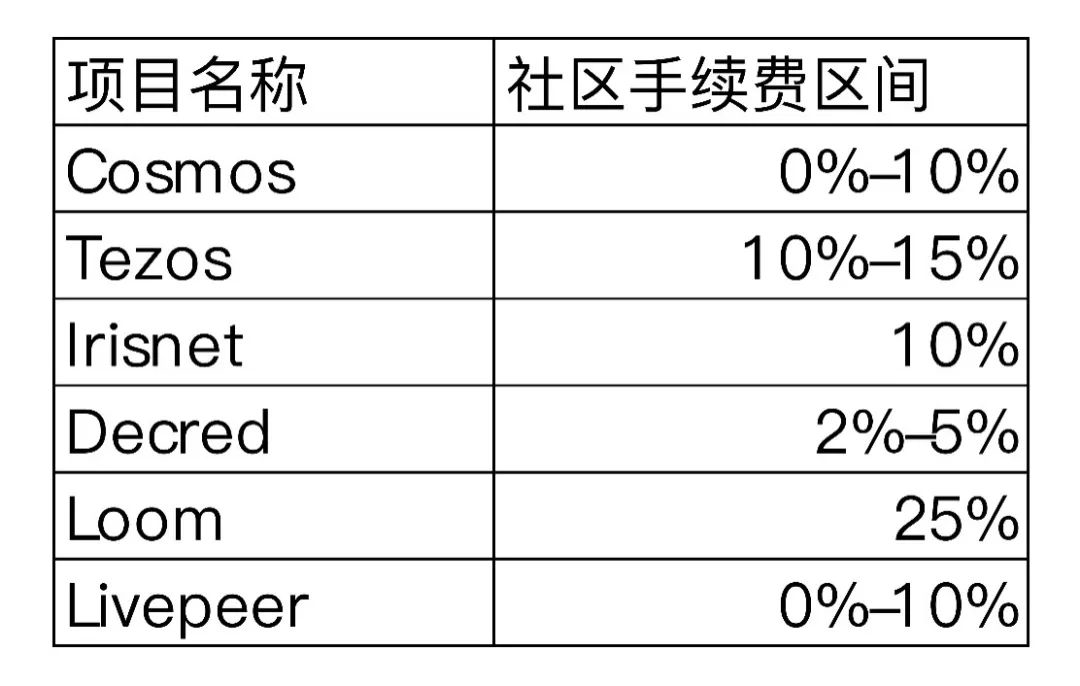

In contrast, there are not so many different models in the PoS economy because of the randomness of mining. According to current observations, the main mode of the entrusted service provided by the node is: the reward is distributed according to the proportion of the Token contributed by each person in the node, and the service fee is charged according to a certain ratio. The current Staking service fee on the market is between 5% and 20%.

Image from the chain (Staking economy operating expert complete manual)

Image from the chain (Staking economy operating expert complete manual)

Of course, as the competition between nodes deepens, there will be a more flexible revenue settlement model, such as:

1. Service charge adjustment mode: Different nodes use the service fee rate competition to attract the client. This is the most direct factor affecting the revenue of the commissioned user. However, the too low rate will damage the interests of the node. The current gameplay is The promotional service rate will be adjusted later, or the service rate will be reduced in the middle of several cycles.

2. Guaranteed revenue model: When the node loses the block because it is not online for any reason, and then loses the reward, the node still guarantees that the principal has the reward of the block.

3. Timely arrival mode: Each block of PoS consensus block will have a token lock period in order to ensure that the node does not do evil. A node with certain liquidity (such as an exchange) promises that the proceeds will be distributed on the same day to meet the user's liquidity needs.

3.3 Where users need to pay attention before participating in Staking

Although participation in Staking can benefit, different blockchain projects will generate different Token economies because of different economic rules. Different nodes have different income rates and security, which will affect the final revenue of users. If you want to participate in Staking, here are a few things to focus on:

Inflation rate

Most of the PoS projects are rewarded by S tokens by issuing additional Tokens. This part of the Token will cause inflation in the overall economic system. Like the central bank, proper issuance is conducive to the improvement and development of the economic system. However, if the issuance is too fast, it may cause the depreciation of its own currency. At this time, Staking's reward may not be as good as the depreciation. However, too few additional issuances will result in the currency price not being able to bring the expected income of the miners. It is difficult to encourage the miners to participate in the network verification, making the potential attack cost lower and lower, and even the chronic death of the network congestion project. PoS's early exploration projects, such as Nxt, black and shadow, failed. So choosing a project with a reliable economic mechanism is the basic homework before Staking.

2. Locking period

In order to prevent nodes from doing evil, most projects' Staking has a Token lockout period. When the principal chooses to opt out of Staking, they will have to wait until the lockout period is over before the token can be transferred. This makes the cost of the node increase, which is a kind of protection for the chain, but it also restricts the mobility of Token to some extent. Tezos is about 15 days, Cosmos is about 30 days, and each project has its own lock-up period. You need to find information in the project's white paper, and users need to pay more attention.

3. Expected annual yield

Before Stake, users need to examine the Staking ratio and profitability of the project, and try to select the candidate nodes with relatively stable yields to commission. At the same time, we must also pay attention to the performance of the nodes, because the poor performance of the nodes will cause the holders not only to lose the rewards, but also to lose the original Staking tokens.

4. Service expense ratio

The node operator will receive a block reward, which will be rewarded to the Stake users proportionally after charging a certain service fee. The service rate of each node operator varies according to the operator's background and project. As the cost of consumption, the commissioner also needs to examine this part.

5. Node delegation type

As discussed above, the principal does not lose control of his Token during the Staking delegation process. The Staking node service providers are divided into a decentralized mode and a centralized mode. Each of them has advantages, and the user needs to be personally Select the node type of the delegate from the perspective of convenience and security.

Fourth, the positive significance and risk of Staking

In the era of Staking economy, the connection between users and the blockchain network was strengthened. Ordinary holders of money, through the action of Stake, can not only increase their own money-bearing income, but also contribute to network security and stability, and participate in ecological governance. Therefore, Staking is not only an economic act, but also highly relevant to blockchain network governance and community. Of course, this model brings convenience and risks in terms of security and governance.

4.1 The positive significance of Staking

1. For the public chain, the stable operation of the node and the high Staking ratio of the whole network are the key factors affecting the safety and performance of the public chain. In the PoS system, the rights of the Token holders are fully reflected in the value of the Token. They have direct power maintenance systems and are therefore less likely to participate in malicious actions. In the PoW system, after the attacker implements the attack to obtain short-term benefits, the hardware investment such as computing power can be transferred to other blockchain systems, and the possibility of malicious behavior is higher. The more people involved in Staking, the greater the consensus consistency of each block. Therefore, the amount of Staking is basically equal to the amount of computing power in the PoW public chain. The more Staking, the more stable the stability of the chain, and the greater the value of this chain.

2. For the holder of the currency, Staking is the best means of maintaining and increasing the value of the equity. The PoS public chain will generally issue Tokens as node rewards generated by the block. The verification node has hardware configuration requirements, mortgage requirements and other soft requirements. The holders with less currency shares and no hardware devices can pass Staking points. Rewarders who do not participate in Staking will suffer from inflation losses caused by the issuance of tokens.

3. For ecological governance, chain governance determines the parameter settings of the entire blockchain system. These parameters determine the direction of operation of the entire network. The existence of Staking's mechanism allows the holders who do not have enough tokens or lack of stable operating node conditions to participate in mining and receive dividends, which greatly enhances the participation of the whole network. Ordinary users gain the sense of participation and real benefits through Staking, and they are more willing to contribute to the project's publicity, and the project is more likely to enter a virtuous circle.

4.2 Risk of Staking

1. Token liquidity risk

The crypto asset market is a highly volatile market, and Staking is mostly locked in with a certain amount of time. Once the user entrusts to participate in Staking, the funds cannot be realized in time due to extreme market fluctuations. In terms of the currency standard, the number of coins held after Staking has indeed increased, but if it is for legal currency, it may suffer certain losses under special circumstances. Therefore, before Staking, the holder must consider the risk of currency fluctuations that should be locked in order to earn a return. If it is only for short-term gains, then it needs to be cautious.

2. Token security risk

The most important thing for the currency holder to participate in Staking is to ensure the security of his Token.

When a node is out of the box, it is subject to economic penalties, namely Slash, because it is passive, passive, or malicious. The penalty is light, and the node can't continue to get the qualification of the block. In addition, the mortgage is locked directly. Usually the official website of each node will introduce its own security architecture and solutions to prevent attacks. Therefore, users need to understand the penalty rules of the Staking project and choose a good node service provider.

In addition, the centralized node has the risk of running the node and being stolen by the attacker. The holder should try to choose the decentralized node, so that even if the node is attacked, the marked token will not be lost because Token holds The person just delegated the permissions, not the ownership of the Token.

3. Node centralization risk

The risk of centralized power calculation in PoW mining is also unavoidable in the PoS mechanism. The higher the number of nodes Staking, the higher the probability of excavating the block to get the reward, and the reward token obtained can continue to be put into the node for Staking, and the stronger and stronger effect is more obvious. This will lead to the solidification of the nodes and the desire to enter new resources. When the participating nodes are more expensive than the new public chains, this solidification mechanism is a kind of damage to the overall public chain ecology.

In addition, in community governance, nodes may delay the checks and balances of community resolutions that reduce their own income for their own interests rather than the long-term development of the public chain, which will lead to failure of the governance mechanism.

Conclusion

As an interest in the PoS consensus mechanism, nodes must lock their tokens into collateral, and strive to be the verification node. The system uses the algorithm to elect the blocker for each block, and the verification node will have a chance to obtain a fixed out Block rewards. If the certifiers do evil, they will not be able to get the Staking reward as a punishment, or even lose the mortgage, the unique penalty mechanism Slash in PoS.

Its main ecological role is nodes and currency holders, nodes need to meet hardware thresholds, mortgage Token thresholds and other soft thresholds. At present, the node operators mainly have wallets, mining pools, exchanges, community nodes and investment institutions. According to whether the control of the Token will be lost during the Staking delegation process, the node operators of Staking can be divided into decentralized mode and centralized mode. Two types, decentralized mode are more secure.

The node's revenue mainly comes from the additional Token part, which is specifically the block reward, governance voting reward and transaction fee. The specific proportion will vary according to the project. The revenue settlement mode of nodes and users is mainly based on the proportion of Tokens contributed by each person in the nodes, and is charged in the form of a service fee. As the competition between nodes deepens, a more flexible revenue settlement model will emerge.

Before users participate in Staking, they need to pay attention to the inflation rate and lock-up period of the project, as well as the expected annual profit rate, service expense rate and commission type of the node service provider, which will affect the final revenue and asset security of the user.

Of course, Staking economy has a positive sense of coexistence with risks. Ordinary holders of money can increase their own money-bearing income through the action of Stake, and can contribute to network security and stability, and also enhance the participation of the entire network in ecological governance. . Of course, while Staking brings convenience, there are various risks in terms of security and governance, such as the risk of liquidity caused by Token locking in high-volatility markets, and the Tokens that may be suffered after a node is slashed or attacked. Loss, in addition, it is inevitable that it will face the risk of node centralization.

Stimulated by economic factors, investors began to flood into the Staking market, and the market scale has also made great progress. It is foreseeable that Staking is a huge market that will grow as the number of projects increases and the amount of mortgage assets increases.

references:

"Understanding Blockchain PoS Consensus"

"PoS Guide: Everything You Need to Know"

"Staking: The New Wave of Mining under the PoS Era"

The Status of Staking: Observations and Reflections from Verifiers

"Understanding the Five Basic Elements of Staking Business"

Risk Warning: All articles in OKEx Research do not constitute investment recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular science | mining industry panorama

- Interpretation of the central bank's digital currency: to replace cash, mainly for small retail scenes

- Regarding the fact that Litecoin did not have any development progress in 2019, founder Charlie Lee responded

- Babbitt column | How will the digital currency "China team" change the future?

- If the Indian encryption ban is approved, 40,000 BTCs will enter the market.

- Akropolis, the Poca DeFi project: witnessed the collapse of Lehman Brothers, building a new Web 3.0 class financial

- Academic discussion on the practice of the central bank's digital currency DC/EP