How to mitigate the effects of manipulation when investing in cryptocurrencies?

Since the beginning of 2020, interest rates around the world have tended to zero, and a new round of quantitative easing has been introduced. This may be the most important decisive moment in the lives of young investors: grabbing carrots and investing in real estate at an unprecedented high price. , bond or stock market, or enter another market that is largely unaffected by debt distortions? It captures the paradigm shift opportunities that may occur in the next decade. Let's look at how low interest rates operate real estate, bonds, and stock prices on a global scale, and how to mitigate the effects of manipulation when investing in the cryptocurrency market.

(Photo: Federal Reserve)

(Photo: Federal Reserve)

Since 2008, the Federal Reserve has cut interest rates for the first time. Although domestic data is relatively strong, we still believe that interest rate cuts are not conducive to healthy economic development. In addition, Europe, Australia and New Zealand are also planning to cut interest rates further in the coming weeks.

The official said that interest rate cuts are due to the global economic slowdown, but in fact, there are many angles to analyze, especially the US president’s request for the dollar to depreciate to remain competitive, making it easier for the United States to continue financing the deficit, which may also make the United States historically The country with the most debt.

Adjusting interest rates for "justifiable reasons" to control economic inflation and employment means raising asset prices or corporate balance sheets, which should never happen! This is the operation of the Fed. And more and more similar things are happening all over the world.

- Popular science | mining industry panorama

- Interpretation of the central bank's digital currency: to replace cash, mainly for small retail scenes

- Regarding the fact that Litecoin did not have any development progress in 2019, founder Charlie Lee responded

The driving force behind quantitative easing (transfer from creditors to debtors) was introduced as the “new normal” after the first introduction during the 2008 Global Financial Crisis (GFC). The original economic situation, then there will be more of the same situation in the next few decades, just as Japan has been continuing deflation since the 1990s.

Reverse investor's haven

The media has long referred to Bitcoin as “the monster of the financial industry”, which describes the cryptocurrency market: it is lurking in the shallow market “whales” (people who hold large amounts of crypto assets, usually early players and Investors) manipulated. Conversely, as a compliant ordinary citizen, retail investors should have believed in trillions of dollars in debt that would sustain traditional market operations, and now this traditional market is indistinguishable from Ponzi schemes.

Perhaps because the intention of currency manipulation is slowly being revealed, Bitcoin is beginning to show its original intention: a safe haven away from the traditional market.

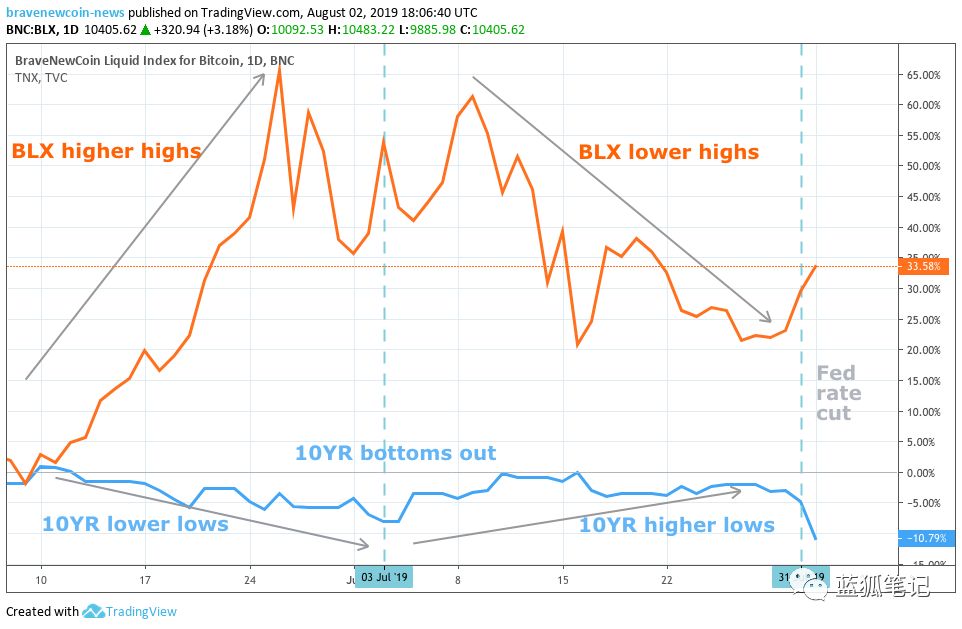

New normal? In the more than a month before the Fed cut interest rates, BLX global bitcoin prices have been negatively correlated with US 10-year government bond rates.

New normal? In the more than a month before the Fed cut interest rates, BLX global bitcoin prices have been negatively correlated with US 10-year government bond rates.

Since the Fed cut interest rates by 25 basis points to 2.25%, Bitcoin has risen by about 10%. The price lags behind other safe-haven assets such as gold, the yen and the Swiss franc, all of which have been hit, albeit to a small extent.

Although Bitcoin is far from perfect, it still looks like the cleanest shirt in a pile of dirty clothes in a laundry room compared to many other markets.

Great transfer of wealth

From Australia, New Zealand to Brussels, central banks in these countries are rapidly turning to financially restrained monetary policy, dropping interest rates and bond rates to historical lows, even negative ones, which will lead to the transfer of wealth from creditors (storage) to debtors (borrowers) ) body.

Ray Dalio, founder of Bridge Water Fund, believes that by observing the holders of debt and credit, we can gain insight into paradigm shifts.

“By observing who owns what assets and liabilities, asking who the central bank needs the most help, and considering the tools they have to find out the most likely operations, you can get the most likely monetary policy shift, that’s The main driving force of "paradigm shift."

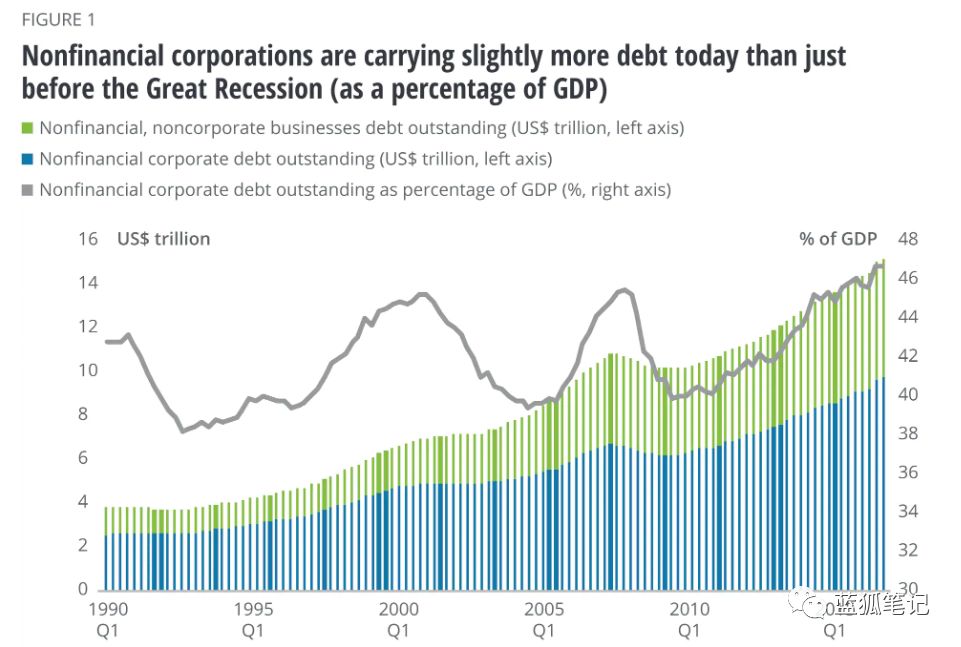

The biggest debtor is the business.

US corporate bonds hit a record high of about $15 trillion.

US corporate bonds hit a record high of about $15 trillion.

According to the Fed's data (above), the ratio of US corporate debt to GDP has reached an all-time high, accounting for 47% of GDP (according to IMF data, this figure is close to 75%). There are nearly $13 trillion in negative income debt (corporate and government bonds) worldwide, and trillions of dollars in debt just above zero.

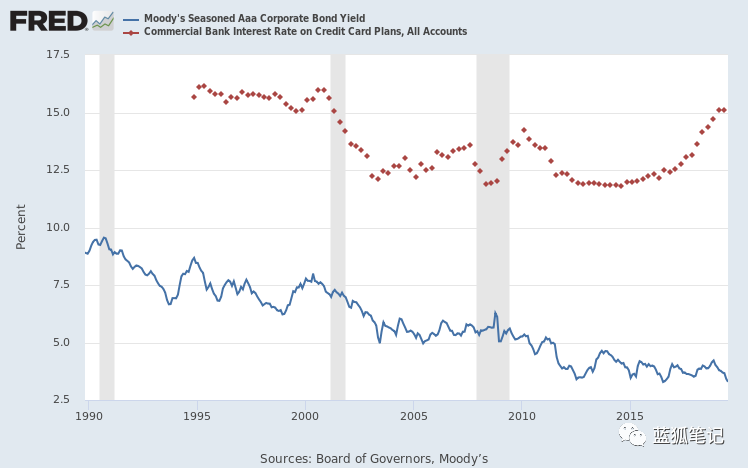

The US AAA corporate lending rate (blue line) is close to the historical low of 3.2%, while the credit card rate just exceeded the record high of 15.1%.

The US AAA corporate lending rate (blue line) is close to the historical low of 3.2%, while the credit card rate just exceeded the record high of 15.1%.

Because lending rates are so low, corporate debt (which plays a big role in US stock repurchases) has reached historical highs. At the same time, credit card consumer loans have almost hit a record high, steadily rising while corporate interest rates continue to fall.

In the past decade, although the private sector has been reducing debt, the corporate sector has been gorging and, more importantly, since the central bank repurchased most of its government debt through quantitative easing, its acquisitions and asset prices have risen. Reaction.

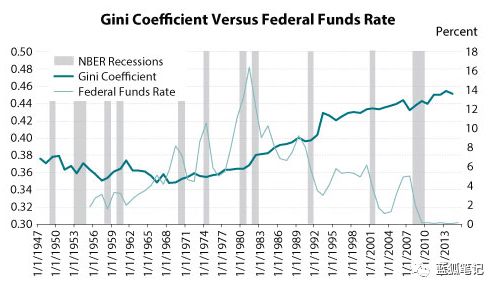

The Gini coefficient, the left axis, is between 0 (completely equal) and 1.

The transfer of US wealth brought about by low interest rates can be reflected in the widening gap between the rich and the poor. The Gini Index, used to measure a country's inequality, has been highly negatively correlated with the Fed's fund rate since the 1980s. In other words, when interest rates fall, it will increase the price of wealthy people own assets and widen the gap between rich and poor.

Negative interest rate: open market

More than 40% (ie 1.4 trillion euros) of corporate bonds in Europe now have a negative yield, and more than 50% of government bonds have a negative yield; in fact, this is equivalent to borrowing money to earn.

These negative yields change the nature of the bond. In general, the government or company promises to pay positive credits to creditors during the duration of the bond (usually between 2, 5, 10, 20 or 30 years), and the worse the credit rating of the bond issuer, The higher the bond yield, the risk is compensated. vice versa.

But if safe sovereign bonds don't provide positive yields, and high-risk companies have a slightly higher yield, they're actually no longer fixed-income instruments. Bonds have become an accounting tool for balance sheets, representing transfers between central banks, commercial banks and businesses.

In order to revive its economy from the biggest economic crisis of the 1990s, Japan was the first country to try negative interest rates and negative bond yields. The goal is to keep the economy (not assets) inflicted, but after more than 20 years of negative interest rates and zero interest rates, the country is still in deflation, and although it is strange, the economy has not stagnated.

Housing market

The major property markets in the United States, Canada, Ireland, Australia and New Zealand have been distorted by record low interest rates and foreign capital inflows, pushing house prices up to several times the average income, exceeding the affordability of most young people in the region.

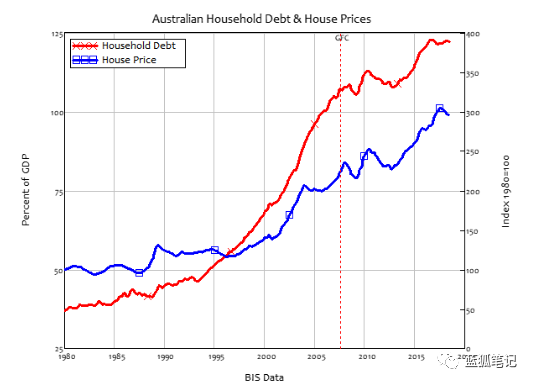

The Reserve Bank of New Zealand and the Reserve Bank of Australia are the first countries in the OECD countries to cut interest rates this year. In both countries, the banking industry (more than 60% of New Zealand) has exposed serious exposure to the real estate market, with major banks in both countries having the same parent company (the Big Four banks).

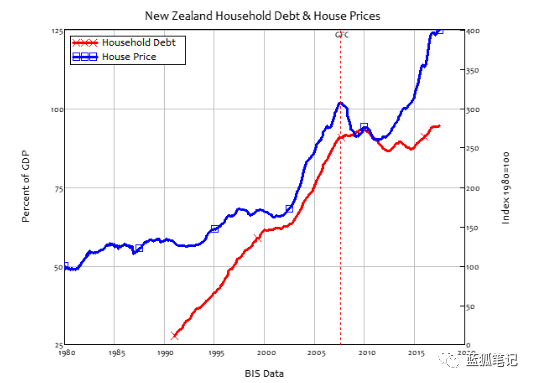

The correlation between New Zealand housing prices and household debt is 0.82 (highly correlated), Source: Professor Steve Keen

Interest rates in both countries are at historically low levels, with New Zealand and Australia at 1.5% and 1.25%, respectively, below the emergency level during the global financial crisis, and there may be two further rate cuts this year. Both RBA and RBNZ will hold a meeting and are expected to announce a rate cut. The Central Bank of Canada has bucked the trend and raised interest rates from the historical low of the global financial crisis (GFC) to 1.75%.

The correlation between Australian house prices and household debt is 0.6. Source: Professor Steve Keen

Financial propaganda

First-time buyers are often encouraged to use $100,000 to leverage a 5:1 leverage to buy a home. They lack experience and the authenticity of the data is influenced by the media, real estate agents, developers, and interest rate and debt growth rates. And the manipulation of offshore capital flows.

Despite a 10-year warning signal, the Australian, New Zealand and Canadian governments have recently introduced stricter anti-money laundering and foreign investor policies to counter speculators and money laundering activities from abroad. However, it is these overseas capital flows that provide most of the liquidity in these markets.

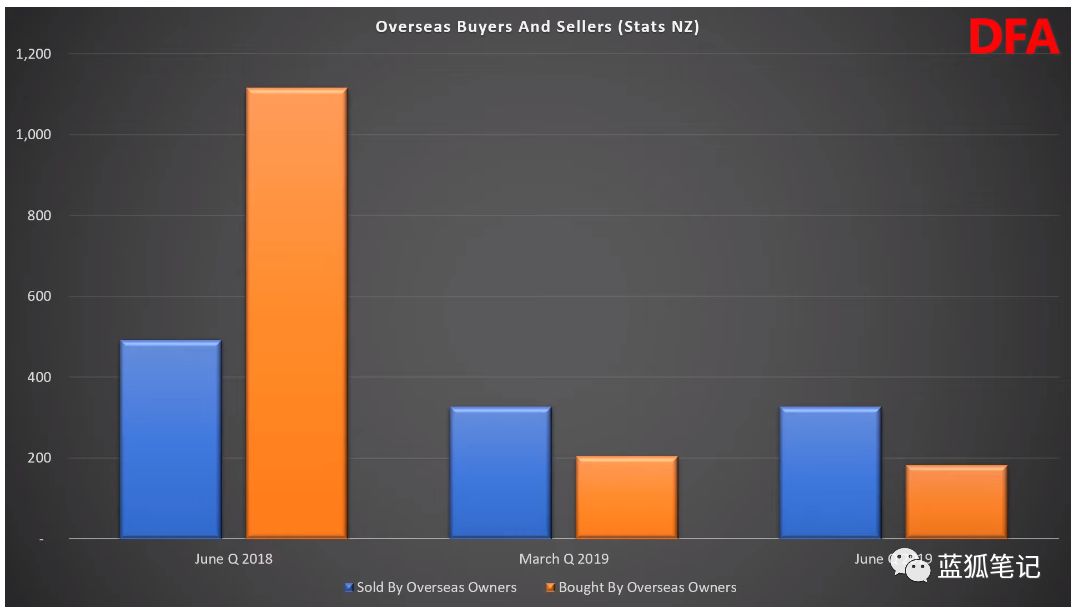

Number of overseas buyers in the New Zealand real estate market. Source: Digital Finance Analytics

Number of overseas buyers in the New Zealand real estate market. Source: Digital Finance Analytics

At the end of last year, New Zealand introduced legislation that required non-citizens to apply for property for the first time. Since then, according to Statistics of Statistics New Zealand, the number of overseas buyers in the first three months of 2019 has fallen by 81% compared with the previous year.

Similarly, since the launch of the “empty housing tax” to defend against foreign speculators, Vancouver’s home sales in May fell by 90%. At present, the real estate market in New Zealand and Australia is one of the most expensive markets in the world, and house prices are almost nine times the average income. With the introduction of bans from overseas buyers, especially in the high-end housing market, the housing market in New Zealand and Australia has begun to show a sharp decline in volume and prices.

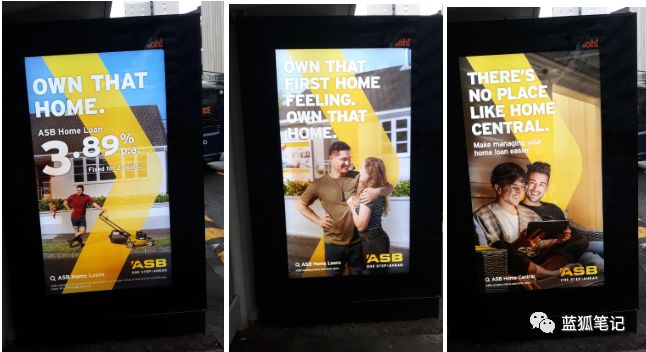

Three advertisements for first-time homebuyers, the same bank in the same bus shelter in downtown Auckland. Language and imagery openly manipulate people's emotions. Source: The author

Three advertisements for first-time homebuyers, the same bank in the same bus shelter in downtown Auckland. Language and imagery openly manipulate people's emotions. Source: The author

In order to slow down the price gap between the top and bottom prices of the property market, commercial banks began a campaign called “financial propaganda” to attract first-time buyers to enter the property market, increase sales and re-establish market confidence. With the slowdown in credit growth in New Zealand, banks have used a bait of the lowest interest rate in history to launch a variety of fancy advertisements and offers.

Although the mainstream media in New Zealand are reporting the housing shortage crisis, especially in Auckland, the opposite is true: housing stocks have accumulated historical records and building permits are at historically high levels.

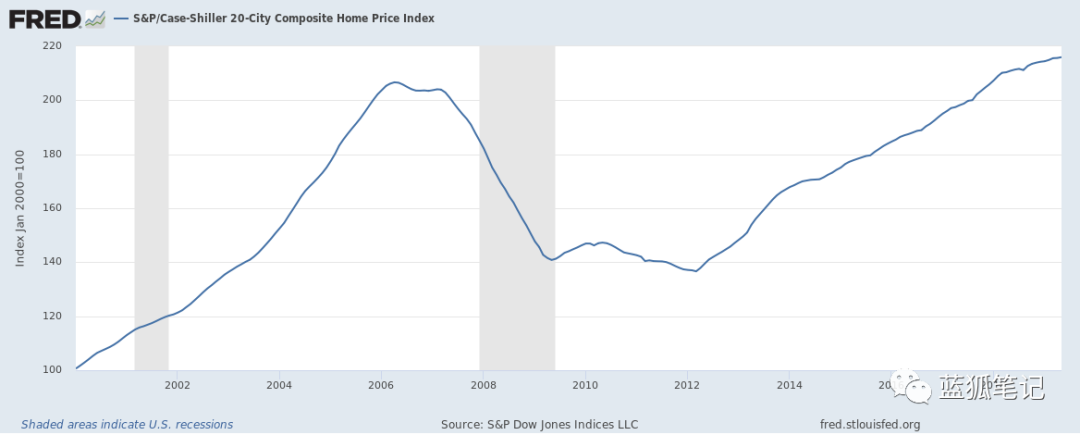

S&P/Case-Shiller 20 US urban comprehensive house price indices are currently well above the historical highs of the subprime mortgage era.

In addition, current US housing prices are already much higher than the historical highs of the previous subprime mortgage crisis. The housing prices in the subprime mortgage crisis caused the United States to fall into the worst financial crisis since the Great Depression.

New Irish property crisis

To understand the current market situation in New Zealand and Australia, we can look back at Ireland's situation before and after the “Celtic Tiger” construction boom (2000-2007).

After the collapse of the Celtic Tiger bubble, tens of thousands of unfinished houses and apartments were left in the country, especially in Dublin. After the global financial crisis and interest rates hit a record low, venture capital and hedge funds have harvested bad assets on a global scale, including many of Dublin's real estate sectors. They ambushed for several years on previously unfinished projects, waiting for prices and rents to pick up, and then slowly releasing supplies to the market.

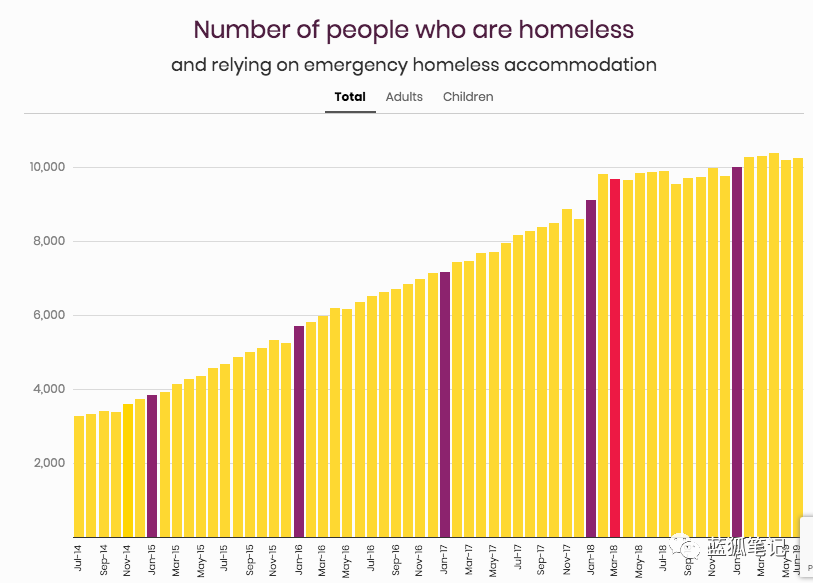

The total number of homeless people in Ireland has reached a record high, with more than 10,000 people, from Focus.ie

The total number of homeless people in Ireland has reached a record high, with more than 10,000 people, from Focus.ie

After recovering from the impact of real estate booms and busts, Ireland found that it faced another type of housing crisis – insufficient supply – especially in the capital, Dublin, pushing real estate competition and rents to an unbearable new level. And caused a record high in housing prices. In 2018 alone, nearly 1,000 families in Dublin were homeless.

In 2018 alone, 1.1 billion euros invested in nearly 3,000 residential properties in Ireland, accounting for nearly 30% of total real estate investment in the year.

Stock market

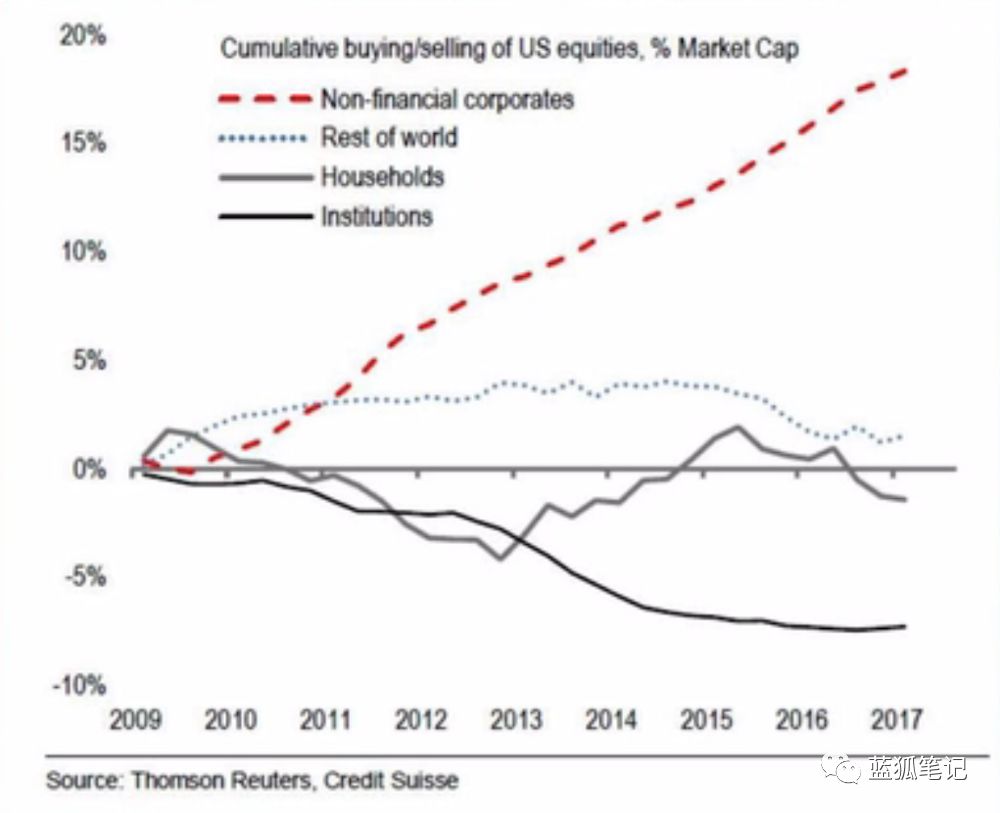

Just as in the era of zero interest rates, the central bank is the largest holder of government debt, and American companies have become the largest stockholders in the stock market (mainly their own stocks).

Most of the cheap credit injected into companies through quantitative easing is used to buy stocks, making non-financial companies the largest shareholder.

Most of the cheap credit injected into companies through quantitative easing is used to buy stocks, making non-financial companies the largest shareholder.

Most of the cheap credit easing that was injected into the company was used to repurchase shares, which also led the company to become the largest shareholder or “whale” in the stock market. Back in 1982, it was illegal for companies to buy back their stocks, but this was reversed in the era of deregulation by the Reagan administration. Stock repurchases lead to growing wealth inequality within the country.

From 2007 to 2016, in the Standard & Poor's 500 Index, 461 listed companies' corporate profits were not invested in re-production, but stock repurchases amounted to 4 trillion US dollars, accounting for 54% of total profits. At the same time, the CEO's average annual salary has doubled. Stock repurchase has seriously affected the company's healthy development, although it has increased earnings per share (EPS), and even corporate earnings actually fell. Therefore, repo is also described as a legitimate form of market manipulation.

Next, we will look at volatility, not just the difference from the average, but how volatility and risk are masked in the stock market.

Volatility masks risk

The risk that bitcoin and crypto assets can be identified is always due to their high volatility. Because the financial industry uses the backtracking VaR (risk value) indicator (which equates high volatility to high risk) to measure risk, most fund managers do not like to encrypt assets. Is this a negative indicator of error?

Bitmex's Historical Volatility Index (BVOL) has risen 48% this year, while the Standard & Poor's Invisible Volatility Index (VIX) has fallen almost the same, just slightly above historical lows.

Bitmex's Historical Volatility Index (BVOL) has risen 48% this year, while the Standard & Poor's Invisible Volatility Index (VIX) has fallen almost the same, just slightly above historical lows.

Shorting VIX is the most popular trading strategy in a decade, and even ETFs for retail traders, which artificially suppressed VIX, making VIX 13.9, two or more standard deviations below its long-term average of 18.3. However, this low volatility may mask the risk. The financial instability hypothesis of the economist Hyman Minsky argues that “stability may lead to instability” or long-term low volatility leads to more debt and risk, leading to a crisis. The hypothesis was recently supported by empirical research from the London School of Economics Research:

“The level of volatility is not a good indicator of the crisis, but relatively high or low volatility. Low volatility increases the likelihood of bank crises. High volatility and low volatility are important for stock market crises. And any form of volatility does not seem to explain the currency crisis."

It is undeniable that compared with the stock market (the smaller the market, the greater the volatility), cryptocurrency is a more volatile asset class, but with global stock markets, even with private debt, corporate bonds and stock repurchases. Unlike the real estate market, the cryptocurrency does not show any signs of a surrender in the upcoming market.

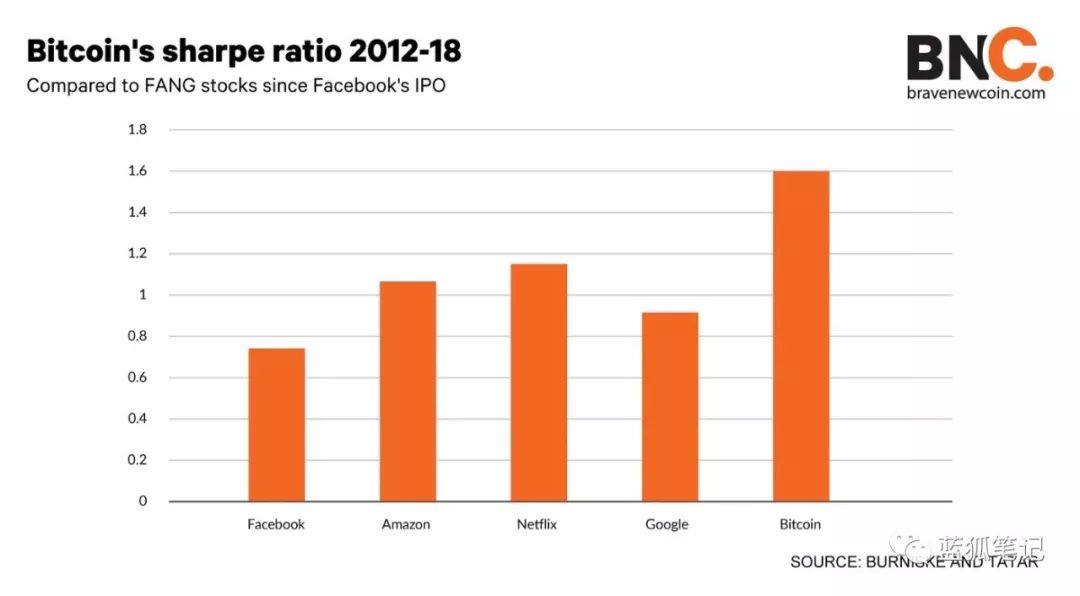

The Sharpe Ratio ratio reflects the return of an asset divided by its volatility. The higher the ratio, the higher the risk return.

The Sharpe Ratio ratio reflects the return of an asset divided by its volatility. The higher the ratio, the higher the risk return.

Sharpe Ratio is a closely watched indicator of investment, used to measure the risk-reward ratio of assets. According to this indicator, Bitcoin has outperformed FANG stock since 2012 (Blue Fox notes: FANG refers to Facebook, Amazon, Netflix, Google, etc.) The tech giants, compared to Facebook, have fluctuated over the years, and Bitcoin has already generated twice the risk-reward.

In addition, the open source nature of blockchain technology shows the transparency of wallet transactions and the traders behind them.

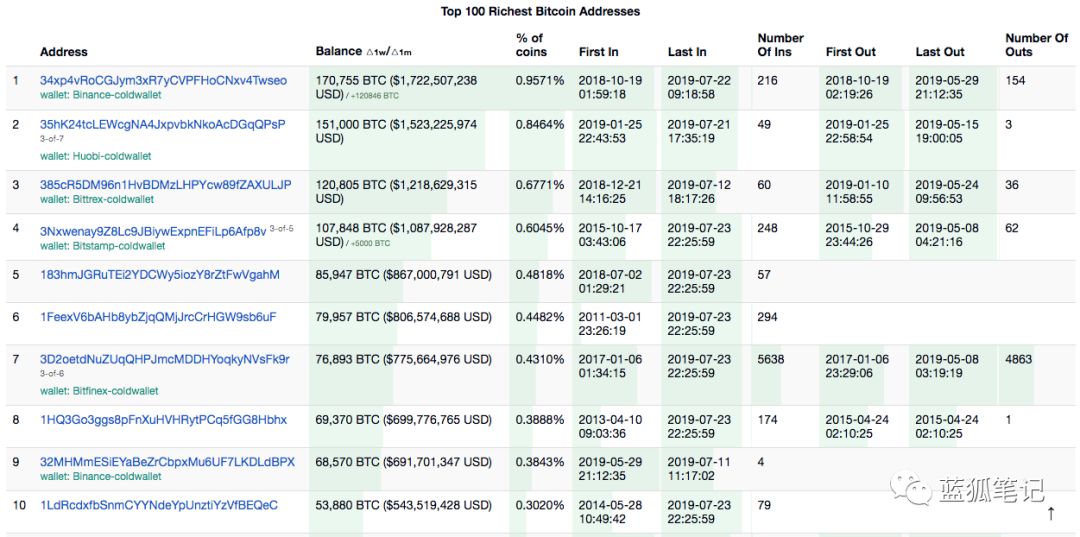

Of the top 10 richest bitcoin addresses, six are wallets from the world's largest exchanges, which together account for about 4% of the total circulating currency.

Of the top 10 richest bitcoin addresses, six are wallets from the world's largest exchanges, which together account for about 4% of the total circulating currency.

It is necessary to focus on how the “encrypted whales” (many of whom are early adopters or developers who started the project) are driving the market. Of the top 10 bitcoin wallets, six are global exchanges, and there may be more exchanges and over-the-counter (OTC) vendors, such as Cumberland, which have not yet been confirmed.

Retail investors (whether traders or not) are often dominated by mainstream claims: bitcoin and other markets are being manipulated, this is a Ponzi scheme that may return to zero, and so on. Compared with the real estate market and corporate profits, the real estate market and corporate profits are based on the credit growth rate of the economy, as long as these economies grow faster than debt indefinitely, and are GDP index Growth, new debt into the system can repay the previous outstanding debt.

How to reduce the risk of the encryption market

Newcomers to the cryptocurrency market may increase their risk if they use the wrong trading platform.

Although price discovery is still in an early stage, it is well known that there are huge price differences between cryptographic assets in different crypto exchanges (although they have been aggregated), which often provides a lot of arbitrage opportunities, but in fact ordinary traders or investors It is difficult to find real asset prices.

So far, the demand for retail investors from traditional markets to enter the cryptocurrency market has grown, and market CFD platforms such as CMC Markets, eToro and Plus500 have filled this demand. However, people should not invest in CFD or market maker platforms, and traders should be very cautious in trading encrypted CFDs.

These platforms create markets that provide liquidity by bringing both parties to the customer's transaction history. This controversial business model, when the customer loses money in the transaction, the exchange may make a profit, so there is a motive – "stop hunting", that is, clearing the customers visible on their books Position. (Blue Fox Notes HQ Note: Traders and traders are in a position of opposition, so traders in order to earn more customers' profits, manipulate price fluctuations in the background to reach the trader's stop loss line, called Stop Loss Hunting in English)

Market makers are one of the most popular retail trader/investor platforms because they offer low fees, small spreads and most products. Regulators in France and the United Kingdom are considering bans on CFD products, creating opportunities for non-market-making brokers (straight-through-processors) to fill market gaps.

By establishing a trusted third-party index and cryptographic pricing data, it is a key step in bridging the gap between traditional brokers and new clients, and portfolio and money managers can establish and understand the risk profile of their cryptographic assets, just as MSCI does to emerging markets. The assets do.

Self-retrieving platform: conflict of interest

One of the main volatility concerns for encrypted retail investors/sellers is that prices tend to gap due to stop loss and account loss.

Bitmex, a crypto-derivative exchange known as a 100-fold futures contract, has recently become the focus of a major US regulatory review, and Bitmex has been criticized for exposing retail investors to excessive risk. Bitmex is a market maker who once complained about the platform "hunting stop loss".

Conflicts of interest in market maker platforms include:

(i) Self-pricing and self-indexing

As the exchange sets reference prices and provides liquidity, it increases the chances of internally manipulating the spot price and volume of a single asset.

(ii) Loss caused by hunting and stopping losses

Since the exchange keeps all the orders on the account, it also knows the price at which the trader stops the loss, and the market makers are plagued by the use of this information for profit.

(iii) Self-indexing products using their own reference prices

Raising questions about transparency, manipulation and fairness of customer disputes

Reduce manipulation of customers and brokers

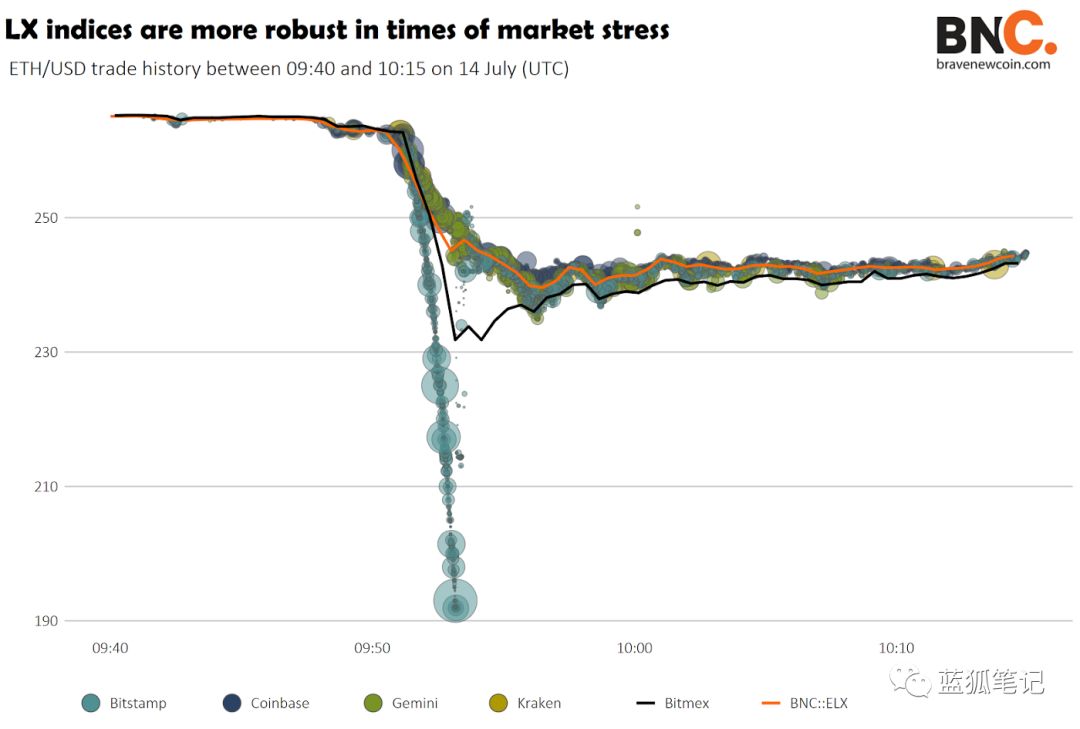

Recently, Ethereum suffered a price crash between exchanges because of a huge order on the Bitstamp exchange, and the price dropped from $270 to $190 in a few minutes, which not only erased Bittamp's client position. It also erased customer positions on major exchanges such as Bitmex, Kraken, Gemini and Coinbase.

The use of an independent third-party index validated by the EU Benchmarks Regulation and the International Securities Commission (IOSCO) provides a more equitable and stable single asset pricing scheme for exchanges and clients.

Compared with the total liquidity index of the most trusted exchanges, the price of Ethereum in the five exchanges decreased during the period of the plunge.

Compared with the total liquidity index of the most trusted exchanges, the price of Ethereum in the five exchanges decreased during the period of the plunge.

When Bitstamp sells a large number of sell orders for ETH, BNC's Ethereum Flow Index Price (ELX) protects trader stops, especially on Bitmex and Bitstamp. The LX Series Index combines the trading volume and price of the six most liquid exchanges in the world by calculating the “fair global prices” of Bitcoin, Ripple and Ethereum, weighted by order depth. It also energizes and filters out false transactions.

ETF providers are more inclined to reduce third-party costs and provide cheaper fees by creating their own indices. However, this benchmark setting has triggered conflicts of interest with EU regulators, including changes in the previous index or tampering with the ETF's net asset value. Currently, some CFD exchanges (such as CMC) also provide self-indexing encryption products.

A better option is that retail investors investing in crypto assets and traditional products will use the same platform that processes orders directly to the global marketplace and uses a separate price and index provider, but these platforms are less well known. (Not the main sponsor of football and rugby jerseys), nor the same rich trading products or tools.

in conclusion

For the millennial and younger generations, the next decade will be epoch-making. We are in a market operation that looks more like a global linkage. We either participate or resist and try another option – the digital asset market.

We are still in the early stages of blockchain and bitcoin. Under ideal circumstances, will there be no hidden power? But for retail investors, even if these hidden forces exist, compete with the vested interests of trillion-dollar fund managers or multinational companies, which ones have greater risks?

——

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

Editor's Note: The original title is "Select "New Normal" or "New Paradigm"? 》

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | How will the digital currency "China team" change the future?

- If the Indian encryption ban is approved, 40,000 BTCs will enter the market.

- Akropolis, the Poca DeFi project: witnessed the collapse of Lehman Brothers, building a new Web 3.0 class financial

- Academic discussion on the practice of the central bank's digital currency DC/EP

- Bitcoin Position Weekly: Does the retail bullish sentiment reach a historical high? Will the truth belong to the majority?

- Why do you believe that Bitcoin is worth nothing, no matter how you say it?

- 15 countries will jointly develop global digital currency monitoring system with international organization FATF