Popular science | mining industry panorama

As of July 2019, Bitcoin miners generated more than $6 billion in annual revenue (including mining incentives and transaction fees).

In the field of cryptographic currency, the underlying hardware and mining activities that ensure the security of Bitcoin and other cryptocurrency networks are a frequently overlooked market. However, mining combined with trading is one of the core markets for generating significant profits.

In this article, I will share an overview of Bitcoin and other cryptographic currency mining areas, support the basic hardware of mining, the ecology of the industry, and delve into the benefits and market size of this area.

Introduction to the principle of cryptography currency mining

Proof of work (mining) is the process of adding new transactions to the Bitcoin blockchain and agreeing (consensus) on the reasonable order of these transactions.

- Interpretation of the central bank's digital currency: to replace cash, mainly for small retail scenes

- Regarding the fact that Litecoin did not have any development progress in 2019, founder Charlie Lee responded

- Babbitt column | How will the digital currency "China team" change the future?

One of my favorite analogies about this process is to think of it as a Sudoku puzzle. (Translator's Note: You need to push other numbers on a 9*9 panel based on existing numbers, guaranteeing each row and column. 1~9 in the nine squares of each thick line setting are not repeated). It's a problem that needs to burn a lot of brain cells to solve, but once it's solved, it's easy for others to verify that your answer is correct.

In essence, miners (geographically dispersed computers around the world) compete with each other to solve a computationally intensive problem. Once solved, it can be confirmed that the blockchain can be generated (with transactions packaged in the block). One block. The first miner to solve the problem can get a block reward ("coinbase reward" + transaction fee). Once a new block is created, all miners in the network can verify the correctness of the block and then enter the competition to solve the next block problem.

Miners play a role in the bitcoin and blockchain ecosystem

All computers around the world that compete for the next challenge are participants in the mining ecosystem. The aggregated computing resources are one of the core elements that provide basic security for Bitcoin.

Through this network, Bitcoin users can expect:

-

Their transactions will be confirmed by the Bitcoin blockchain. -

Their transactions will be packaged in a reasonable order (preventing a sum of money twice). -

The history of the Bitcoin blockchain will remain the same (not modified).

Hardware for mining

In the early days of the Bitcoin network, it was also profitable to use consumer-grade CPUs to dig bitcoins. However, the development of the Bitcoin network to today's scale is no longer practical.

Currently, miners within the Bitcoin ecosystem are dominated by application specific integrated circuits (ASICs). For most other cryptographic currencies, graphics processing units (GPUs) and field programmable gate arrays (FPGAs) are the main form of mining machines. There are also many cryptographic currencies that use the same hash algorithm (SHA256) as Bitcoin, which are also compatible with Bitcoin's ASIC miners.

Landscape of mining ecosystem

Below is a panoramic view of the mining ecosystem from chip to end user:

Foundries

TSMC and Samsung are two core semiconductor manufacturers that produce silicon wafers for all mining hardware. In particular, TSMC, which dominates the chipset supply chain.

For example: NVIDIA, AMD, Xilinx, Bitland and Jianan Zhizhi all use TSMC as their core production line.

Packaging, testing, assembly

Once the wafers are produced, you need to test them, slice them, package them into the final chip, and retest. The entire process is usually handled by OSAT (outsourcing packaging and testing company), the largest of which are ASE Group (Taiwan) and Amkor Technology.

IC design and manufacturers * Most IC companies do not disclose their OSAT vendors.

Companies that design and sell chips are often referred to as fabless chip companies (manufacturing itself is the responsibility of the foundry and OSAT).

For the GPU, the top two manufacturers are NVIDIA and AMD. For FPGAs, the top manufacturer is Xilinx. For the ASIC chips specifically designed for cryptographic currency mining, the top three manufacturers are Bitland, Jianan Zhizhi, and Pangolin Miner (Whatsminer). manufacturer).

In addition to these three types of manufacturers, there are other integrated circuit design companies in the industry, including: Wingbit, Core Dynamics, Bitfury, Obelisk, and others.

* NVIDIA and AMD produce GPUs for all use cases, not just mining. ** Market share comes from estimates by Jon Peddie Research. *** The final valuation after the failure of Bitian and Jianan Zhizhi to go to the Hong Kong Stock Exchange. **** Valuation is based on exchanges with large miners and earlier IPO applications.

Miners and mines

Once the chip is produced, it can be used to dig cryptocurrency. ASIC chips are designed to dig a mining algorithm (usually SHA256 or Bitcoin), while GPUs are more flexible.

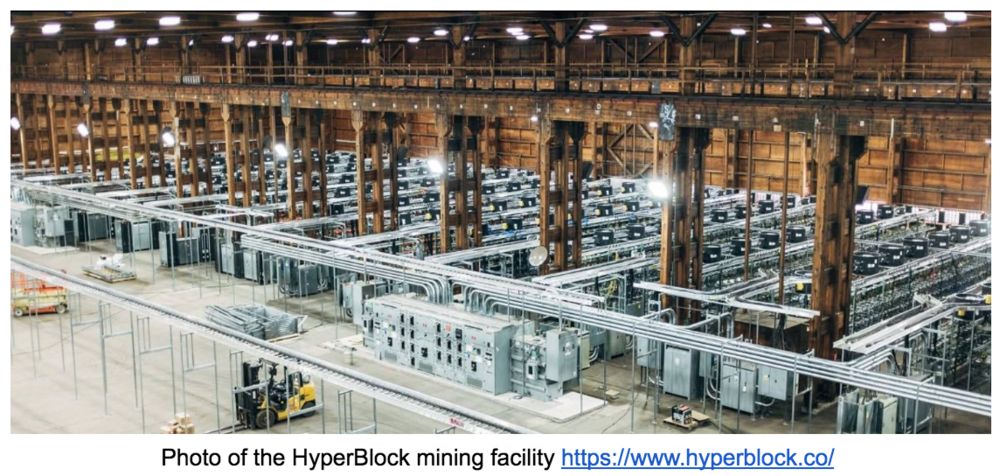

Miners include: people using one machine for mining, small mining operations (5-10 machines), medium-sized mines (10-100 machines), large-scale mines (100-1,000 machines) to Industrial scale mines (more than 1,000 machines). To date, the largest mines I have ever heard have run as many as 100,000 mining machines in multiple locations.

In addition to designing chips, some manufacturers themselves are involved in mining (eg Bitland, Jianan Zhizhi, Pangolin). For example, Bittland publicly discloses their own mining status every month.

Large and small miners can join a mine pool (described in more detail later). If the mine is large enough, they can also solo mine – just bring together their own hash calculations to find the area directly. Block, do not mix power with other miners.

* A controversial part is that manufacturers of mining chips may use them for mining before they sell chips. However, if you really have a profitable device, you have no reason to leave it in the warehouse, and you may use it to mine before you sell it.

Mine pool (single currency and multi-currency)

For miners from the individual to the non-industrial level, it is more economically more reasonable to join a pool instead of mining alone. The pool pools the hashing power of many miners, making each miner's return curve smoother. The pool is responsible for optimizing all hash calculations, running mining procedures, collecting and distributing rewards, and charging additional fees for these services.

Some mines focus on digging specific cryptocurrencies (such as Spark Pool, focusing on Ethereum and Grin), while other mines have multiple pools covering all major cryptocurrencies (ant pools) , fish pond, coin ingot pool, Slushpool, etc.). All of these pools began with a focus on digging a cryptocurrency currency (usually bitcoin) and later expanded to cover all forms of cryptocurrency.

One of my favorite analogies about how the mine works is to think of it as an office lottery pool. By bringing together the lottery tickets that everyone buys, everyone (miners) has a greater chance to win rewards.

However, the use of a mining pool means trusting the mine – the exact amount of power that everyone has and the reasonable income are recorded and distributed by the pool. To increase transparency, there are some services like PoolWatch that track and compare reports from various mines.

Computing market

Computing market

In addition to direct mining, miners can also sell their calculations to others. In reality, there is such a computing power to buy and sell the market – the largest market currently is NiceHash. In addition, there is a smaller peer-to-peer market for power: Mining Rig Rentals.

In these markets, people can sell their computing power and/or buy computing power at the same time – any algorithm for any cryptographic currency. Although there are many reasons for people to buy computing power, one of the main reasons is that purchasing power is an entry point for cryptocurrency.

Many times people use computing power to speculate on various cryptocurrencies—for example, want to purchase a hashing power that fits SHA256 to dig BSV instead of bitcoin (it's really a worthwhile deal…)

Cloud mining

Cloud mining is a computing contract for direct trading, consumers do not need to touch any hardware. A bit similar to the market for power mentioned above, usually operated by a centralized supplier.

The two largest companies in this field are Genesis Mining (USA) and Bitdeer (Asia). Also similar to the one mentioned above, one of the main reasons people use cloud mining services is that purchasing power is used as an entry point to obtain cryptocurrency. In this way, people can use French currency to buy bitcoin or other cryptocurrency directly without going through the exchange.

Intelligent miner

Intelligent miners are a new category that has recently emerged. Mining is a complex task that requires participants to understand hardware, networks, energy, power forecasting, and optimization for specific algorithms. In addition, with the emergence of new cryptocurrencies and the demise of old cryptocurrencies, all of these factors are constantly changing every day.

Intelligent miner software like Honeyminer is designed to optimize all of these factors at the same time, so that ordinary consumers and professionals can earn as much as possible through their computing power. There are also two similar products – HashFish and Cudo Miner.

In a short period of time, these products have gathered considerable power on the supply side.

Scale and revenue of the mining market

Calculated on a yearly basis, the cryptographic currency mining industry generates more than $8 billion in annual profits.

In all blockchains based on proof of work, profits come from block rewards and transaction fees included in each block. According to the latest mining award data published by CoinMetrics on June 25, 2019, the following are mining, weekly, monthly, and annual mining revenues.

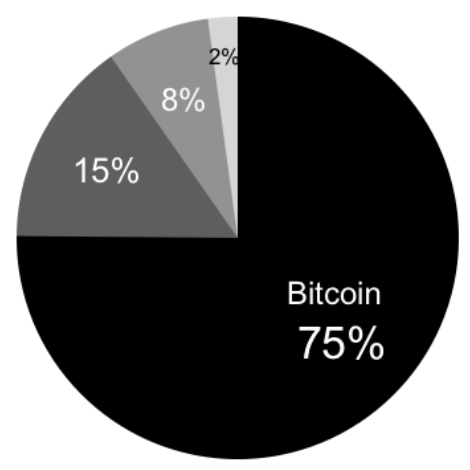

In the world of cryptographic currency mining, Bitcoin still dominates, and only the Bitcoin network itself creates 75% of the mining revenue.

In the world of cryptographic currency mining, Bitcoin still dominates, and only the Bitcoin network itself creates 75% of the mining revenue.

This is also in line with today's (July 1, 2019) bitcoin dominated market share. According to CoinMarketCap, Bitcoin occupies 60% of the market value.

However, the overall profit created by the mining industry is directly linked to the price of the cryptocurrency currency, so it will in turn directly affect the cryptocurrency market (hence, it is difficult for Wall Street to understand the companies in this industry). The details will be described below.

Understand the profitability of the mining industry

The overall profit, cost, and profitability of mining industry participants are affected by a few key factors.

Capital expenditure (Capex)

The main capital expenditure for miners is the cost of the mining machine itself plus all the facilities/buildings needed to operate the machine.

For example, if you want to purchase 10,000 of the latest Bitland-produced Ant Mining Machine S17 at retail price, it will cost $16 million. Large miners can buy at special prices. However, when the demand for mining machines is so high that it is difficult to guarantee supply, the price concessions will be small.

This has not taken into account the cost of building facilities that will transform mining from hobbies into truly professional industrial-scale projects.

Operating cost (Opex)

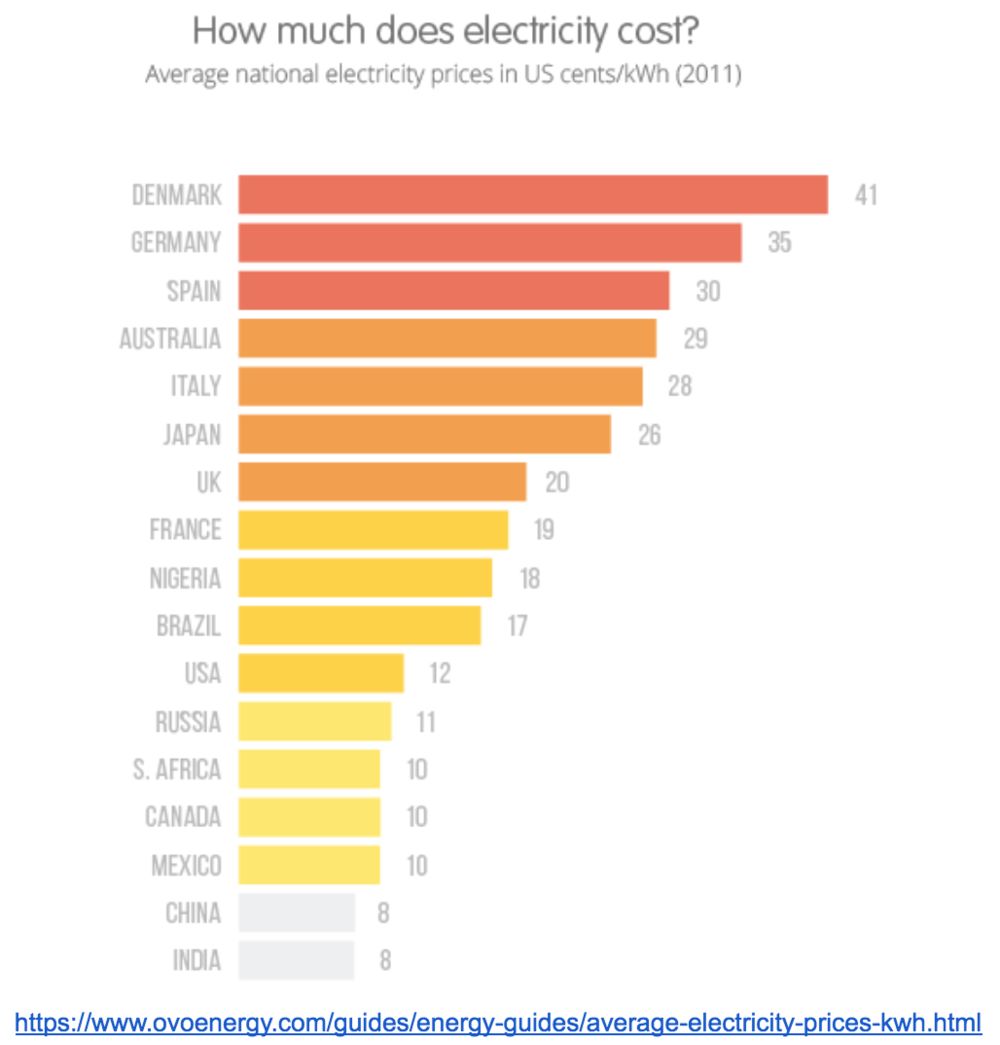

For miners, the main operating cost is the electricity bill required to run the miner every day.

For example, if you run a 10,000-bit S7 mine at 7*24 hours, at $0.05 per kilowatt hour, you will spend $36,000 (about $13 million a year) on electricity every day— – Just support the operation of the mining machine.

The average cost of electricity bills depends on the location of the mine and the source of electricity used, which varies greatly:

The nature of miners motivates them to find the cheapest energy in the world, which is why Coinshares estimates that 75% of the electricity that powers the Bitcoin network comes from renewable sources, mainly hydropower.

In addition to maintaining the electricity costs required to operate the mine, other uninterrupted operating costs include: heat, labor, maintenance, safety and general facility operations. In general, it can be roughly estimated that uninterrupted operating costs are 1.5 times the electricity bill.

Based on our example of the S17 mining machine operating 10,000 Bitland, the cost can be roughly estimated as:

-

$16 million in capital expenditure + $3 million (import tax) + $4 million (facilities + security) -

$20 million in operating costs (per year) -

Potential gains of $67 million (based on today's bitcoin price)

The above is just a rough estimate, just to show the scale of the various costs that miners need to pay. The real cost will depend entirely on where you are and where you are building. However, due to the market factors we will describe below, the above costs will continue to change.

Market factor

Miner Cost & Visible Supply

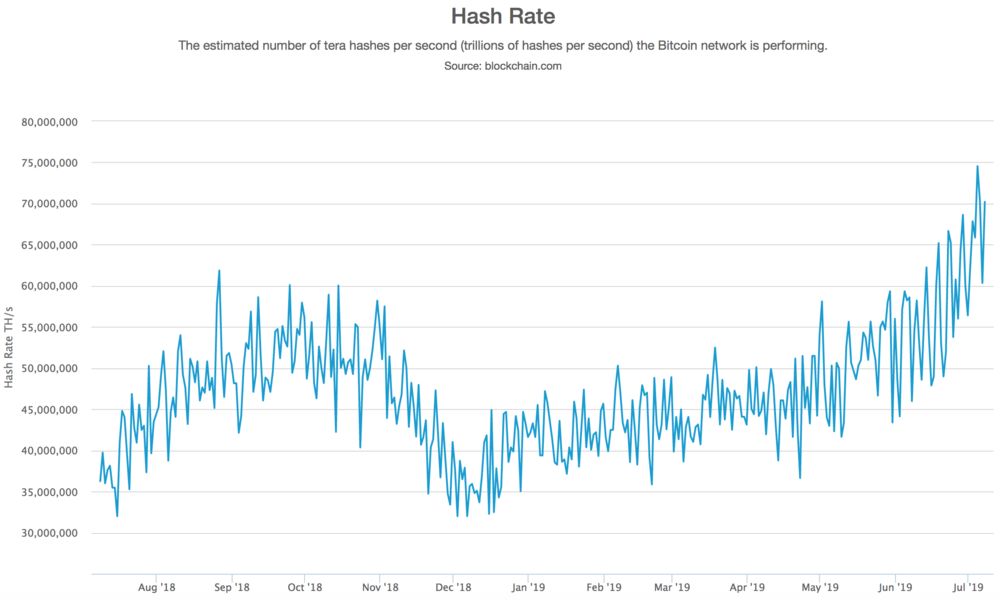

Computing power

The opportunity for miners to acquire the right to pack the next block is proportional to their computing power as a percentage of the total bitcoin network computing power (for the sake of simplicity, bitcoin is used for explanation).

To illustrate, in the simplest case, if you are a miner with a bitcoin power of 1% of the total network, you can expect to get 1% of the total reward from the Bitcoin network.

However, the total power of the Bitcoin network is always changing, so the profitability of each miner depends on how many miners join or leave the ecosystem. The Bitcoin protocol has an internal method to adjust the difficulty of mining (want to learn more? See here).

Bitcoin price

Because the block reward is paid directly in the underlying cryptocurrency. For example, if you are digging bitcoin, then the block reward you earn is paid in bitcoin. Therefore, the value of the reward is directly linked to the price of Bitcoin itself.

The more bitcoin is worth, the more rewards for mining. To be engaged in the mining industry, you must be optimistic about the cryptographic currency you are digging, because your profitability depends on it.

One of the main reasons why Bitcoin dominates all cryptocurrencies (except for the first place) is its transparent, open and fair distribution plan. Starting from the creation block, Bitcoin has a fixed distribution plan that sets the upper limit for its issuance – up to 21 million bitcoins will be created.

Mining is a way to create bitcoin and distribute it to the world. Today, every bitcoin block reward is 12.5 bitcoins; however, this amount decreases with every 210,000 blocks once. When the 630,000th block (estimated to be around May 24, 2020) was dug up, the block reward would be reduced to 6.25 bitcoins – also known as the halving event.

To see how the previous halving event affected Bitcoin and other cryptocurrency networks, check out this great article from CoinMetrics, which sorts out the previous halving event. If you want to learn more about Bitcoin's release plan and what happens when bitcoin is dug up, check out these two articles on bitcoin issuance and overall security budget (a comprehensive report for Dan Held) Call).

In a word summary – the price of Bitcoin and the basic issuance plan for Bitcoin have greatly affected the profitability of mining itself.

My main harvest

After an in-depth study of the mining field of cryptographic currency, the following are my biggest gains:

-

We often overlook the important role played by the mining industry and basic hardware in the blockchain network. -

Calculation = cryptography currency = money. For many people, computing power is the key to entering the world of encryption. -

Just as we see the financialization of Bitcoin, I predict that we will see that computing power will be similarly financial.

If you are an entrepreneur in this field, a trading market, a financial product, or any entrepreneur with services related to the mining industry, I would be happy to talk to you. I can find my contact information on our fund's website: Proof of Capital.

Many thanks to Edith Yeung, Noah Jessop, Jane Wu, and a few other big miners who are willing to give anonymous feedback to this report. (Finish)

Original link: https://www.chrismccann.com/blog/crypto-mining-101-overview-and-landscape-of-the-mining-industry

Author: Chris McCann

Translation & Proofreading: Zeng Yi & A Jian

This article was authored by the original author to translate and republish EthFans.

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- If the Indian encryption ban is approved, 40,000 BTCs will enter the market.

- Akropolis, the Poca DeFi project: witnessed the collapse of Lehman Brothers, building a new Web 3.0 class financial

- Academic discussion on the practice of the central bank's digital currency DC/EP

- Bitcoin Position Weekly: Does the retail bullish sentiment reach a historical high? Will the truth belong to the majority?

- Why do you believe that Bitcoin is worth nothing, no matter how you say it?

- 15 countries will jointly develop global digital currency monitoring system with international organization FATF

- Technical point of view | Changan Wanglou? This is just the tip of the ancient Chinese cryptography application.